Data-mining and analytics company Palantir (NYSE:PLTR) reported strong growth in the Q1 FY2021 earnings announcement, with revenue up 48.7% year on year to $341.2 million. Palantir made a GAAP loss of $123.4 million, down on its loss of $54.2 million, in the same quarter last year.

Get investing superpowers with StockStory. View our latest analysis for Palantir

Palantir (PLTR) Q1 FY2021 Highlights:

- Revenue: $341.2 million vs analyst estimates of $332.3 million (2.68% beat)

- EPS (non-GAAP): $0.04 vs analyst estimates of $0.04 (7.87% beat)

- Revenue guidance for Q2 2021 is $360 million at the midpoint, above analyst estimates of $342.8 million

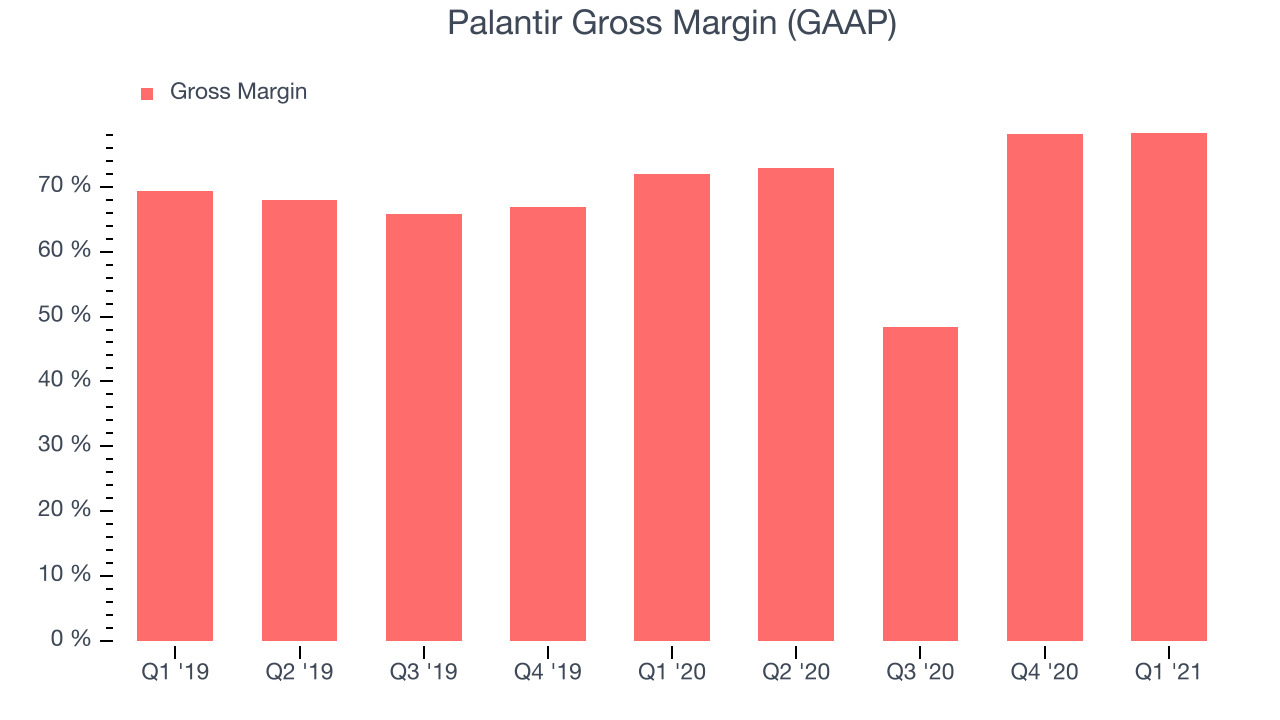

- Gross Margin (GAAP): 78.2%, in line with previous quarter

- Free Cash Flow: $150.9 milion

Having experience with building fraud-predicting algorithms at his previous company Paypal, Peter Thiel started Palantir after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks. The company got its first external funding from the CIA and offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir’s technology provides customers with capabilities to gather and ingest data from almost any source in almost any format and store it in the same type of interconnected architecture that Google uses. On top of the data platform then sits a range of data analysis and visualization tools, each with specific use case from crime investigations, counterterrorism operation planning over to supply chain management and financial compliance.

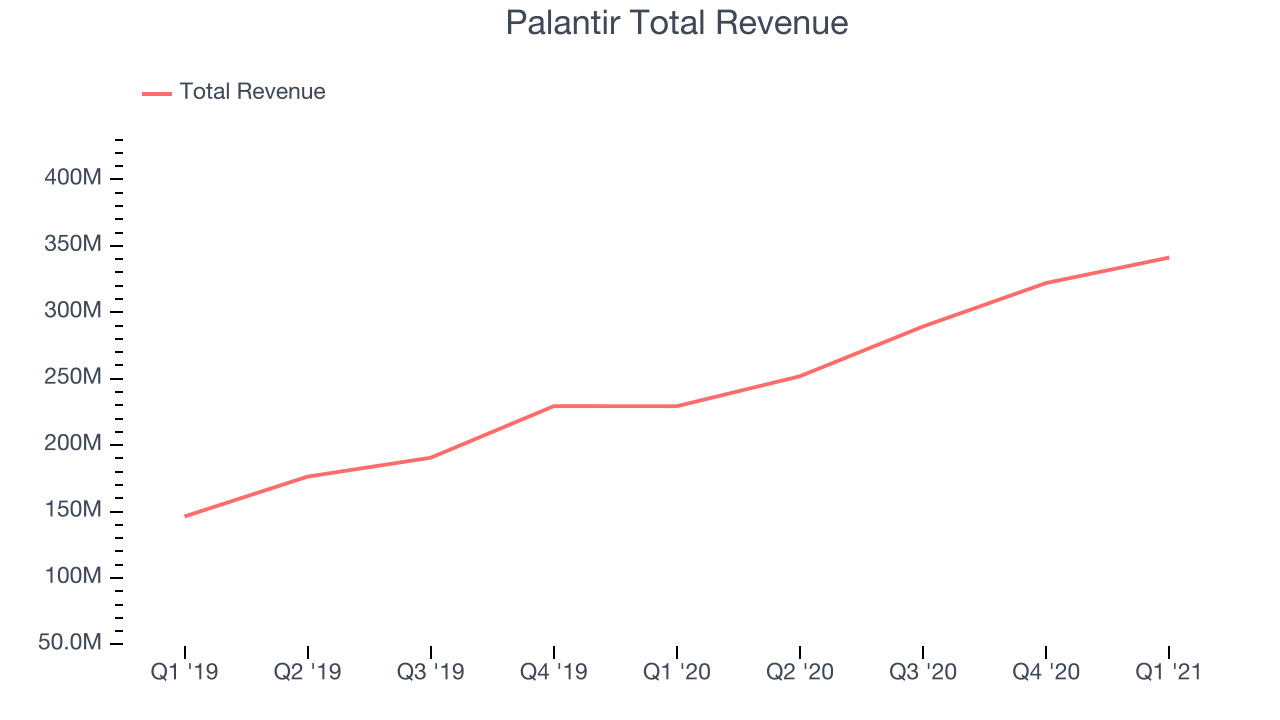

As you can see below, Palantir's revenue growth has been impressive over the last twelve months, growing from $229.3 million to $341.2 million.

And unsurprisingly, this was another great quarter for Palantir with revenue up an absolutely stunning 48.7% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $19.1 million in Q1, compared to $32.7 million in Q4 2020. So while the growth is overall still impressive, we will be keeping an eye on the slowdown.

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Palantir is bit of a special case here as a lot of their government customers require a great deal of custom work and support.

Palantir's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 78.2% in Q1. That means that for every $1 in revenue the company had $0.78 left to spend on developing new products, marketing & sales and the general administrative overhead. Trending up over the last year, this is a good gross margin that will allow Palantir to fund large investments in product and sales during periods of rapid growth and be profitable when it reaches maturity.

Key Takeaways from Palantir's Q1 Results

With market capitalisation of $34.4 billion, more than $2.33 billion in cash and with free cash flow being positive, the company is in a very strong position to invest in growth.

We were impressed by the very optimistic revenue guidance Palantir provided for the next quarter. And we were also excited to see the really strong revenue growth. Zooming out, we think this was a great quarter and we have no doubt shareholders will feel excited about the results. Palantir was already worth keeping an eye on before these results and will now look even more attractive.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.