Welding and cutting equipment manufacturer ESAB (NYSE:ESAB) announced better-than-expected revenue in Q3 CY2024, but sales fell 1.1% year on year to $673.3 million. Its non-GAAP profit of $1.25 per share was also 11.4% above analysts’ consensus estimates.

Is now the time to buy ESAB? Find out by accessing our full research report, it’s free.

ESAB (ESAB) Q3 CY2024 Highlights:

- Revenue: $673.3 million vs analyst estimates of $620.4 million (8.5% beat)

- Adjusted EPS: $1.25 vs analyst estimates of $1.12 (11.4% beat)

- EBITDA: $59.4 million vs analyst estimates of $119.5 million (50.3% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $4.88 at the midpoint

- EBITDA guidance for the full year is $507.5 million at the midpoint, above analyst estimates of $502.9 million

- Gross Margin (GAAP): 37.7%, up from 36.7% in the same quarter last year

- Operating Margin: 15.7%, in line with the same quarter last year

- EBITDA Margin: 8.8%, down from 18% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 14% in the same quarter last year

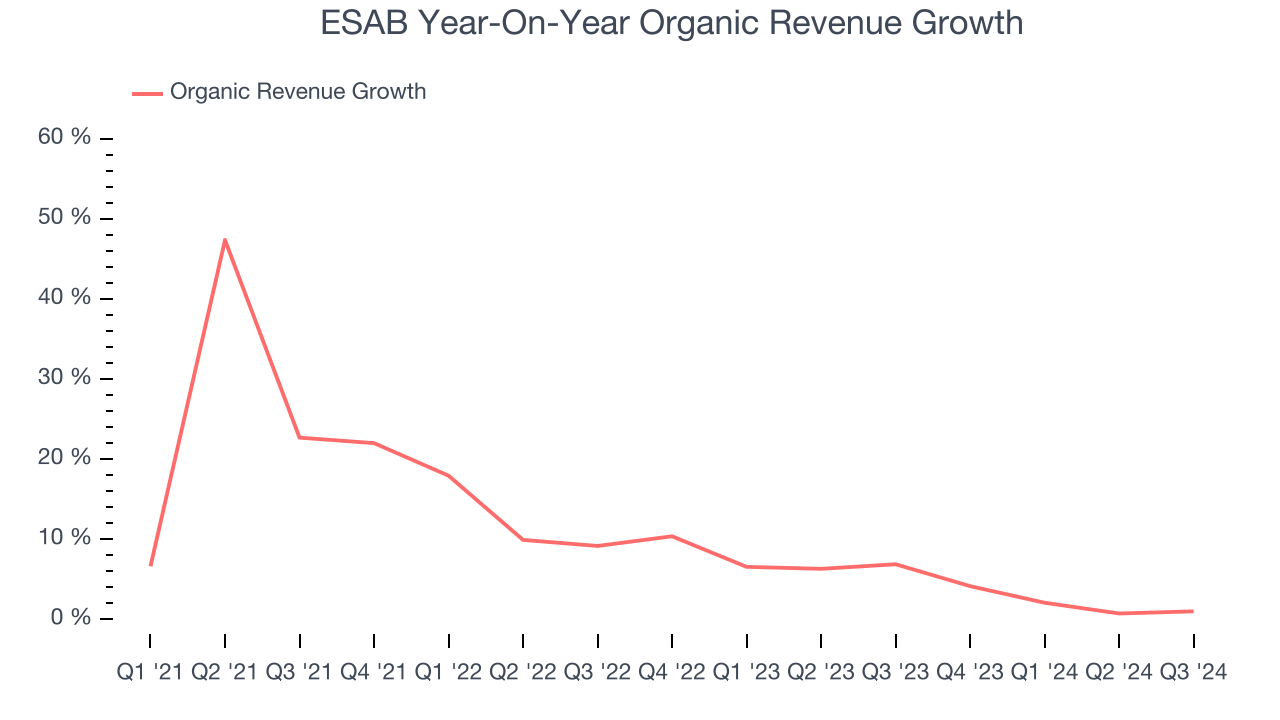

- Organic Revenue rose 1% year on year (6.9% in the same quarter last year)

- Market Capitalization: $6.73 billion

“ESAB delivered another strong quarter, marked by positive volume growth, record margin, and robust cash flow, amid a challenging end market environment,” said Shyam P. Kambeyanda, President and CEO of ESAB.

Company Overview

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

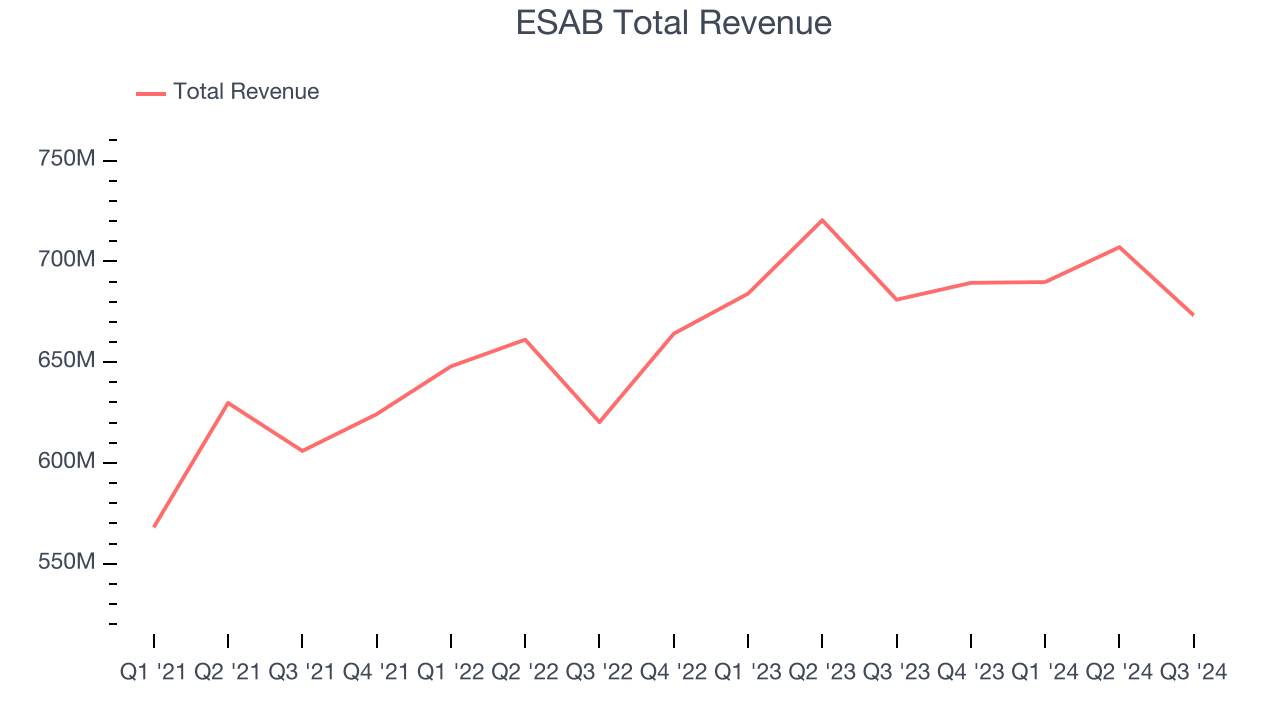

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, ESAB’s 4.7% annualized revenue growth over the last three years was tepid. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. ESAB’s annualized revenue growth of 4% over the last two years aligns with its three-year trend, suggesting its demand was consistently weak.

ESAB also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, ESAB’s organic revenue averaged 4.8% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not M&A) drove most of its performance.

This quarter, ESAB’s revenue fell 1.1% year on year to $673.3 million but beat Wall Street’s estimates by 8.5%.

Looking ahead, sell-side analysts expect revenue to decline 3.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

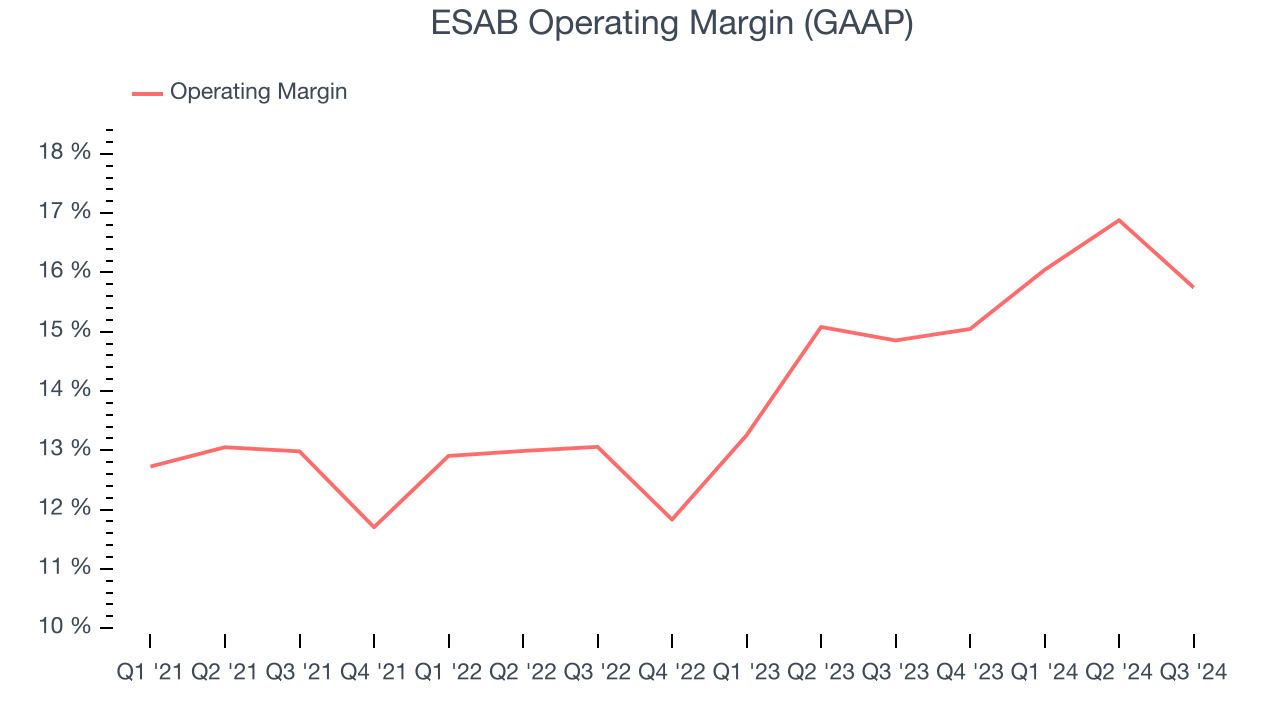

ESAB has been an optimally-run company over the last four years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.9%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ESAB’s annual operating margin rose by 3.3 percentage points over the last four years, showing its efficiency has improved.

This quarter, ESAB generated an operating profit margin of 15.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

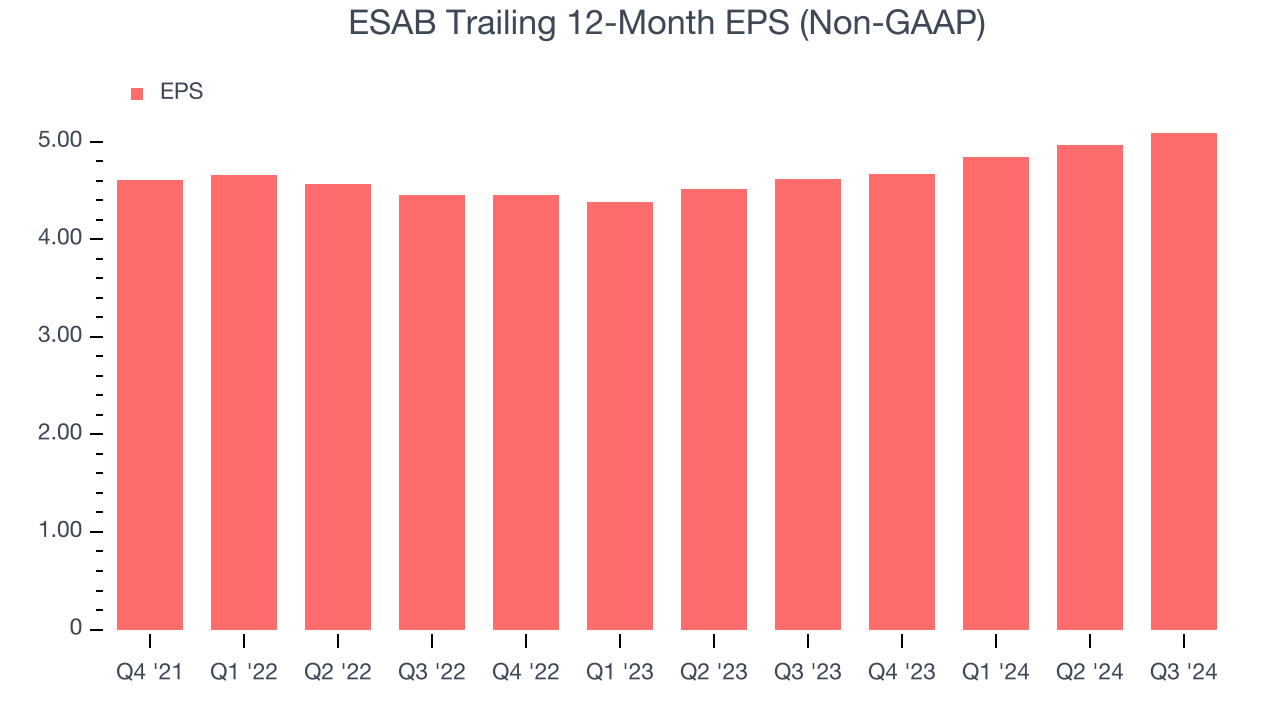

ESAB’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 4% annualized revenue growth and tells us the company became more profitable as it expanded.

We can take a deeper look into ESAB’s earnings to better understand the drivers of its performance. While we mentioned earlier that ESAB’s operating margin was flat this quarter, a two-year view shows its margin has expanded by 2.7 percentage points. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, ESAB reported EPS at $1.25, up from $1.13 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ESAB’s full-year EPS of $5.09 to grow by 3.3%.

Key Takeaways from ESAB’s Q3 Results

We were impressed by how significantly ESAB blew past analysts’ revenue expectations this quarter. We were also glad its organic revenue topped Wall Street’s estimates. Guidance was similarly encouraging, with full year EBITDA ahead of expectations. On the other hand, its EBITDA missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $111.42 immediately after reporting.

So do we think ESAB is an attractive buy at the current price?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.