Earnings results often give us a good indication what direction will the company will take in the months ahead. With Q2 now behind us, let’s have a look at UiPath (NYSE:PATH) and its peers.

Automation seems to be an inescapable trend since the dawn of software, driven by the ever-present pressure on increased productivity. Improving software capabilities are now finally allowing automation beyond the simple one- or two-steps workflows, and as a result automation software is becoming integral to many processes inside enterprises.

The 5 automation software stocks we track reported a a solid Q2; on average, revenues beat analyst consensus estimates by 4.33%, while on average next quarter revenue guidance was 3.12% above consensus. On average the share price was down 3.3% the day after the earnings.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

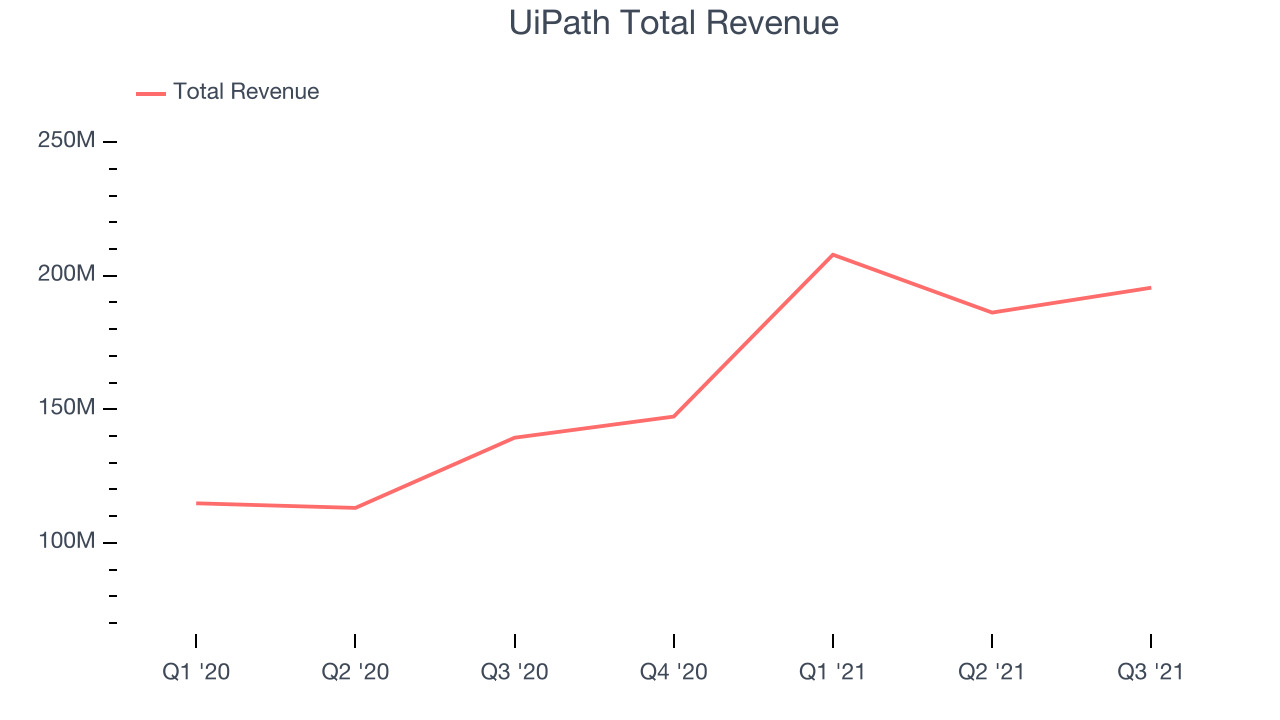

UiPath reported revenues of $195.5 million, up 40.2% year on year, beating analyst expectations by 4.84%. It was a very strong quarter for the company, with a significant improvement in gross margin and an exceptional revenue growth.

“We continued our very strong momentum in the second quarter of fiscal year 2022 with ARR growing 60 percent year-over-year to $726.5 million. Our results were driven by both new customer additions, ending the quarter with more than 9,100 customers, as well as robust expansion with existing customers, reflected in our best-in-class dollar-based net retention rate of 144 percent,” said Daniel Dines, UiPath Co-Founder and Chief Executive Officer.

UiPath pulled off the fastest revenue growth but had the weakest full year guidance update of the whole group. Investors probably wanted to see even more from this market darling, as the stock is down 22.7% since the results and currently trades at $48.22.

We think UiPath is a good business, but is it a buy today? Read our full report here, it's free.

Best Q2: Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

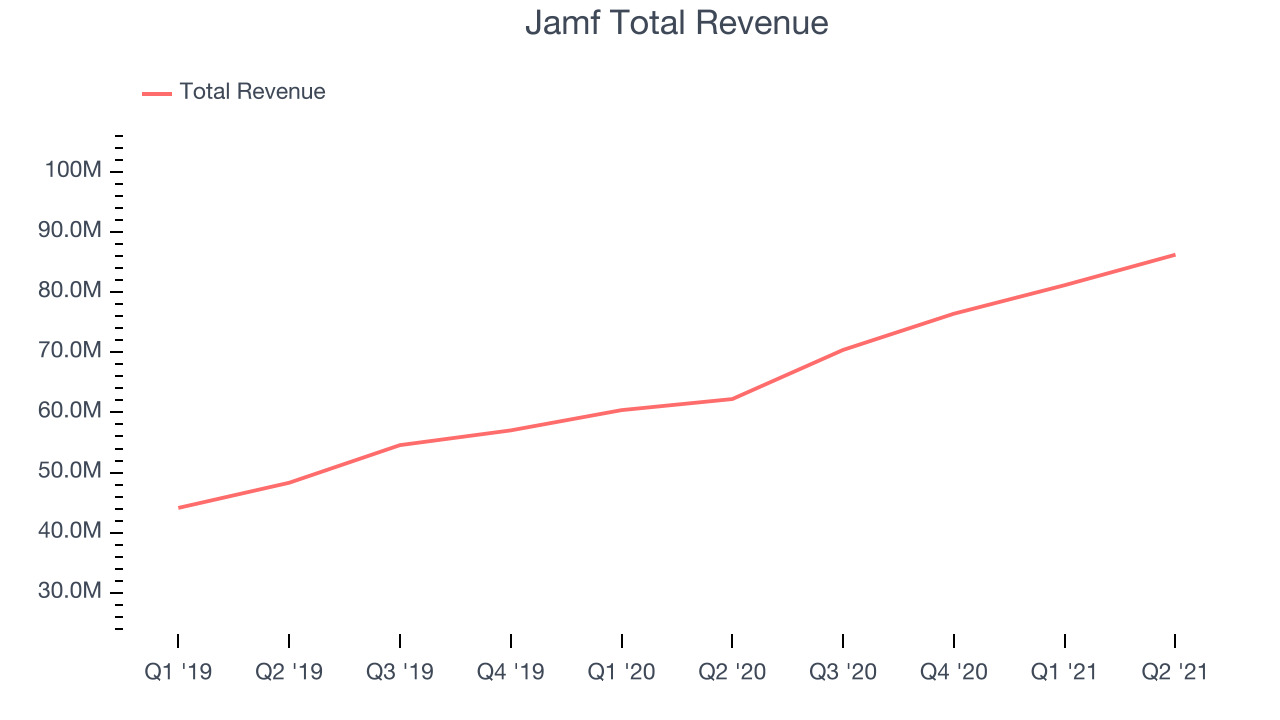

Jamf reported revenues of $86.2 million, up 38.5% year on year, beating analyst expectations by 3.83%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter and a full year guidance beating analysts' expectations.

The stock is up 30.7% since the results and currently trades at $41.09.

Is now the time to buy Jamf? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $82.9 million, up 24.2% year on year, beating analyst expectations by 6.24%. It was a decent quarter for the company, with a solid beat of analyst estimates but a decline in gross margin.

Appian scored the strongest analyst estimates beat but had the slowest revenue growth in the group. The stock is down 19.6% since the results and currently trades at $90.21.

Read our full analysis of Appian's results here.

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $86.6 million, up 32.5% year on year, beating analyst expectations by 3.25%. It was a decent quarter for the company, with a strong top line growth but a decline in gross margin.

Everbridge had the weakest performance against analyst estimates among the peers. The stock is down 1.45% since the results and currently trades at $142.34.

Read our full, actionable report on Everbridge here, it's free.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy who wrote the code for the initial prototype on a single flight from San Francisco to London, ServiceNow offers software as a service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR and Customer Service.

ServiceNow reported revenues of $1.4 billion, up 31.5% year on year, beating analyst expectations by 3.5%. It was a good quarter for the company, with a strong top line growth.

ServiceNow delivered the highest full year guidance raise among the peers. The company added 55 enterprise customers paying more than $1m annually to a total of 1,201. The stock is up 8.16% since the results and currently trades at $631.05.

Read our full, actionable report on ServiceNow here, it's free.

The author has no position in any of the stocks mentioned