As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the footwear industry, including Genesco (NYSE:GCO) and its peers.

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 8 footwear stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 4.4% above.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation, and while some footwear stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.7% since the latest earnings results.

Best Q2: Genesco (NYSE:GCO)

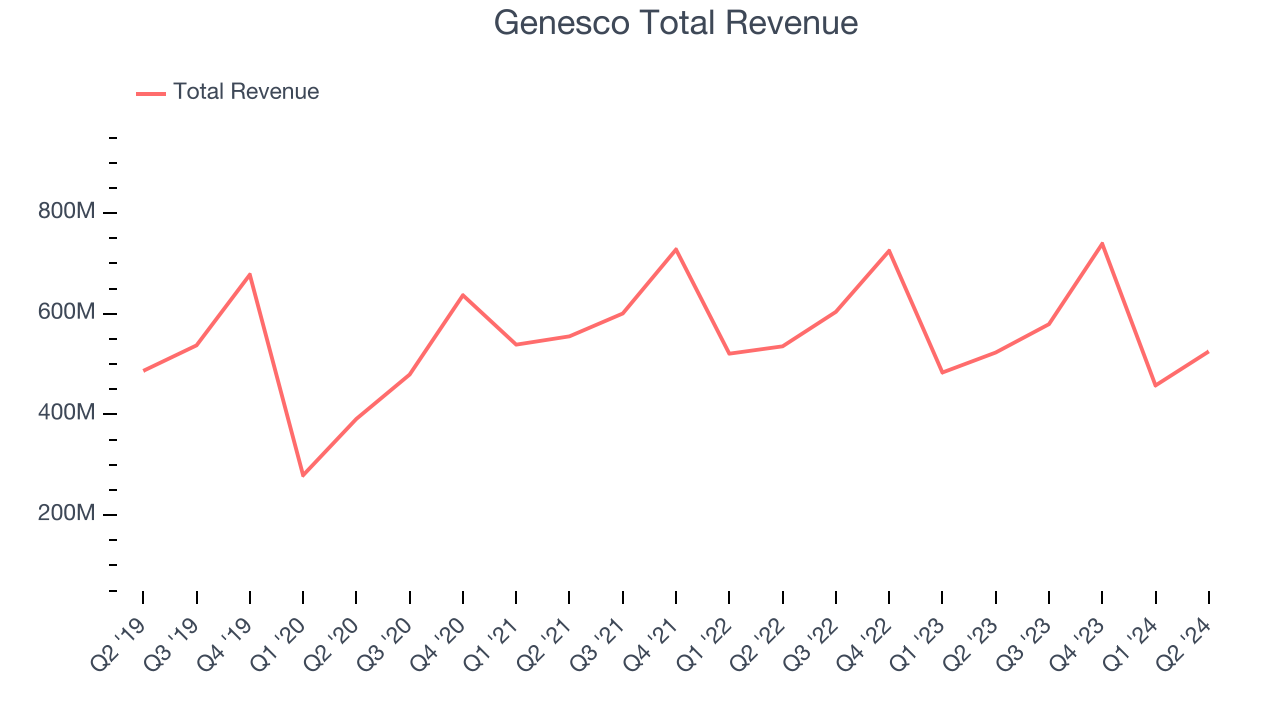

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $525.2 million, flat year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ operating margin and earnings estimates.

Mimi E. Vaughn, Genesco’s Board Chair, President and Chief Executive Officer, said, “We delivered another quarter that surpassed our top- and bottom-line expectations, as the improvement in our Journeys business continues to gain traction.”

Unsurprisingly, the stock is down 12.7% since reporting and currently trades at $25.72.

Is now the time to buy Genesco? Access our full analysis of the earnings results here, it’s free.

Wolverine Worldwide (NYSE:WWW)

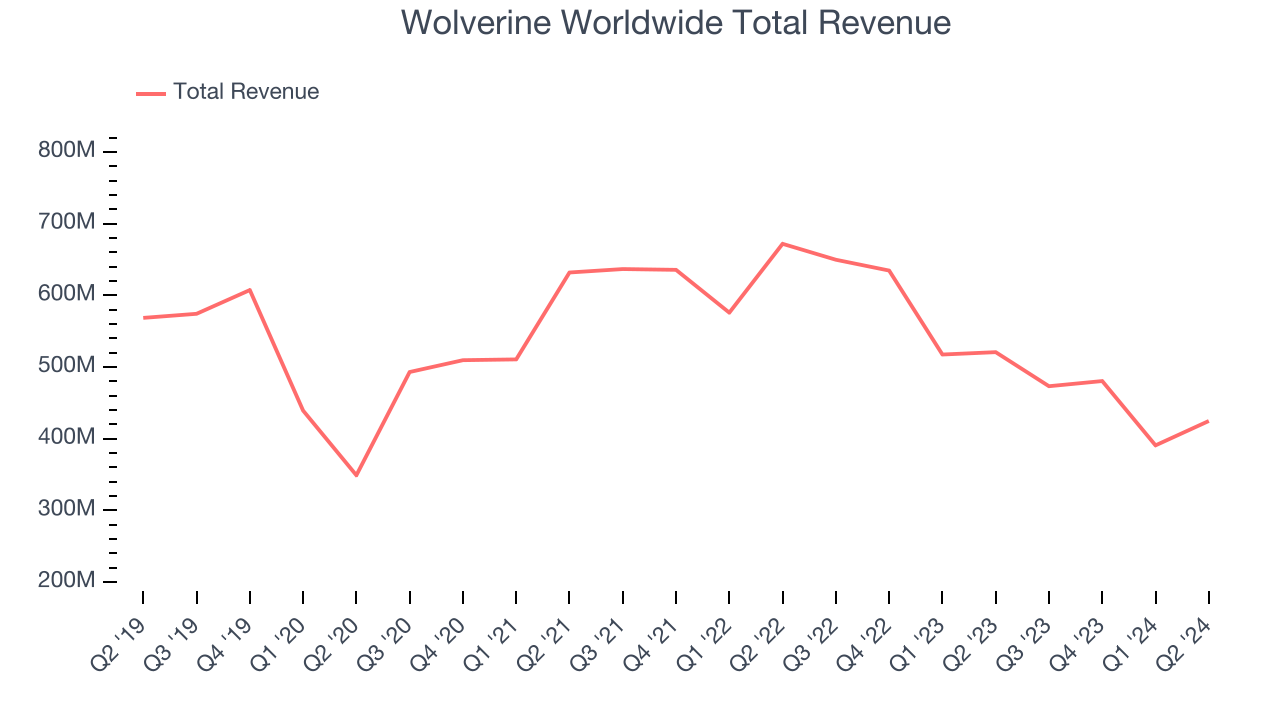

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $424.8 million, down 18.4% year on year, outperforming analysts’ expectations by 3.4%. The business had a strong quarter with an impressive beat of analysts’ earnings estimates.

Wolverine Worldwide delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.4% since reporting. It currently trades at $14.56.

Is now the time to buy Wolverine Worldwide? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Nike (NYSE:NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Nike reported revenues of $12.61 billion, down 1.7% year on year, falling short of analysts’ expectations by 1.9%. It was a mixed quarter as it posted a solid beat of analysts’ earnings estimates but a miss of analysts’ constant currency revenue estimates.

As expected, the stock is down 16% since the results and currently trades at $79.19.

Read our full analysis of Nike’s results here.

Crocs (NASDAQ:CROX)

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

Crocs reported revenues of $1.11 billion, up 3.6% year on year. This result was in line with analysts’ expectations. Overall, it was a mixed quarter. Its EPS outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter missed.

The stock is down 4.2% since reporting and currently trades at $128.80.

Read our full, actionable report on Crocs here, it’s free.

Deckers (NYSE:DECK)

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

Deckers reported revenues of $825.3 million, up 22.1% year on year. This result topped analysts’ expectations by 2.4%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ operating margin estimates but full-year revenue guidance missing analysts’ expectations.

Deckers delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 11.5% since reporting and currently trades at $941.58.

Read our full, actionable report on Deckers here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.