Wrapping up Q3 earnings, we look at the numbers and key takeaways for the footwear retailer stocks, including Foot Locker (NYSE:FL) and its peers.

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

The 4 footwear retailer stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

While some footwear retailer stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.9% since the latest earnings results.

Weakest Q3: Foot Locker (NYSE:FL)

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE:FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

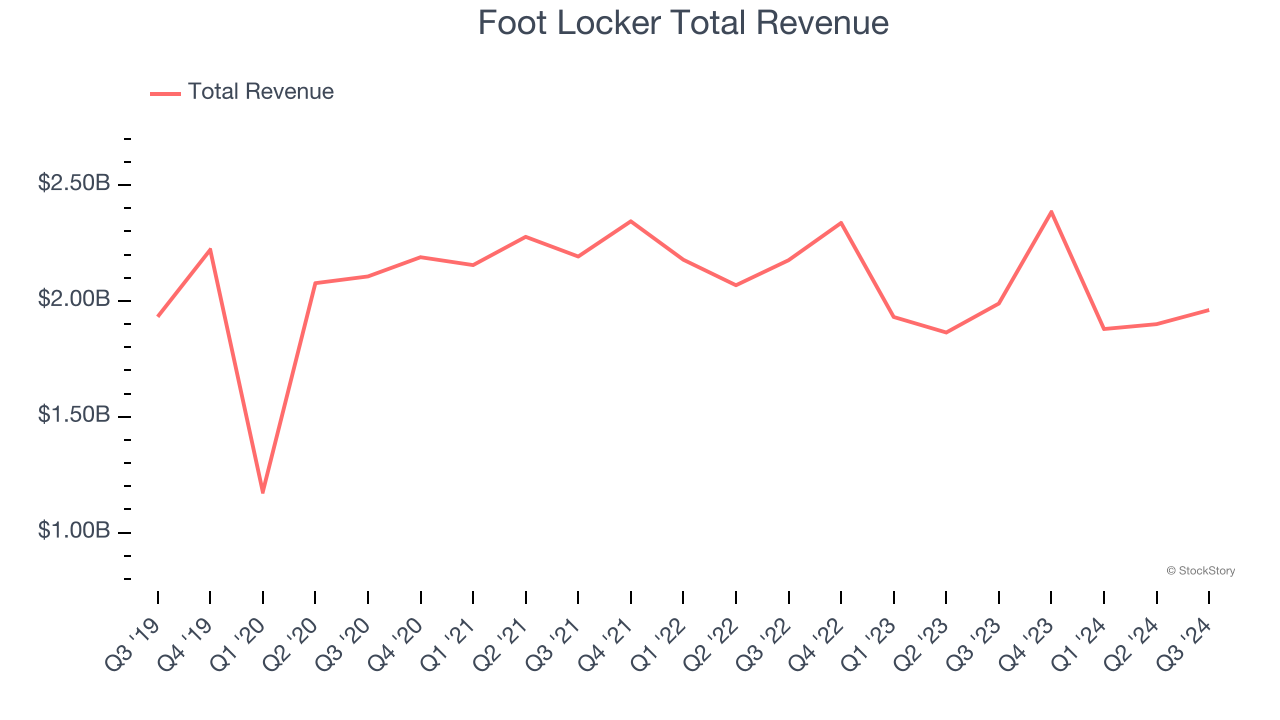

Foot Locker reported revenues of $1.96 billion, down 1.4% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a disappointing quarter for the company with full-year EPS guidance missing analysts’ expectations.

Mary Dillon, President and Chief Executive Officer, said, "Our team's continued focus on execution drove positive comparable sales trends and meaningful gross margin expansion in the quarter. However, our third quarter top- and bottom-line performance fell short of our expectations. Consumer spending trends softened following the peak Back-to-School period in August, and the promotional environment was more elevated than anticipated. At the same time, we continued to demonstrate progress with our Lace Up Plan, including further cementing our leadership position at the heart of basketball and sneaker culture. In the quarter, we continued the rollout of our Foot Locker 'Home Court' experience in collaboration with Nike and Jordan Brand, and we also announced a multi-year partnership with the legendary Chicago Bulls franchise."

Unsurprisingly, the stock is down 8.6% since reporting and currently trades at $22.10.

Read our full report on Foot Locker here, it’s free.

Best Q3: Boot Barn (NYSE:BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

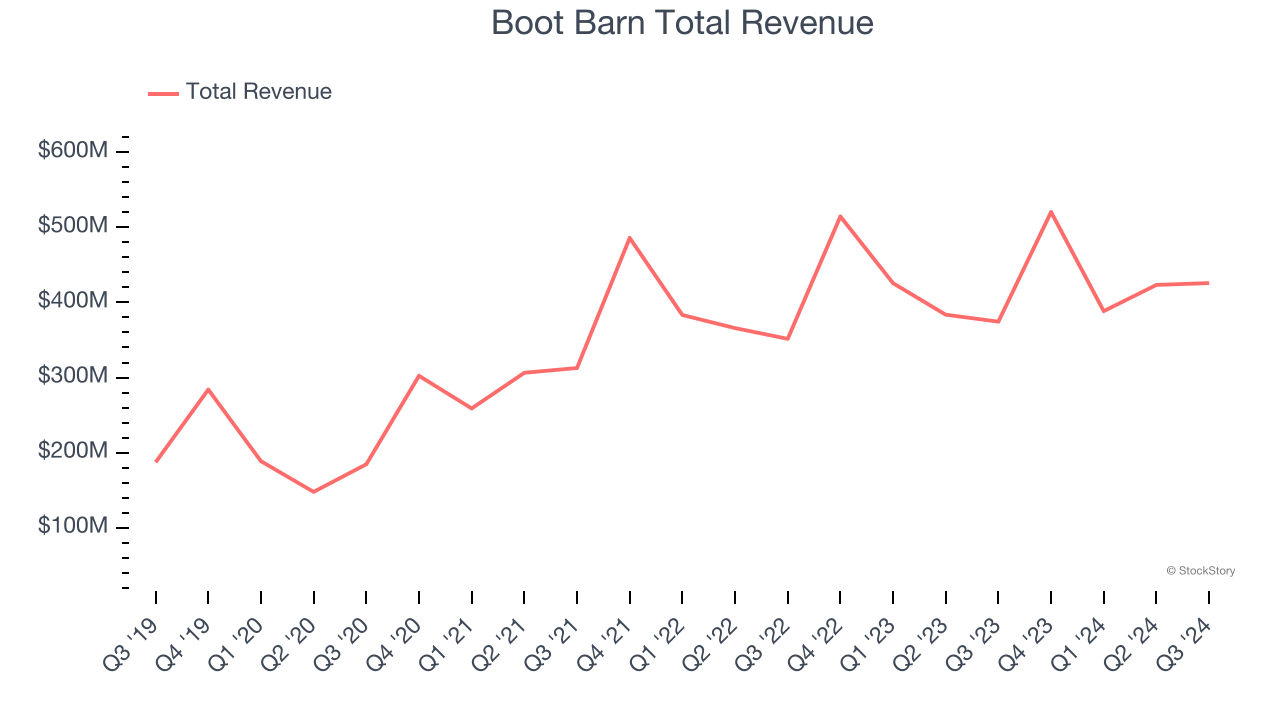

Boot Barn reported revenues of $425.8 million, up 13.7% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a mixed quarter with an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

Boot Barn scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.8% since reporting. It currently trades at $145.57.

Is now the time to buy Boot Barn? Access our full analysis of the earnings results here, it’s free.

Designer Brands (NYSE:DBI)

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Designer Brands reported revenues of $777.2 million, down 1.2% year on year, falling short of analysts’ expectations by 3.1%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a miss of analysts’ gross margin estimates.

Designer Brands delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 3.8% since the results and currently trades at $6.

Read our full analysis of Designer Brands’s results here.

Shoe Carnival (NASDAQ:SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $306.9 million, down 4.1% year on year. This result missed analysts’ expectations by 3%. Overall, it was a slower quarter as it also produced a slight miss of analysts’ gross margin and EBITDA estimates.

Shoe Carnival had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is up 6.9% since reporting and currently trades at $35.77.

Read our full, actionable report on Shoe Carnival here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.