Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q4 now behind us, let’s have a look at Wix (NASDAQ:WIX) and its peers.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

The 4 e-commerce software stocks we track reported a weak Q4; on average, revenues beat analyst consensus estimates by 2.27%, while on average next quarter revenue guidance was 2.41% under consensus. Tech stocks have been under pressure since the end of last year, but e-commerce software stocks held their ground better than others, with share price down 4.01% since earnings, on average.

Weakest Q4: Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ:WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $328.3 million, up 16.2% year on year, missing analyst expectations by 1.34%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

"2020 and 2021 brought unprecedented changes, challenges and opportunities for almost every business worldwide due to uncertainty and volatility brought on by the pandemic. Now, as we enter our third year of COVID-19, the world has begun to transition once again," said Avishai Abrahami, Co-founder and CEO of Wix.

Wix delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 18.9% since the results and currently trades at $93.80.

Read our full report on Wix here, it's free.

Best Q4: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

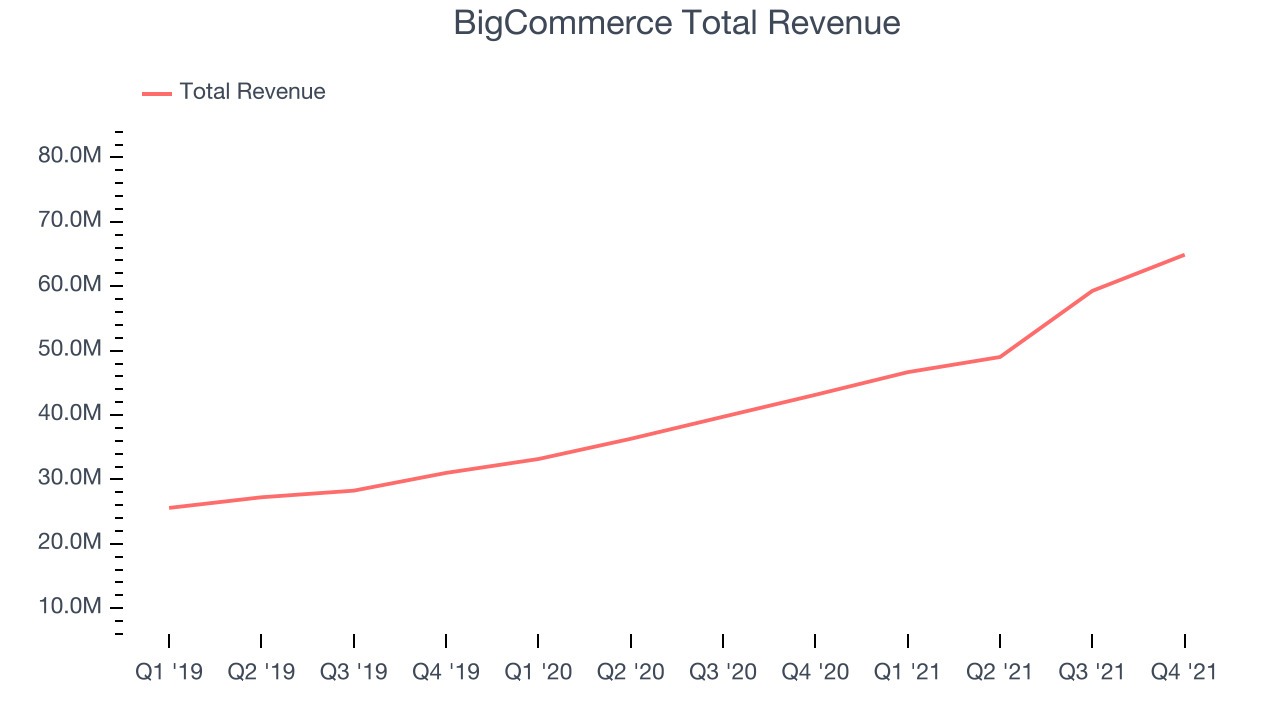

BigCommerce reported revenues of $64.8 million, up 50.4% year on year, beating analyst expectations by 4.96%. It was a weaker quarter for the company, with an underwhelming guidance for the next year and decelerating growth in large customers.

BigCommerce achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 376 enterprise customers paying more than $2,000 annually to a total of 12,754. The stock is down 20.1% since the results and currently trades at $20.68.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $207.4 million, up 20.3% year on year, in line with analyst expectations. It was a weak quarter for the company, with a decline in gross margin and underwhelming guidance for the next year.

Squarespace had the weakest full year guidance update in the group. The stock is up 14.4% since the results and currently trades at $25.99.

Read our full analysis of Squarespace's results here.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $1.01 billion, up 16.6% year on year, beating analyst expectations by 4.74%. It was a weak quarter for the company, with a decline in gross margin and an underwhelming revenue guidance for the next quarter.

The stock is up 11% since the results and currently trades at $82.38.

Read our full, actionable report on GoDaddy here, it's free.

The author has no position in any of the stocks mentioned