Clothing and footwear retailer Boot Barn (NYSE:BOOT) announced better-than-expected results in Q2 CY2024, with revenue up 10.3% year on year to $423.4 million. The company expects next quarter's revenue to be around $408.5 million, in line with analysts' estimates. It made a GAAP profit of $1.26 per share, improving from its profit of $1.13 per share in the same quarter last year.

Is now the time to buy Boot Barn? Find out in our full research report.

Boot Barn (BOOT) Q2 CY2024 Highlights:

- Revenue: $423.4 million vs analyst estimates of $416.6 million (1.6% beat)

- EPS: $1.26 vs analyst estimates of $1.07 (17.8% beat)

- Revenue Guidance for Q3 CY2024 is $408.5 million at the midpoint, roughly in line with what analysts were expecting

- The company lifted its revenue guidance for the full year from $1.78 billion to $1.83 billion at the midpoint, a 2.8% increase

- EPS (GAAP) guidance for Q3 CY2024 is $0.84 at the midpoint, missing analyst estimates by 9.6%

- Gross Margin (GAAP): 37%, in line with the same quarter last year

- EBITDA Margin: 15.2%, down from 17% in the same quarter last year

- Free Cash Flow of $14.25 million, down 65.2% from the same quarter last year

- Locations: 411 at quarter end, up from 361 in the same quarter last year

- Same-Store Sales rose 1.4% year on year (-2.9% in the same quarter last year)

- Market Capitalization: $3.59 billion

Jim Conroy, President and Chief Executive Officer, commented, “I am very pleased with our first quarter results and want to thank the entire Boot Barn team across the country for excellent execution. We increased revenue by more than 10% with growth in sales from both new stores and same store sales and exceeded the high end of our guidance range across every metric, including a significant beat of earnings per share. The sequential improvement we have seen in consolidated same store sales growth not only continued into the first quarter but grew consistently from month to month within the quarter itself. We are encouraged by the building sales momentum we have seen, particularly while maintaining our low promotional posture. Looking forward, despite the potential macroeconomic challenges, we remain steadfast in maintaining our focus on our strategic initiatives and feel that we are well-positioned for long-term success.”

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

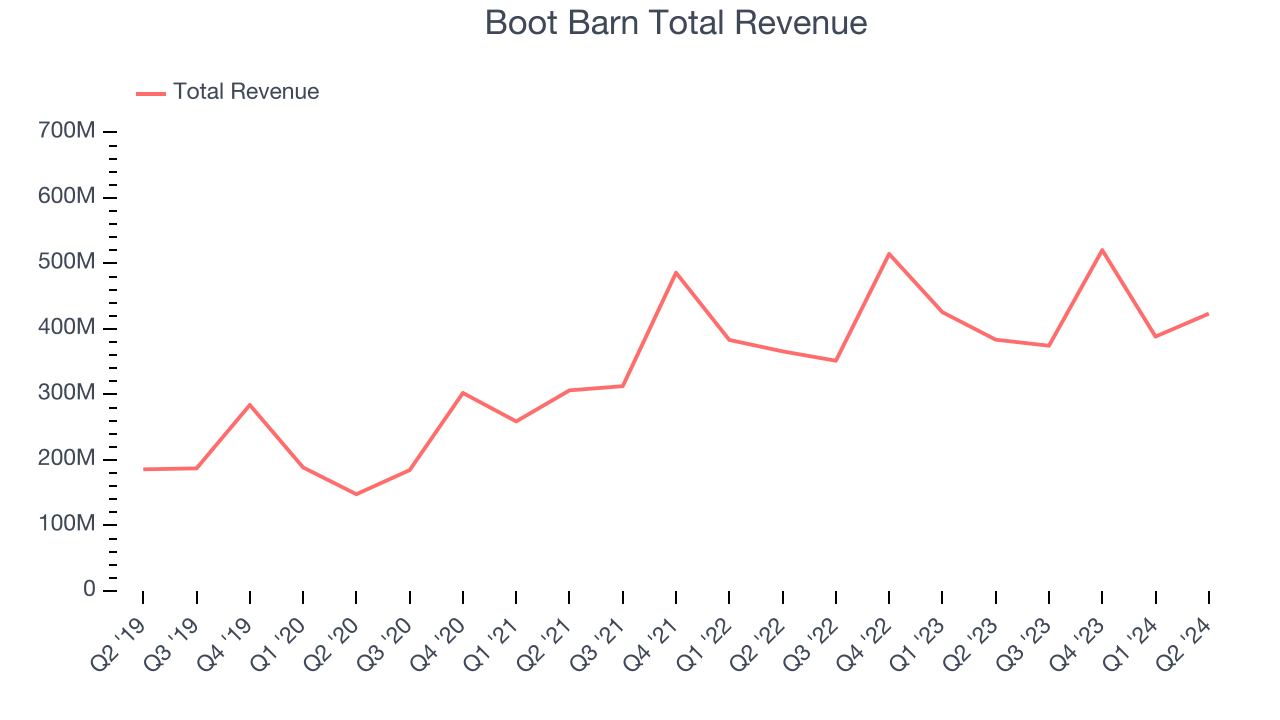

As you can see below, the company's annualized revenue growth rate of 16.3% over the last five years was impressive as it added more brick-and-mortar locations and expanded its reach.

This quarter, Boot Barn reported robust year-on-year revenue growth of 10.3%, and its $423.4 million in revenue exceeded Wall Street's estimates by 1.6%. The company is guiding for revenue to rise 9.1% year on year to $408.5 million next quarter, improving from the 6.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 10.3% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

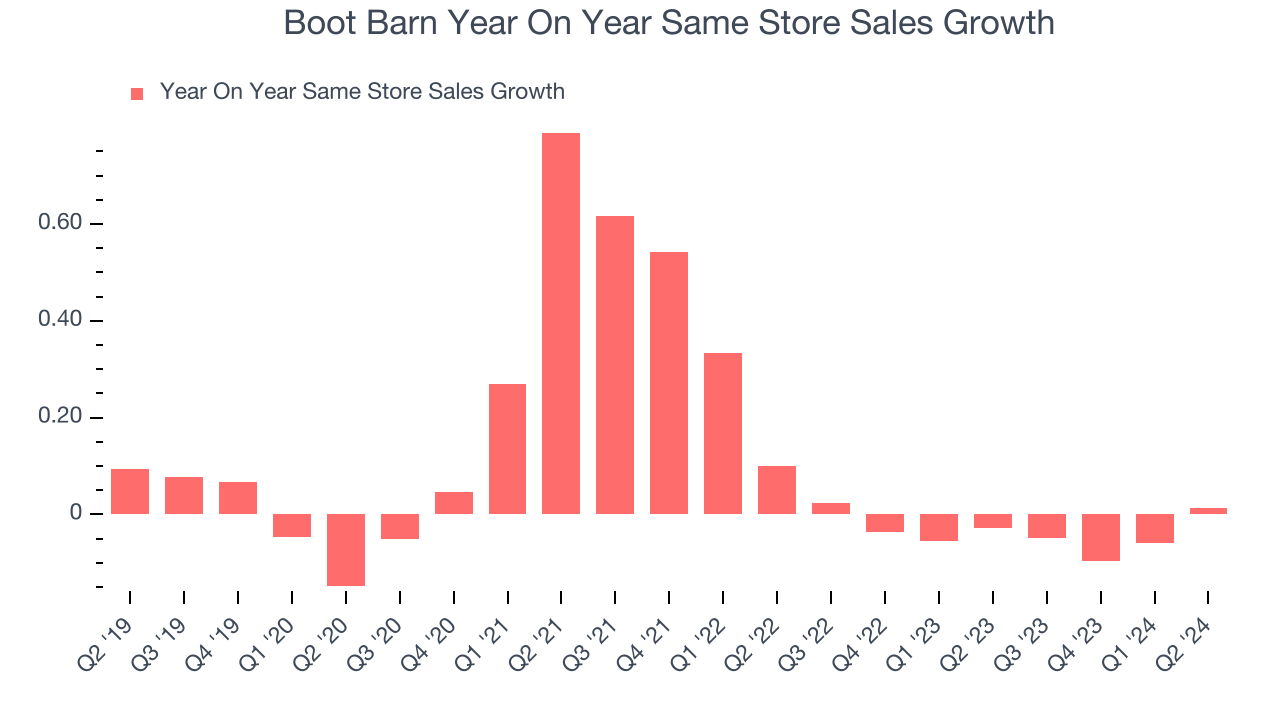

Boot Barn's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 3.6% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Boot Barn's same-store sales rose 1.4% year on year. This growth was a well-appreciated turnaround from the 2.9% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Boot Barn's Q2 Results

We enjoyed seeing Boot Barn exceed analysts' revenue, gross margin, and EPS expectations this quarter. We were also excited it raised its full-year revenue guidance, which outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter fell short. Zooming out, we think this was a mixed quarter. The stock traded up 5% to $121.64 immediately after reporting.

So should you invest in Boot Barn right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.