Let’s dig into the relative performance of The Trade Desk (NASDAQ:TTD) and its peers as we unravel the now-completed Q3 advertising software earnings season.

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.6% while next quarter’s revenue guidance was 0.9% above.

In light of this news, share prices of the companies have held steady as they are up 2.3% on average since the latest earnings results.

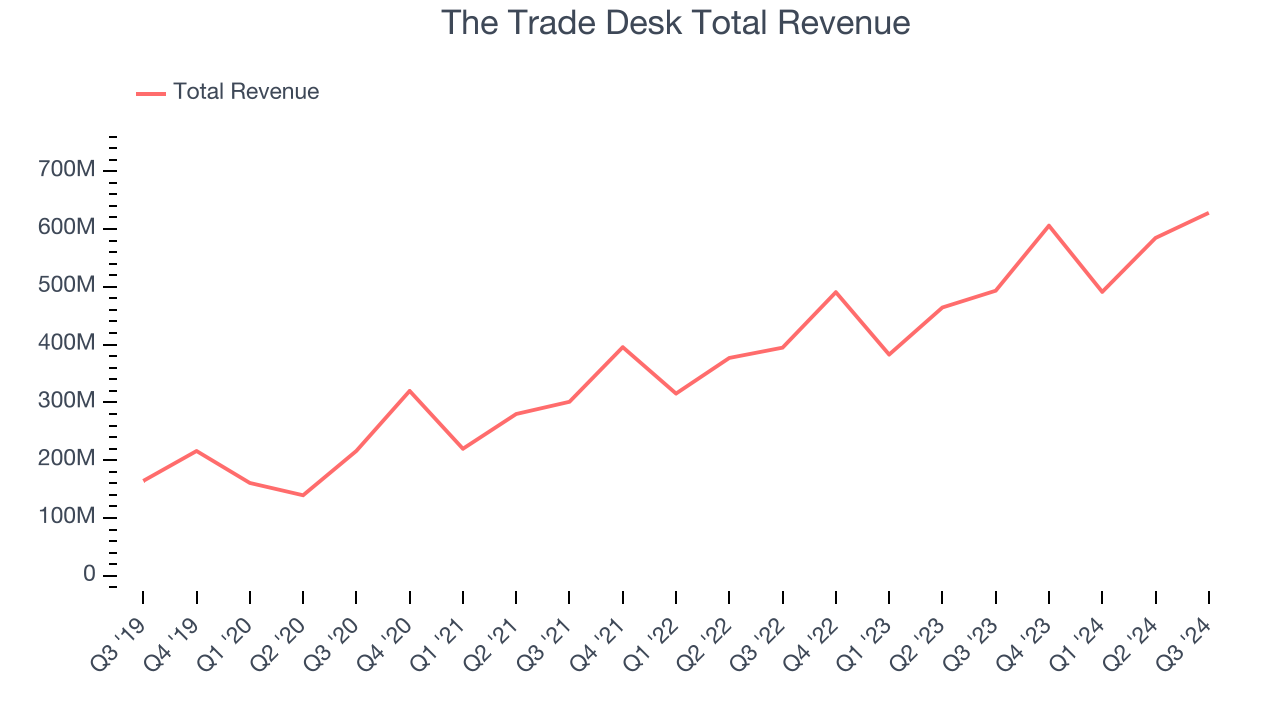

Weakest Q3: The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $628 million, up 27.3% year on year. This print exceeded analysts’ expectations by 1.2%. Despite the top-line beat, it was still a mixed quarter for the company with a narrow beat of analysts’ EBITDA estimates but a slight of analysts’ billings estimates.

“The Trade Desk delivered strong performance in the third quarter, with revenue of $628 million, accelerating growth to 27%. This performance underlines the value that advertisers are placing on precision and transparency as they work with us to maximize the impact of their campaigns,” said Jeff Green, Co-founder and CEO of The Trade Desk.

Unsurprisingly, the stock is down 5.9% since reporting and currently trades at $124.70.

Is now the time to buy The Trade Desk? Access our full analysis of the earnings results here, it’s free.

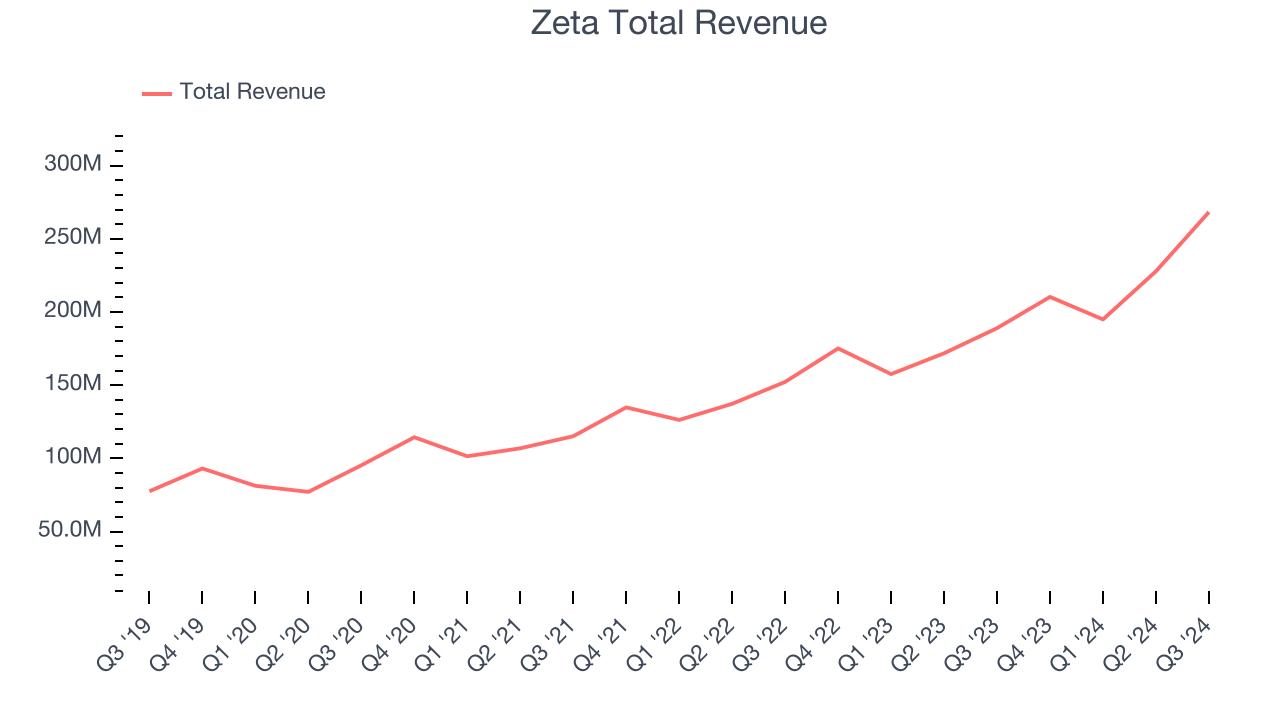

Best Q3: Zeta (NYSE:ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $268.3 million, up 42% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta achieved the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 50% since reporting. It currently trades at $18.39.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE:DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $169.6 million, up 17.8% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

DoubleVerify delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 1.9% since the results and currently trades at $19.95.

Read our full analysis of DoubleVerify’s results here.

PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $71.79 million, up 12.7% year on year. This result beat analysts’ expectations by 8.7%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

PubMatic scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is down 5% since reporting and currently trades at $15.60.

Read our full, actionable report on PubMatic here, it’s free.

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) is a software-as-a-service provider that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $185.5 million, up 16% year on year. This print beat analysts’ expectations by 5.3%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a meaningful improvement in its net revenue retention rate.

The company added 10 enterprise customers paying more than $1m annually to reach a total of 125. The stock is up 8.1% since reporting and currently trades at $28.45.

Read our full, actionable report on LiveRamp here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.