Online study and academic help platform Chegg (NYSE:CHGG) beat analysts' expectations in Q2 FY2023, with revenue down 6.09% year on year to $182.9 million. The company also expects next quarter's revenue to be around $152 million, roughly in line with analysts' estimates. Chegg made a GAAP profit of $24.6 million, improving from its profit of $7.48 million in the same quarter last year.

Is now the time to buy Chegg? Find out by accessing our full research report free of charge.

Chegg (CHGG) Q2 FY2023 Highlights:

- Revenue: $182.9 million vs analyst estimates of $176.5 million (3.59% beat)

- EPS (non-GAAP): $0.28 vs analyst expectations of $0.29 (2.35% miss)

- Revenue Guidance for Q3 2023 is $152 million at the midpoint, roughly in line with what analysts were expecting

- Free Cash Flow of $55.8 million, similar to the previous quarter

- Gross Margin (GAAP): 74.1%, down from 76.5% in the same quarter last year

- Services Subscribers: 4.8 million, down 0.5 million year on year

“Chegg outperformed guidance for both revenue and adjusted EBITDA in Q2 and saw year-over-year customer acquisition and retention rates improve during the quarter,” said Dan Rosensweig, CEO & President of Chegg, Inc. “We launched the beta version of our initial generative AI experience in May and feedback has been very positive. We believe we are in an unrivaled position to deliver a unique, personalized learning experience for students because we have the assets, the vision, and the balance sheet that no one else has.”

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to or what movie they watch, or finding a date, online consumer businesses today are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have increased usage and stickiness of many online consumer services.

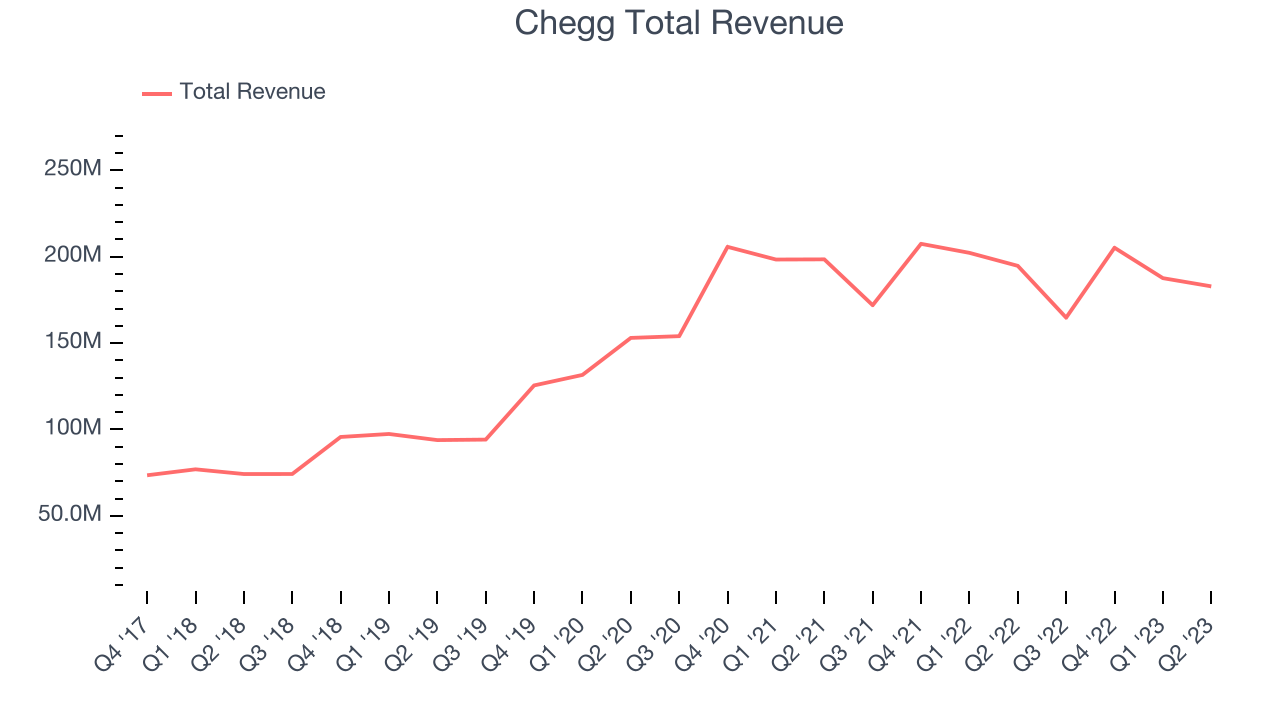

Sales Growth

Chegg's revenue growth over the last three years has been mediocre, averaging 16.8% annually. This quarter, Chegg beat analysts' estimates but reported a year on year revenue decline of 6.09%.

Chegg is expecting next quarter's revenue to decline 7.73% year on year to $152 million, a further deceleration of the 4.19% year-on-year decrease it recorded in the same quarter last year. Before the earnings results were announced, Wall Street analysts covering the company were projecting revenue to decline -5.3% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

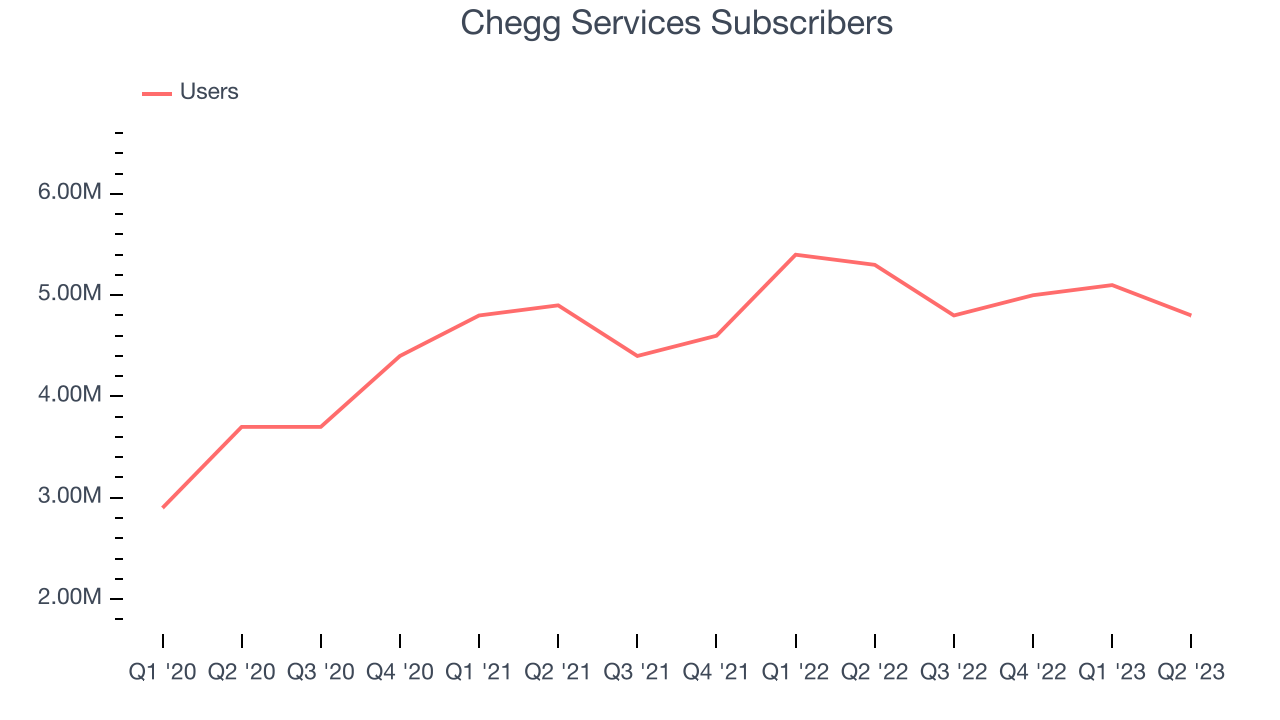

Usage Growth

As a subscription-based app, Chegg generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Chegg's users, a key performance metric for the company, grew 5.87% annually to 4.8 million. This is average growth for a consumer internet company.

Unfortunately, Chegg's users decreased by 0.5 million in Q2, a 9.43% drop since last year.

Key Takeaways from Chegg's Q2 Results

Sporting a market capitalization of $1.26 billion, Chegg is among smaller companies, but its more than $385.1 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was good to see Chegg beat analysts' revenue expectations this quarter, although paying subscribers missed slightly. That really stood out as a positive in these results, especially given the very low expectations going into the quarter. As a reminder, the market was very worried about Chegg as a business and going concern, thinking that AI would decimate demand for the product. On the other hand, the decline in its user base was concerning and its revenue growth was quite weak. Overall, this was a mixed quarter for Chegg on an absolute basis, but again, compared to the low expectations, the results seemed solid. The stock is up 26.2% after reporting and currently trades at $12.65 per share.

Chegg may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.