Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Leggett & Platt (NYSE:LEG) and its peers.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 6 home furnishings stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 3.7% below.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Thankfully, home furnishings stocks have been resilient with share prices up 9.2% on average since the latest earnings results.

Leggett & Platt (NYSE:LEG)

Founded in 1883, Leggett & Platt (NYSE:LEG) is a diversified manufacturer making products for various industries.

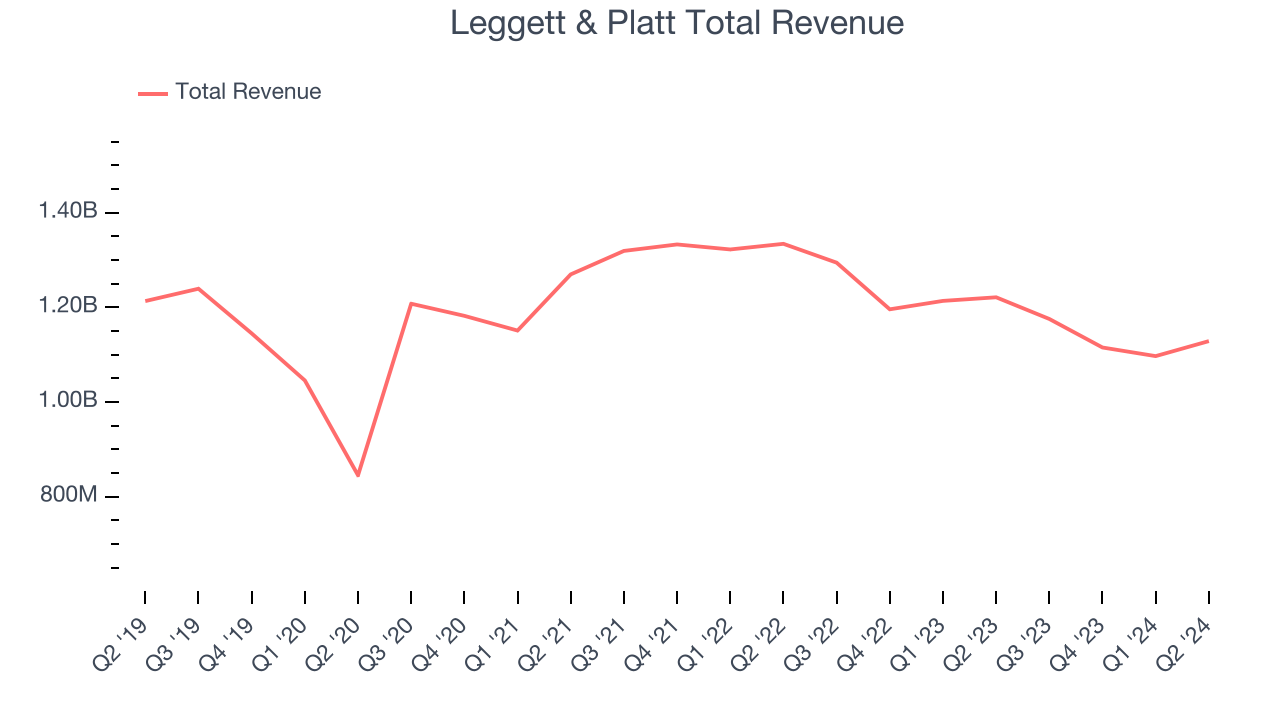

Leggett & Platt reported revenues of $1.13 billion, down 7.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with underwhelming earnings guidance for the full year and a miss of analysts’ operating margin estimates.

President and CEO Karl Glassman commented, "While our second quarter results reflect the ongoing challenging macro environment, I am immensely proud of our team's execution. The restructuring plan is on track, with some elements of the plan progressing ahead of schedule and exceeding expectations. We paid down $73 million of debt and adjusted EBIT margin improved by 50 basis points sequentially this quarter. We remain committed to investing in our key businesses to drive profitable growth when market conditions improve.

Leggett & Platt delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 5.8% since reporting and currently trades at $13.61.

Read our full report on Leggett & Platt here, it’s free.

Best Q2: Mohawk Industries (NYSE:MHK)

Established in 1878, Mohawk Industries (NYSE:MHK) is a leading producer of floor-covering products for both residential and commercial applications.

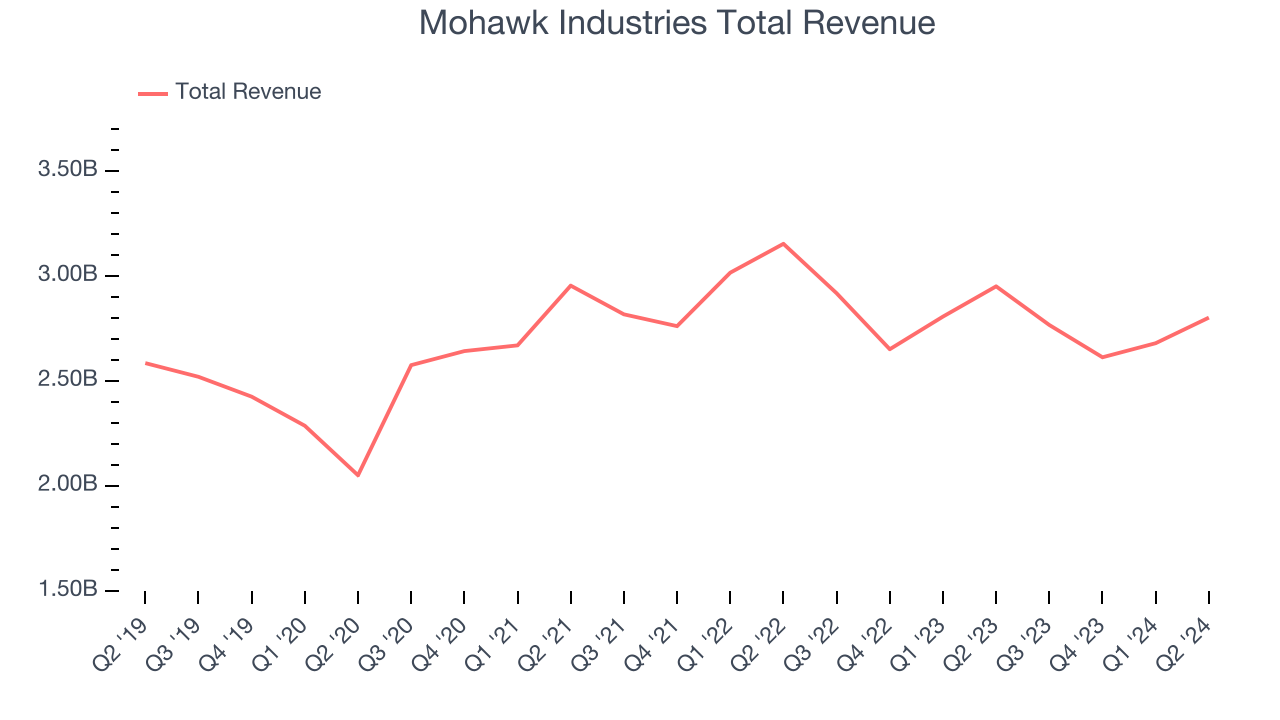

Mohawk Industries reported revenues of $2.80 billion, down 5.1% year on year, falling short of analysts’ expectations by 1.2%. However, the business still had a strong quarter with optimistic earnings guidance for the next quarter and a decent beat of analysts’ operating margin estimates.

The market seems happy with the results as the stock is up 16.2% since reporting. It currently trades at $156.48.

Is now the time to buy Mohawk Industries? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Purple (NASDAQ:PRPL)

Founded by two brothers, Purple (NASDAQ:PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple reported revenues of $120.3 million, up 2% year on year, falling short of analysts’ expectations by 6.3%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Purple delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 13.7% since the results and currently trades at $1.01.

Read our full analysis of Purple’s results here.

Lovesac (NASDAQ:LOVE)

Known for its oversized, premium beanbags, Lovesac (NASDAQ:LOVE) is a specialty furniture brand selling modular furniture.

Lovesac reported revenues of $156.6 million, up 1.3% year on year. This number was in line with analysts’ expectations. Zooming out, it was a slower quarter as it produced underwhelming earnings guidance.

The stock is up 34.6% since reporting and currently trades at $28.30.

Read our full, actionable report on Lovesac here, it’s free.

La-Z-Boy (NYSE:LZB)

The prized possession of every mancave, La-Z-Boy (NYSE:LZB) is a furniture company specializing in recliners, sofas, and seats.

La-Z-Boy reported revenues of $495.5 million, up 2.9% year on year. This result topped analysts’ expectations by 2.8%. Zooming out, it was a mixed quarter as it also logged a narrow beat of analysts’ operating margin estimates but a miss of analysts’ Wholesale revenue estimates.

La-Z-Boy pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 1.1% since reporting and currently trades at $42.35.

Read our full, actionable report on La-Z-Boy here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.