Looking back on finance and HR software stocks' Q3 earnings, we examine the quarters’ best and worst performers, including Anaplan (NYSE:PLAN) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 6.37%, while on average next quarter revenue guidance was 4.1% above consensus. The whole tech sector has been facing a sell-off since late last year and finance and HR software stocks have not been spared, with share price down 28.7% since earnings, on average.

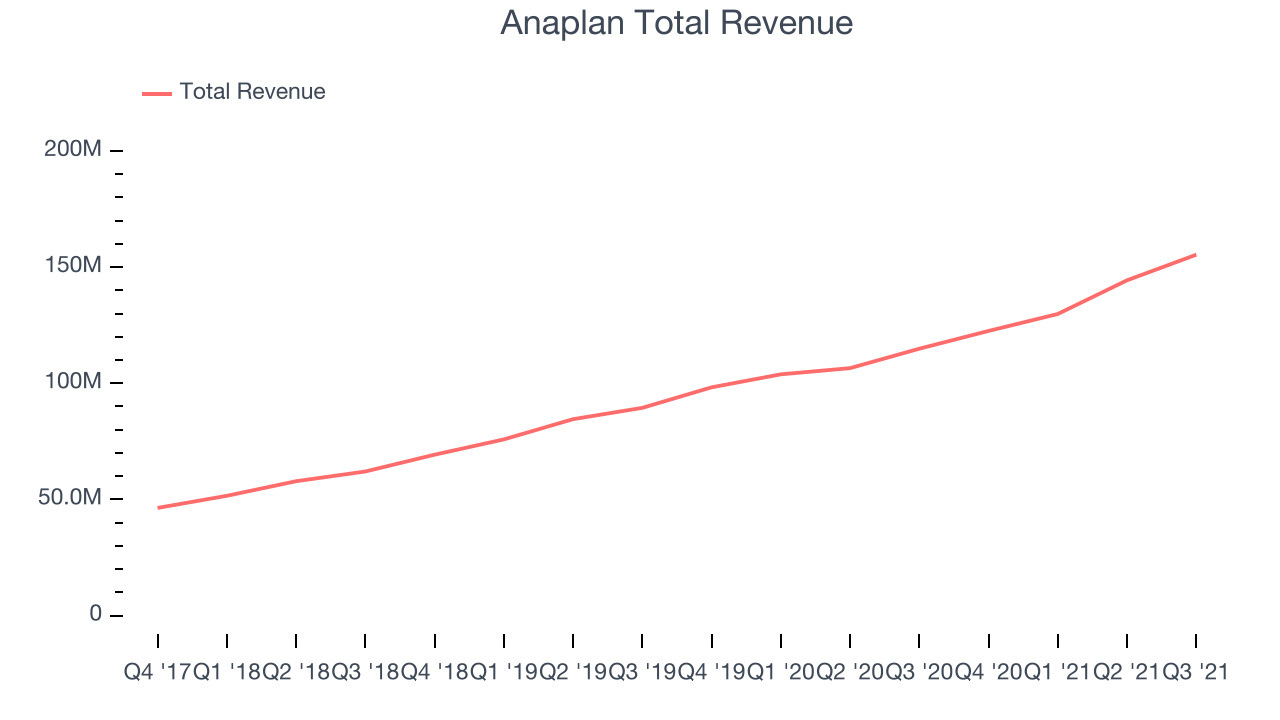

Anaplan (NYSE:PLAN)

Founded by Michael Gould in 2006 in a stone barn in Yorkshire, England, Anaplan (NYSE:PLAN) is a financial modelling software that helps large enterprises with complex decision-making around budgets and financial forecasts.

Anaplan reported revenues of $155.3 million, up 35.2% year on year, beating analyst expectations by 6.17%. It was a mixed quarter for the company, with a solid beat of analyst estimates but a decline in gross margin.

“With a constantly changing environment, we solve our customers’ complex challenges. I am excited about our innovation with the Anaplan Autonomous Enterprise, which provides a real-time, scalable, and intelligent approach to plan, analyze and act,” said Frank Calderoni, chief executive officer of Anaplan.

The stock is down 13% since the results and currently trades at $45.27.

Is now the time to buy Anaplan? Access our full analysis of the earnings results here, it's free.

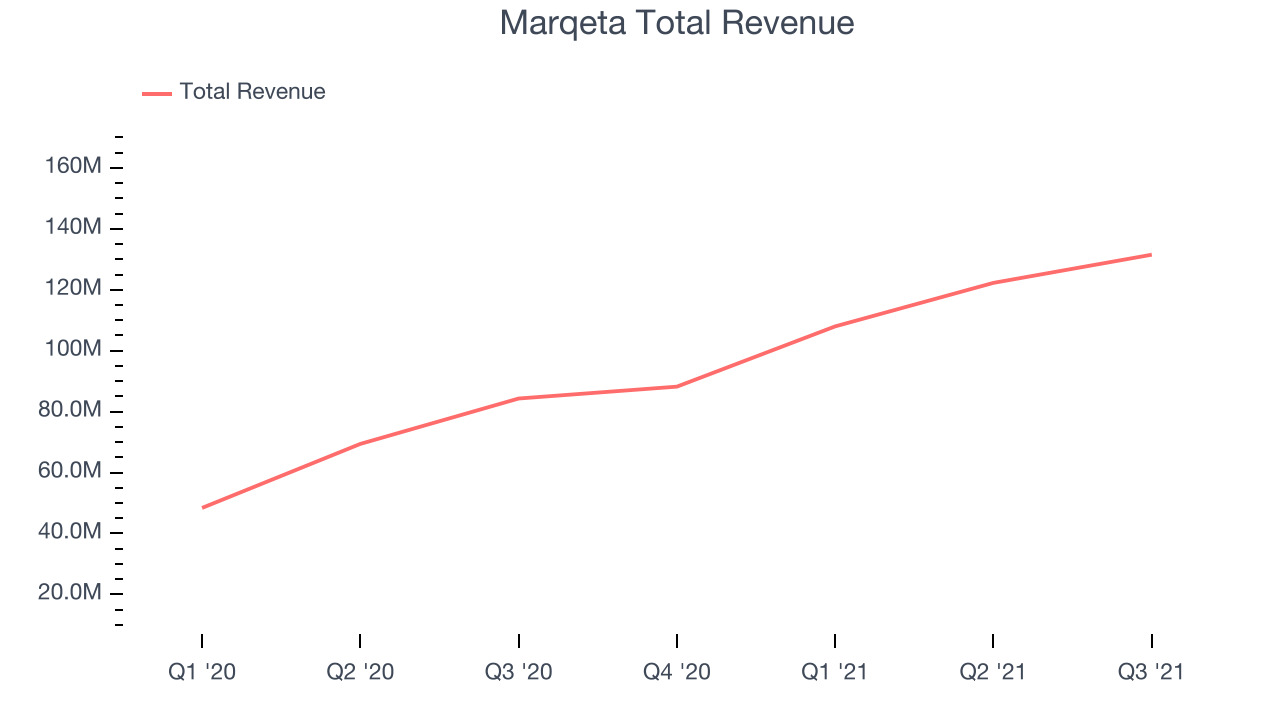

Best Q3: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $131.5 million, up 56% year on year, beating analyst expectations by 10.3%. It was a quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

The stock is down 55.1% since the results and currently trades at $11.22.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $257.2 million, up 25.8% year on year, beating analyst expectations by 1.19%. It was a weak quarter for the company, with a decline in gross margin and decelerating customer growth.

Ceridian had the weakest full year guidance update in the group. The company added 63 customers to a total of 5,227. The stock is down 39.4% since the results and currently trades at $77.65.

Read our full analysis of Ceridian 's results here.

Paychex (NASDAQ:PAYX)

One of the oldest payroll service providers, Paychex provides payroll and human resource (HR) solutions.

Paychex reported revenues of $1.1 billion, up 12.6% year on year. It was an quarter for the company, beating analyst expectations by 4.63%.

Trading on a lower multiple than many of its high-growth competitors, the stock withstood the sell-off so far and is down only 5.84% since the results and currently trades at $119.05.

Read our full, actionable report on Paychex here, it's free.

Flywire Corporation (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire Corporation reported revenues of $67.7 million, up 61% year on year, beating analyst expectations by 29.4%. It was a good quarter for the company, with an impressive beat of analyst estimates.

Flywire Corporation achieved the strongest analyst estimates beat among the peers. The stock is down 35.5% since the results and currently trades at $28.60.

Read our full, actionable report on Flywire Corporation here, it's free.

The author has no position in any of the stocks mentioned