As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the sit-down dining industry, including Dine Brands (NYSE:DIN) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data, and while some sit-down dining stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

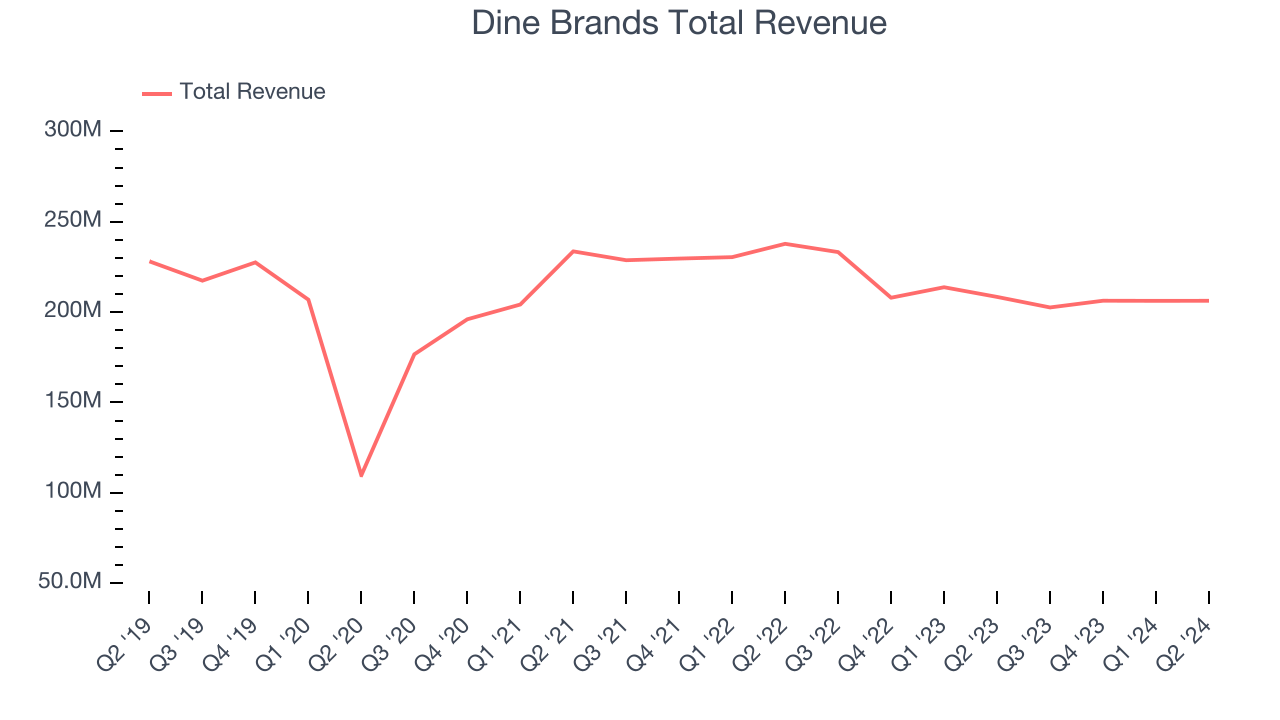

Dine Brands (NYSE:DIN)

Operating a franchise model, Dine Brands (NYSE:DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $206.3 million, down 1% year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a slower quarter for the company with some shareholders anticipating a better outcome.

“Our brands have a long history of weathering economic cycles and despite the consumer pullback the industry witnessed this quarter, we are confident that our strategies around profitable promotions, menu innovation and development will help us manage both short-term challenges while positioning us for the long term,” said John Peyton, chief executive officer, Dine Brands Global, Inc.

Unsurprisingly, the stock is down 5.2% since reporting and currently trades at $30.20.

Read our full report on Dine Brands here, it’s free.

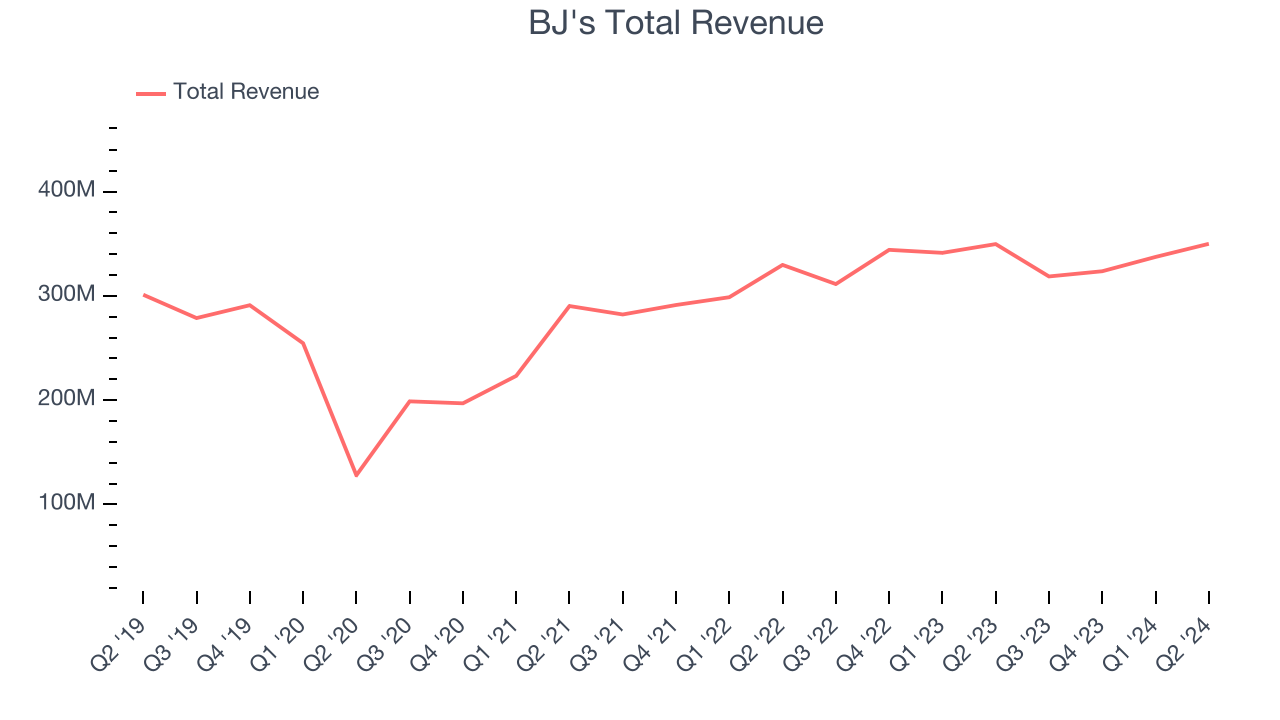

Best Q2: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $349.9 million, flat year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ earnings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.8% since reporting. It currently trades at $31.37.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Denny's (NASDAQ:DENN)

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $115.9 million, flat year on year, falling short of analysts’ expectations by 2.6%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 15.1% since the results and currently trades at $6.51.

Read our full analysis of Denny’s results here.

Darden (NYSE:DRI)

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Darden reported revenues of $2.96 billion, up 6.8% year on year. This number met analysts’ expectations. Taking a step back, it was a slower quarter as it logged full-year revenue guidance missing analysts’ expectations and underwhelming earnings guidance for the full year.

Darden had the weakest full-year guidance update among its peers. The stock is up 5.3% since reporting and currently trades at $160.14.

Read our full, actionable report on Darden here, it’s free.

First Watch (NASDAQ:FWRG)

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

First Watch reported revenues of $258.6 million, up 19.5% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also logged a solid beat of analysts’ earnings estimates.

The stock is up 9.3% since reporting and currently trades at $15.59.

Read our full, actionable report on First Watch here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.