Work management software maker Asana (NYSE: ASAN) announced better-than-expected results in the Q4 FY2021 quarter, with revenue up 57.28% year on year to $68.37 million. Asana made a GAAP loss of $61.51 million, down on its loss of $25.25 million, in the same quarter last year.

Asana (ASAN) Q4 FY2021 Highlights:

- Revenue: $68.37 million vs analyst estimates of $62.72 million (9.0% beat)

- EPS (non-GAAP): -$0.22 vs analyst estimates of -$0.26

- Revenue guidance for Q1 2022 is $70.00 million at the midpoint, above analyst estimates of $65.34 million

- Management's revenue guidance for FY2022 of $311.5 million at the midpoint, predicting 37.22% growth (vs 56.40% in FY2021)

- Free cash flow was negative -$17.48 million, compared to negative free cash flow of -$19.50 million in previous quarter

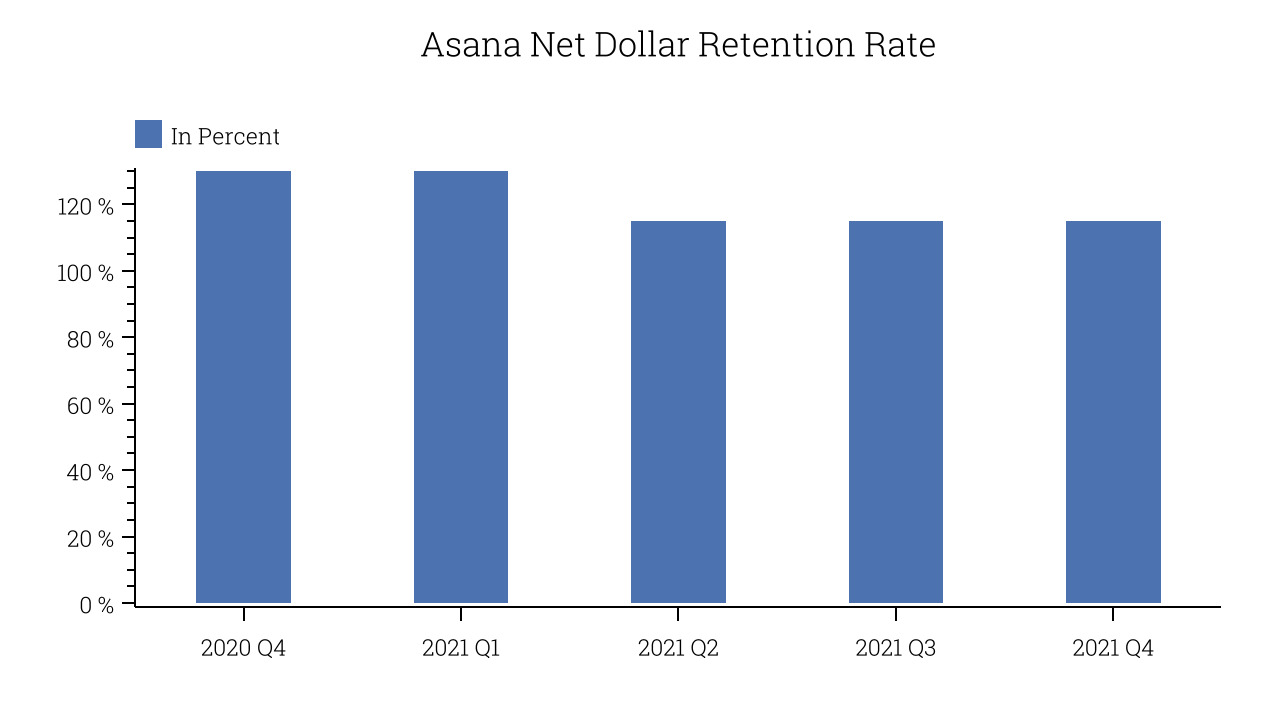

- Net Dollar Retention Rate: 115%, in line with previous quarter

- 93,000 customers, up from 89,000 in previous quarter

- 10,174 customers paying annually more than $5,000

- Gross Margin (GAAP): 88.02%, in line with previous quarter

“We reported a very strong quarter, with total revenue growth of 55 percent year over year and growth of revenue from customers who spend $5,000 or more on an annualized basis of over 80 percent year over year,” said Dustin Moskovitz, co-founder and chief executive officer of Asana. “With the acceleration of digital transformation, organizations are reimagining every aspect of business operations to ensure that people can stay engaged, aligned and effective, no matter where they are. Asana’s Work Graph provides the power, flexibility and control that organizations need to orchestrate work at scale.”

Eliminating The Work About Work

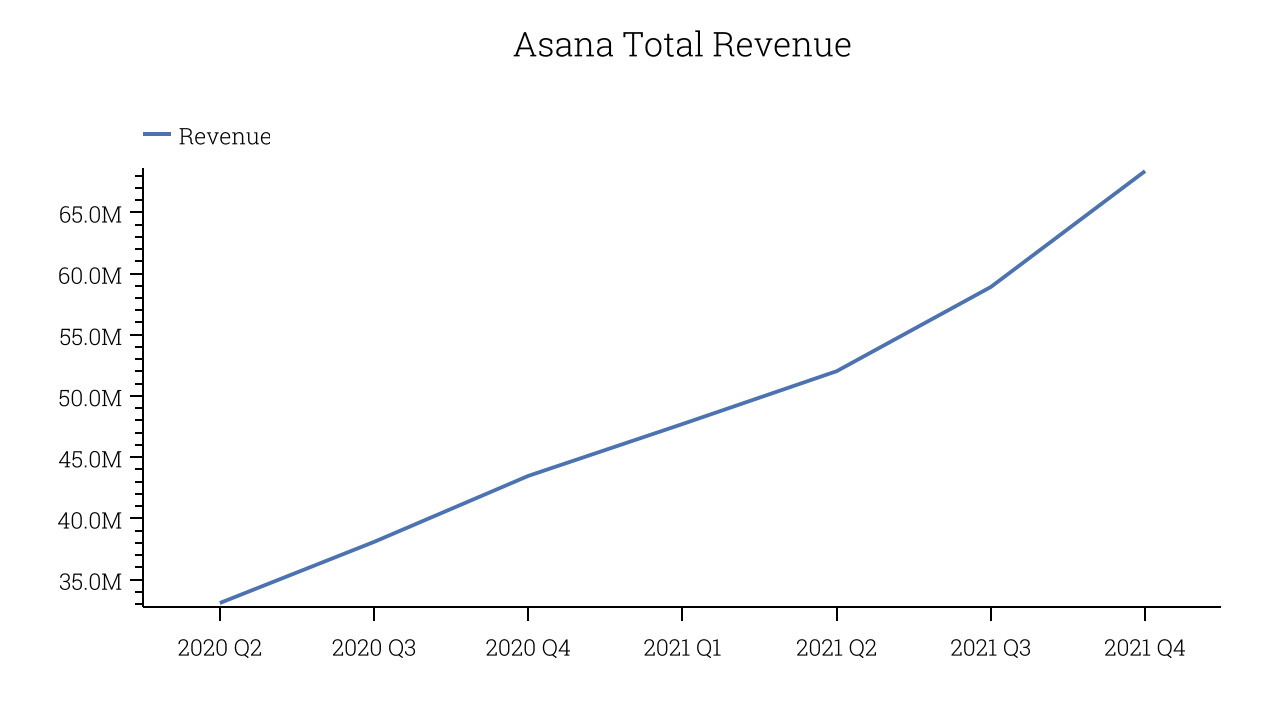

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work. The software integrates with a large number of other services like Dropbox, Slack or email and aims to create a centralised dashboard with a system of record for all information related to work planning. It is a crowded market and Asana is competing with companies like Atlassian (TEAM), SmartSheets (SMAR), Monday.com or Productboard but the demand is also growing strongly as work becomes more distributed and digitized. As you can see below, Asana's revenue growth has been exceptional over the last twelve months, growing from $43.47 million to $68.37 million.

This was another standout quarter with the revenue up a splendid 57.28% year on year. On top of that, revenue increased $9.464 million quarter on quarter, a very strong improvement on the $6.881 million increase in Q3 2021, and a sign of re-acceleration of growth, which is very nice to see indeed.

Asana's Growth Engine

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Asana is offering a limited version of its product for no cost to power a bottom-up distribution model. The software often starts being adopted by a single team in a company and over time penetrates the organization which becomes a paying customer, as more users are invited to collaborate.

Asana's net dollar retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 115% in Q4. That means even if they didn't win any new customers, Asana would have grown its revenue 15% year on year. Despite it going down over the last year this is still a good retention rate and a proof that Asana's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Asana's Q4 Results

Since it is still burning cash it is worth keeping an eye on Asana’s balance sheet, but we note that with $386.3 million cash and market capitalization of $5.225 billion the company has the capacity to continue to prioritise growth over profitability.

We were impressed by how strongly Asana outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing that the revenue guidance for next year indicates a bit of a slowdown. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. Therefore, Asana continues to be a decent growth stock to watch, even more so than before.

The author has no position in any of the stocks mentioned.