Newspaper and digital media company The New York Times (NYSE:NYT) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 5.8% year on year to $625.1 million. It made a non-GAAP profit of $0.45 per share, improving from its profit of $0.38 per share in the same quarter last year.

Is now the time to buy The New York Times? Find out in our full research report.

The New York Times (NYT) Q2 CY2024 Highlights:

- Revenue: $625.1 million vs analyst estimates of $625.2 million (small miss)

- Raised full year guidance for subscription revenue growth to 8% year-on-year at the midpoint from 7% previously

- EPS (non-GAAP): $0.45 vs analyst estimates of $0.41 (10.7% beat)

- Gross Margin (GAAP): 48.4%, in line with the same quarter last year

- EBITDA Margin: 16%, in line with the same quarter last year

- Free Cash Flow was -$46.54 million, down from $46.66 million in the previous quarter

- Subscribers: 10.21 million, up 330,000 year on year

- Market Capitalization: $8.57 billion

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

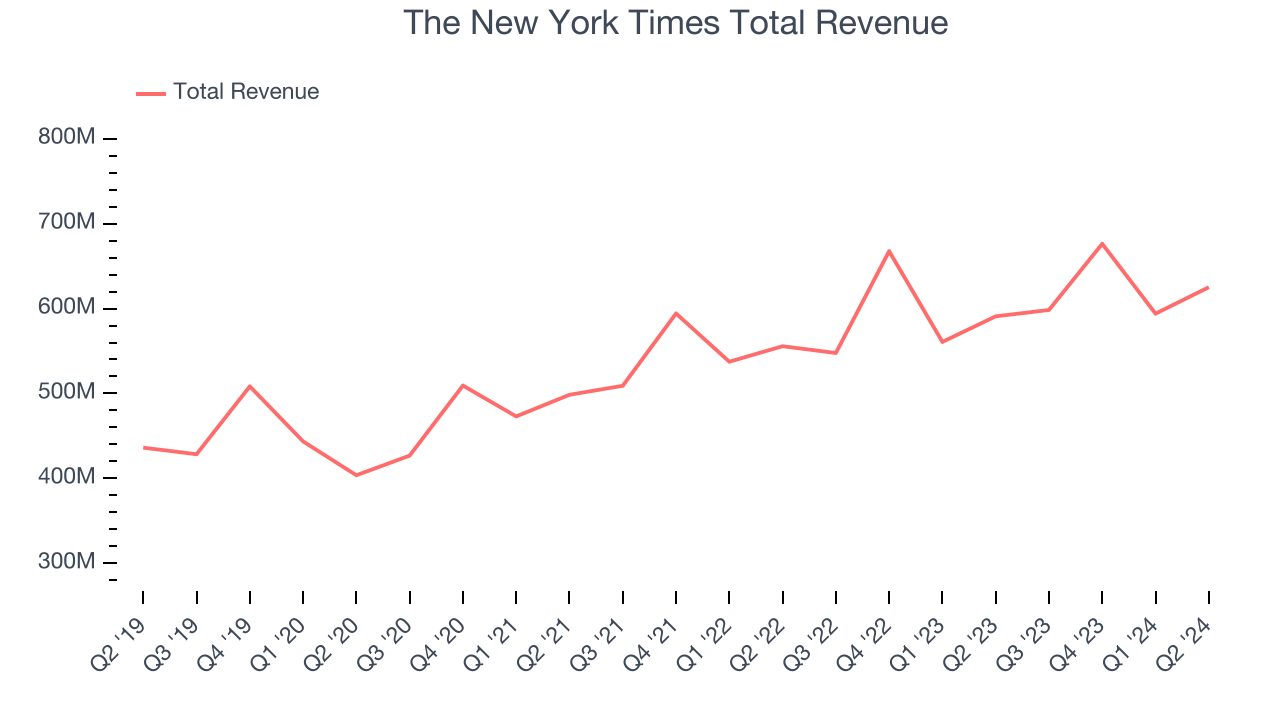

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Over the last five years, The New York Times grew its sales at a weak 6.8% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. The New York Times's annualized revenue growth of 6.6% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

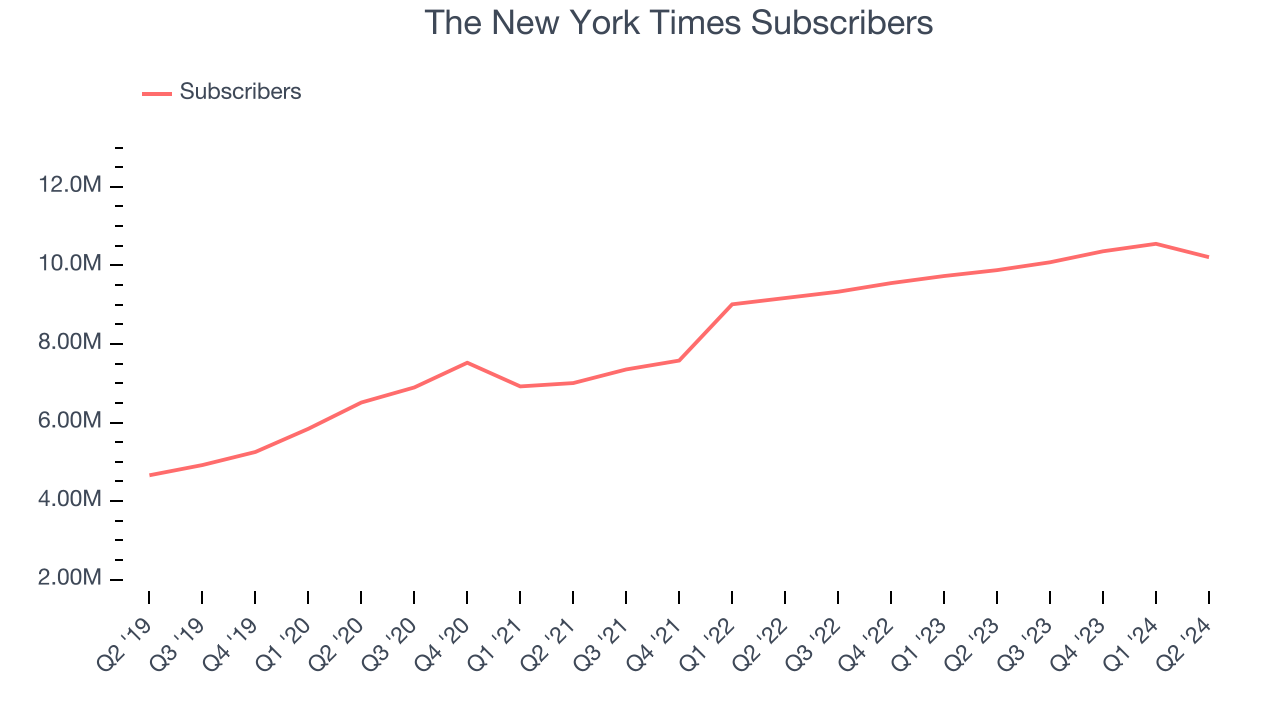

We can better understand the company's revenue dynamics by analyzing its number of subscribers, which reached 10.21 million in the latest quarter. Over the last two years, The New York Times's subscribers averaged 12.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, The New York Times grew its revenue by 5.8% year on year, and its $625.1 million of revenue was in line with Wall Street's estimates. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

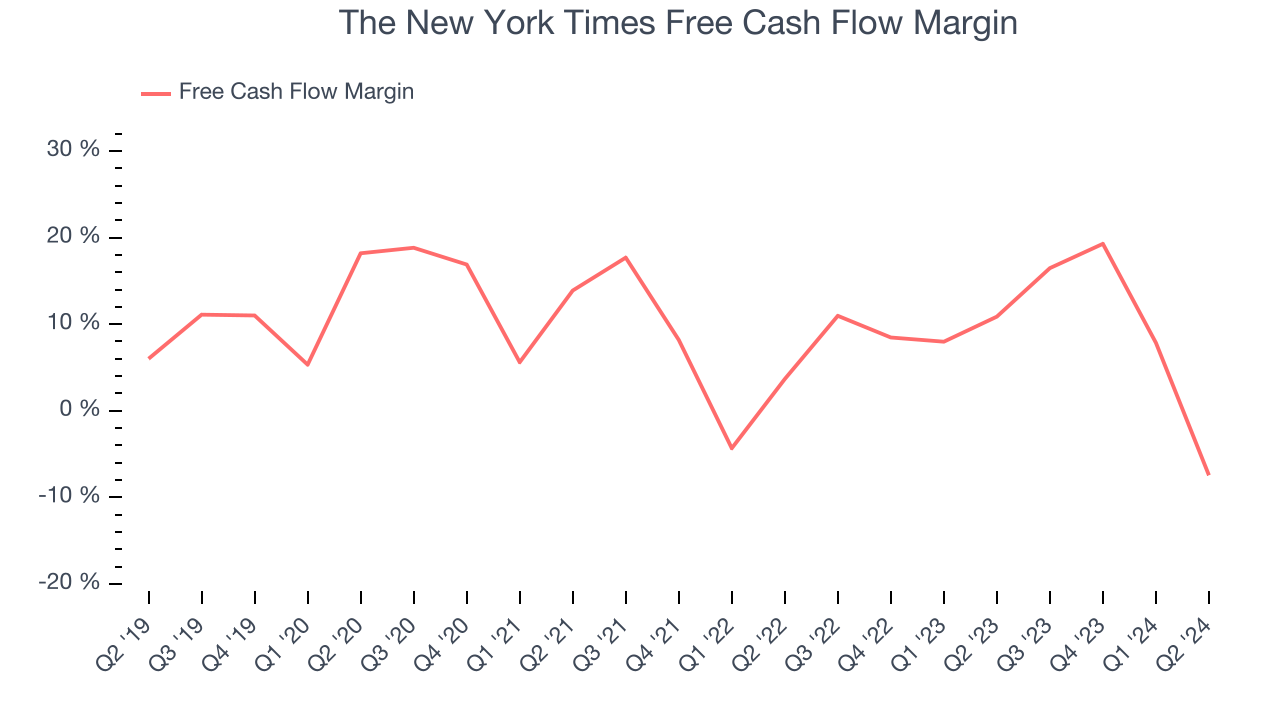

The New York Times has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.4%, subpar for a consumer discretionary business.

The New York Times burned through $46.54 million of cash in Q2, equivalent to a negative 7.4% margin. The company's quarterly cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from The New York Times's Q2 Results

It was good to see The New York Times beat analysts' EPS expectations this quarter. That the company raised full year guidance for subscription revenue growth was another big positive. On the other hand, its number of subscribers unfortunately missed. Overall, this quarter was mixed. The stock traded up 1.6% to $52.95 immediately following the results.

So should you invest in The New York Times right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.