Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at ON24 (NYSE:ONTF) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Thankfully, sales and marketing software stocks have been resilient with share prices up 7.4% on average since the latest earnings results.

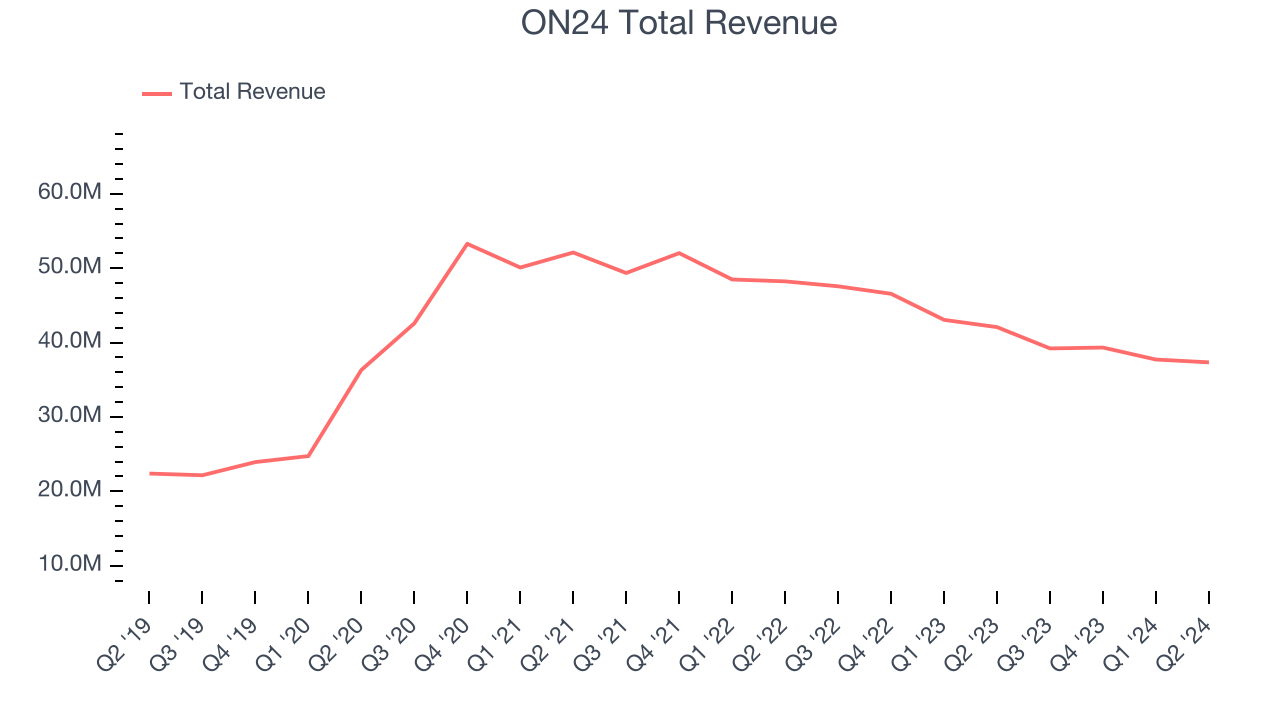

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $37.35 million, down 11.3% year on year. This print exceeded analysts’ expectations by 3.2%. Despite the top-line beat, it was still a mixed quarter for the company with full-year revenue guidance topping analysts’ expectations but a miss of analysts’ billings estimates.

“I am pleased with our Q2 results, as we exceeded guidance on the top and bottom line and delivered positive free cash flow. I am encouraged by another quarter of improvement in gross retention, which is trending much better than the average rates we have seen for each of the past three years,” said Sharat Sharan, co-founder and CEO of ON24.

ON24 delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 6.5% since reporting and currently trades at $6.21.

Read our full report on ON24 here, it’s free.

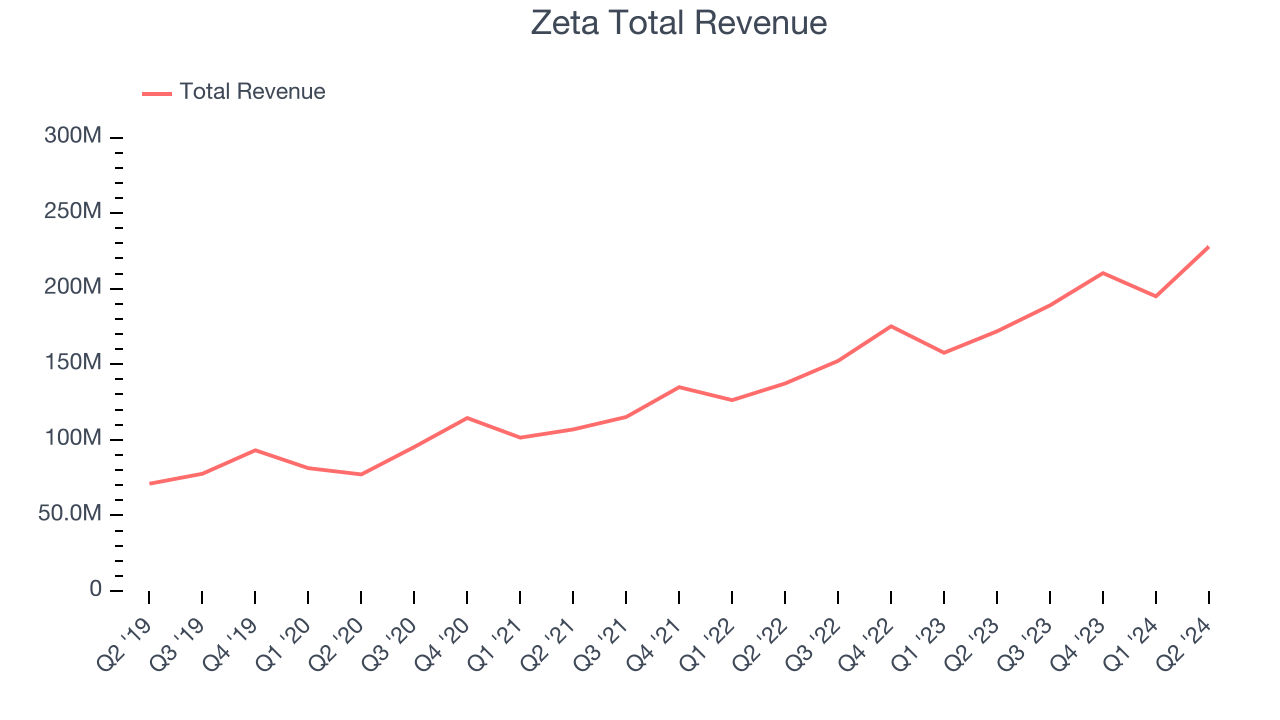

Best Q2: Zeta (NYSE:ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $227.8 million, up 32.6% year on year, outperforming analysts’ expectations by 7.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and optimistic revenue guidance for the next quarter.

Zeta delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 46.5% since reporting. It currently trades at $31.46.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $67.27 million, up 6.2% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter.

As expected, the stock is down 26.1% since the results and currently trades at $14.49.

Read our full analysis of PubMatic’s results here.

Semrush (NYSE:SEMR)

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

Semrush reported revenues of $90.95 million, up 21.8% year on year. This result beat analysts’ expectations by 1.3%. It was a very strong quarter as it also logged an impressive beat of analysts’ billings estimates and a solid beat of analysts’ ARR (annual recurring revenue) estimates.

The company added 4,000 customers to reach a total of 116,000. The stock is up 17.1% since reporting and currently trades at $15.12.

Read our full, actionable report on Semrush here, it’s free.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Freshworks reported revenues of $174.1 million, up 20% year on year. This result surpassed analysts’ expectations by 3%. It was a very strong quarter as it also recorded accelerating growth in large customers and an impressive beat of analysts’ billings estimates.

The company added 1,195 enterprise customers paying more than $5,000 annually to reach a total of 21,744. The stock is down 15.5% since reporting and currently trades at $11.22.

Read our full, actionable report on Freshworks here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.