Banking software provider Q2 (NYSE:QTWO) reported results in line with analyst expectations in Q1 FY2021 quarter, with revenue up 26.1% year on year to $116 million. Q2 made a GAAP loss of $25.6 million, improving on its loss of $34.1 million, in the same quarter last year.

Q2 (NYSE:QTWO) Q1 FY2021 Highlights:

- Revenue: $116 million vs analyst estimates of $115 million (0.97% beat)

- EPS (non-GAAP): $0.10 vs analyst estimates of $0.08 (26.1% beat)

- Revenue guidance for Q2 2021 is $122 million at the midpoint, above analyst estimates of $118 million

- The company lifted revenue guidance for the full year, from $489 million to $496 million at the midpoint, a 1.43% increase

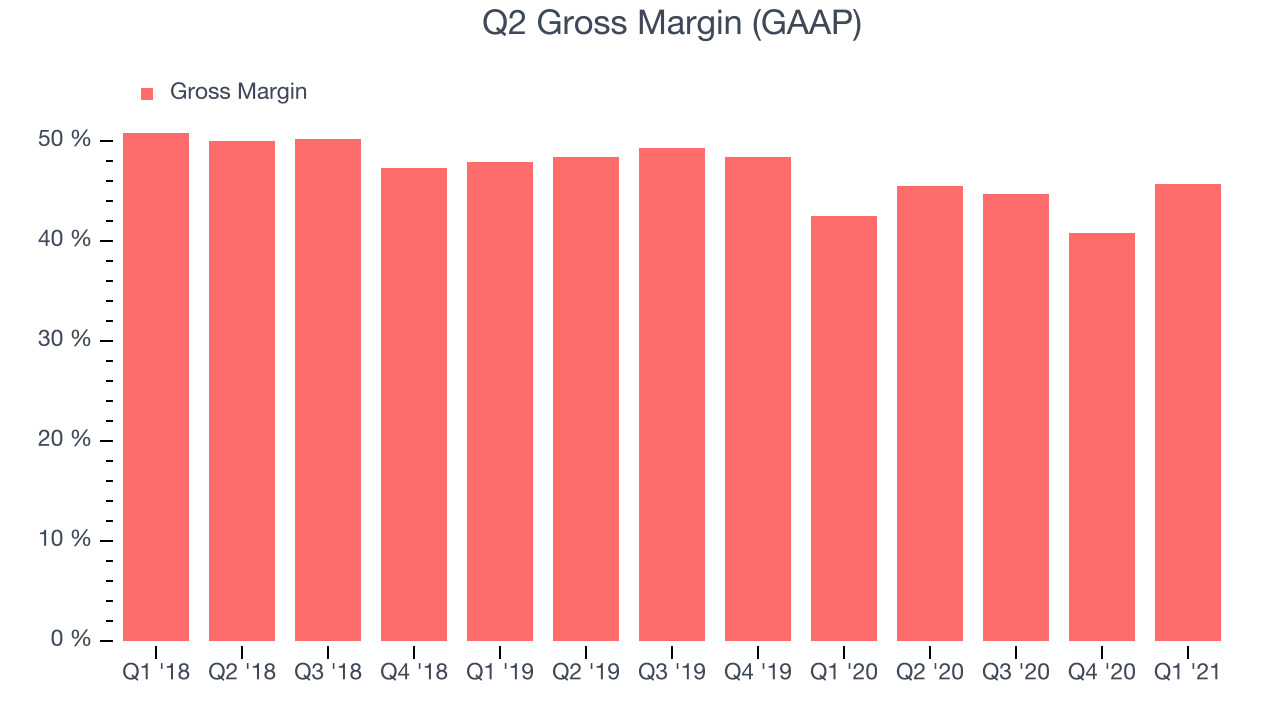

- Gross Margin (GAAP): 45.6%, up from 40.8% previous quarter

“Our first quarter results reflect strong execution in the period, delivering financial results which exceeded the high end of our revenue and adjusted EBITDA guidance," said David Mehok, Q2 CFO. “The revenue and adjusted EBITDA achievement was driven primarily by new customer go-lives and organic user growth in the quarter. We are raising our full year revenue guidance and revising our adjusted EBITDA guidance to reflect our current views on our business outlook for the remainder of 2021 and the impact of the ClickSWITCH acquisition, which closed on April 1st.”

Banking As A Service

Founded in 2004, Q2 (NYSE:QTWO) offers software as a service that enables small banks provide online banking and consumer lending services to their clients. Small, regional and community banks often lack the resources required to manage their own tech infrastructure, making it difficult for them to compete with polished offerings of large national banks. Q2’s cloud-based platform provides them with mobile apps and websites that have the same functionalities big banks offer and allows them to put their own branding on it.

Q2 then handles all the regulatory compliance and security and provides banks with data-based insights on their customers, allowing them to offer more personalized products and better customer service. Community banks and credit unions are under competitive pressure and their numbers have been slowly decreasing due to market consolidation, but there are still thousands of them across the country. Q2 and companies like nCino (NASDAQ:NCNO) or Alkami (NASDAQ:ALKT) are offering them a chance to keep up with the bigger players in the market.

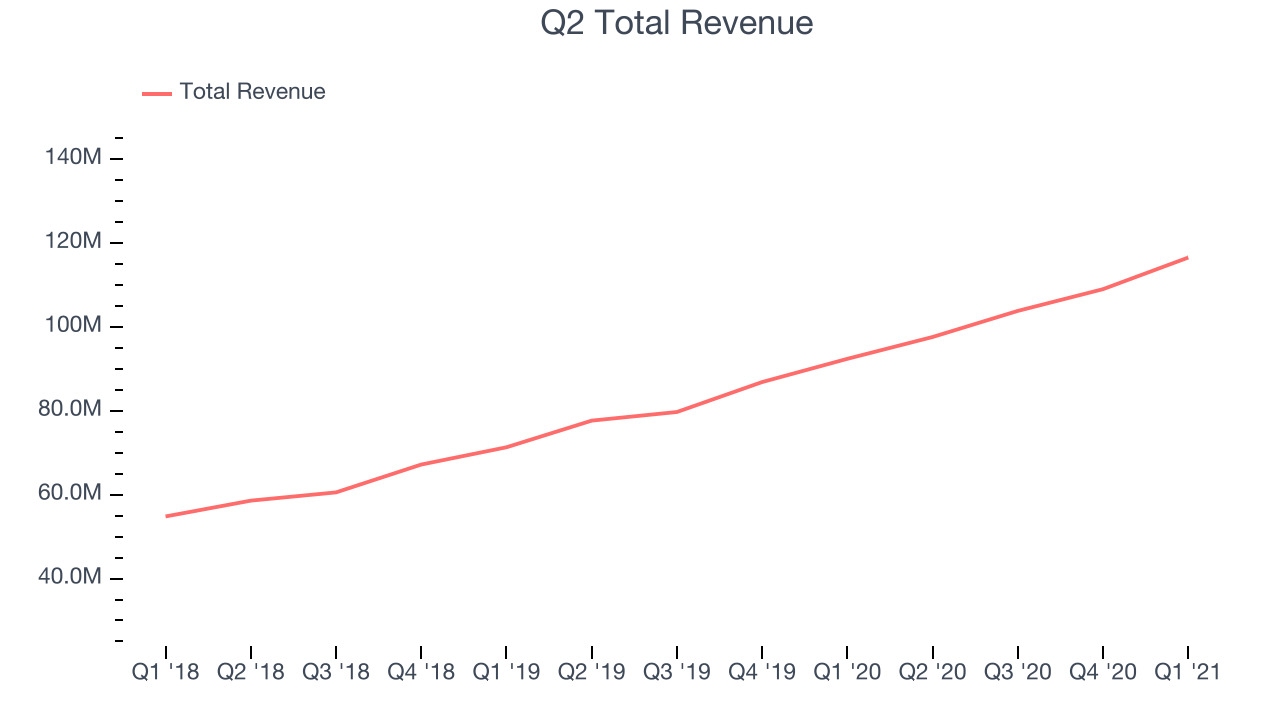

As you can see below, Q2's revenue growth has been strong over the last twelve months, growing from $92.3 million to $116 million.

This quarter, Q2's quarterly revenue was once again up a very solid 26.1% year on year. On top of that, revenue increased $7.53 million quarter on quarter, a very strong improvement on the $5.18 million increase in Q4 2020, which shows acceleration of growth, and is great to see.

Nothing In Banking Happens Quickly

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. But getting a financial institution to adopt new software means a lot of expensive implementation work and ongoing support costs.

Q2's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 45.6% in Q1. That means that for every $1 in revenue the company had $0.45 left to spend on developing new products, marketing & sales and the general administrative overhead. While it improved significantly from previous quarter this is still a low gross margin for a SaaS company and we would like to see the improvements to continue.

Key Takeaways from Q2's Q1 Results

With market capitalisation of $5.54 billion Q2 is among smaller companies, but its more than $528 million in cash and positive free cash flow over the last twelve months give us confidence that Q2 has the resources it needs to pursue a high growth business strategy.

We were very impressed by the strong improvements in Q2’s gross margin this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. Therefore, we think Q2 will look more attractive to growth investors after these results.

PS. Have you noticed we published this analysis in less than 300 seconds since Q2 made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.