The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Anywhere Real Estate (NYSE:HOUS) and the rest of the real estate services stocks fared in Q2.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 13.1% below.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. This year has been a different story as mixed inflation signals have led to market volatility. Luckily, real estate services stocks have performed well with share prices up 24.5% on average since the latest earnings results.

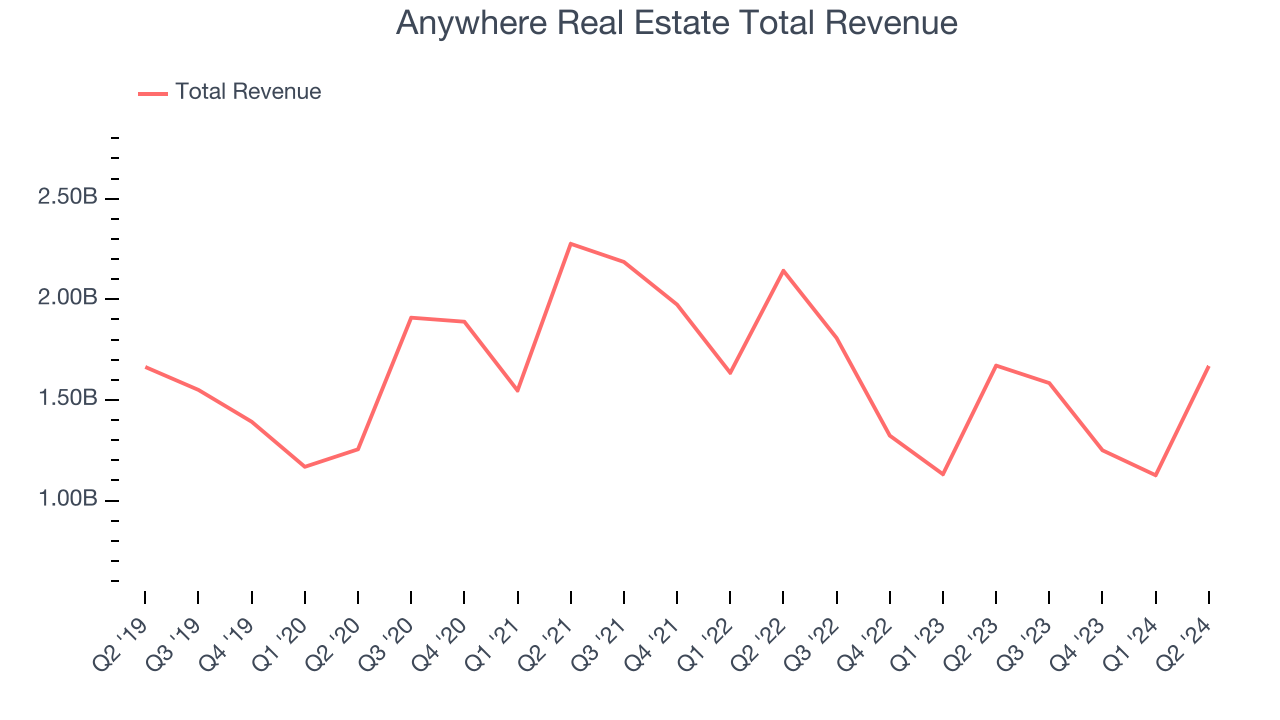

Anywhere Real Estate (NYSE:HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.67 billion, flat year on year. This print fell short of analysts’ expectations by 1.3%. Overall, it was a slower quarter for the company with a miss of analysts’ earnings estimates.

"Anywhere leveraged our distinct advantages to deliver strong results in the quarter, accelerating our transformation and building our future financial octane," said Ryan Schneider, Anywhere president and CEO.

Interestingly, the stock is up 15.1% since reporting and currently trades at $5.42.

Read our full report on Anywhere Real Estate here, it’s free.

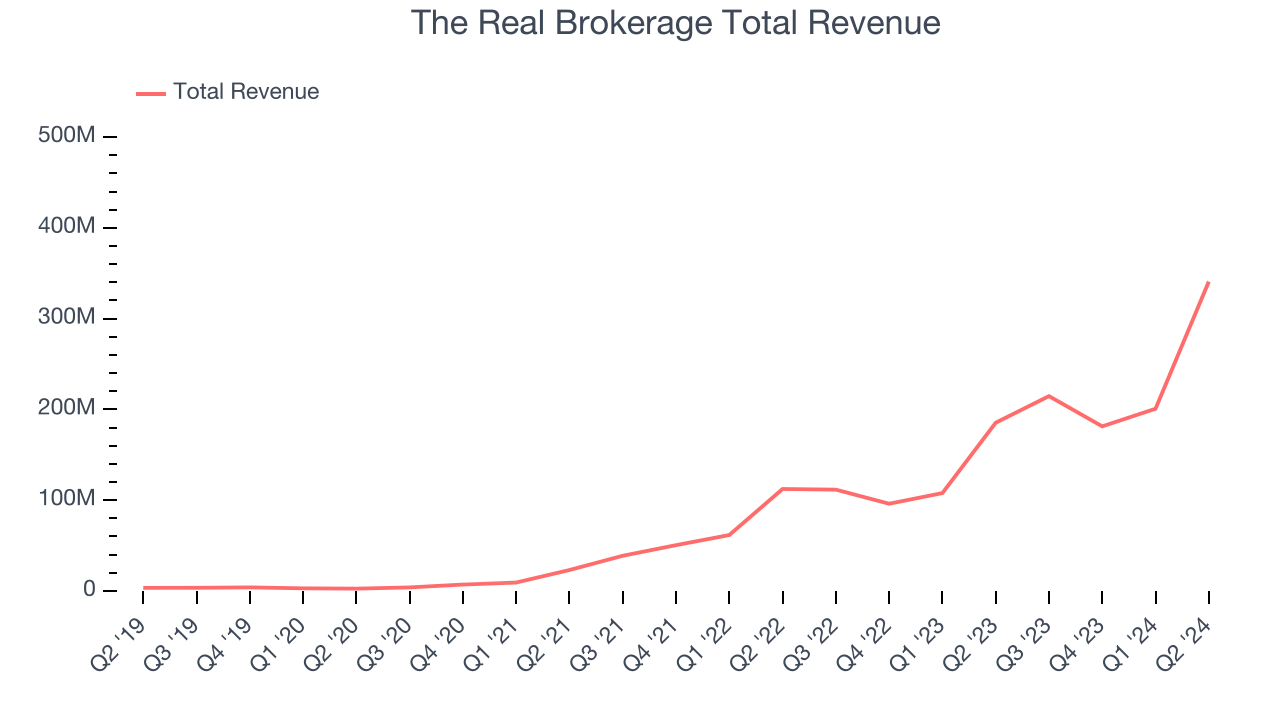

Best Q2: The Real Brokerage (NASDAQ:REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $340.8 million, up 83.9% year on year, outperforming analysts’ expectations by 28.9%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

The Real Brokerage pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.3% since reporting. It currently trades at $5.85.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Offerpad (NYSE:OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE:OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $251.1 million, up 9.1% year on year, falling short of analysts’ expectations by 11.4%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Offerpad delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 6.7% since the results and currently trades at $4.16.

Read our full analysis of Offerpad’s results here.

Zillow (NASDAQ:ZG)

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

Zillow reported revenues of $572 million, up 13% year on year. This number topped analysts’ expectations by 6.3%. It was an exceptional quarter as it also put up an impressive beat of analysts’ operating margin and earnings estimates.

The stock is up 50.8% since reporting and currently trades at $60.87.

Read our full, actionable report on Zillow here, it’s free.

Compass (NYSE:COMP)

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Compass reported revenues of $1.70 billion, up 13.8% year on year. This number beat analysts’ expectations by 3.3%. It was a strong quarter as it also produced an impressive beat of analysts’ earnings estimates and a decent beat of analysts’ operating margin estimates.

The stock is up 48.3% since reporting and currently trades at $6.54.

Read our full, actionable report on Compass here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.