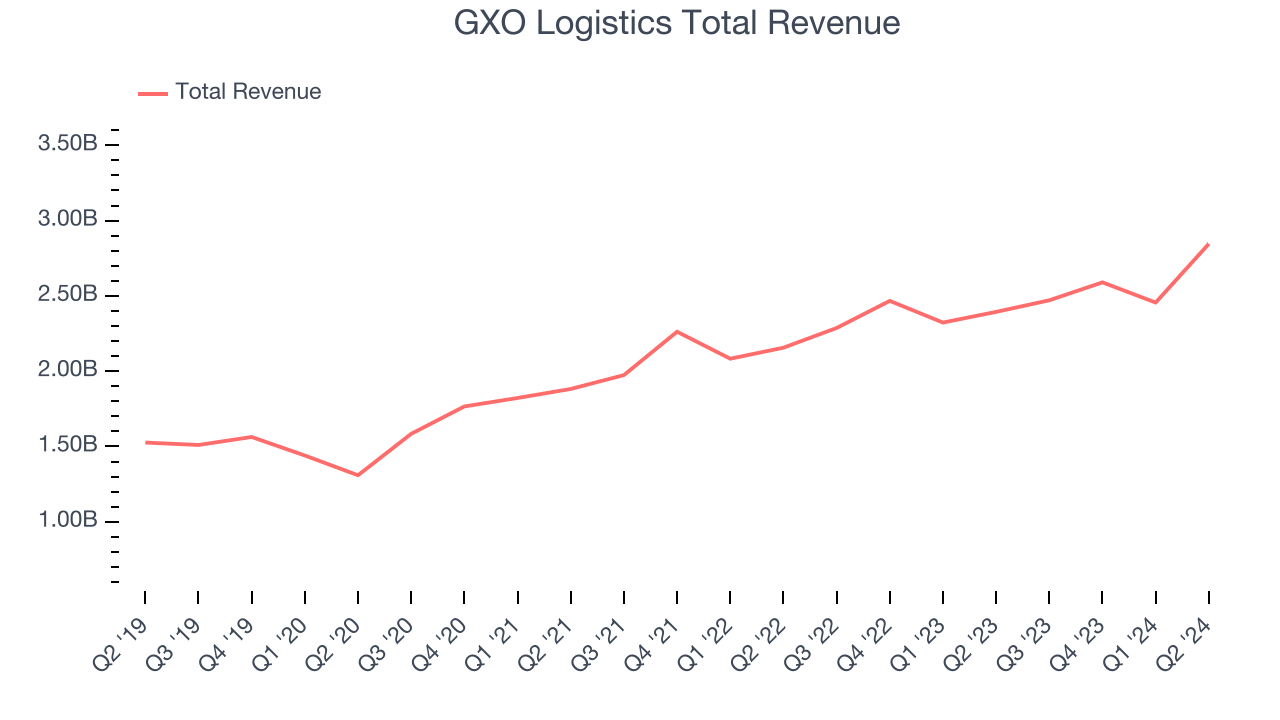

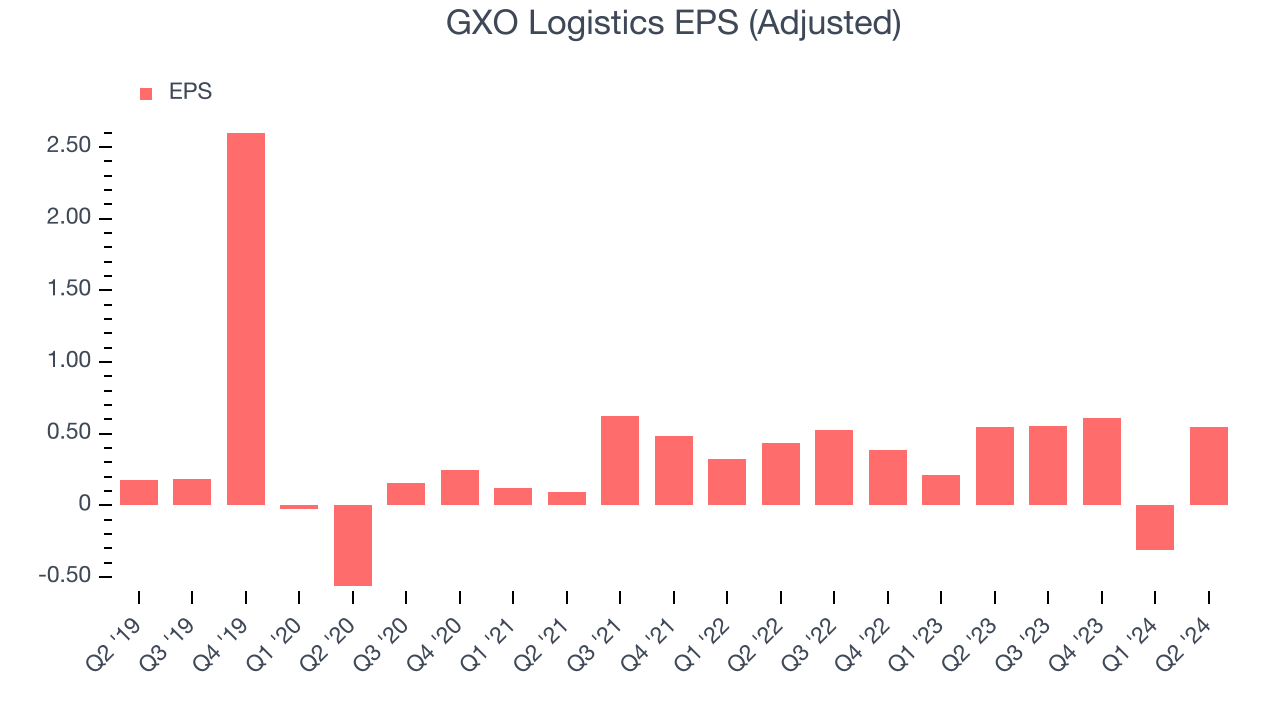

Contract logistics company GXO (NYSE:GXO) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 18.9% year on year to $2.85 billion. It made a non-GAAP profit of $0.55 per share, improving from its profit of $0.54 per share in the same quarter last year.

Is now the time to buy GXO Logistics? Find out in our full research report.

GXO Logistics (GXO) Q2 CY2024 Highlights:

- Revenue: $2.85 billion vs analyst estimates of $2.68 billion (6% beat)

- EPS (non-GAAP): $0.55 vs analyst expectations of $0.55 (in line)

- EPS (non-GAAP) guidance for the full year is $2.83 at the midpoint, beating analyst estimates by 1.9%

- EBITDA guidance for the full year is $820 million at the midpoint, above analyst estimates of $808.7 million

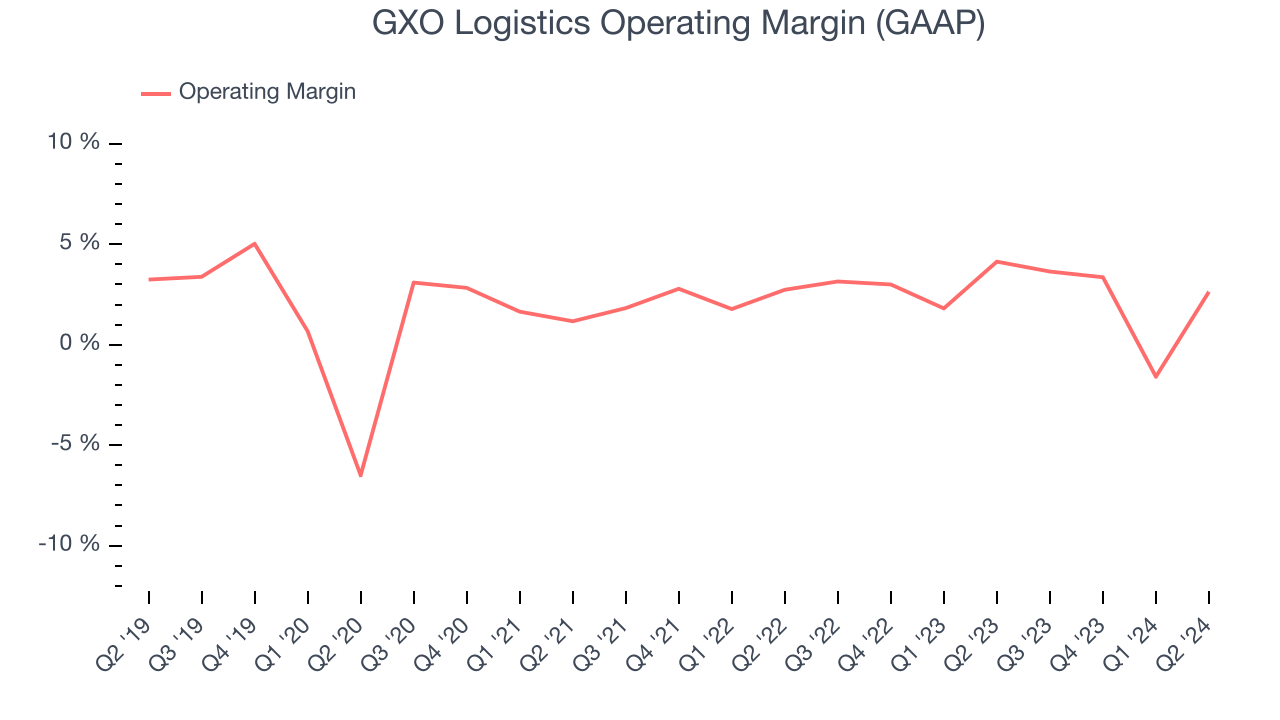

- Gross Margin (GAAP): 16.1%, down from 18.3% in the same quarter last year

- Adjusted EBITDA Margin: 6.6%, down from 7.9% in the same quarter last year

- Free Cash Flow of $21 million is up from -$17 million in the previous quarter

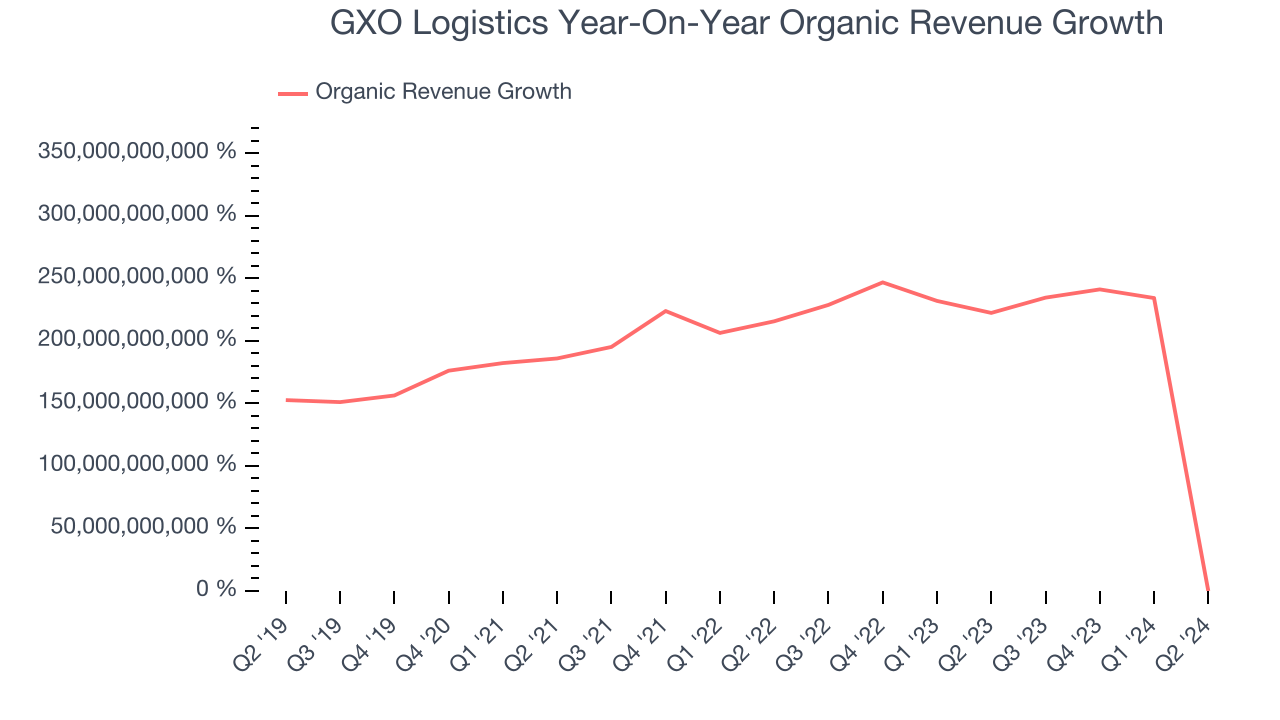

- Organic Revenue rose 2% year on year (222,300,000,000% in the same quarter last year)

- Market Capitalization: $5.89 billion

Malcolm Wilson, chief executive officer of GXO, said, “In the second quarter, GXO delivered record revenue of $2.8 billion, reflecting growth of 19% year over year, along with sequential improvement in organic revenue growth and strong free cash flow.

With notable customers such as Nike and Apple, GXO (NYSE:GXO) manages outsourced supply chains and warehousing for various companies.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, GXO Logistics's 11.9% annualized revenue growth over the last five years was impressive. This shows it expanded quickly, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. GXO Logistics's annualized revenue growth of 10.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

GXO Logistics also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don't accurately reflect its fundamentals. Over the last two years, GXO Logistics's organic revenue averaged 204,925,000,000% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, GXO Logistics reported robust year-on-year revenue growth of 18.9%, and its $2.85 billion of revenue exceeded Wall Street's estimates by 6%. Looking ahead, Wall Street expects sales to grow 16.8% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

GXO Logistics was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 2.2%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, GXO Logistics's annual operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage

This quarter, GXO Logistics generated an operating profit margin of 2.6%, down 1.5 percentage points year on year. Since GXO Logistics's gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased sales, marketing, R&D, and administrative overhead expenses.

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Sadly for GXO Logistics, its EPS declined by 5% annually over the last five years while its revenue grew by 11.9%. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

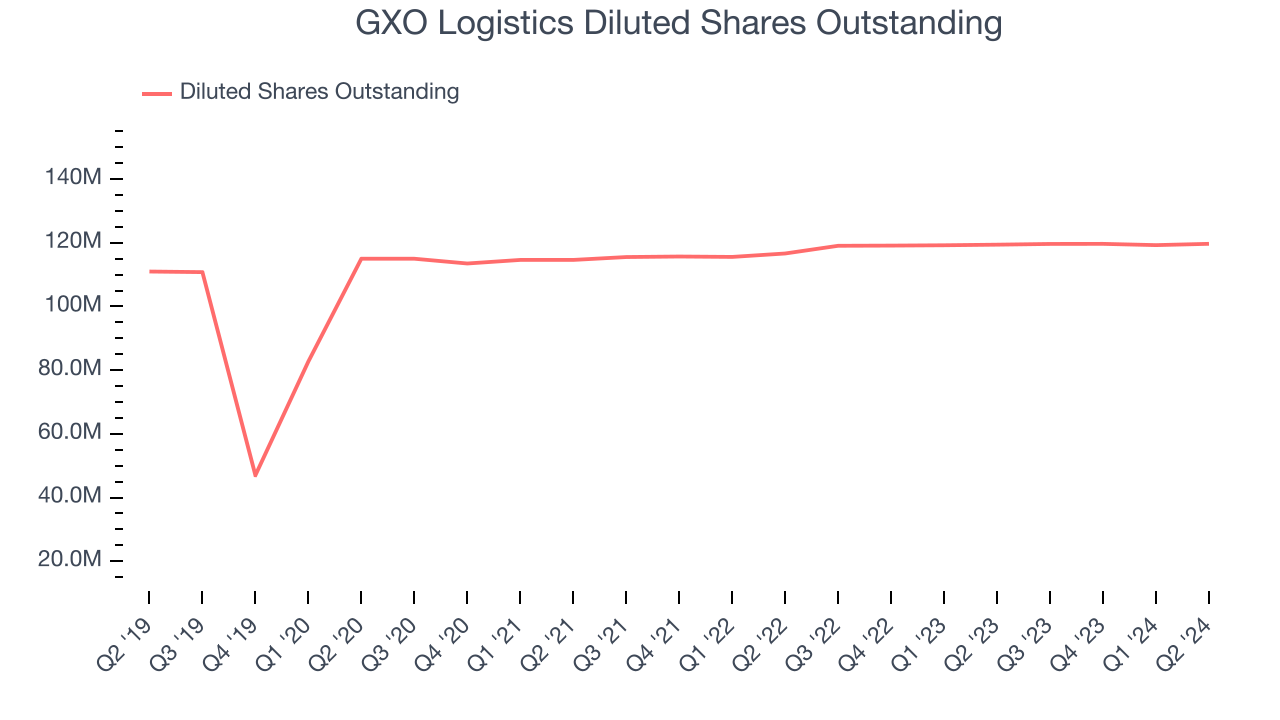

Diving into the nuances of GXO Logistics's earnings can give us a better understanding of its performance. GXO Logistics recently raised equity capital, and in the process, grew its share count by 7.8% over the last five years. This has resulted in muted earnings per share growth but doesn't tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For GXO Logistics, its two-year annual EPS declines of 13.2% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, GXO Logistics reported EPS at $0.55, in line with the same quarter last year. This print was close to analysts' estimates. Over the next 12 months, Wall Street expects GXO Logistics to grow its earnings. Analysts are projecting its EPS of $1.40 in the last year to climb by 121% to $3.09.

Key Takeaways from GXO Logistics's Q2 Results

We were impressed by how significantly GXO Logistics blew past analysts' revenue expectations this quarter. We were also happy its organic revenue topped Wall Street's estimates. On the other hand, its EPS missed. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock traded up 3.3% to $50.94 immediately following the results.

GXO Logistics may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.