As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the HR software stocks, starting with Paycom Software (NYSE:PAYC).

HR software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy to use platforms.

The 6 HR software stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 3.27%, while on average next quarter revenue guidance was 1.66% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but HR software stocks held their ground better than others, with the share prices up 0.71% since the previous earnings results, on average.

Paycom Software (NYSE:PAYC)

Founded in 1998 as one of the first online payroll companies. Today, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

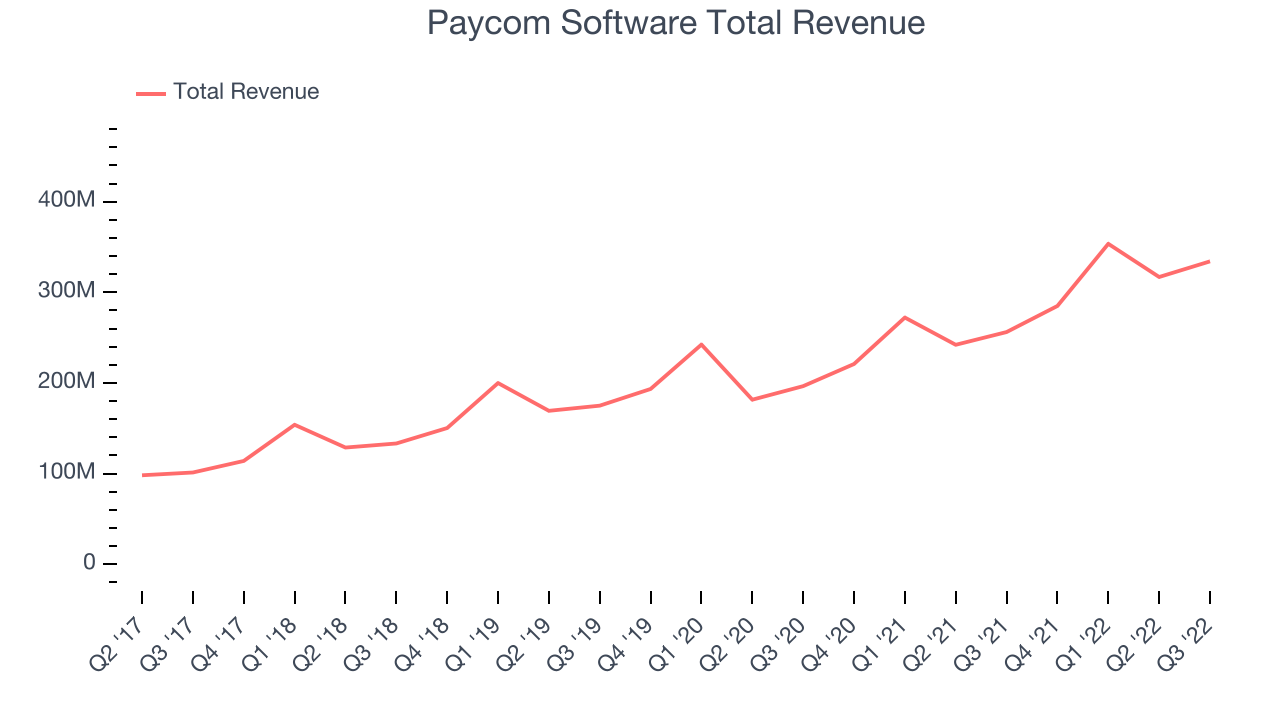

Paycom Software reported revenues of $334.1 million, up 30.4% year on year, beating analyst expectations by 1.79%. It was a mixed quarter for the company, with very optimistic guidance for the next quarter but a decline in gross margin.

“We delivered high quality third quarter results that further strengthened our world class fundamentals. Our very strong results reflect outstanding execution and robust demand for self-service, user-friendly solutions in payroll and human capital management,” said Paycom’s founder and CEO, Chad Richison.

The stock is down 16.3% since the results and currently trades at $287.39.

Is now the time to buy Paycom Software? Access our full analysis of the earnings results here, it's free.

Best Q3: Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio Paycor (NASDAQ: PYCR), provides software for small businesses to manage their payroll and HR needs in one place.

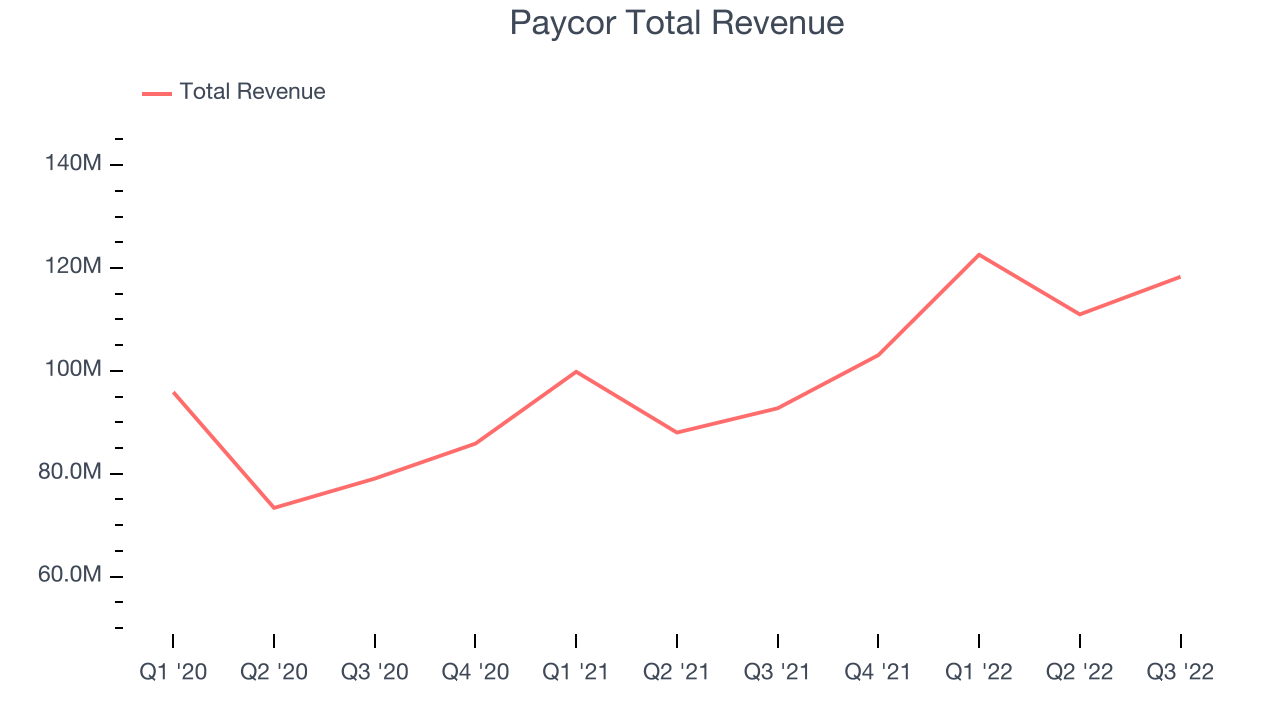

Paycor reported revenues of $118.3 million, up 27.5% year on year, beating analyst expectations by 4.42%. Despite the stock dropping on the results, it was a very strong quarter for the company, with full year guidance beating analysts' expectations and a decent beat of analyst estimates.

Paycor achieved the highest full year guidance raise among its peers. The stock is down 12.6% since the results and currently trades at $24.1.

Is now the time to buy Paycor? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $315.6 million, up 22.7% year on year, beating analyst expectations by 3.28%. It was a weaker quarter for the company, with a decline in gross margin and underwhelming revenue guidance for the next quarter.

Ceridian had the weakest full year guidance update in the group. The company added 120 customers to a total of 5,848. The stock is down 1.45% since the results and currently trades at $60.96.

Read our full analysis of Ceridian's results here.

Paychex (NASDAQ:PAYX)

One of the oldest payroll service providers, Paychex provides payroll and human resource (HR) solutions.

Paychex reported revenues of $1.19 billion, up 7.37% year on year, beating analyst expectations by 1.21%. It was a weaker quarter for the company, with slow revenue growth and a decline in gross margin.

Paychex had the weakest performance against analyst estimates and slowest revenue growth among the peers. The stock is up 2.75% since the results and currently trades at $117.45.

Read our full, actionable report on Paychex here, it's free.

Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $21.9 million, up 21.8% year on year, beating analyst expectations by 3.25%. It was a solid quarter for the company, with a significant improvement in gross margin.

The stock is up 47% since the results and currently trades at $9.63.

Read our full, actionable report on Asure Software here, it's free.

The author has no position in any of the stocks mentioned