Women’s plus-size apparel retailer Torrid Holdings (NYSE:CURV) reported results in line with analysts’ expectations in Q2 CY2024, with revenue down 1.6% year on year to $284.6 million. On the other hand, next quarter’s revenue guidance of $282.5 million was less impressive, coming in 1.9% below analysts’ estimates. It made a GAAP profit of $0.08 per share, improving from its profit of $0.06 per share in the same quarter last year.

Is now the time to buy Torrid? Find out by accessing our full research report, it’s free.

Torrid (CURV) Q2 CY2024 Highlights:

- Revenue: $284.6 million vs analyst estimates of $283 million (small beat)

- EPS: $0.08 vs analyst estimates of $0.06 (33.3% beat)

- The company reconfirmed its revenue guidance for the full year of $1.14 billion at the midpoint

- EBITDA guidance for the full year is $113 million at the midpoint, below analyst estimates of $114.6 million

- Gross Margin (GAAP): 38.7%, up from 35.5% in the same quarter last year

- EBITDA Margin: 12.2%, up from 11.1% in the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 5.7% in the same quarter last year

- Locations: 657 at quarter end, up from 639 in the same quarter last year

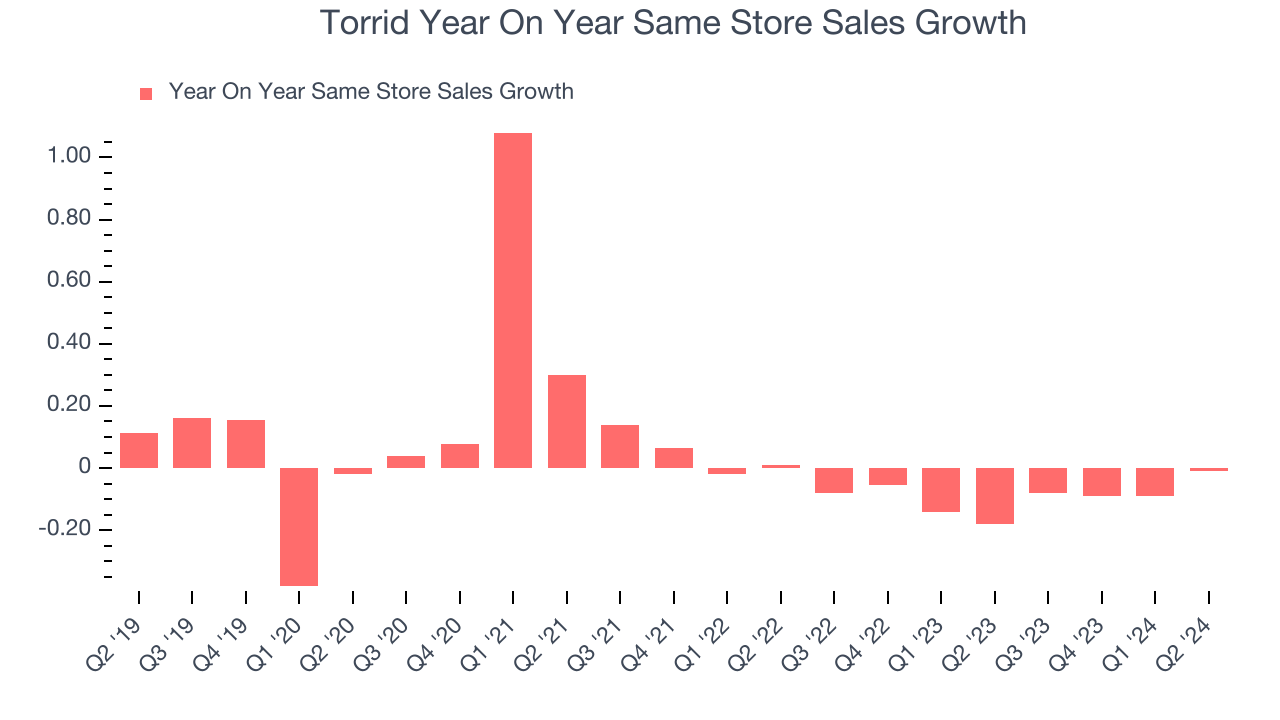

- Same-Store Sales were flat year on year (-18% in the same quarter last year)

- Market Capitalization: $640.7 million

Lisa Harper, Chief Executive Officer, stated, “We are very pleased with our second quarter performance, which came in at the high end of sales guidance and exceeded our adjusted EBITDA expectations. Customers are responding to our new product offerings, resulting in regular price comparable sales(2) growth of 6.4%, and gross margin expansion of 323 basis points. We ended the quarter with $54 million in cash and cash equivalents as we continue to tightly manage our inventory levels, which were down 19% to last year, driving a $35 million increase in total cash. We believe we are at an inflection point in the business and are well positioned to build on the success we have seen in the first half of the year. We expect to generate low single digit positive comparable store sales in the back half of the year driven by higher full-price sales as our markdown levels normalize.”

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

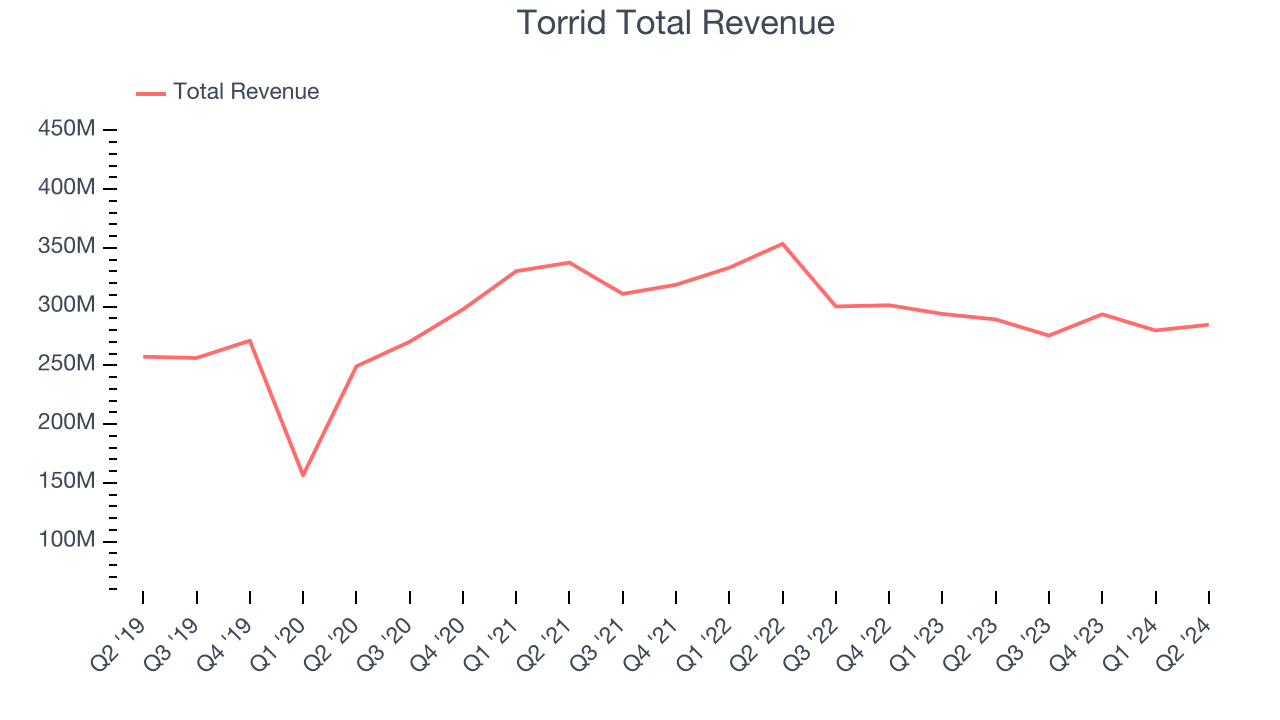

As you can see below, the company’s annualized revenue growth rate of 2.9% over the last five years was sluggish , but to its credit, it opened new stores and expanded its reach.

This quarter, Torrid reported a rather uninspiring 1.6% year-on-year revenue decline to $284.6 million in revenue, in line with Wall Street’s estimates. The company is guiding for revenue to rise 2.6% year on year to $282.5 million next quarter, improving from the 8.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer’s established brick-and-mortar stores and e-commerce platform.

Torrid’s demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 9% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Torrid’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from the 18% year-on-year decline it posted 12 months ago, showing the business is doing better.

Key Takeaways from Torrid’s Q2 Results

We were impressed by how significantly Torrid blew past analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter was underwhelming and its gross margin missed Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock remained flat at $6.14 immediately following the results.

So should you invest in Torrid right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.