Energy and construction materials company MDU Resources (NYSE:MDU) missed analysts' expectations in Q2 CY2024, with revenue down 4% year on year to $1.05 billion. It made a GAAP profit of $0.30 per share, down from its profit of $0.64 per share in the same quarter last year.

Is now the time to buy MDU Resources? Find out by accessing our full research report, it's free.

MDU Resources (MDU) Q2 CY2024 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.06 billion (1.3% miss)

- EBITDA guidance for the full year is $230 million at the midpoint, below analyst estimates of $729.3 million

- Gross Margin (GAAP): 21%, up from 17% in the same quarter last year

- EBITDA Margin: 15.7%, up from 9.8% in the same quarter last year

- Market Capitalization: $5.18 billion

"Our second quarter results reflect the exceptional efforts and dedication of our employees," said Nicole A. Kivisto, president and CEO of MDU Resources.

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE:MDU) provides products and services in the utilities and construction materials industries.

Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

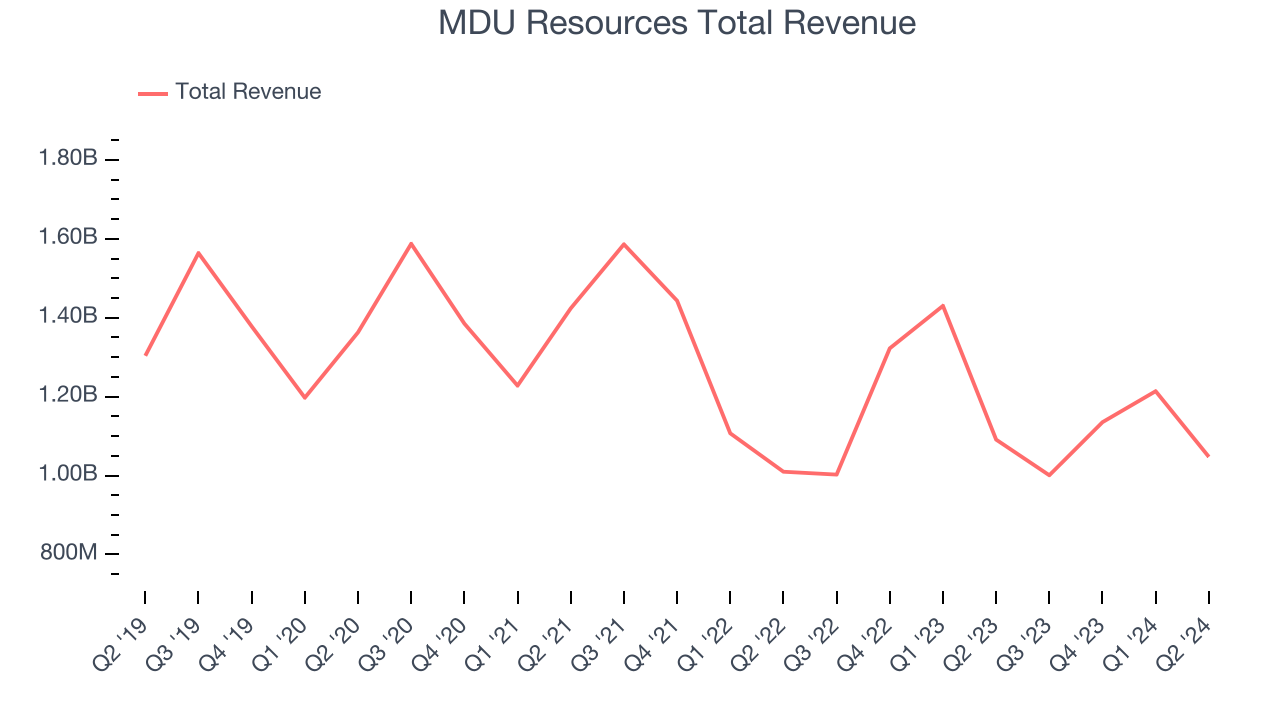

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, MDU Resources's revenue declined by 1.2% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. MDU Resources's recent history shows its demand has stayed suppressed as its revenue has declined by 7.6% annually over the last two years.

This quarter, MDU Resources missed Wall Street's estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $1.05 billion of revenue. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

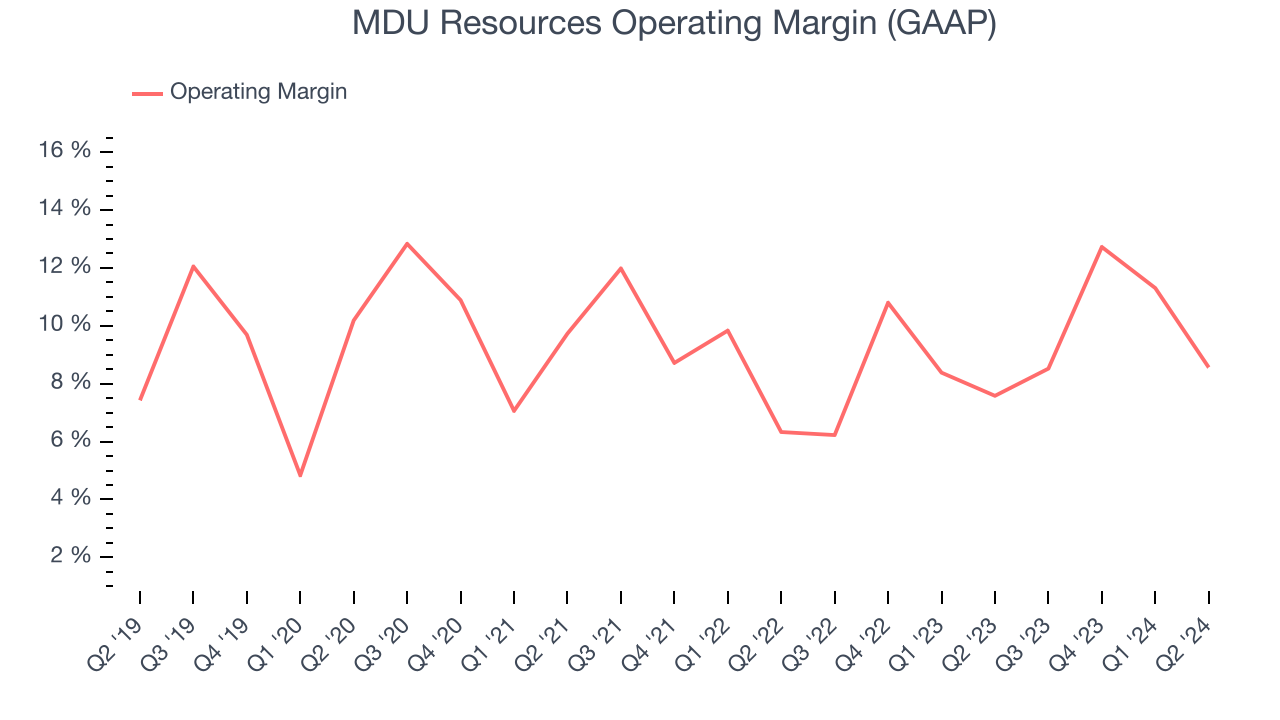

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MDU Resources has done a decent job managing its expenses over the last five years. The company has produced an average operating margin of 9.6%, higher than the broader industrials sector.

Looking at the trend in its profitability, MDU Resources's annual operating margin might have seen some fluctuations but has remained more or less the same over the last five years. Shareholders will want to see MDU Resources grow its margin in the future.

This quarter, MDU Resources generated an operating profit margin of 8.6%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

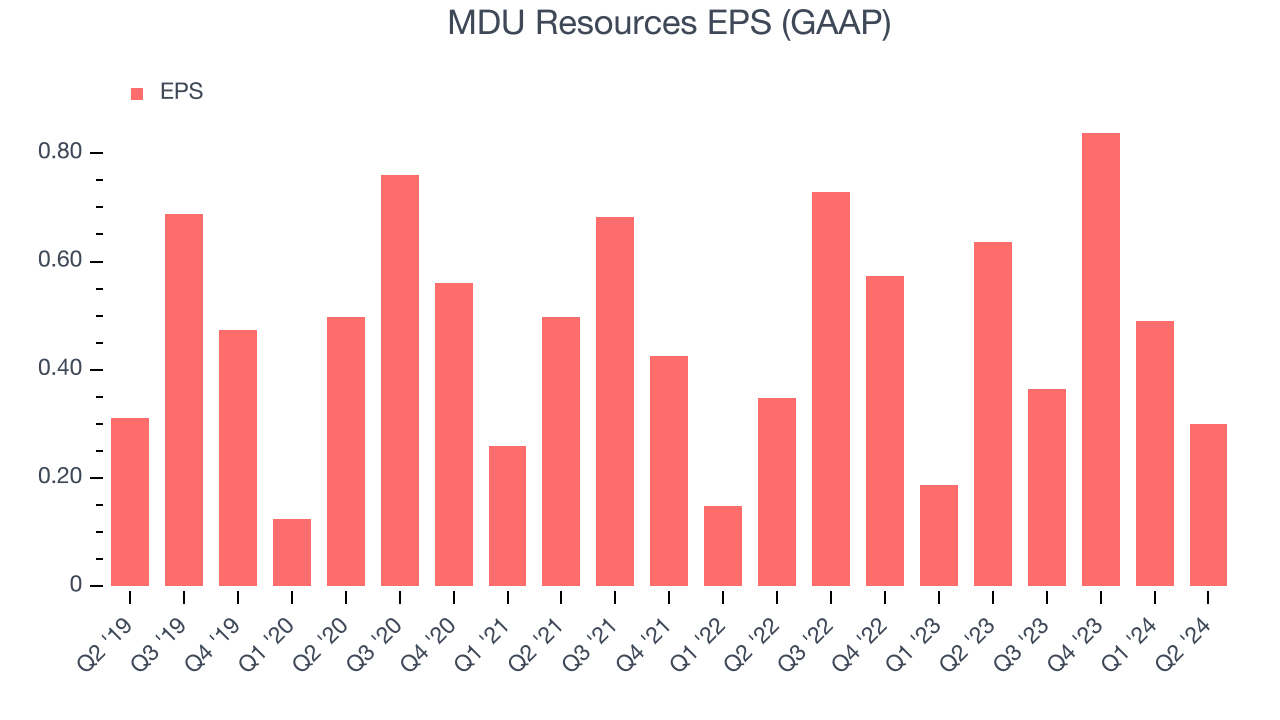

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

MDU Resources's EPS grew at a remarkable 12% compounded annual growth rate over the last five years, higher than its 1.2% annualized revenue declines. However, this alone doesn't tell us much about its day-to-day operations because its operating margin didn't expand.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. MDU Resources's two-year annual EPS growth of 11.5% was good and topped its two-year revenue performance.

In Q2, MDU Resources reported EPS at $0.30, down from $0.64 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but there is insufficient data.

Key Takeaways from MDU Resources's Q2 Results

We struggled to find many strong positives in these results. Its EBITDA forecast for the full year missed and its revenue fell short of Wall Street's estimates. Overall, this was a weaker quarter for MDU Resources. The stock remained flat at $25.42 immediately after reporting.

MDU Resources may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.