Timeshare vacation company Hilton Grand Vacations (NYSE:HGV) fell short of analysts' expectations in Q2 CY2024, with revenue up 22.6% year on year to $1.24 billion. It made a non-GAAP profit of $0.62 per share, down from its profit of $0.71 per share in the same quarter last year.

Is now the time to buy Hilton Grand Vacations? Find out by accessing our full research report, it's free.

Hilton Grand Vacations (HGV) Q2 CY2024 Highlights:

- Revenue: $1.24 billion vs analyst estimates of $1.34 billion (7.7% miss)

- EPS (non-GAAP): $0.62 vs analyst expectations of $1.05 (41.1% miss)

- Gross Margin (GAAP): 38.9%, up from 36.4% in the same quarter last year

- EBITDA Margin: 21.5%, down from 24.6% in the same quarter last year

- Free Cash Flow of $95 million is up from -$374 million in the previous quarter

- Members: 720,000, up 197,844 year on year

- Market Capitalization: $3.99 billion

“Our results were below expectations this quarter, as we experienced some sales challenges along with a pullback in consumer spending behavior late in the quarter,” said Mark Wang, CEO of Hilton Grand Vacations.

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Hilton Grand Vacations's sales grew at a decent 17.5% compounded annual growth rate over the last five years. This shows it was successful in expanding, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Hilton Grand Vacations's recent history shows its demand slowed as its annualized revenue growth of 12.6% over the last two years is below its five-year trend.

We can better understand the company's revenue dynamics by analyzing its number of members, which reached 720,000 in the latest quarter. Over the last two years, Hilton Grand Vacations's members averaged 12.7% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company's monetization was fairly consistent.

This quarter, Hilton Grand Vacations generated an excellent 22.6% year-on-year revenue growth rate, but its $1.24 billion of revenue fell short of Wall Street's high expectations. Looking ahead, Wall Street expects sales to grow 16.9% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

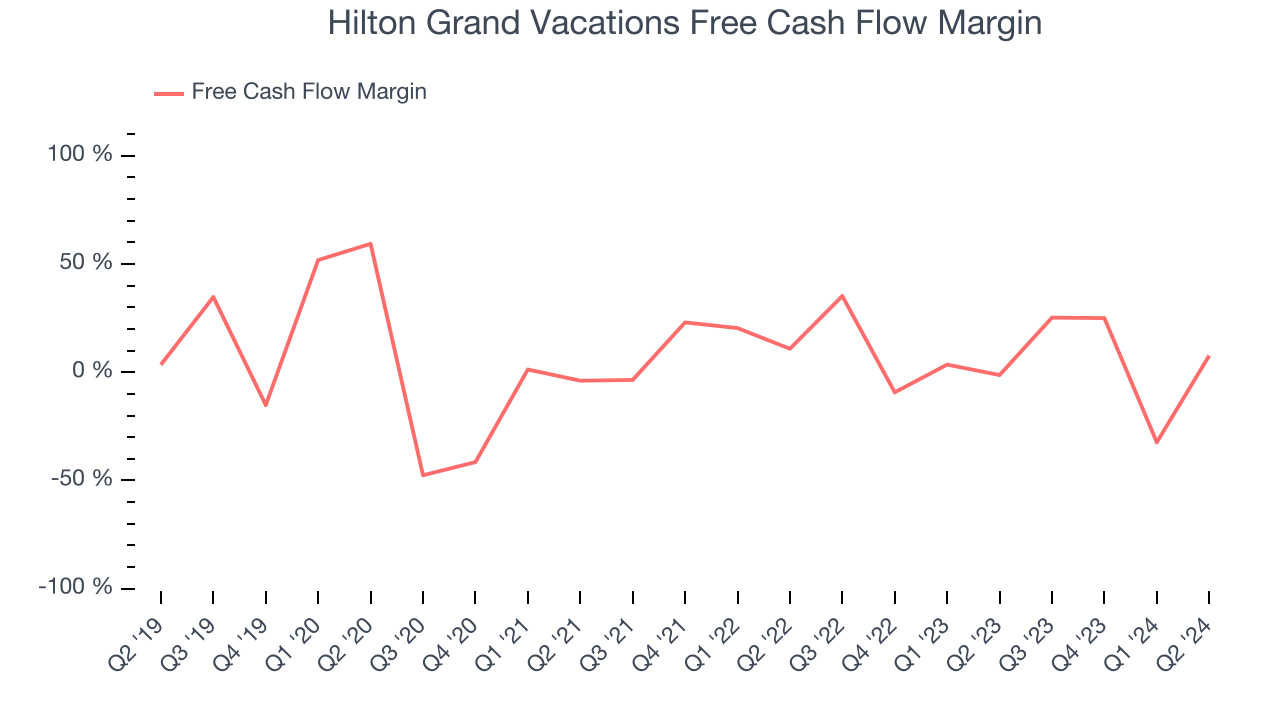

Hilton Grand Vacations has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.5%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Hilton Grand Vacations to make large cash investments in working capital and capital expenditures.

Hilton Grand Vacations's free cash flow clocked in at $95 million in Q2, equivalent to a 7.7% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, but we wouldn't read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Key Takeaways from Hilton Grand Vacations's Q2 Results

It was good to see Hilton Grand Vacations beat analysts' members expectations this quarter. On the other hand, its revenue unfortunately missed and its EPS fell short of Wall Street's estimates. Overall, this was a weaker quarter for Hilton Grand Vacations. The stock traded down 4.7% to $36.78 immediately after reporting.

Hilton Grand Vacations may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.