As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at heavy transportation equipment stocks, starting with REV Group (NYSE:REVG).

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 10 heavy transportation equipment stocks we track reported a solid Q1; on average, revenues beat analyst consensus estimates by 2.2%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the heavy transportation equipment stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.1% on average since the previous earnings results.

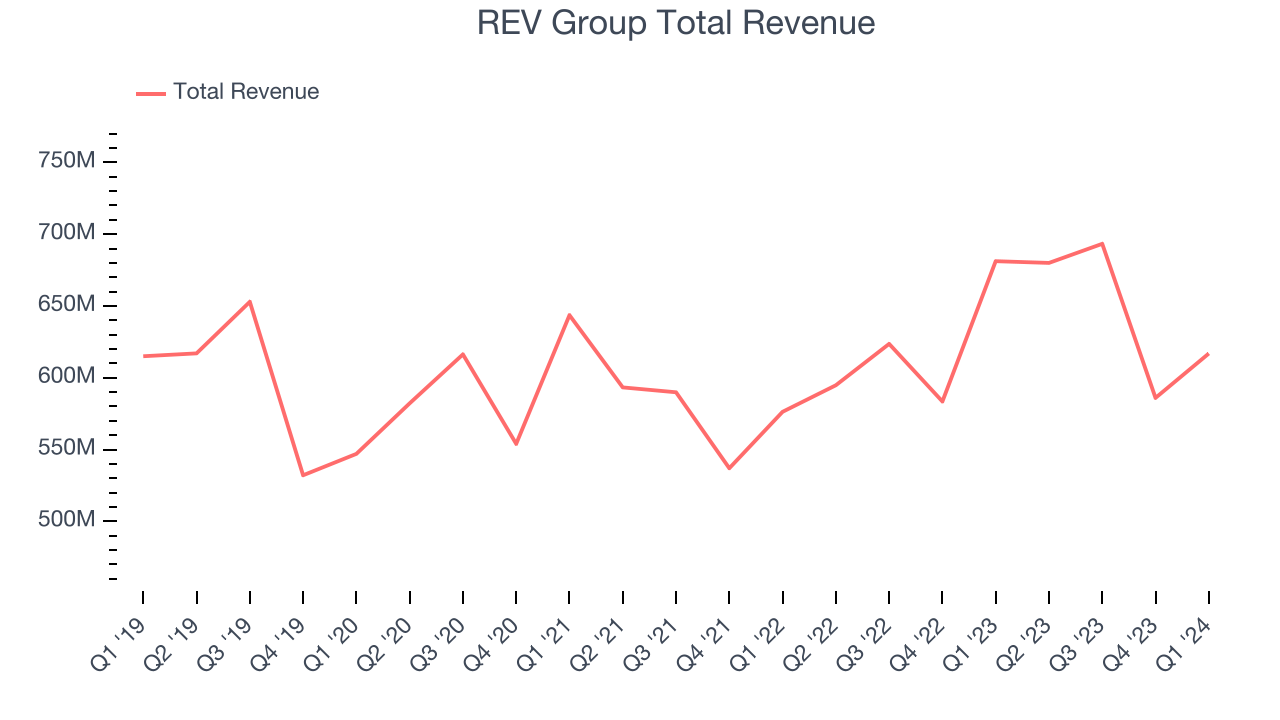

REV Group (NYSE:REVG)

A conglomerate of 30 specialty vehicle brands, REV (NYSE:REVG) produces specialty vehicles like ambulances, fire trucks, buses, and recreational vehicles.

REV Group reported revenues of $616.9 million, down 9.4% year on year, topping analysts' expectations by 2.6%. It was a very strong quarter for the company with revenue and EPS exceeding expectations.

The stock is up 1.9% since the results and currently trades at $25.26.

Is now the time to buy REV Group? Access our full analysis of the earnings results here, it's free.

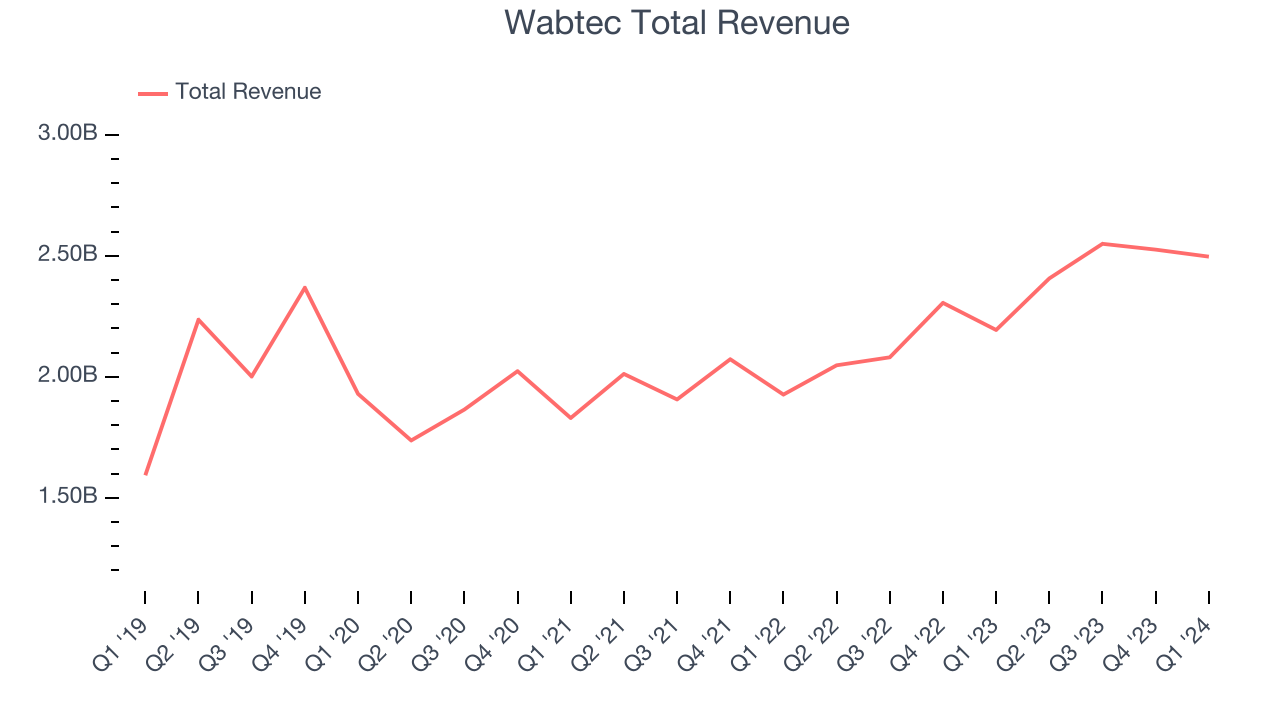

Best Q1: Wabtec (NYSE:WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and its related software for the railway industry.

Wabtec reported revenues of $2.50 billion, up 13.8% year on year, outperforming analysts' expectations by 4.4%. It was a stunning quarter for the company, with an impressive beat of analysts' organic revenue estimates.

The stock is up 6.4% since the results and currently trades at $158.

Is now the time to buy Wabtec? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Wabash (NYSE:WNC)

Headquartered in Indiana, Wabash National (NYSE:WNC) is a diversified industrial company, mainly producing semi-trailers and liquid transportation systems.

Wabash reported revenues of $515.3 million, down 17% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' earnings estimates and a miss of analysts' backlog sales estimates.

The stock is down 15.2% since the results and currently trades at $21.84.

Read our full analysis of Wabash's results here.

Cummins (NYSE:CMI)

Having produced the first commercially available diesel engine in 1933, Cummins (NYSE:CMI) designs and manufactures engines used in cars, trucks, heavy machinery, and other types of vehicles.

Cummins reported revenues of $8.40 billion, down 0.6% year on year, falling short of analysts' expectations by 0.5%. It was a weaker quarter for the company, with a miss of analysts' revenue estimates.

Cummins had the weakest performance against analyst estimates among its peers. The stock is down 4.1% since the results and currently trades at $272.08.

Read our full, actionable report on Cummins here, it's free.

Oshkosh (NYSE:OSK)

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

Oshkosh reported revenues of $2.54 billion, up 12.2% year on year, surpassing analysts' expectations by 2.2%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and a solid beat of analysts' backlog sales estimates.

The stock is down 12.7% since the results and currently trades at $105.97.

Read our full, actionable report on Oshkosh here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.