Earnings results often give us a good indication what direction will the company will take in the months ahead. With Q2 now behind us, let’s have a look at Upstart (NASDAQ:UPST) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 8 vertical software stocks we track reported a a solid Q2; on average, revenues beat analyst consensus estimates by 5.6%, while on average next quarter revenue guidance was 5.5% above consensus. The market rewarded the results with the average return the day after earnings coming in at 3.07%.

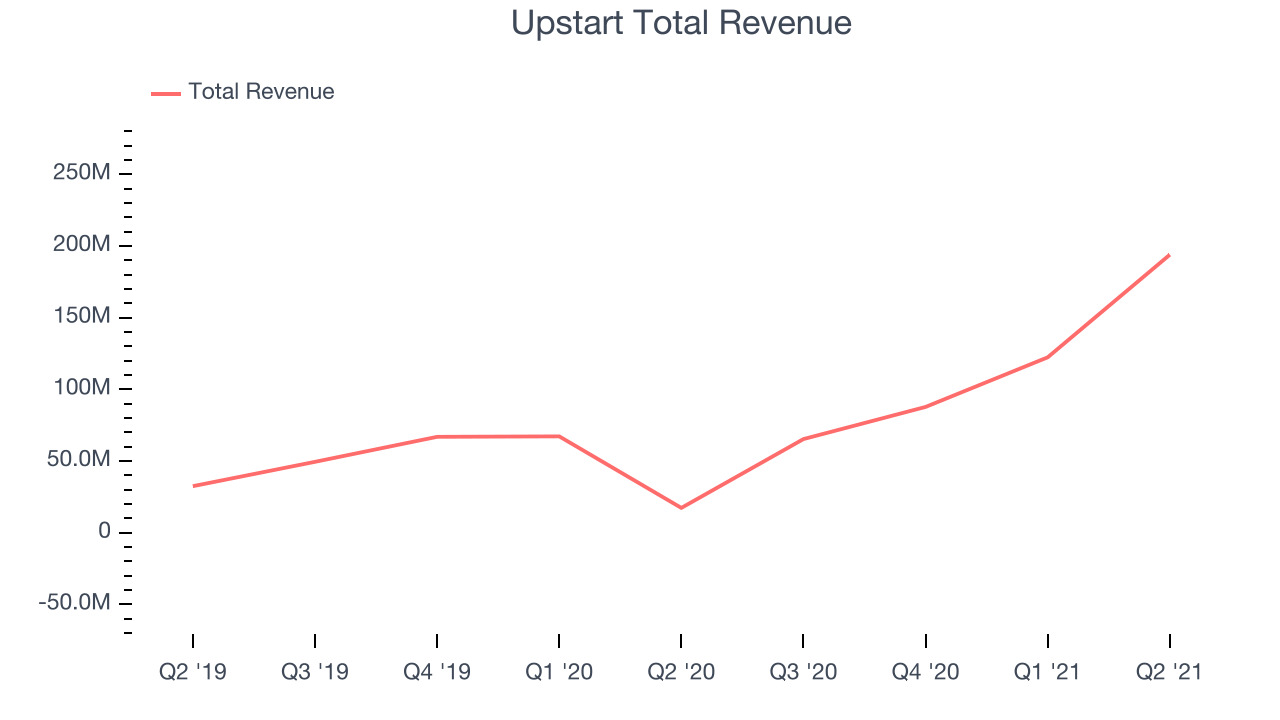

Best Q2: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $193.9 million, up more than 10x year on year (off the Covid lows), beating analyst expectations by 22.9%. It was an exceptional quarter for the company, with an eye watering beat of analyst estimates and an impressive revenue growth.

“Our second quarter results continue to show why Upstart has the potential to be among the world’s largest and most impactful FinTechs,” said Dave Girouard, CEO of Upstart.

Upstart achieved the strongest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 159% since the results and currently trades at $352.32.

Read why we think that Upstart is one of the best vertical software stocks, our full report is free.

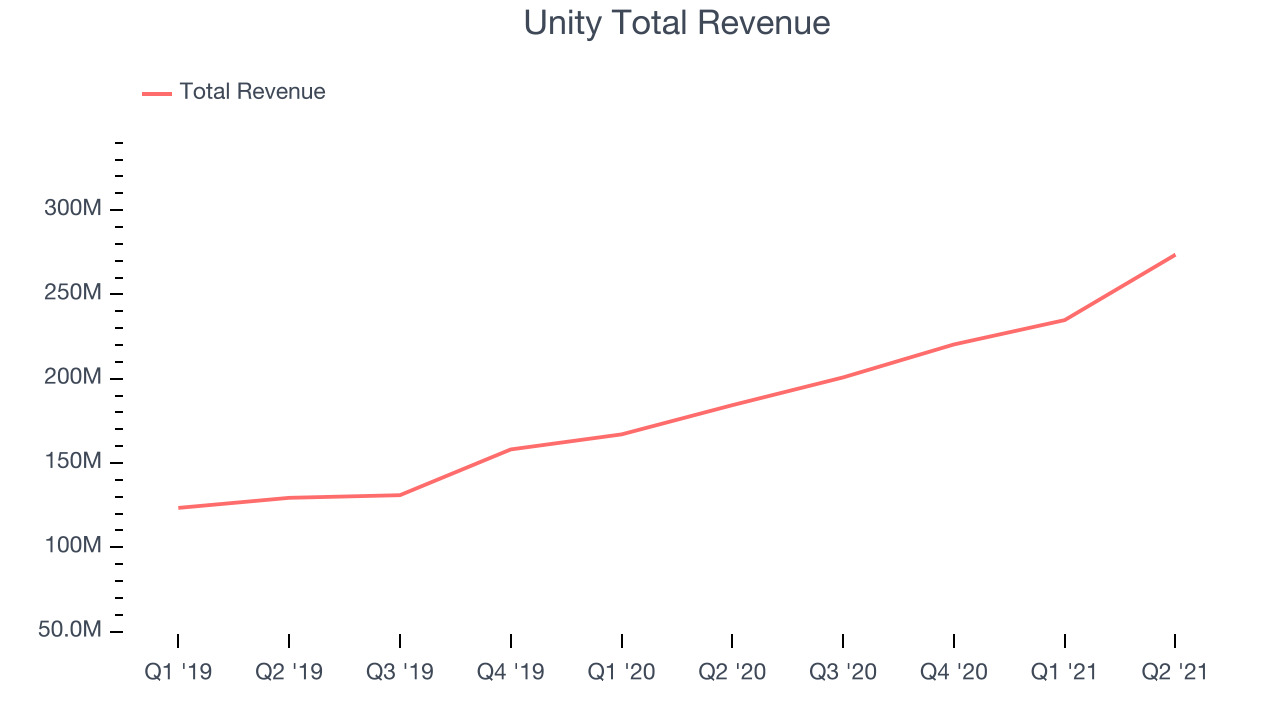

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $273.5 million, up 48.4% year on year, beating analyst expectations by 12.6%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

The stock is up 30.2% since the results and currently trades at $139.50.

Is now the time to buy Unity? Access our full analysis of the earnings results here, it's free.

Weakest Q2: 2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $237.2 million, up 29.8% year on year, beating analyst expectations by 1.54%. It was a weaker quarter for the company, with a strong top line growth but a full year guidance missing analysts' expectations.

2U had the weakest full year guidance update in the group. The stock is down 26% since the results and currently trades at $34.03.

Read our full analysis of 2U's results here.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.05 billion, up 16% year on year, in line with analyst expectations. It was a decent quarter for the company, with a small upgrade to the full year guidance.

Autodesk had the weakest performance against analyst estimates and slowest revenue growth among the peers. The stock is down 17.1% since the results and currently trades at $283.45.

Read our full, actionable report on Autodesk here, it's free.

nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $66.5 million, up 36.4% year on year, beating analyst expectations by 4.39%. It was a strong quarter for the company, with a significant improvement in gross margin.

The stock is up 19.6% since the results and currently trades at $75.42.

Read our full, actionable report on nCino here, it's free.

The author has no position in any of the stocks mentioned