Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Air Lease (NYSE:AL) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

The 4 vehicle parts distributors stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 7.1%.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data. However, vehicle parts distributors stocks have held steady amidst all this with share prices up 1.2% on average since the latest earnings results.

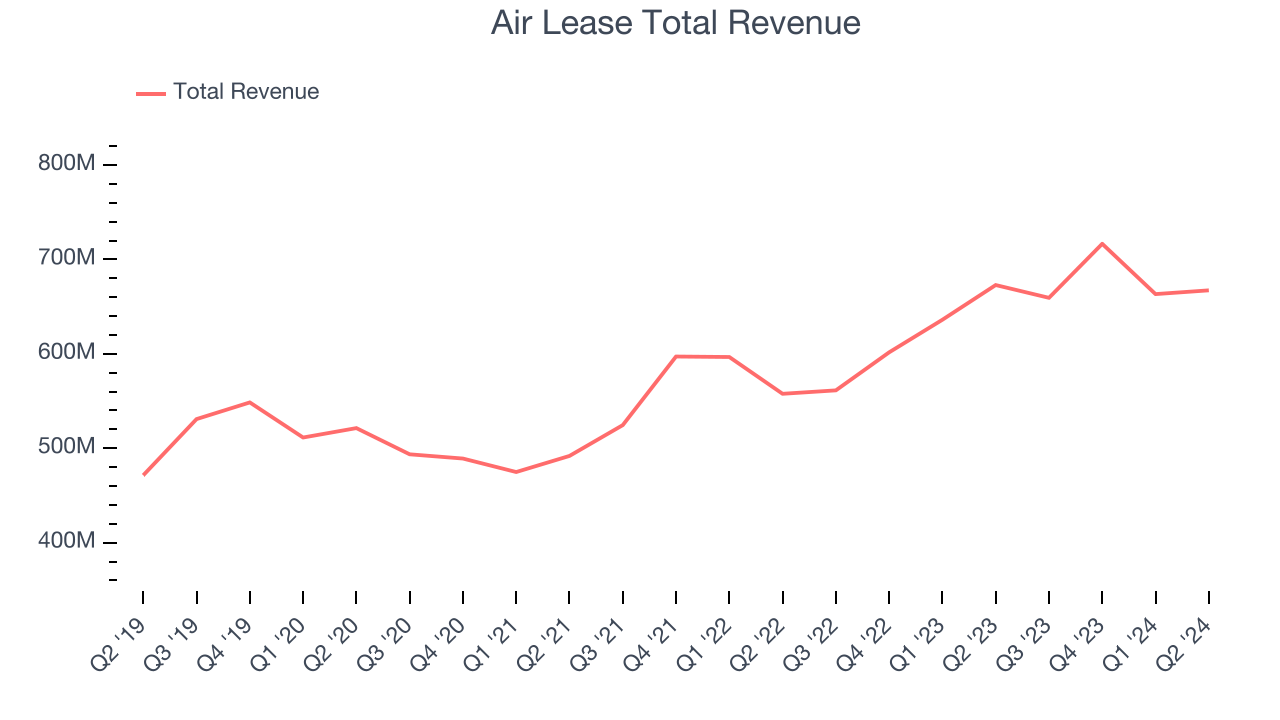

Weakest Q2: Air Lease (NYSE:AL)

Established by a founder of Century City in Los Angeles, Air Lease Corporation (NYSE:AL) provides aircraft leasing and financing solutions to airlines worldwide.

Air Lease reported revenues of $667.3 million, flat year on year. This print fell short of analysts’ expectations by 2.6%. Overall, it was a softer quarter for the company with a miss of analysts’ earnings estimates.

Air Lease delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 7.4% since reporting and currently trades at $44.18.

Read our full report on Air Lease here, it’s free.

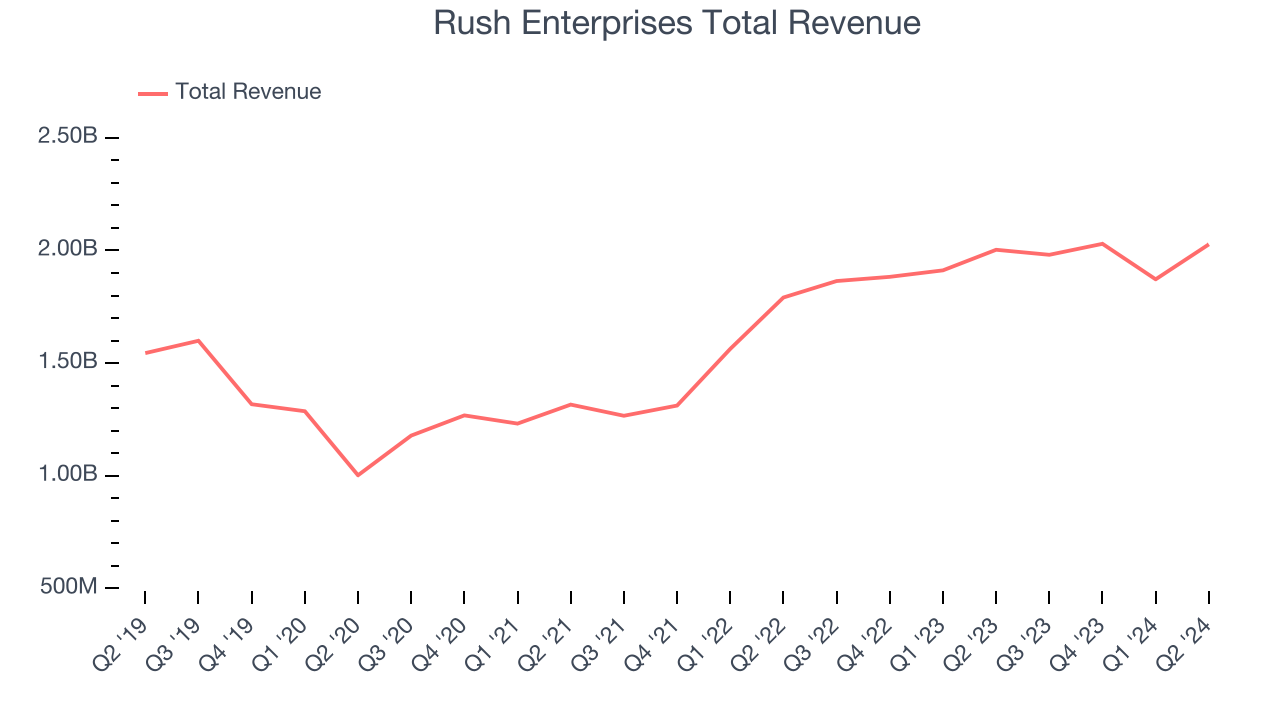

Best Q2: Rush Enterprises (NASDAQ:RUSHA)

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $2.03 billion, up 1.2% year on year, outperforming analysts’ expectations by 8.8%. The business had an exceptional quarter with an impressive beat of analysts’ earnings estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $51.47.

Is now the time to buy Rush Enterprises? Access our full analysis of the earnings results here, it’s free.

FTAI Aviation (NASDAQ:FTAI)

With a focus on the CFM56 engine that powers Boeing and Airbus’s aircrafts, FTAI Aviation (NASDAQ:FTAI) provides aircraft and engine leasing as well as the maintenance and repair of these products.

FTAI Aviation reported revenues of $443.6 million, up 61.7% year on year, exceeding analysts’ expectations by 22%. Still, it was a slower quarter as it posted a miss of analysts’ earnings estimates.

Interestingly, the stock is up 16.5% since the results and currently trades at $125.71.

Read our full analysis of FTAI Aviation’s results here.

GATX (NYSE:GATX)

Originally founded to ship beer, GATX (NYSE:GATX) provides leasing and management services for railcars and other transportation assets globally.

GATX reported revenues of $386.7 million, up 12.7% year on year. This result was in line with analysts’ expectations. However, it was a softer quarter as it produced a miss of analysts’ earnings estimates and underwhelming earnings guidance for the full year.

The stock is down 5.4% since reporting and currently trades at $137.59.

Read our full, actionable report on GATX here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.