Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Chewy (NYSE:CHWY) and the best and worst performers in the online retail industry.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 6 online retail stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 1.3% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Luckily, online retail stocks have performed well with share prices up 18.5% on average since the latest earnings results.

Chewy (NYSE:CHWY)

Founded by Ryan Cohen who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

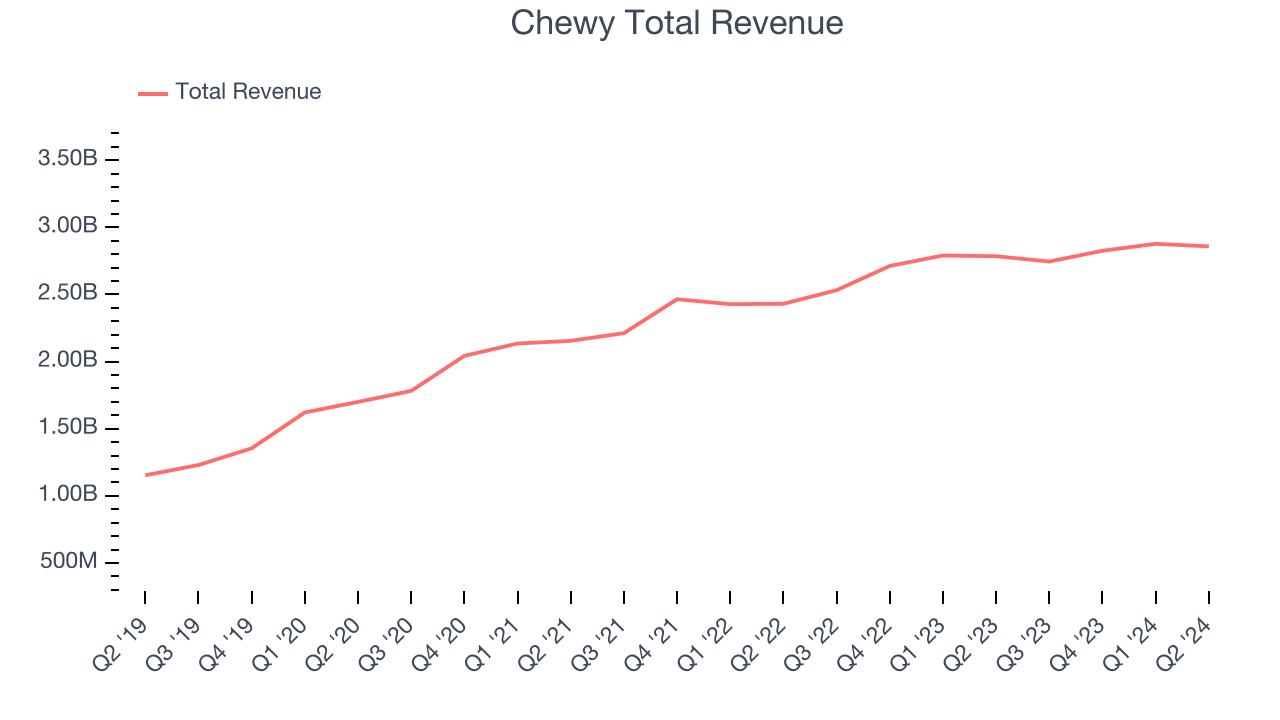

Chewy reported revenues of $2.86 billion, up 2.6% year on year. This print was in line with analysts’ expectations, but overall, it was a weaker quarter for the company with slow revenue growth.

Interestingly, the stock is up 14.9% since reporting and currently trades at $29.68.

Read our full report on Chewy here, it’s free.

Best Q2: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

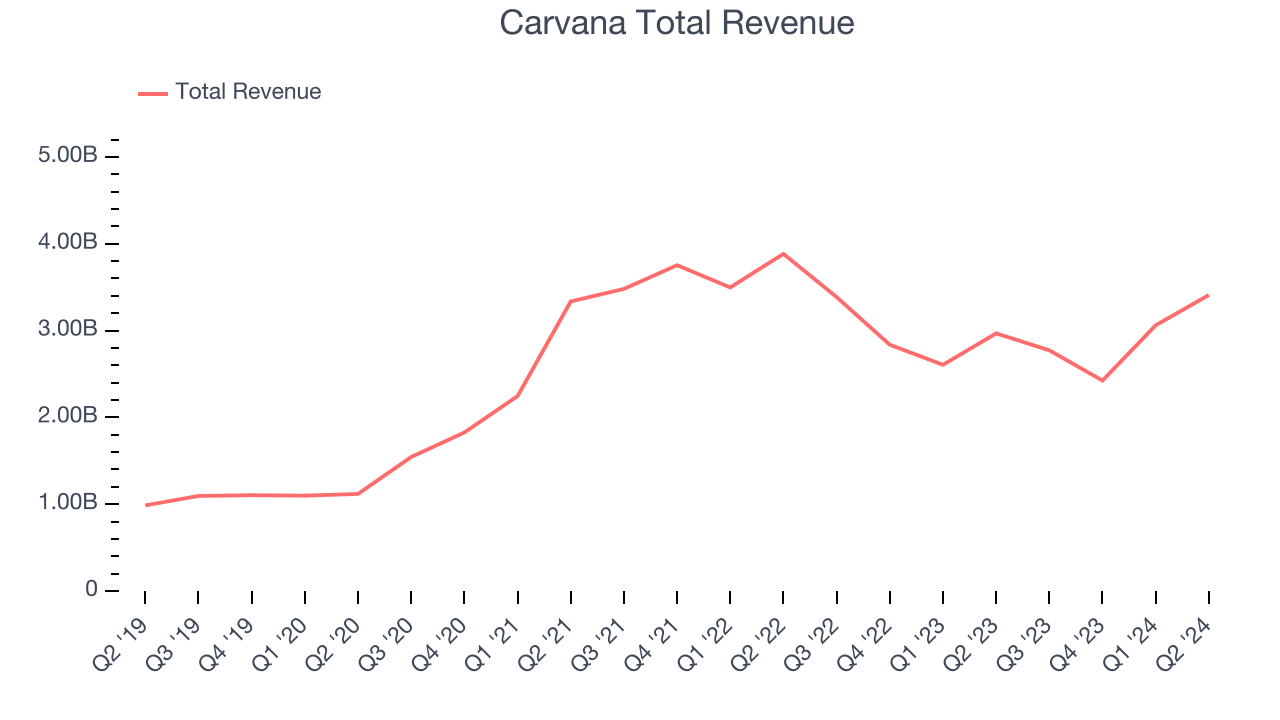

Carvana reported revenues of $3.41 billion, up 14.9% year on year, outperforming analysts’ expectations by 4.6%. Overall, the business had a strong quarter.

Carvana pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 27.7% since reporting. It currently trades at $170.21.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.12 billion, down 1.7% year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted a miss of analysts’ buyer estimates and slow revenue growth.

Wayfair delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 22 million active buyers, up 0.9% year on year. The stock is flat since the results and currently trades at $54.36.

Read our full analysis of Wayfair’s results here.

Coupang (NYSE:CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

Coupang reported revenues of $7.32 billion, up 25.4% year on year. This result was in line with analysts’ expectations. Aside from that, it was a slower quarter as it missed analysts’ buyer estimates.

Coupang delivered the fastest revenue growth among its peers. The company reported 21.7 million active buyers, up 11.9% year on year. The stock is up 20.7% since reporting and currently trades at $24.95.

Read our full, actionable report on Coupang here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.