Looking back on apparel and footwear retail stocks' Q3 earnings, we examine this quarter's best and worst performers, including Dick's (NYSE:DKS) and its peers.

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

The 18 apparel and footwear retail stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 1.8% while next quarter's revenue guidance was 2.1% above consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but apparel and footwear retail stocks held their ground better than others, with the share prices up 8.9% on average since the previous earnings results.

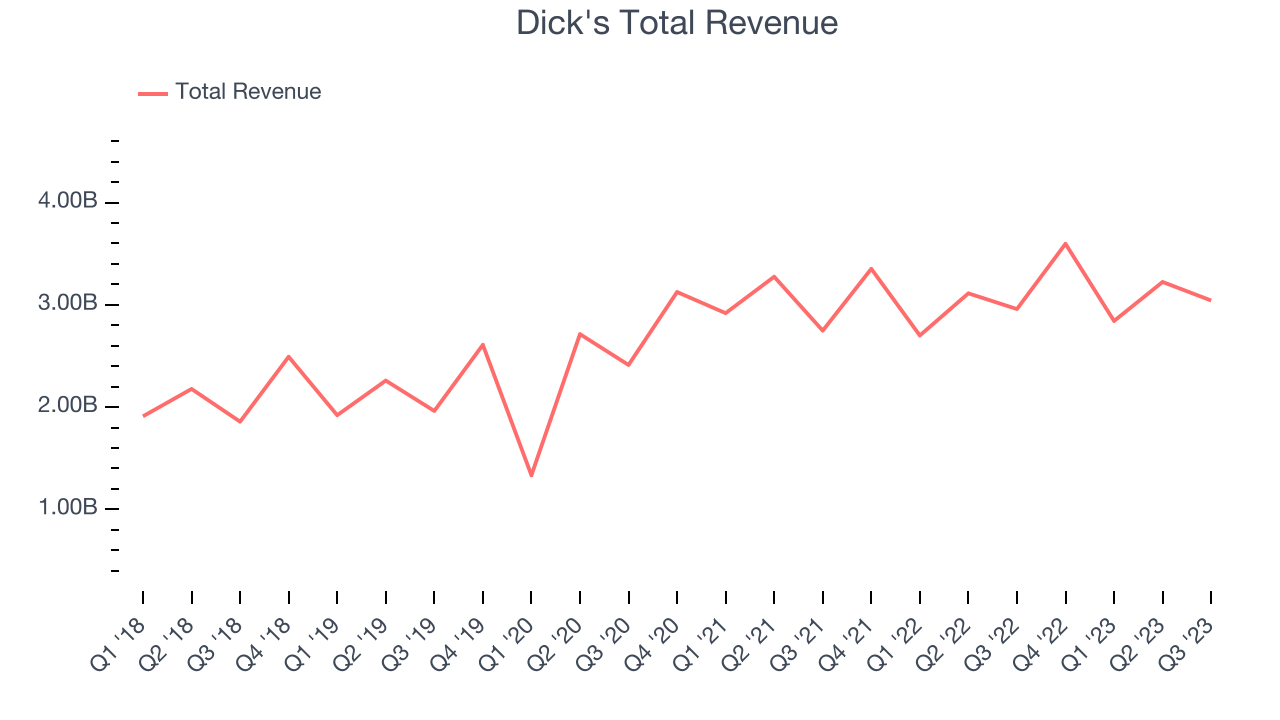

Dick's (NYSE:DKS)

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Dick's reported revenues of $3.04 billion, up 2.8% year on year, topping analyst expectations by 3.3%. It was a very strong quarter for the company, with an impressive beat of analysts' revenue estimates and optimistic earnings guidance for the full year.

The stock is up 26.3% since the results and currently trades at $150.25.

Is now the time to buy Dick's? Access our full analysis of the earnings results here, it's free.

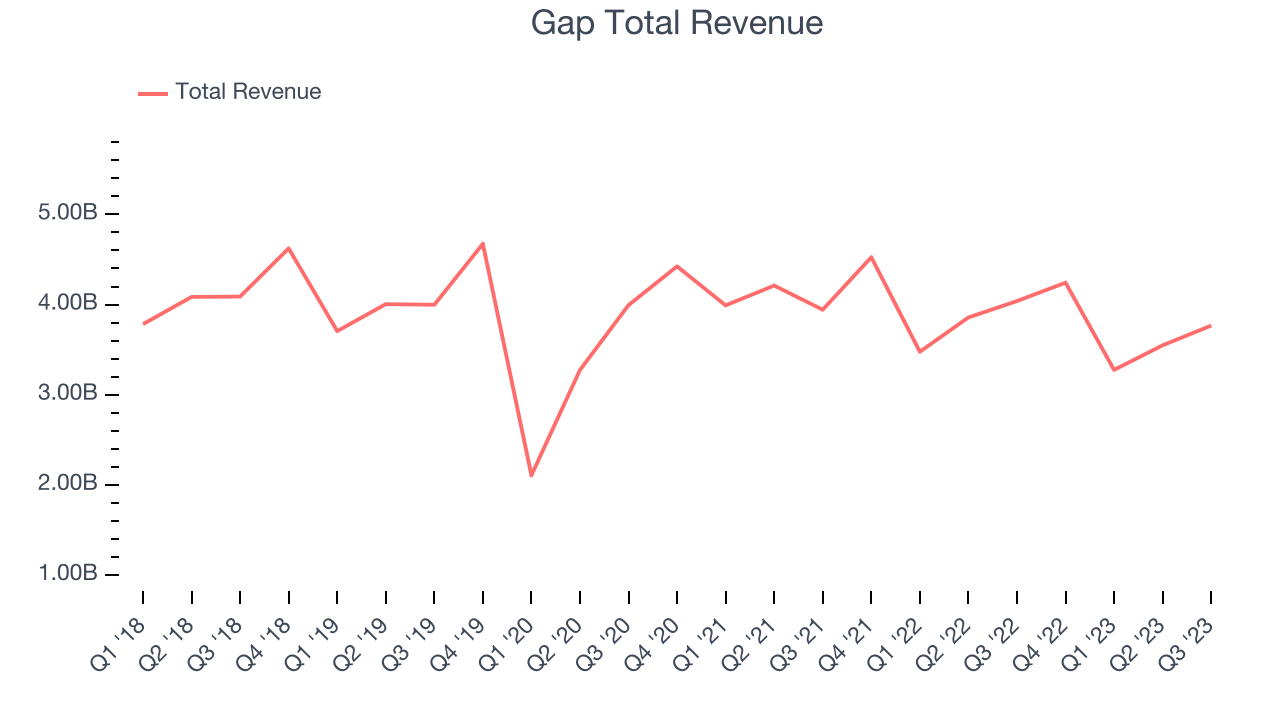

Best Q3: Gap (NYSE:GPS)

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Gap reported revenues of $3.77 billion, down 6.7% year on year, outperforming analyst expectations by 4.4%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 40% since the results and currently trades at $19.13.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Designer Brands (NYSE:DBI)

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Designer Brands reported revenues of $786.3 million, down 9.1% year on year, falling short of analyst expectations by 4.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' revenue estimates.

Designer Brands had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 34.1% since the results and currently trades at $8.45.

Read our full analysis of Designer Brands's results here.

TJX (NYSE:TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $13.27 billion, up 9% year on year, surpassing analyst expectations by 1.4%. It was a mixed quarter for the company, with a decent beat of analysts' gross margin estimates but underwhelming earnings guidance for the next quarter.

The stock is up 2.9% since the results and currently trades at $95.15.

Read our full, actionable report on TJX here, it's free.

Shoe Carnival (NASDAQ:SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $319.9 million, down 6.4% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

The stock is up 6% since the results and currently trades at $25.63.

Read our full, actionable report on Shoe Carnival here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned