Aerospace and defense company Ducommun (NYSE:DCO) beat analysts' expectations in Q2 CY2024, with revenue up 5.2% year on year to $197 million. It made a non-GAAP profit of $0.83 per share, improving from its profit of $0.54 per share in the same quarter last year.

Is now the time to buy Ducommun? Find out in our full research report.

Ducommun (DCO) Q2 CY2024 Highlights:

- Revenue: $197 million vs analyst estimates of $194.9 million (1.1% beat)

- EPS (non-GAAP): $0.83 vs analyst estimates of $0.61 (36.6% beat)

- Gross Margin (GAAP): 26%, up from 21.7% in the same quarter last year

- EBITDA Margin: 15.2%, up from 13.9% in the same quarter last year

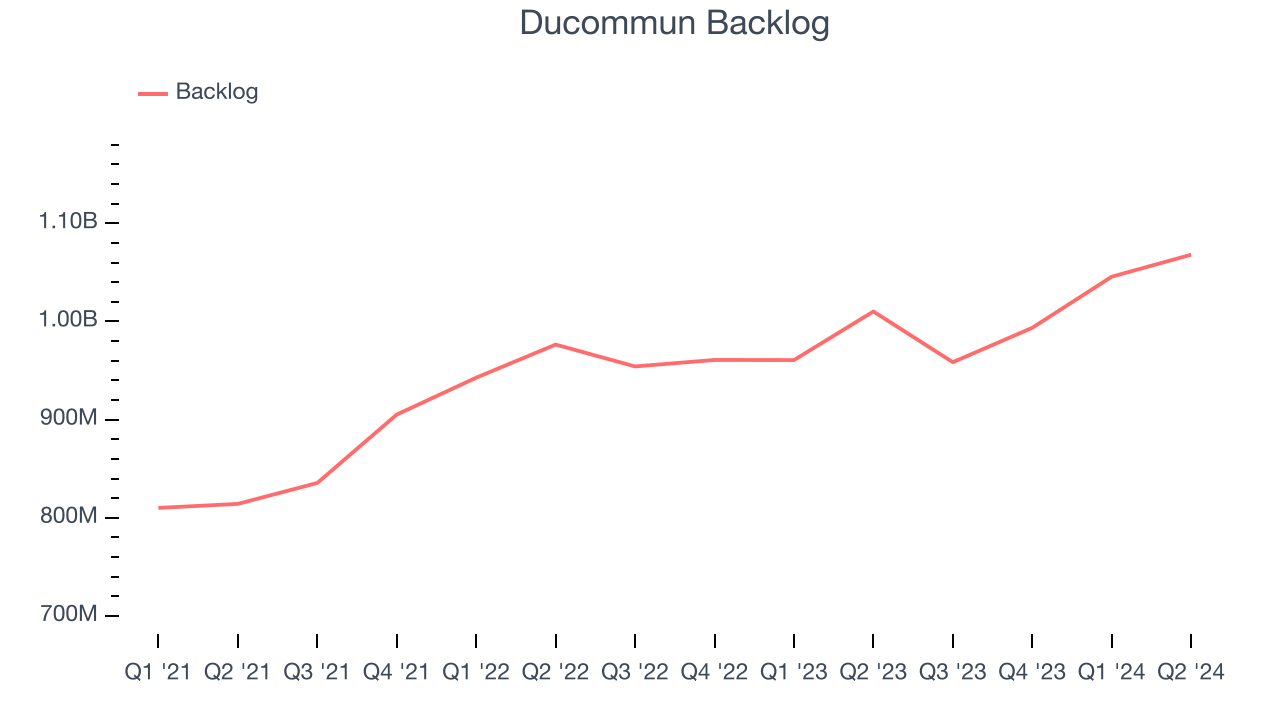

- Backlog: $1.07 billion at quarter end, up 5.7% year on year

- Market Capitalization: $878.9 million

“Q2 was another outstanding quarter for DCO as we grew our topline both year-over-year and sequentially, led by strength in both of our Commercial Aerospace and Military segments along with strong quarterly gross margins and Adjusted EBITDA margins,” said Stephen G. Oswald, chairman, president and chief executive officer.

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

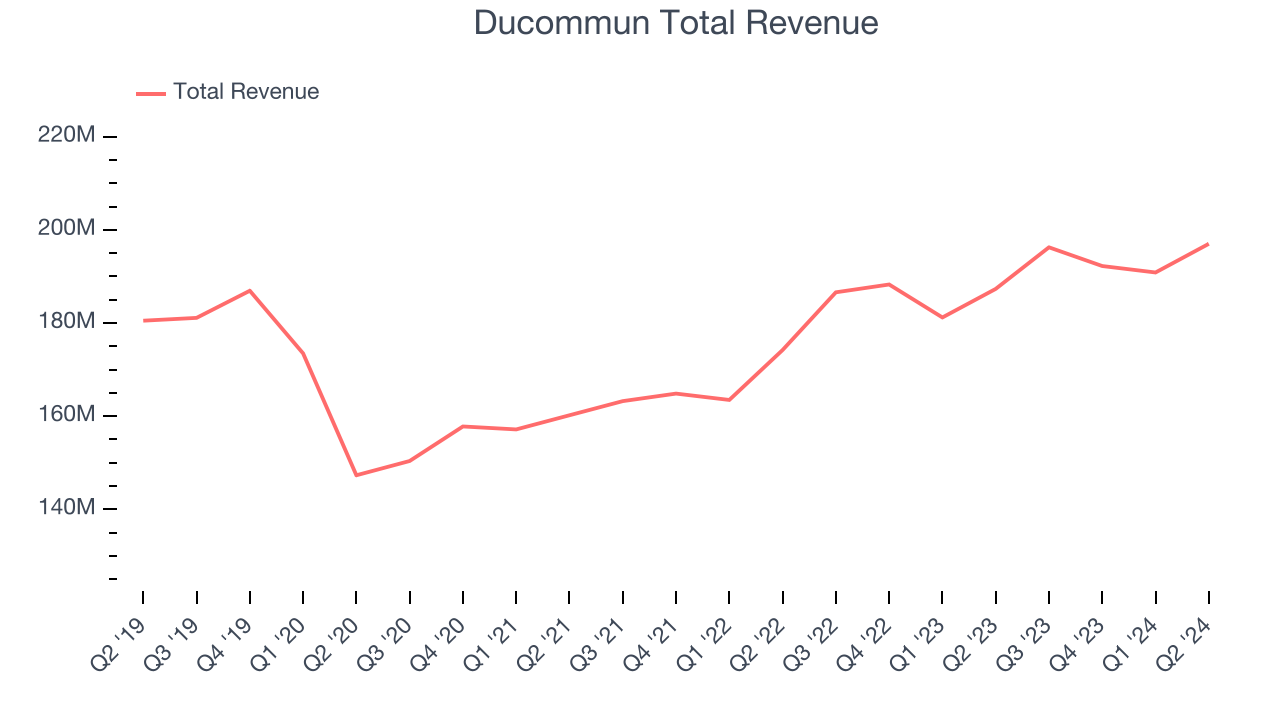

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Regrettably, Ducommun's sales grew at a weak 2.3% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Ducommun's annualized revenue growth of 8% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig further into the company's revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Ducommun's backlog reached $1.07 billion in the latest quarter and averaged 5.5% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Ducommun was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Ducommun reported solid year-on-year revenue growth of 5.2%, and its $197 million of revenue outperformed Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects sales to grow 5.8% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

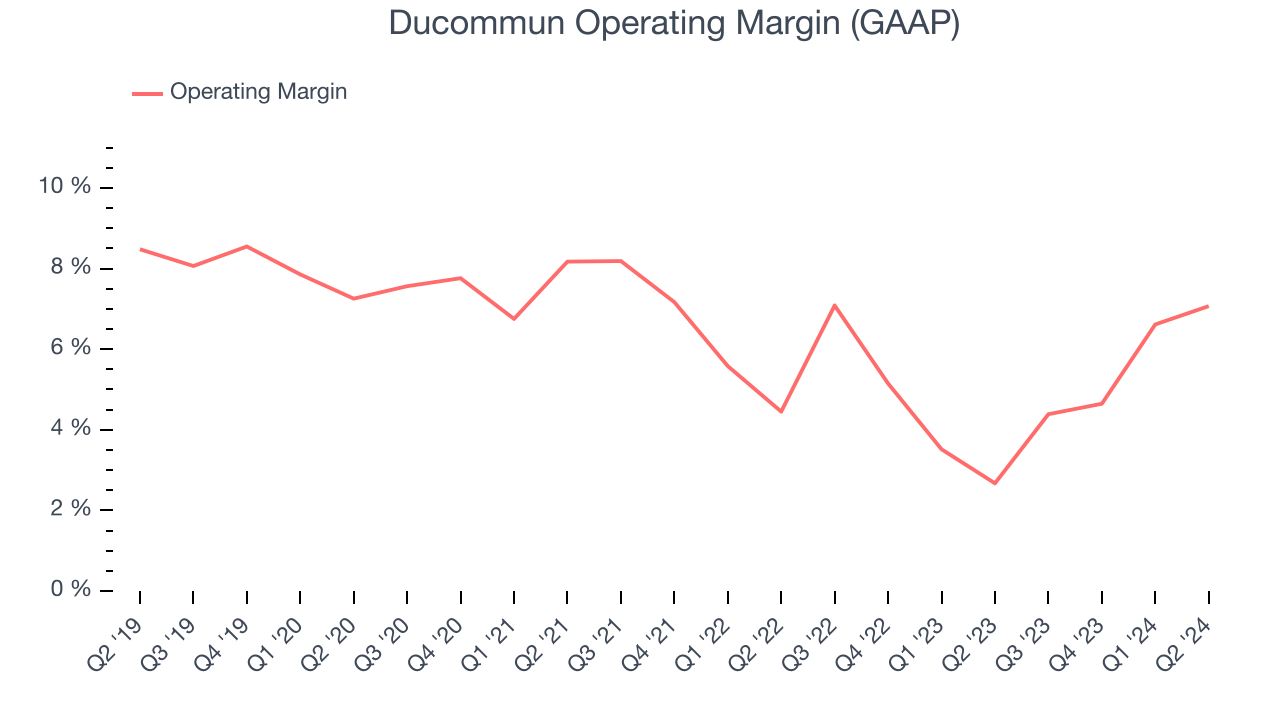

Operating Margin

Ducommun was profitable over the last five years but held back by its large expense base. It demonstrated paltry profitability for an industrials business, producing an average operating margin of 6.4%.

Looking at the trend in its profitability, Ducommun's annual operating margin decreased by 2.3 percentage points over the last five years. The company's performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn't pass those costs onto its customers.

This quarter, Ducommun generated an operating profit margin of 7.1%, up 4.4 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

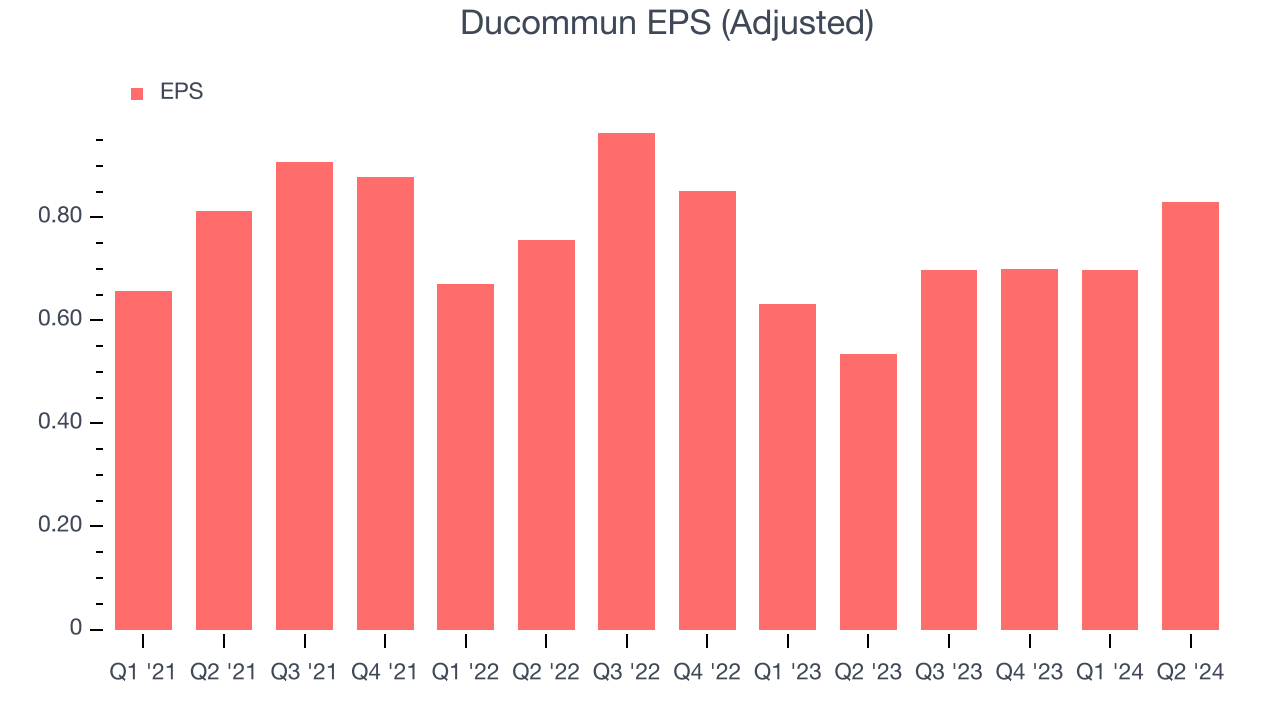

EPS

Analyzing revenue trends tells us about a company's historical growth, but earnings per share (EPS) growth points to the profitability of that growth–for example, a company could inflate sales through excessive spending on advertising and promotions.

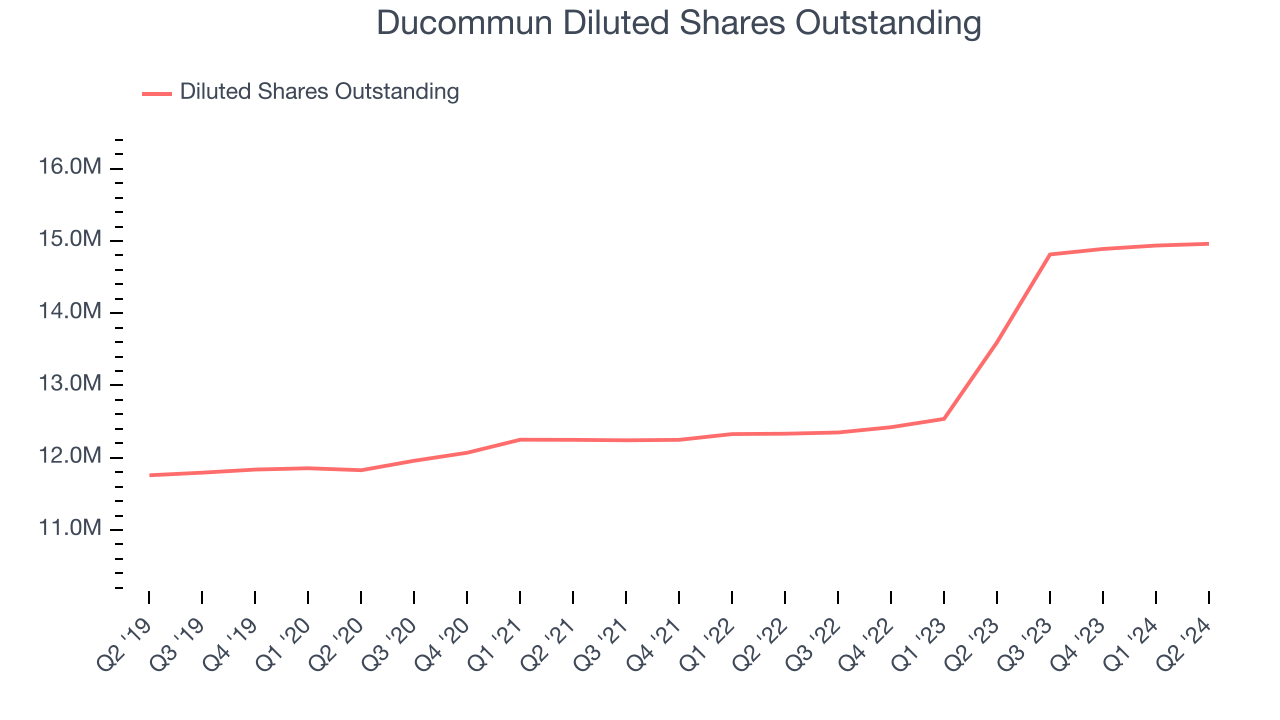

Sadly for Ducommun, its EPS declined by 4.6% annually over the last two years while its revenue grew 8%. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Diving into the nuances of Ducommun's earnings can give us a better understanding of its performance. A two-year view shows Ducommun has diluted its shareholders, growing its share count by 21.3%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

In Q2, Ducommun reported EPS at $0.83, up from $0.54 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ducommun to grow its earnings. Analysts are projecting its EPS of $2.93 in the last year to climb by 11.7% to $3.27.

Key Takeaways from Ducommun's Q2 Results

We were impressed by how significantly Ducommun blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $59.72 immediately after reporting.

Ducommun may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.