Zoom (NASDAQ:ZM) Posts Better-Than-Expected Sales In Q1

Adam Hejl /

May 20, 2024

Video conferencing platform Zoom (NASDAQ:ZM) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 3.2% year on year to $1.14 billion. The company expects next quarter's revenue to be around $1.15 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.35 per share, improving from its profit of $1.16 per share in the same quarter last year.

Is now the time to buy Zoom? Find out in our full research report.

Zoom (ZM) Q1 CY2024 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.13 billion (1.2% beat)

- EPS (non-GAAP): $1.35 vs analyst estimates of $1.19 (13.5% beat)

- Revenue Guidance for Q2 CY2024 is $1.15 billion at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $4.62 billion at the midpoint

- Gross Margin (GAAP): 76.1%, in line with the same quarter last year

- Free Cash Flow of $569.7 million, up 71.2% from the previous quarter

- Net Revenue Retention Rate: 99%, in line with the previous quarter

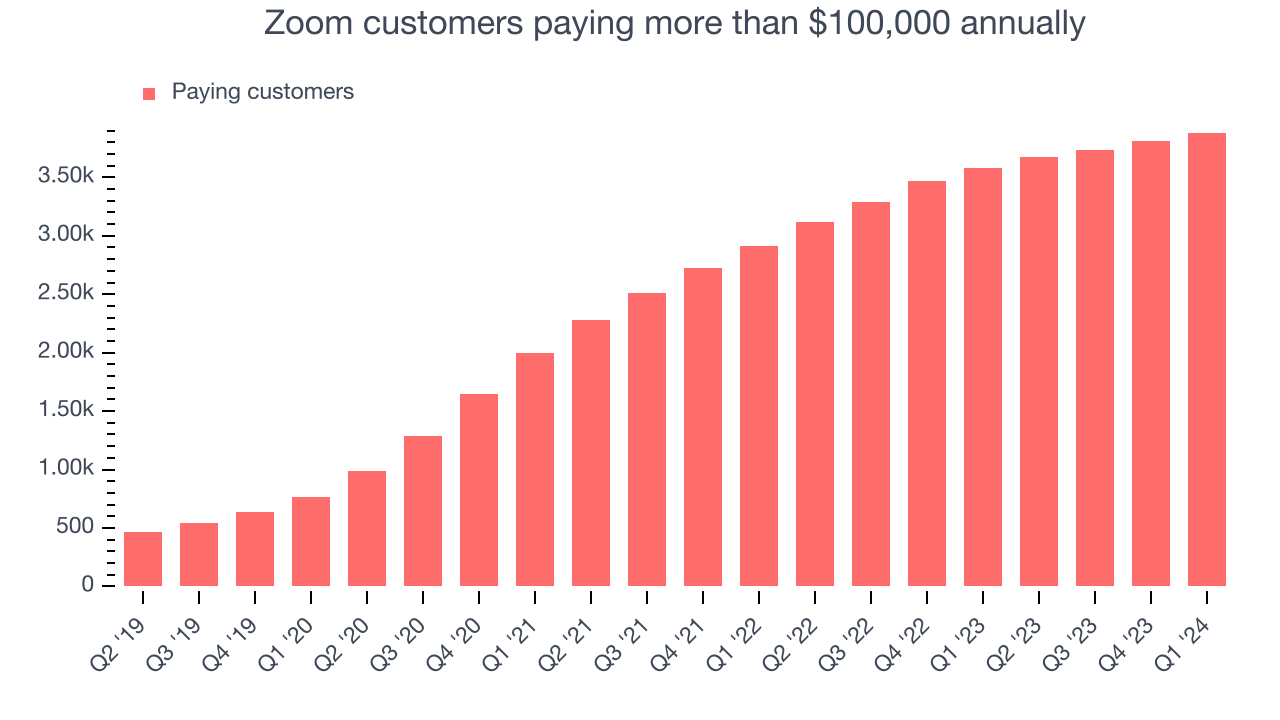

- Customers: 3,883 customers paying more than $100,000 annually

- Market Capitalization: $19.92 billion

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

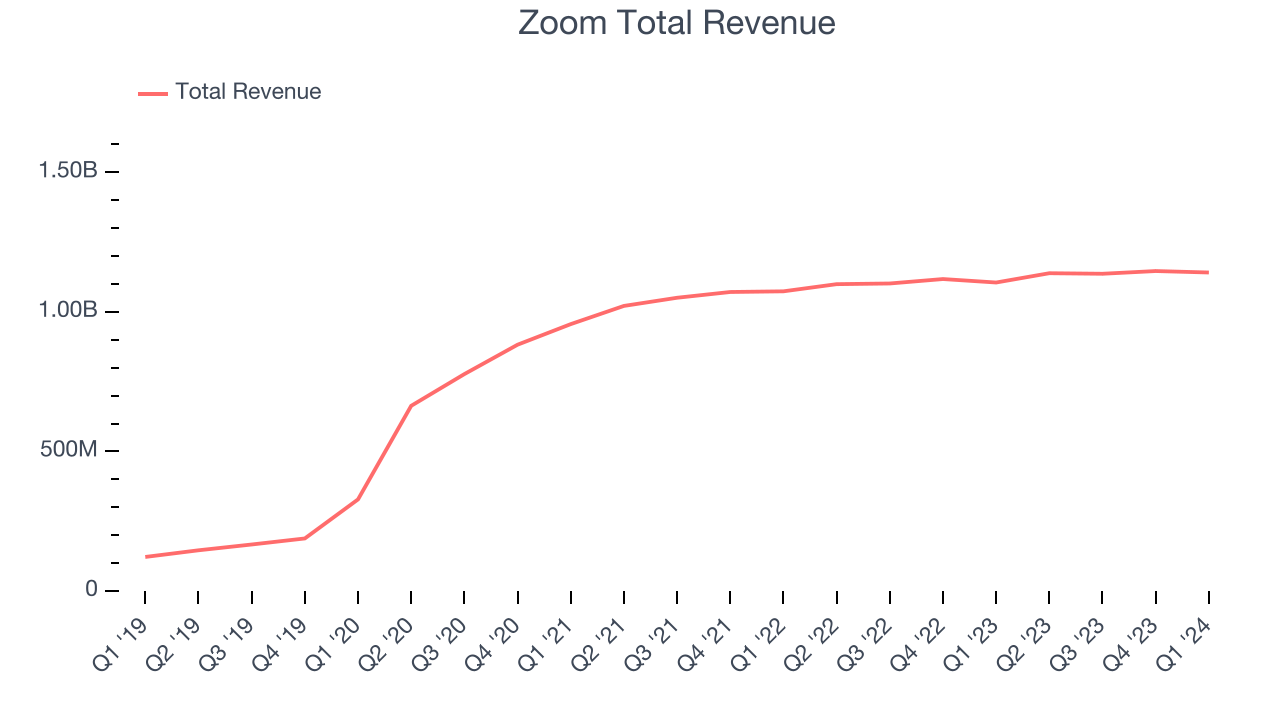

As you can see below, Zoom's revenue growth has been unremarkable over the last three years, growing from $956.2 million in Q1 2022 to $1.14 billion this quarter.

Zoom's quarterly revenue was only up 3.2% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $5.22 million in Q1 compared to the $9.73 million increase in Q4 CY2023. Sales also dropped by a similar amount a year ago and management is guiding for revenue to rebound in the coming quarter, which might hint at an emerging seasonal pattern.

Next quarter's guidance suggests that Zoom is expecting revenue to grow 0.8% year on year to $1.15 billion, slowing down from the 3.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 1.9% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Large Customers Growth

This quarter, Zoom reported 3,883 enterprise customers paying more than $100,000 annually, an increase of 73 from the previous quarter. That's in line with the number of contracts wins in the last quarter but quite a bit below what we've typically observed over the last year, suggesting that the sales slowdown we observed in the last quarter could continue.

Key Takeaways from Zoom's Q1 Results

It was encouraging to see Zoom narrowly top analysts' revenue expectations this quarter. On the other hand, its revenue guidance for next quarter underwhelmed and its net revenue retention decreased. Overall, the results could have been better. The company is down 1.7% on the results and currently trades at $63 per share.

So should you invest in Zoom right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.