Home security provider Arlo (NYSE:ARLO) reported Q2 CY2024 results topping analysts' expectations, with revenue up 10.8% year on year to $127.4 million. On the other hand, the company's full-year revenue guidance of $137 million at the midpoint came in 74% below analysts' estimates. It made a GAAP loss of $0.12 per share, down from its loss of $0.08 per share in the same quarter last year.

Is now the time to buy Arlo? Find out by accessing our full research report, it's free.

Arlo (ARLO) Q2 CY2024 Highlights:

- Revenue: $127.4 million vs analyst estimates of $125 million (1.9% beat)

- EPS: -$0.12 vs analyst estimates of -$0.06 (-$0.06 miss)

- Gross Margin (GAAP): 36.8%, in line with the same quarter last year

- EBITDA Margin: -8.7%, down from -7.1% in the same quarter last year

- Free Cash Flow of $6.17 million, down 68.3% from the previous quarter

- Market Capitalization: $1.25 billion

With its name deriving from the Old English word meaning “to see,” Arlo (NYSE:ARLO) provides home security products and other accessories to protect homes and businesses.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Arlo's sales grew at a decent 8% compounded annual growth rate over the last five years. This shows it was successful in expanding, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Arlo's recent history shows its demand slowed as its annualized revenue growth of 1.9% over the last two years is below its five-year trend.

This quarter, Arlo reported robust year-on-year revenue growth of 10.8%, and its $127.4 million of revenue exceeded Wall Street's estimates by 1.9%. Looking ahead, Wall Street expects sales to grow 5.1% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

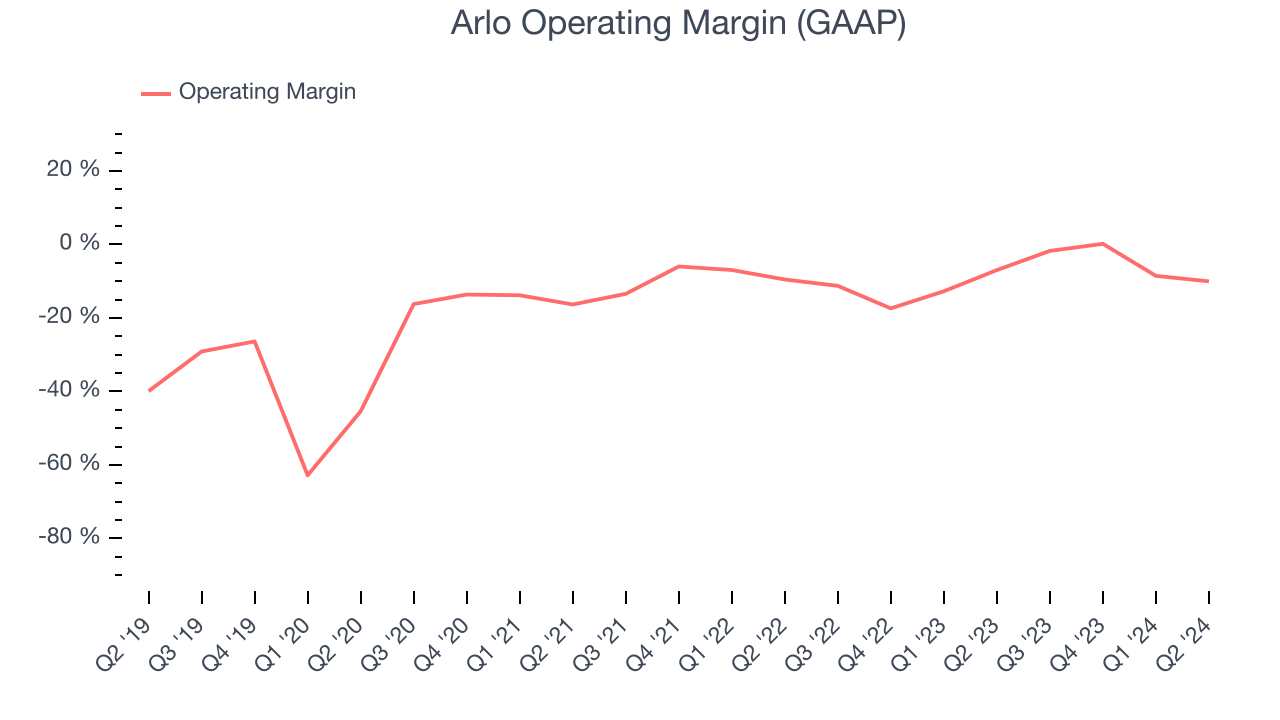

Operating Margin

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that Arlo can endure a full cycle as its high expenses have contributed to an average operating margin of negative 14.3% over the last five years. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Arlo's annual operating margin rose by 32.4 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

This quarter, Arlo generated an operating profit margin of negative 10%, down 3.1 percentage points year on year. Since Arlo's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

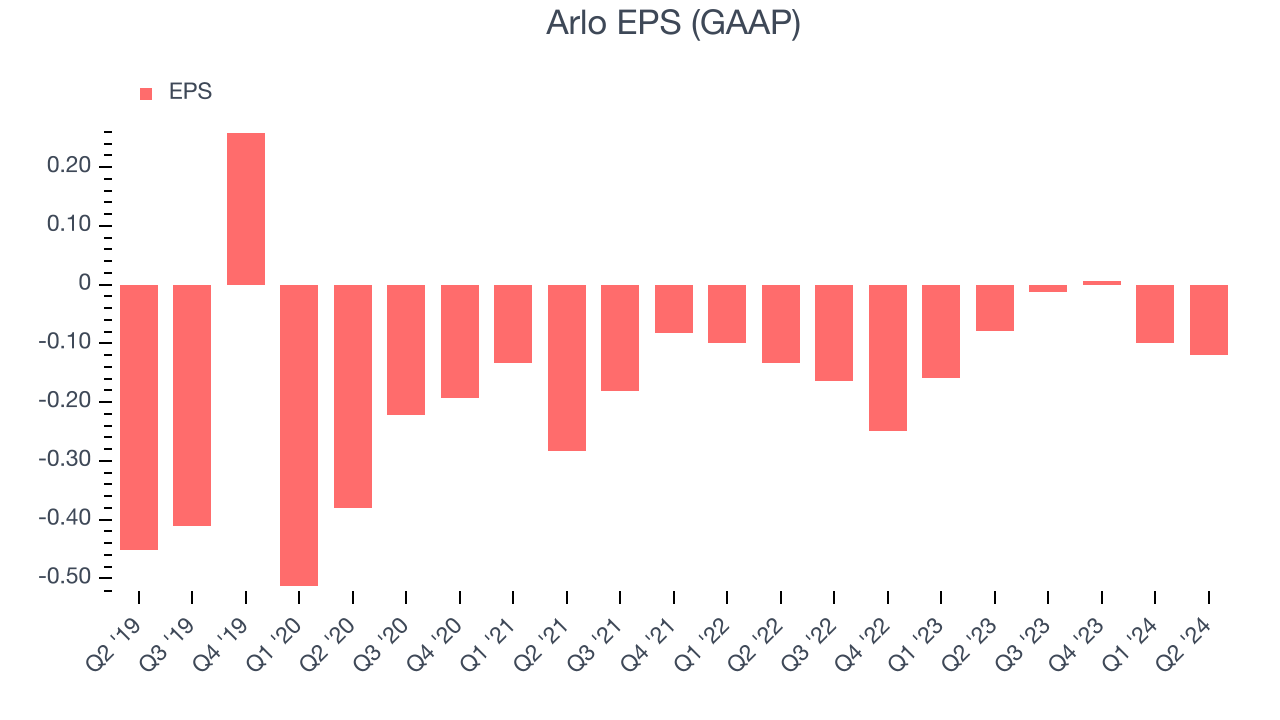

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Although Arlo's full-year earnings are still negative, it reduced its losses and improved its EPS by 32.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q2, Arlo reported EPS at negative $0.12, down from negative $0.08 in the same quarter last year. This print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Arlo's EPS of negative $0.23 in the last year to reach break even.

Key Takeaways from Arlo's Q2 Results

We enjoyed seeing Arlo exceed analysts' revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its EPS fell short of Wall Street's estimates. Overall, this was a mixed but overall mediocre quarter for Arlo. The stock remained flat at $13.52 immediately following the results.

So should you invest in Arlo right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.