Agricultural and farm machinery company Lindsay (NYSE:LNN) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 3.1% year on year to $166.3 million. Its GAAP profit of $1.57 per share was 12.5% above analysts’ consensus estimates.

Is now the time to buy Lindsay? Find out by accessing our full research report, it’s free.

Lindsay (LNN) Q4 CY2024 Highlights:

- Revenue: $166.3 million vs analyst estimates of $169.8 million (3.1% year-on-year growth, 2.1% miss)

- Adjusted EPS: $1.57 vs analyst estimates of $1.40 (12.5% beat)

- Adjusted EBITDA: $28.27 million vs analyst estimates of $23.75 million (17% margin, 19.1% beat)

- Operating Margin: 12.6%, in line with the same quarter last year

- Free Cash Flow Margin: 7.5%, down from 9.3% in the same quarter last year

- Market Capitalization: $1.28 billion

“Our first quarter results demonstrate the resilience of our business, as we were able to deliver revenue growth and expansion to net earnings, despite the ongoing cyclical challenges of the mature irrigation markets. While agricultural market conditions in North America and Brazil remain challenged as lower commodity prices negatively impact grower profitability, our international irrigation business drove revenue growth in the segment, supported by additional volumes from our large project in the MENA region,” said Randy Wood, President and Chief Executive Officer.

Company Overview

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE:LNN) provides a variety of proprietary water management and road infrastructure products and services.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

Sales Growth

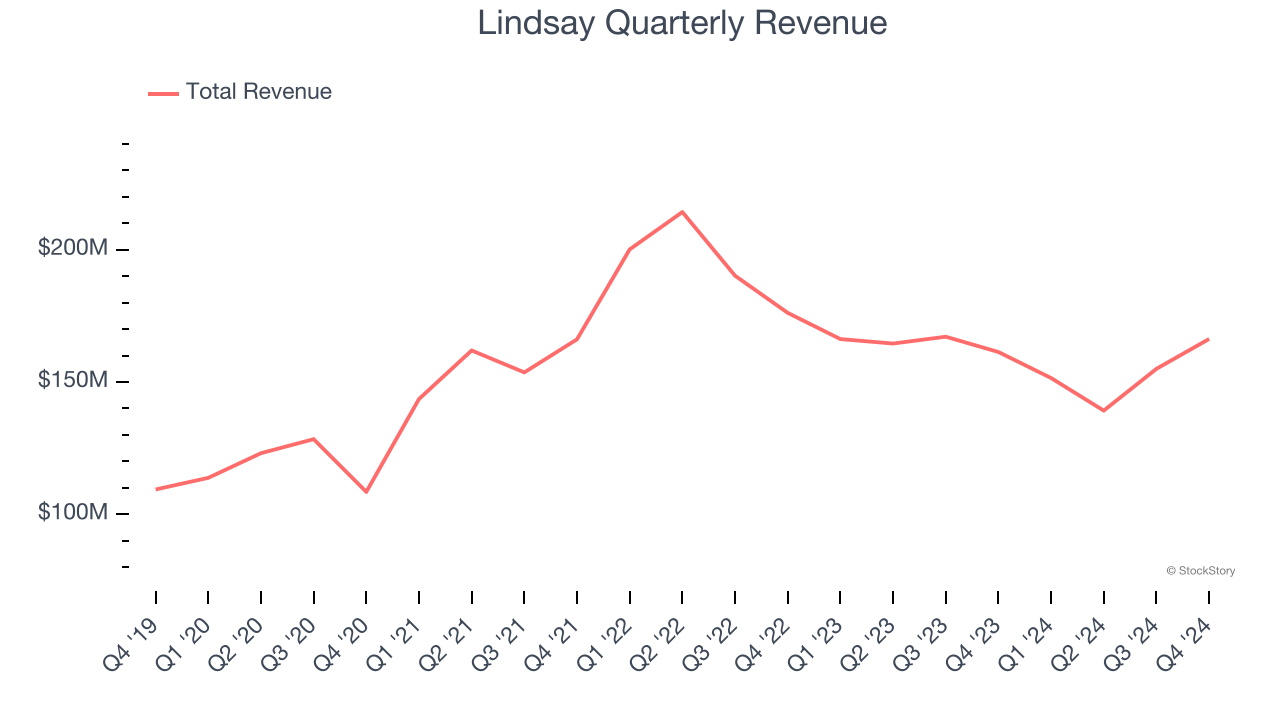

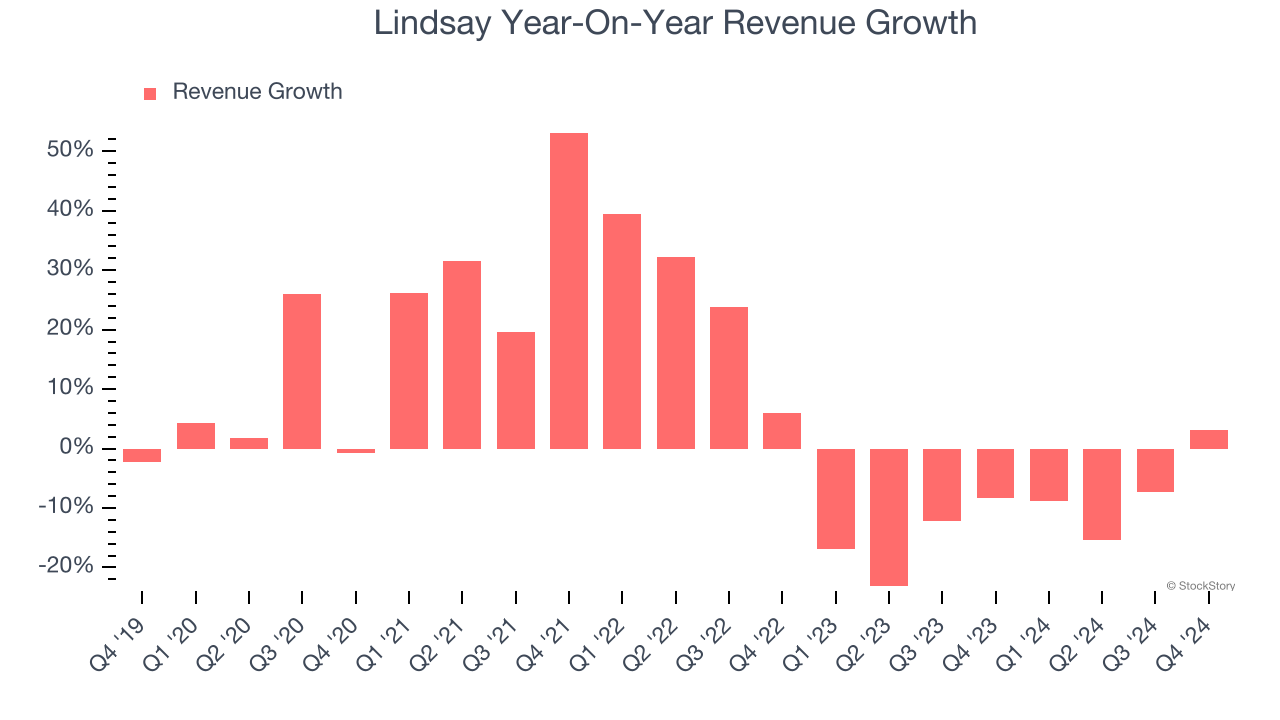

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Lindsay’s sales grew at a mediocre 6.7% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Lindsay’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 11.5% annually. Lindsay isn’t alone in its struggles as the Agricultural Machinery industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Lindsay’s revenue grew by 3.1% year on year to $166.3 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.7% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

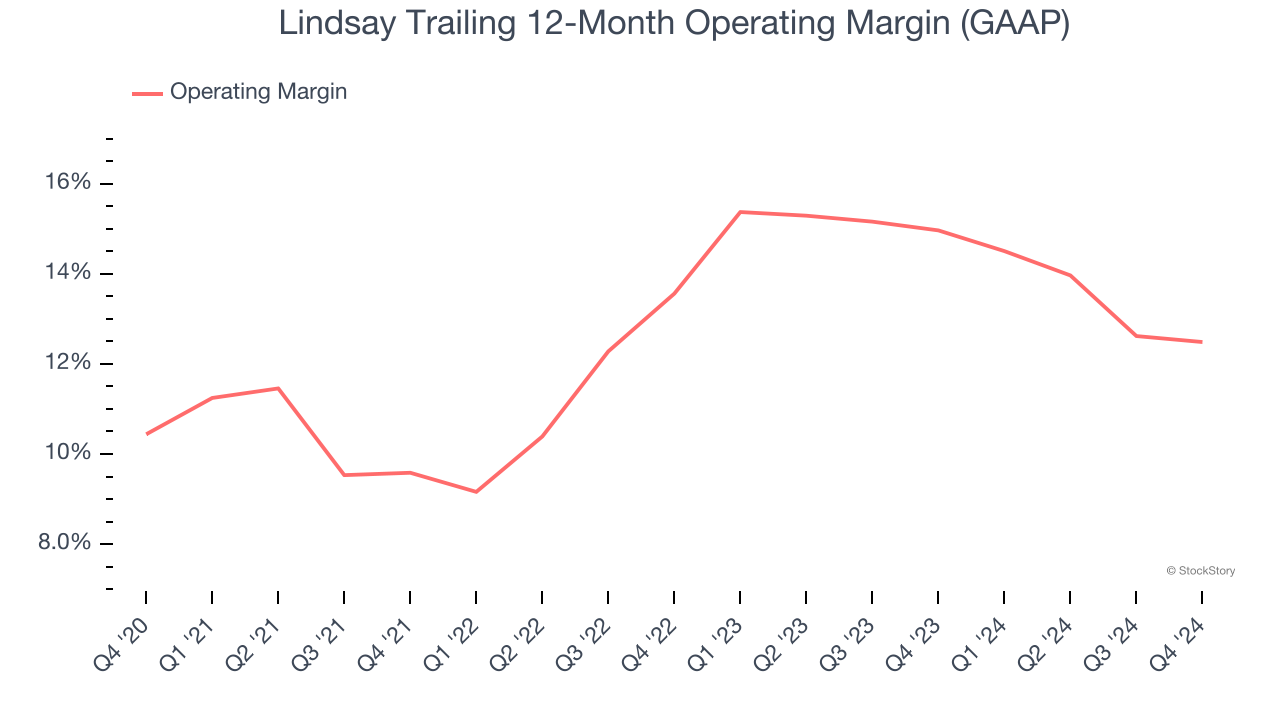

Operating Margin

Lindsay has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Lindsay’s operating margin rose by 2 percentage points over the last five years, showing its efficiency has improved.

This quarter, Lindsay generated an operating profit margin of 12.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

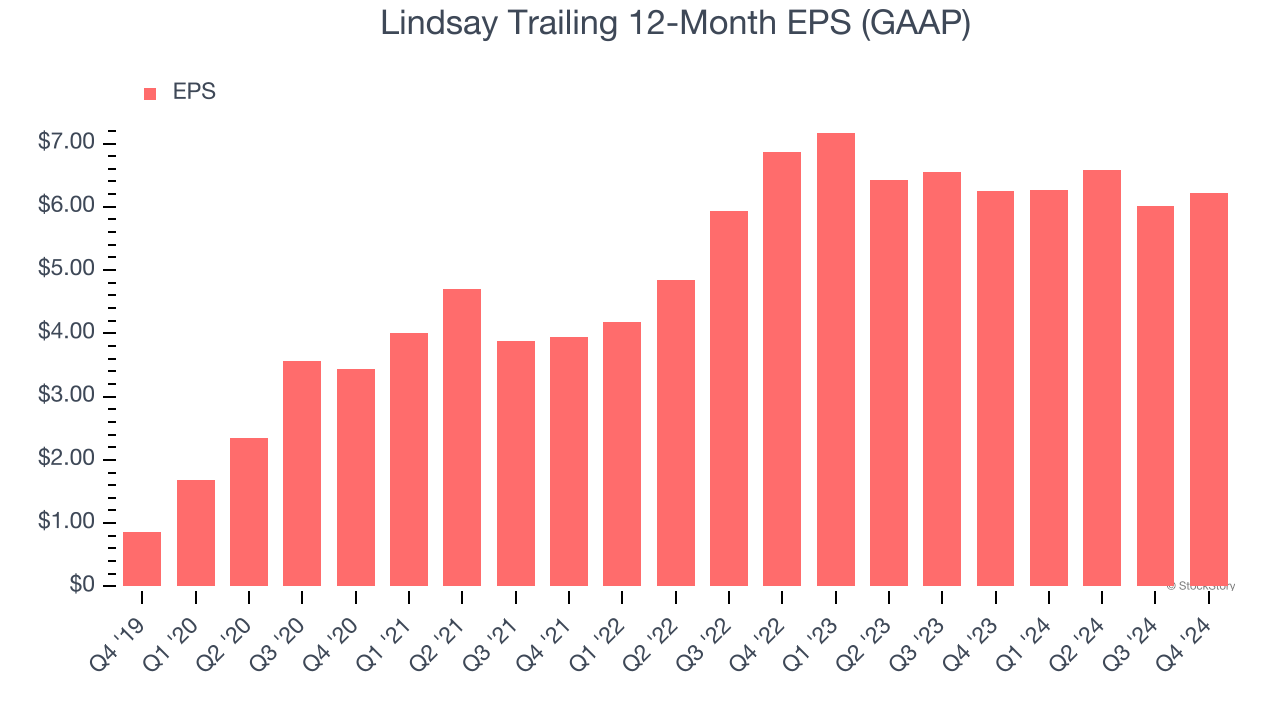

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Lindsay’s EPS grew at an astounding 48.6% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Lindsay’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Lindsay’s operating margin was flat this quarter but expanded by 2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lindsay, its two-year annual EPS declines of 4.8% mark a reversal from its (seemingly) healthy five-year trend. We hope Lindsay can return to earnings growth in the future.In Q4, Lindsay reported EPS at $1.57, up from $1.36 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lindsay’s full-year EPS of $6.22 to shrink by 1.9%.

Key Takeaways from Lindsay’s Q4 Results

We were impressed by how significantly Lindsay blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this quarter was mixed. The stock traded up 1.4% to $119.14 immediately after reporting.

Is Lindsay an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.