As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the defense contractors industry, including Huntington Ingalls (NYSE:HII) and its peers.

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 15 defense contractors stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was 6.7% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Luckily, defense contractors stocks have performed well with share prices up 10.7% on average since the latest earnings results.

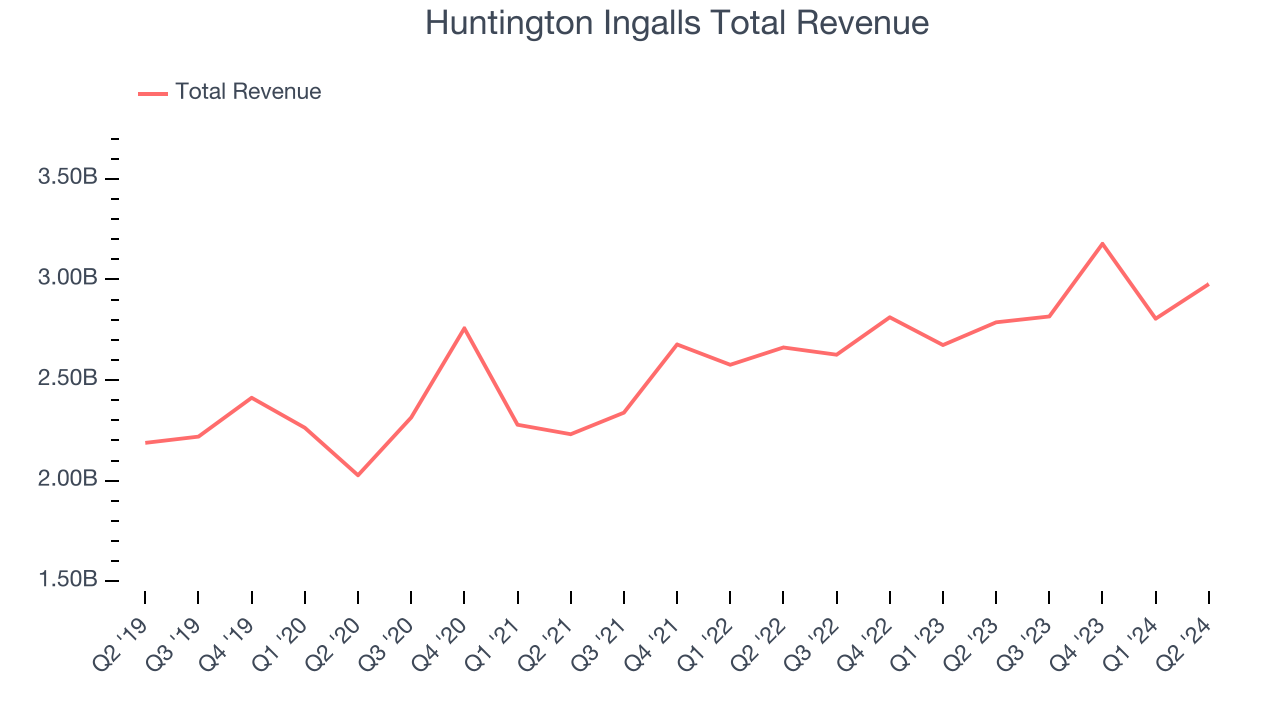

Huntington Ingalls (NYSE:HII)

Building Nimitz-class aircraft carriers used in active service, Huntington Ingalls (NYSE:HII) develops marine vessels and their mission systems and maintenance services.

Huntington Ingalls reported revenues of $2.98 billion, up 6.8% year on year. This print exceeded analysts’ expectations by 4.7%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ earnings estimates but a miss of analysts’ operating margin estimates.

Unsurprisingly, the stock is down 4.2% since reporting and currently trades at $268.13.

Is now the time to buy Huntington Ingalls? Access our full analysis of the earnings results here, it’s free.

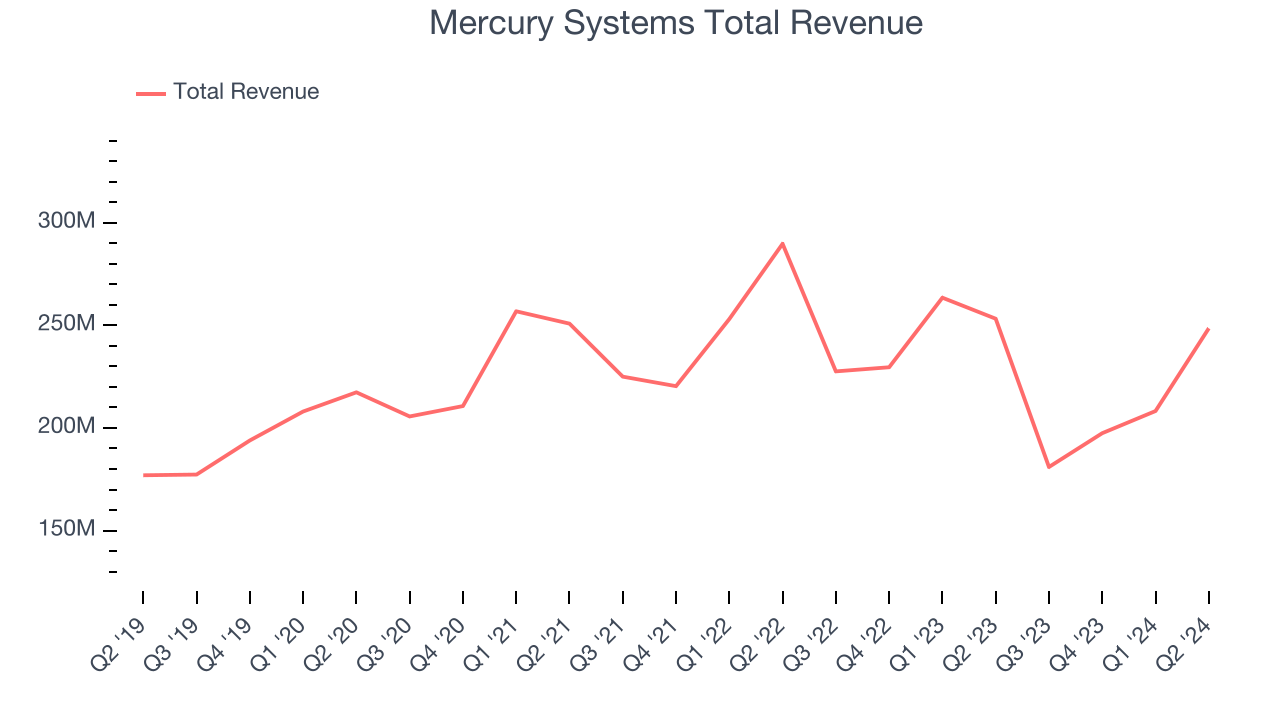

Best Q2: Mercury Systems (NASDAQ:MRCY)

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $248.6 million, down 1.8% year on year, outperforming analysts’ expectations by 7.8%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue and earnings estimates.

The market seems happy with the results as the stock is up 6.2% since reporting. It currently trades at $36.11.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: General Dynamics (NYSE:GD)

Creator of the famous M1 Abrahms tank, General Dynamics (NYSE:GD) develops aerospace, marine systems, combat systems, and information technology products.

General Dynamics reported revenues of $11.98 billion, up 18% year on year, exceeding analysts’ expectations by 4.1%. Still, it was a slower quarter as it posted a miss of analysts’ backlog sales estimates.

Interestingly, the stock is up 4.6% since the results and currently trades at $308.

Read our full analysis of General Dynamics’s results here.

Parsons (NYSE:PSN)

Delivering aerospace technology during the Cold War-era, Parsons (NYSE:PSN) offers engineering, construction, and cybersecurity solutions for the infrastructure and defense sectors.

Parsons reported revenues of $1.67 billion, up 23.1% year on year. This result surpassed analysts’ expectations by 8.2%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ operating margin and earnings estimates.

Parsons pulled off the highest full-year guidance raise among its peers. The stock is up 31.3% since reporting and currently trades at $101.35.

Read our full, actionable report on Parsons here, it’s free.

AeroVironment (NASDAQ:AVAV)

Focused on the future of autonomous military combat, AeroVironment (NASDAQ:AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

AeroVironment reported revenues of $189.5 million, up 24.4% year on year. This number surpassed analysts’ expectations by 2.1%. Aside from that, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ earnings estimates but full-year revenue guidance missing analysts’ expectations.

AeroVironment scored the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 6.1% since reporting and currently trades at $205.90.

Read our full, actionable report on AeroVironment here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.