The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the sales and marketing software stocks have fared in Q2, starting with Upland Software (NASDAQ:UPLD).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.83%, while on average next quarter revenue guidance was 1.25% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital and sales and marketing software stocks have not been spared, with share prices down 10.4% since the previous earnings results, on average.

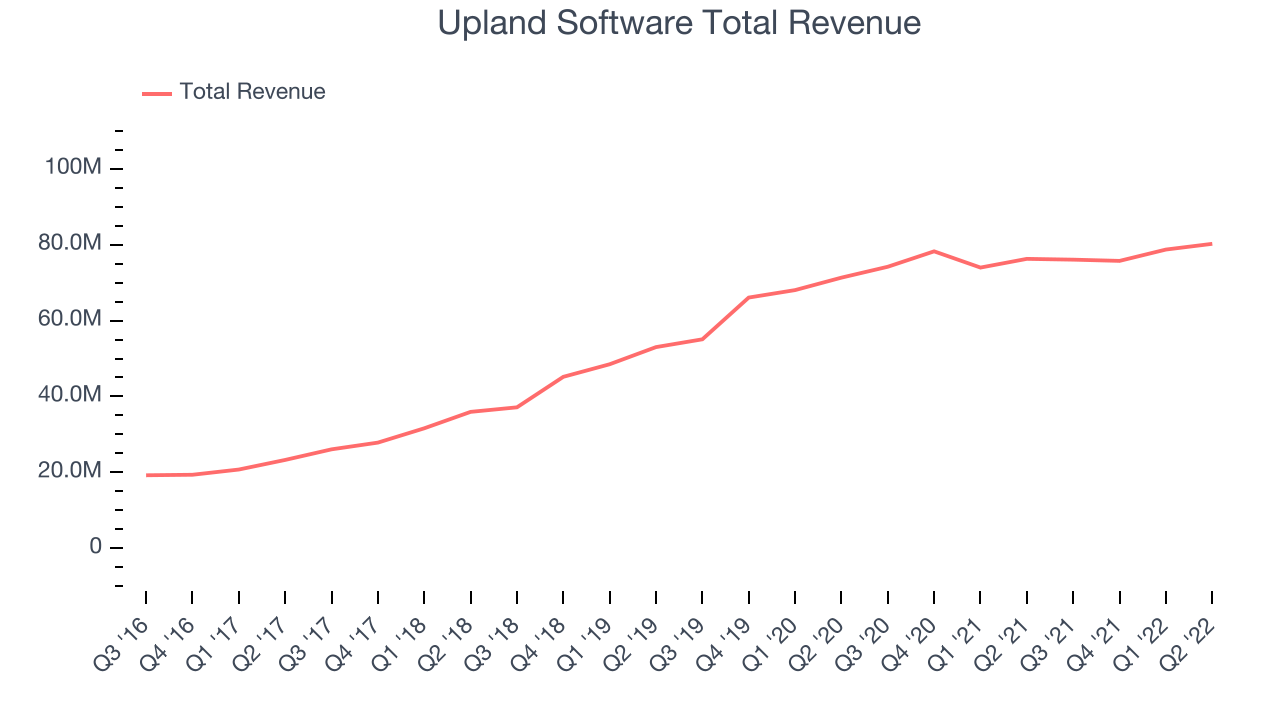

Upland Software (NASDAQ:UPLD)

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Upland Software reported revenues of $80.2 million, up 5.19% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

"We had a strong Q2, beating our guidance midpoints on revenue and Adjusted EBITDA, even after FX headwinds, and outperforming our targets on operating and free cash flow," said Jack McDonald, Upland's chairman and chief executive officer.

The stock is down 40.2% since the results and currently trades at $7.11.

Read our full report on Upland Software here, it's free.

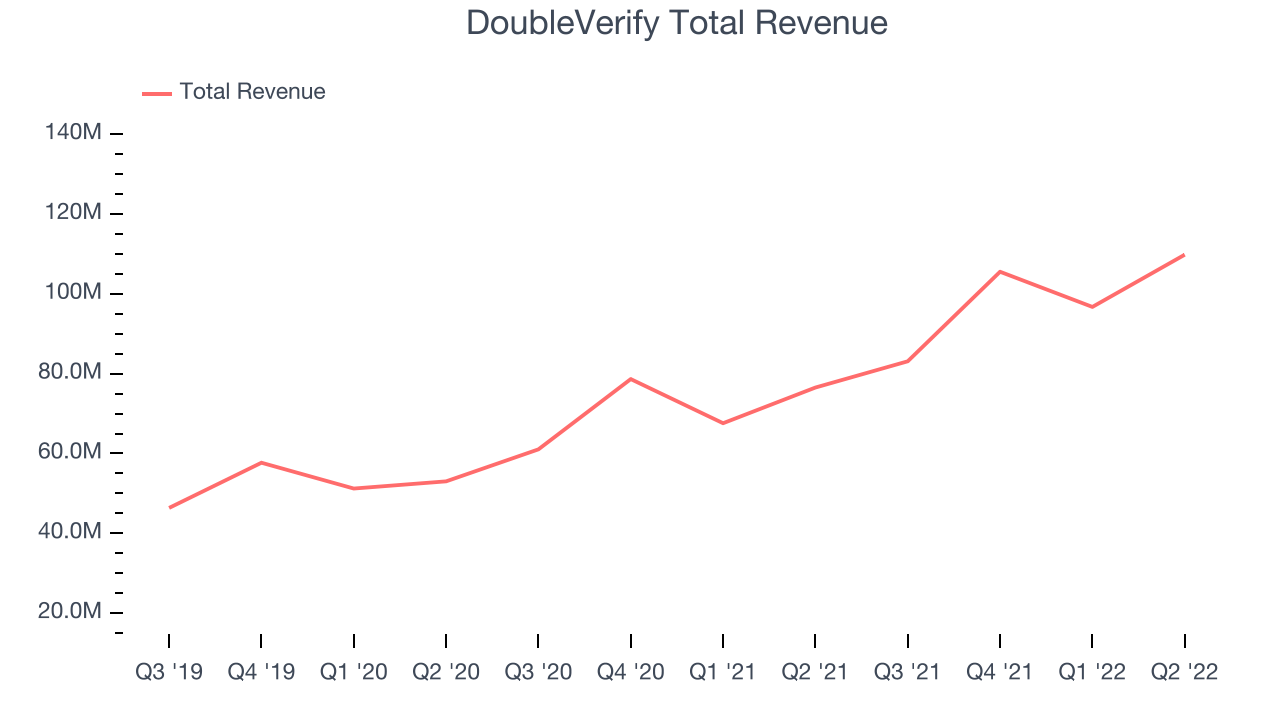

Best Q2: DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $109.8 million, up 43.4% year on year, beating analyst expectations by 7.67%. It was a very strong quarter for the company, with exceptional revenue growth and an impressive beat of analyst estimates.

DoubleVerify achieved the strongest analyst estimates beat among its peers. The stock is up 18% since the results and currently trades at $28.21.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.29 billion, up 15.6% year on year, missing analyst expectations by 2.67%. It was a weak quarter for the company, with a miss of the top line analyst estimates and slow revenue growth.

The stock is down 1.19% since the results and currently trades at $27.92.

Read our full analysis of Shopify's results here.

Sprout Social (NASDAQ:SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Sprout Social reported revenues of $61.4 million, up 37.4% year on year, beating analyst expectations by 1.95%. It was a mixed quarter for the company, with exceptional revenue growth but decelerating customer growth.

The company added 451 enterprise customers paying more than $10,000 annually to a total of 5,800. The stock is up 11.6% since the results and currently trades at $58.06.

Read our full, actionable report on Sprout Social here, it's free.

Momentive (NASDAQ:MNTV)

Previously known as SurveyMonkey, Momentive (NASDAQ:MNTV) offers software as a service that makes it easy for users create, manage and distribute online surveys.

Momentive reported revenues of $120.1 million, up 9.84% year on year, missing analyst expectations by 1.01%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

The company added 15,300 customers to a total of 909,700. The stock is down 12.1% since the results and currently trades at $7.53.

Read our full, actionable report on Momentive here, it's free.

The author has no position in any of the stocks mentioned