Sales intelligence platform ZoomInfo reported Q2 FY2021 results that beat analyst expectations, with revenue up 56.8% year on year to $174 million. ZoomInfo made a GAAP profit of $24.5 million, improving on its loss of $77.9 million, in the same quarter last year.

Is now the time to buy ZoomInfo? Get early access to our full analysis of the earnings results here, it's free

ZoomInfo (ZI) Q2 FY2021 Highlights:

- Revenue: $174 million vs analyst estimates of $162.4 million (7.13% beat)

- EPS (non-GAAP): $0.14 vs analyst estimates of $0.12 (19.3% beat)

- Revenue guidance for Q3 2021 is $183 million at the midpoint, above analyst estimates of $171.4 million

- The company lifted revenue guidance for the full year, from $673 million to $705 million at the midpoint, a 4.75% increase

- Free cash flow of $91.8 million, roughly flat from previous quarter

- Customers: 1,100 customers paying more than $100,000 annually

- Gross Margin (GAAP): 86.4%, in line with previous quarter

"ZoomInfo delivered another record quarter, including the highest levels ever for both retention activity and customer engagement, and accelerating revenue growth, as customers in all industries continue to choose ZoomInfo to transform their go-to-market motion,” said Henry Schuck, ZoomInfo Founder and CEO.

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

Sales representatives spend only a minority of their time actually selling, in large part because they must spend so much of their time researching potential prospects. Sales and marketing departments are coming under pressure to increase efficiency, and that drives demand for platforms like ZoomInfo.

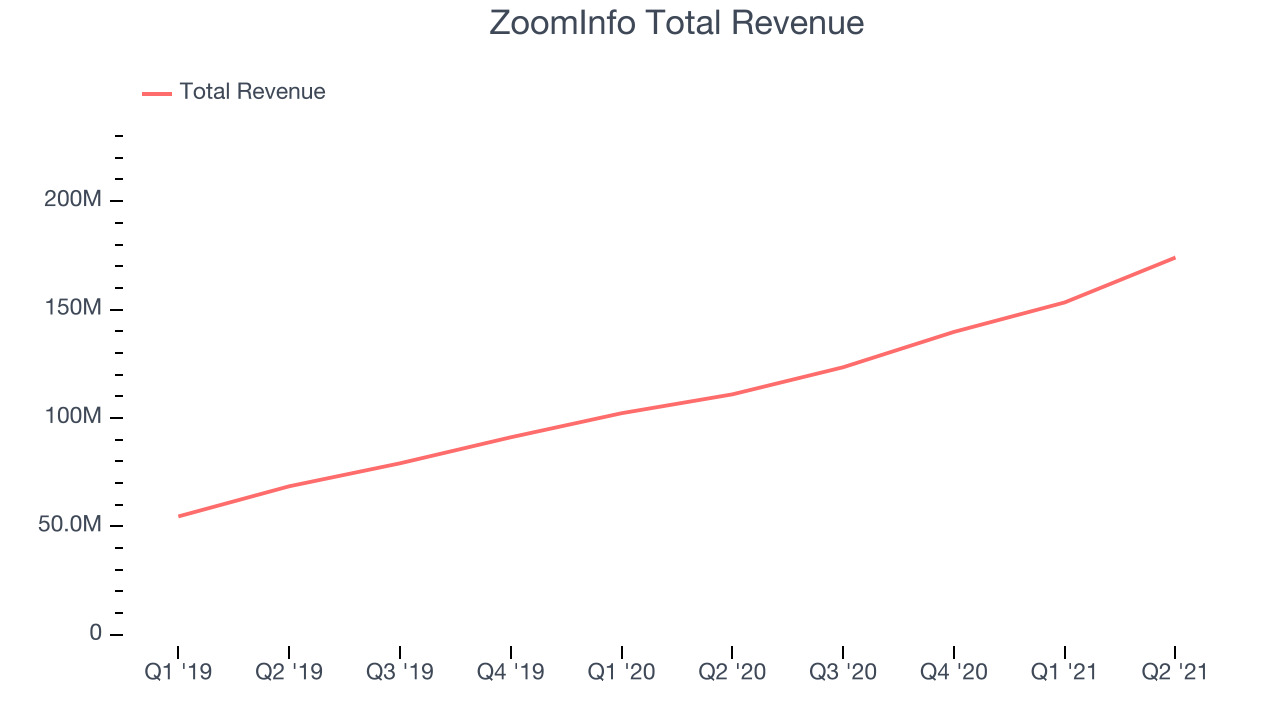

Sales Growth

As you can see below, ZoomInfo's revenue growth has been exceptional over the last year, growing from quarterly revenue of $110.9 million, to $174 million.

This was another standout quarter with the revenue up a splendid 56.8% year on year. On top of that, revenue increased $20.7 million quarter on quarter, a very strong improvement on the $13.6 million increase in Q1 2021, and a sign of acceleration of growth, which is very nice to see indeed.

Analysts covering the company are expecting the revenues to grow 31.7% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

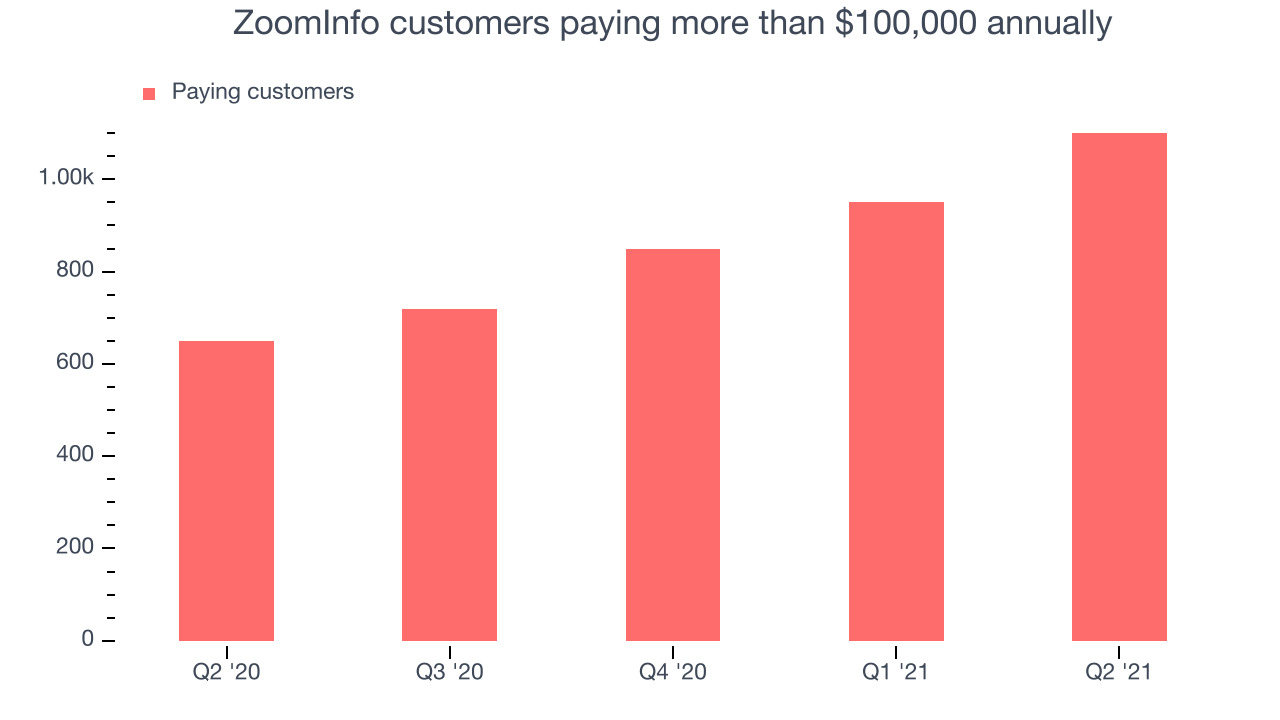

Large Customers Growth

You can see below that at the end of the quarter ZoomInfo reported 1,100 enterprise customers paying more than $100,000 annually, an increase of 150 on last quarter. That is quite a bit more contract wins than last quarter and quite a bit above what we have typically seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from ZoomInfo's Q2 Results

With market capitalisation of $9.96 billion ZoomInfo is among smaller companies, but its more than $399.7 million in cash and positive free cash flow over the last twelve months give us confidence that ZoomInfo has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth ZoomInfo delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this was a great quarter and we have no doubt shareholders will feel excited about the results. The company is up 5.86% on the results and currently trades at $57.95 per share.

When considering ZoomInfo, investors should take into account its valuation and business qualities, as well as what happened in the latest quarter. Is now the right time to invest? Are there better opportunities? Get access to our full analysis here, it's free.

The author has no position in any of the stocks mentioned.