Golf entertainment and gear company Topgolf Callaway (NYSE:MODG) fell short of analysts' expectations in Q2 CY2024, with revenue down 1.9% year on year to $1.16 billion. Next quarter's revenue guidance of $980 million also underwhelmed, coming in 13.8% below analysts' estimates. It made a non-GAAP profit of $0.42 per share, improving from its profit of $0.39 per share in the same quarter last year.

Is now the time to buy Topgolf Callaway? Find out by accessing our full research report, it's free.

Topgolf Callaway (MODG) Q2 CY2024 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.19 billion (2.8% miss)

- EPS (non-GAAP): $0.42 vs analyst estimates of $0.27 ($0.15 beat)

- Revenue Guidance for Q3 CY2024 is $980 million at the midpoint, below analyst estimates of $1.14 billion

- The company dropped its revenue guidance for the full year from $4.46 billion to $4.23 billion at the midpoint, a 5.1% decrease

- EPS (non-GAAP) guidance for the full year is $0.16 at the midpoint, missing analyst estimates by 51.7%

- EBITDA guidance for the full year is $580 million at the midpoint, below analyst estimates of $626 million

- Gross Margin (GAAP): 63.2%, up from 35.9% in the same quarter last year

- EBITDA Margin: 17.8%, in line with the same quarter last year

- Free Cash Flow of $140.8 million is up from -$138.7 million in the previous quarter

- Constant Currency Revenue was down 1.9% year on year

- Market Capitalization: $2.57 billion

"Despite macro headwinds including the cumulative impact of negative FX trends, persistently high inflation and recent softer-than-expected traffic to our Topgolf venues, I am incredibly proud of our team's ability to drive market share gains in our products business as well as the continued strengthening of the digital capabilities and fundamental venue profitability at Topgolf," commented Chip Brewer, President and Chief Executive Officer of Topgolf Callaway Brands.

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

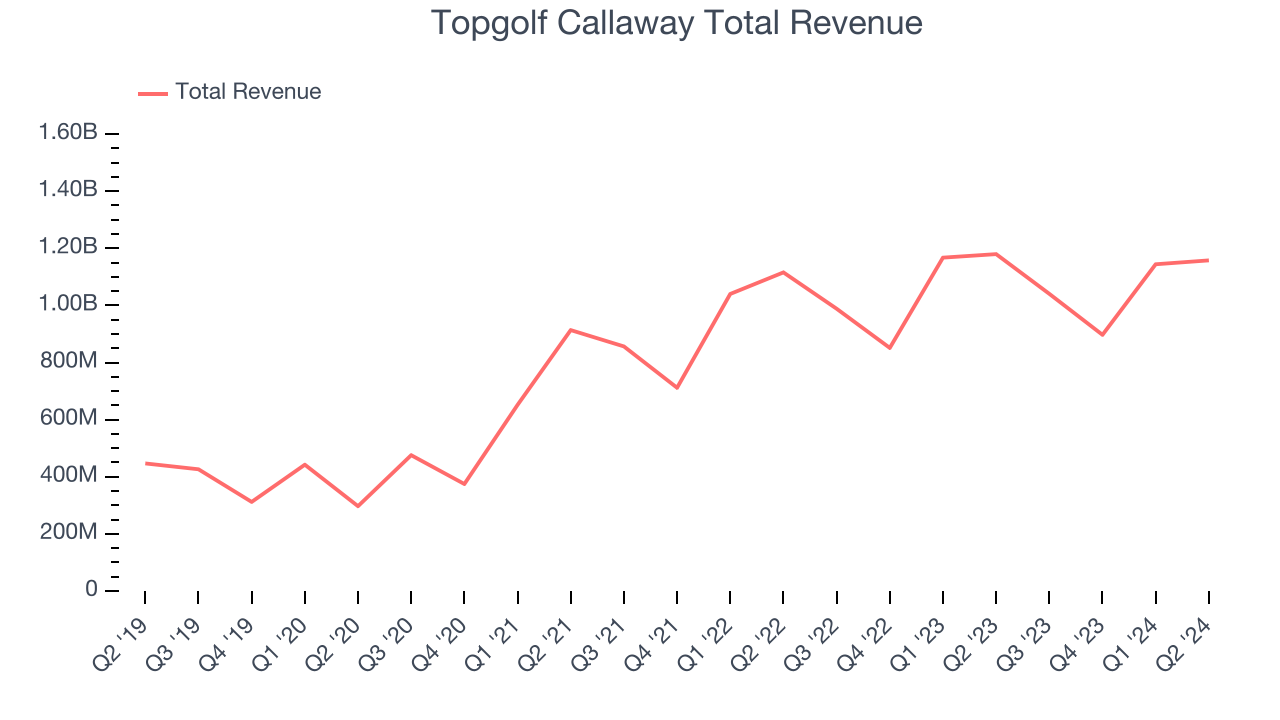

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, Topgolf Callaway grew its sales at an excellent 24.7% compounded annual growth rate. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Topgolf Callaway's recent history shows its demand slowed significantly as its annualized revenue growth of 6.7% over the last two years is well below its five-year trend. Note that COVID hurt Topgolf Callaway's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Topgolf Callaway missed Wall Street's estimates and reported a rather uninspiring 1.9% year-on-year revenue decline, generating $1.16 billion of revenue. The company is guiding for a 5.8% year-on-year revenue decline next quarter to $980 million, a reversal from the 5.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 8.9% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

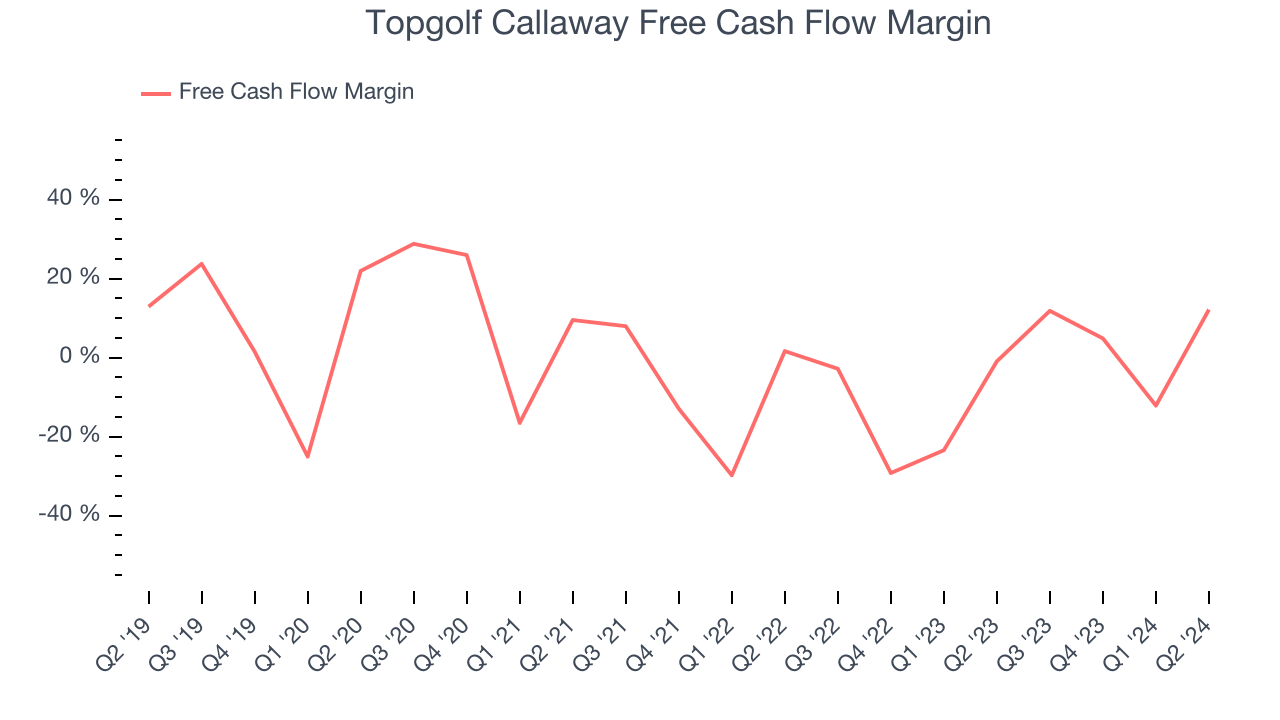

While Topgolf Callaway posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Topgolf Callaway's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin was among the worst in the consumer discretionary sector, averaging negative 4.6%.

Topgolf Callaway's free cash flow clocked in at $140.8 million in Q2, equivalent to a 12.2% margin. This quarter's result was good as its margin was 13.1 percentage points higher than in the same quarter last year, but we wouldn't put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Topgolf Callaway's Q2 Results

We were impressed by how Topgolf Callaway blew past analysts' EPS expectations this quarter. On the other hand, it lowered its full-year revenue and earnings guidance, which fell short of Wall Street's estimates. Overall, this quarter could have been better. The stock traded up 3.9% to $12.70 immediately after reporting.

So should you invest in Topgolf Callaway right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.