Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q1 now behind us, let’s have a look at Workday (NASDAQ:WDAY) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.17%, while on average next quarter revenue guidance was 2.1% above consensus. Tech stocks have had a rocky start in 2022, but finance and HR software stocks held their ground better than others, with share price down 6.01% since earnings, on average.

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

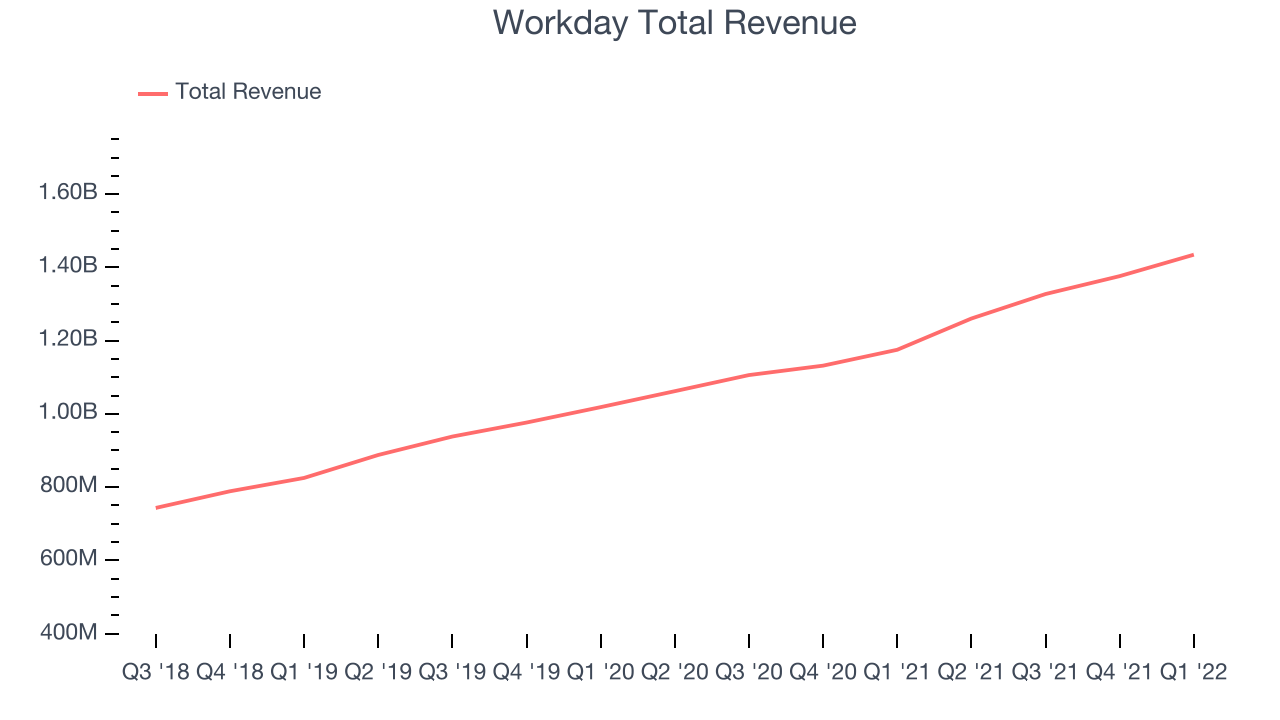

Workday reported revenues of $1.43 billion, up 22% year on year, in line with analyst expectations. It was a mixed quarter for the company, with top-line results in line with analysts' estimates but a miss on the bottom line.

"Workday had a strong first quarter, building on the fiscal 2022 acceleration of our business," said Aneel Bhusri, co-founder, co-CEO, and chairman, Workday.

The stock is down 15.3% since the results and currently trades at $142.29.

Is now the time to buy Workday? Access our full analysis of the earnings results here, it's free.

Best Q1: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

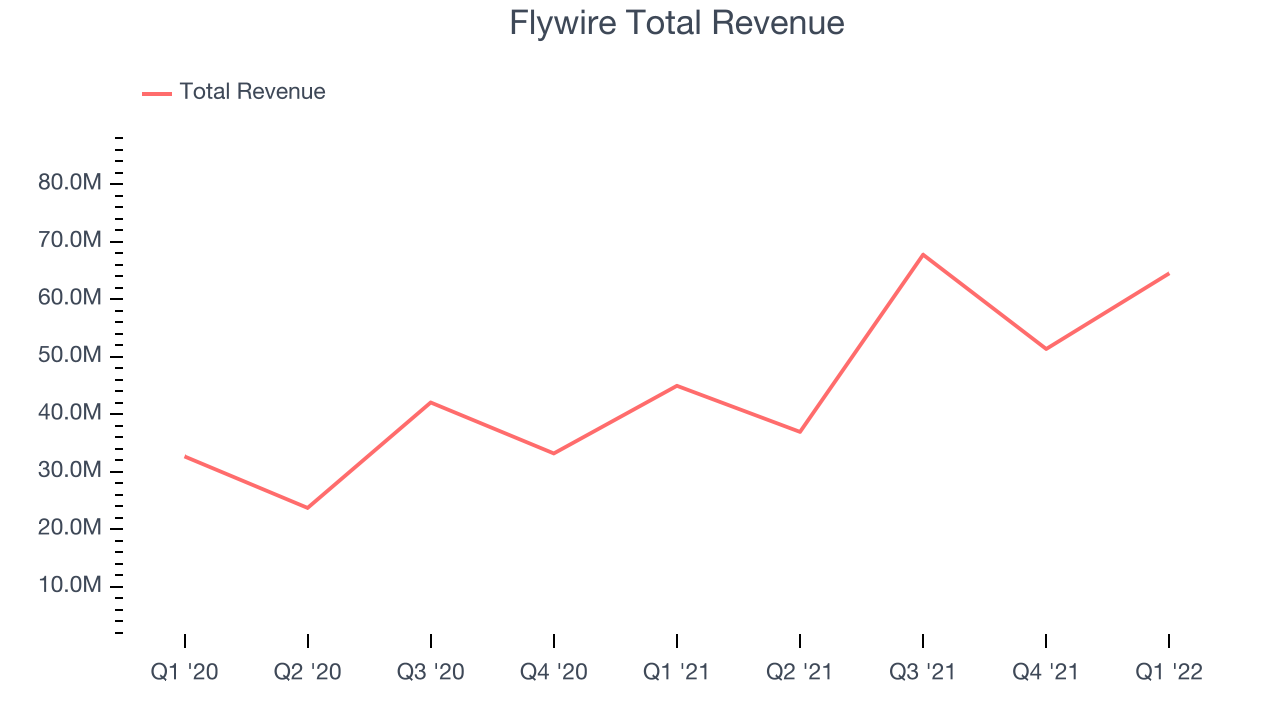

Flywire reported revenues of $64.5 million, up 43.4% year on year, beating analyst expectations by 13.5%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Flywire achieved the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 12.8% since the results and currently trades at $18.40.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $93.1 million, up 16% year on year, beating analyst expectations by 1.03%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and decelerating growth in large customers.

The stock is down 4.51% since the results and currently trades at $9.10.

Read our full analysis of Zuora's results here.

Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $24.3 million, up 22.8% year on year, beating analyst expectations by 3.26%. It was a mixed quarter for the company, with an underwhelming revenue guidance for the next quarter.

The stock is down 6.6% since the results and currently trades at $5.66.

Read our full, actionable report on Asure Software here, it's free.

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $5.63 billion, up 34.9% year on year, beating analyst expectations by 2.16%. It was a very strong quarter for the company, with a significant improvement in gross margin.

The stock is up 6.74% since the results and currently trades at $384.

Read our full, actionable report on Intuit here, it's free.

The author has no position in any of the stocks mentioned