Boat and marine products retailer MarineMax (NYSE:HZO) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 11.2% year on year to $468.5 million. Its non-GAAP profit of $0.17 per share was significantly above analysts’ consensus estimates.

Is now the time to buy MarineMax? Find out by accessing our full research report, it’s free.

MarineMax (HZO) Q4 CY2024 Highlights:

- Revenue: $468.5 million vs analyst estimates of $485.2 million (11.2% year-on-year decline, 3.5% miss)

- Adjusted EPS: $0.17 vs analyst estimates of -$0.22 (significant beat)

- Adjusted EBITDA: $26.06 million vs analyst estimates of $16.91 million (5.6% margin, 54.1% beat)

- Management reiterated its full-year Adjusted EPS guidance of $2.30 at the midpoint

- EBITDA guidance for the full year is $165 million at the midpoint, below analyst estimates of $167.8 million

- Operating Margin: 8.3%, up from 3.6% in the same quarter last year

- Locations: 70 at quarter end, down from 81 in the same quarter last year

- Same-Store Sales fell 11% year on year (4% in the same quarter last year, miss vs expectations of down 6% year on year)

- Market Capitalization: $634 million

“Our December quarter revenue and same-store sales performance reflected a combination of the soft retail environment that affected the recreational boating industry throughout 2024, and the significant disruptions caused by Hurricanes Helene and Milton,” said Brett McGill, Chief Executive Officer and President of MarineMax.

Company Overview

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE:HZO) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

MarineMax is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

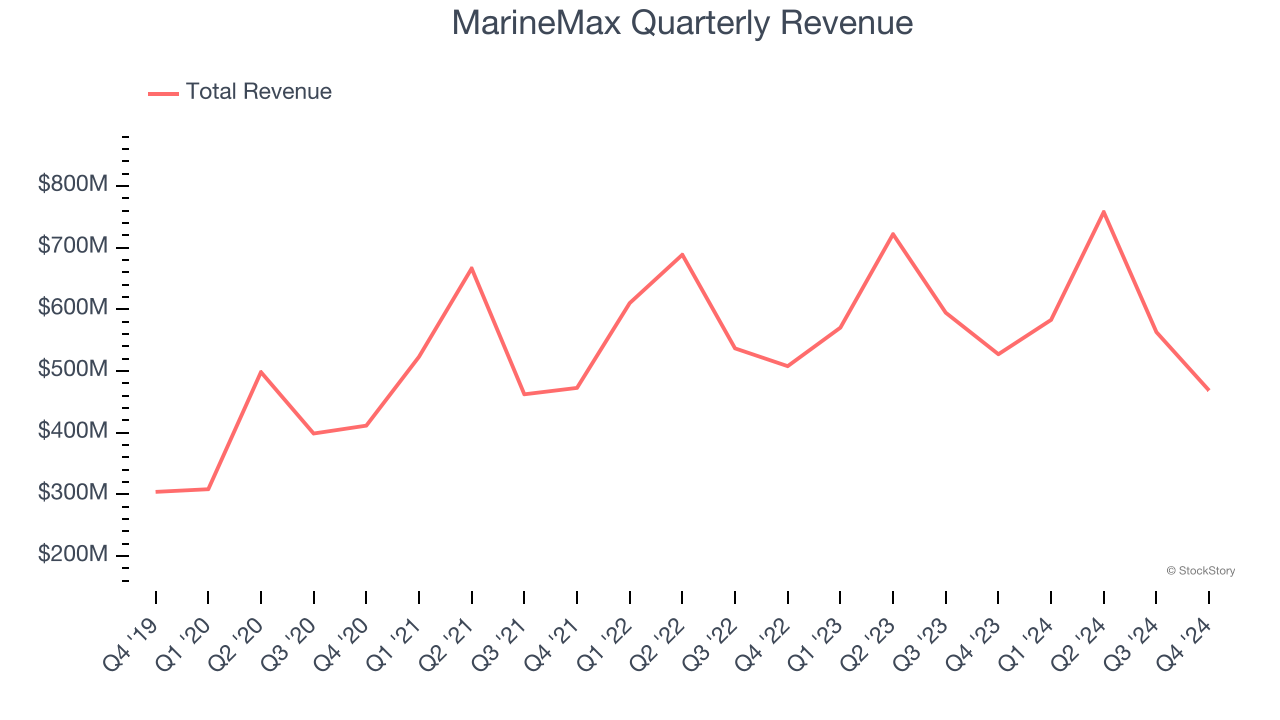

As you can see below, MarineMax’s 12.8% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was solid despite closing stores.

This quarter, MarineMax missed Wall Street’s estimates and reported a rather uninspiring 11.2% year-on-year revenue decline, generating $468.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last five years. Despite the slowdown, this projection is above the sector average and suggests the market is baking in some success for its newer products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

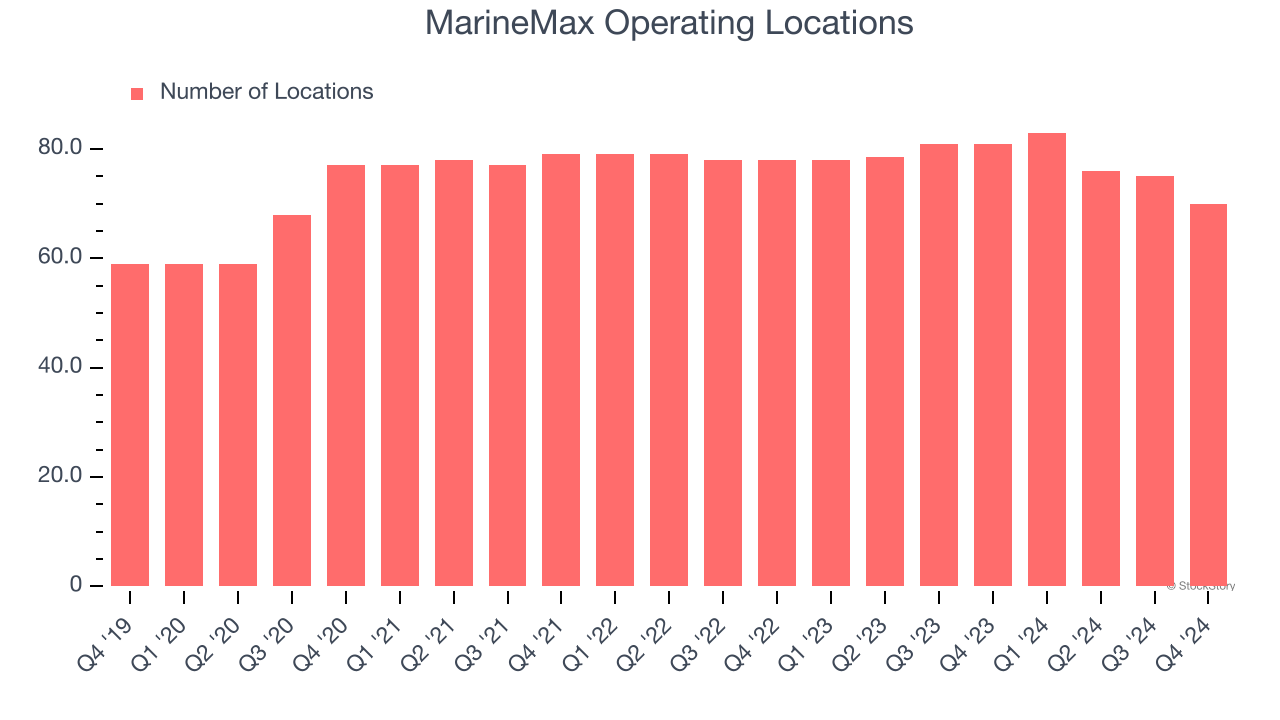

MarineMax listed 70 locations in the latest quarter and has generally closed its stores over the last two years, averaging 1.5% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

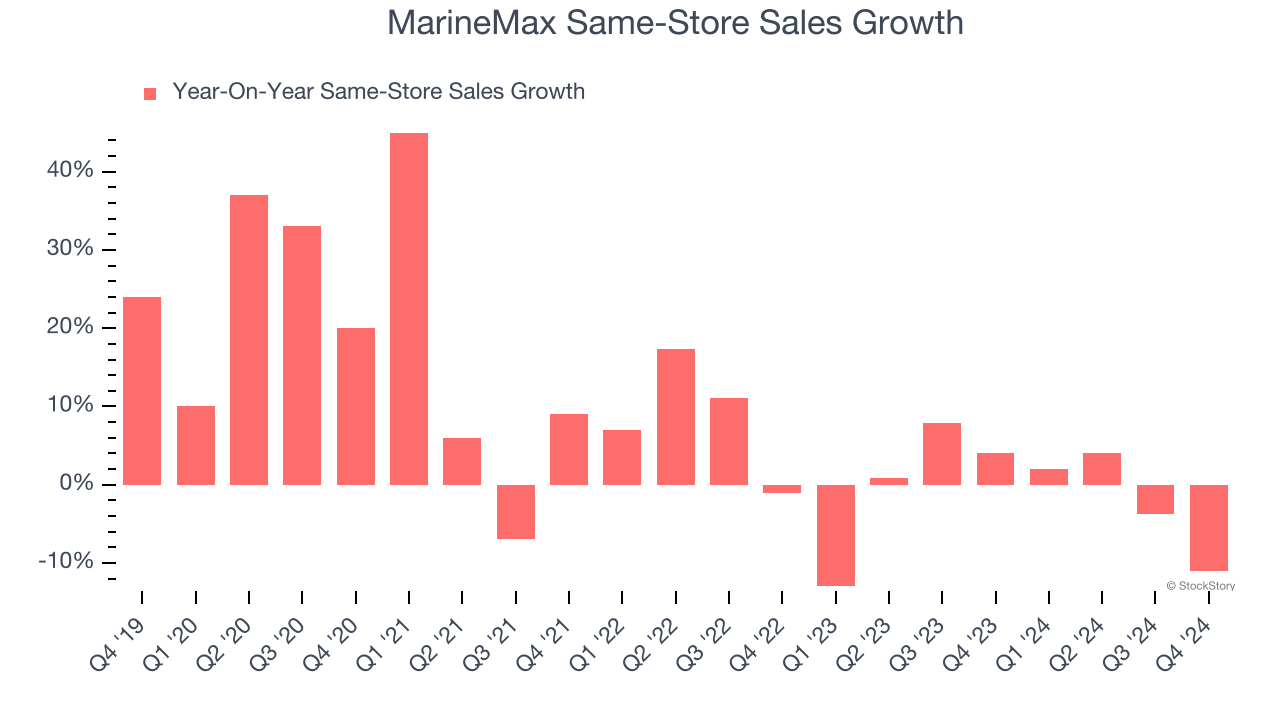

MarineMax’s demand has been shrinking over the last two years as its same-store sales have averaged 1.1% annual declines. This performance isn’t ideal, and MarineMax is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, MarineMax’s same-store sales fell by 11% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from MarineMax’s Q4 Results

We were impressed by how significantly MarineMax blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue missed due to lower-than-expected same-store sales. Its full-year EBITDA guidance also fell short of Wall Street’s estimates. Overall, this quarter was mixed, with the positives seemingly buoying shares. The stock traded up 6.1% to $29.61 immediately following the results.

MarineMax may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.