As Q4 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the sales software stocks, including ZoomInfo (NASDAQ:ZI) and its peers.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality, coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrate data analytics with sales and marketing functions.

The 5 sales software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 3.62%, while on average next quarter revenue guidance was 1.88% above consensus. Technology stocks have been hit hard on fears of higher interest rates, but sales software stocks held their ground better than others, with share price down 5.49% since earnings, on average.

Best Q4: ZoomInfo (NASDAQ:ZI)

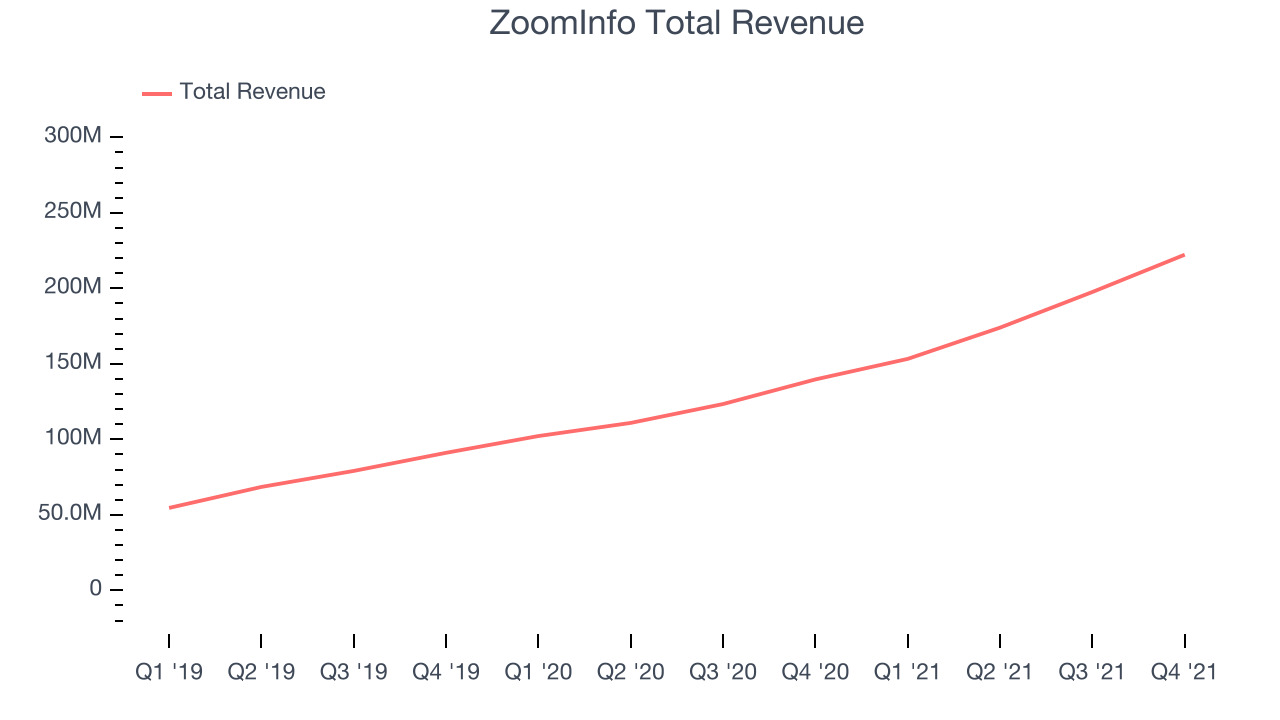

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $222.3 million, up 59.1% year on year, beating analyst expectations by 7.02%. It was a strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

“In 2021 we delivered a leading combination of growth and profitability, significantly expanded our platform, added more new customers than ever before, and drove record customer retention,” said Henry Schuck, ZoomInfo Founder and CEO.

ZoomInfo scored the strongest analyst estimates beat and fastest revenue growth of the whole group. The company added 202 enterprise customers paying more than $100,000 annually to a total of 1,452. The stock is down 3.38% since the results and currently trades at $56.79.

Read why we think that ZoomInfo is one of the best sales software stocks, our full report is free.

HubSpot (NYSE:HUBS)

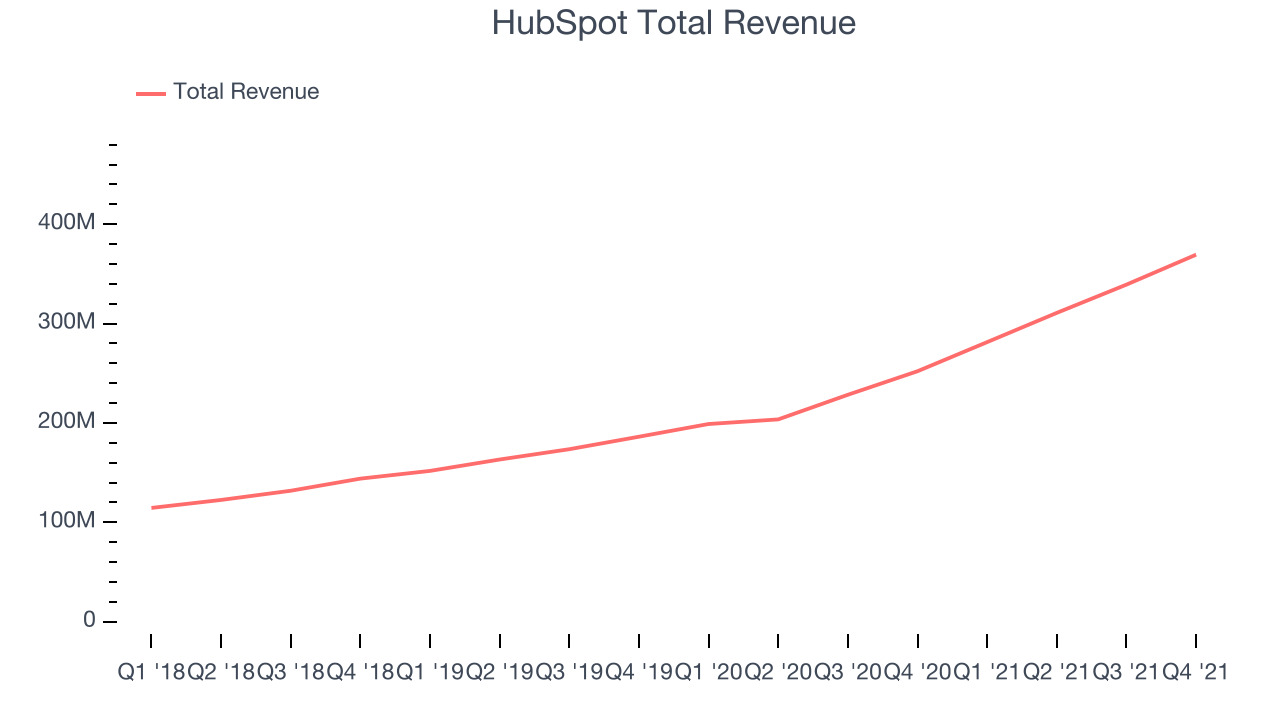

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $369.3 million, up 46.5% year on year, beating analyst expectations by 3.29%. It was an impressive quarter for the company, with an exceptional revenue growth and guidance for the next year above analysts' estimates.

HubSpot delivered the highest full year guidance raise among its peers. The company added 7,298 customers to a total of 135,442. The stock is down 15.2% since the results and currently trades at $452.70.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Zendesk (NYSE:ZEN)

Founded in 2006 by three Danish friends who got tired of implementing complex old-school solutions, Zendesk (NYSE:ZEN) is a software as a service platform that makes it easier for companies to provide help and support to their customers.

Zendesk reported revenues of $375.3 million, up 32.4% year on year, beating analyst expectations by 1.5%. It was a decent quarter for the company, with a strong top line growth and revenue guidance for the next quarter roughly in line with analysts' expectations.

Zendesk had the weakest full year guidance update in the group. The stock is up 12.6% since the results and currently trades at $128.58.

Read our full analysis of Zendesk's results here.

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software as a service platform that helps companies access, manage and share sales information.

Salesforce reported revenues of $7.32 billion, up 25.9% year on year, beating analyst expectations by 1.16%. It was a decent quarter for the company, with a strong sales guidance for the next quarter.

Salesforce had the weakest performance against analyst estimates and slowest revenue growth among the peers. The stock is down 8.66% since the results and currently trades at $190.80.

Read our full, actionable report on Salesforce here, it's free.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium sized businesses.

Freshworks reported revenues of $105.4 million, up 44.4% year on year, beating analyst expectations by 5.12%. It was a decent quarter for the company, with an exceptional revenue growth but an underwhelming guidance for the next year.

The company added 735 enterprise customers paying more than $5,000 annually to a total of 14,814. The stock is down 12.6% since the results and currently trades at $19.61.

Read our full, actionable report on Freshw

The author has no position in any of the stocks mentioned