Home automation and security solutions provider Resideo Technologies (NYSE:REZI) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue flat year on year at $1.59 billion. On top of that, next quarter's revenue guidance ($1.81 billion at the midpoint) was surprisingly good and 15.1% above what analysts were expecting. It made a non-GAAP profit of $0.62 per share, improving from its profit of $0.48 per share in the same quarter last year.

Is now the time to buy Resideo? Find out in our full research report.

Resideo (REZI) Q2 CY2024 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.53 billion (3.6% beat)

- EPS (non-GAAP): $0.62 vs analyst estimates of $0.49 (26.5% beat)

- Revenue Guidance for Q3 CY2024 is $1.81 billion at the midpoint, above analyst estimates of $1.57 billion

- The company lifted its revenue guidance for the full year from $6.18 billion to $6.72 billion at the midpoint, a 8.7% increase

- EPS (non-GAAP) guidance for Q3 CY2024 is $0.54 at the midpoint, below analyst estimates of $0.59

- EPS (non-GAAP) guidance for the full year is $2.25 at the midpoint, beating analyst estimates by 5.1%

- EBITDA guidance for the full year is $675 million at the midpoint, above analyst estimates of $626.1 million

- Gross Margin (GAAP): 28.1%, in line with the same quarter last year

- EBITDA Margin: 11%, up from 1.6% in the same quarter last year

- Free Cash Flow of $77 million is up from -$19 million in the previous quarter

- Market Capitalization: $2.75 billion

"Our second quarter results demonstrated the substantial progress we have made in transforming the structural profitability profile of the business and in executing on value creating strategic transactions," commented Jay Geldmacher, Resideo's President and CEO.

Resideo Technologies, Inc. (NYSE: REZI) is a manufacturer and distributor of technology-driven products and solutions for home comfort, energy management, water management, and safety and security.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, Resideo's 4.6% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Resideo's recent history shows its demand slowed as its revenue was flat over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, ADI Global Distribution and Products & Solutions, which are 60.4% and 39.6% of revenue. Over the last two years, Resideo's ADI Global Distribution revenue (wholesale distribution of 450k+ products) averaged 1.2% year-on-year growth while its Products & Solutions revenue (branded offerings) was flat.

This quarter, Resideo's $1.59 billion of revenue was flat year on year but beat Wall Street's estimates by 3.6%. The company is guiding for revenue to rise 16.5% year on year to $1.81 billion next quarter, improving from the 4% year-on-year decrease it recorded in the same quarter last year. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

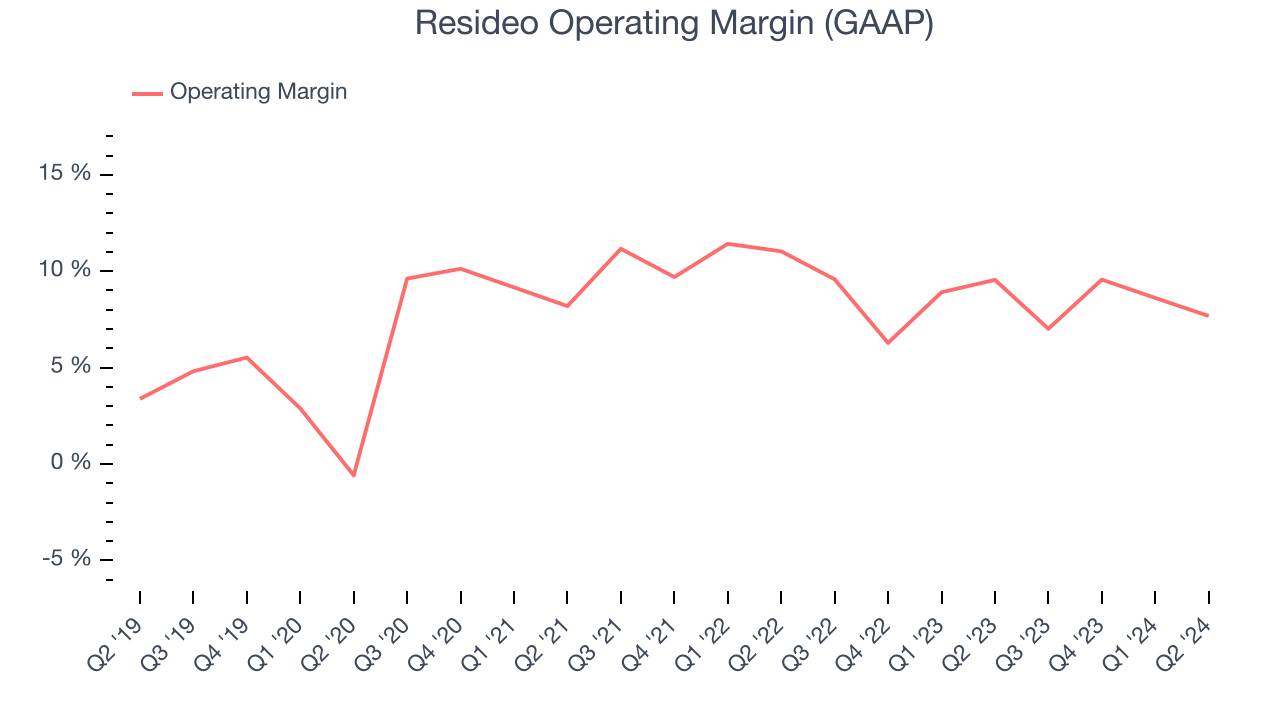

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Resideo has done a decent job managing its expenses over the last five years. The company has produced an average operating margin of 8.3%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Resideo's annual operating margin rose by 4.9 percentage points over the last five years, showing its efficiency has improved.

In Q2, Resideo generated an operating profit margin of 7.7%, down 1.9 percentage points year on year. Since Resideo's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

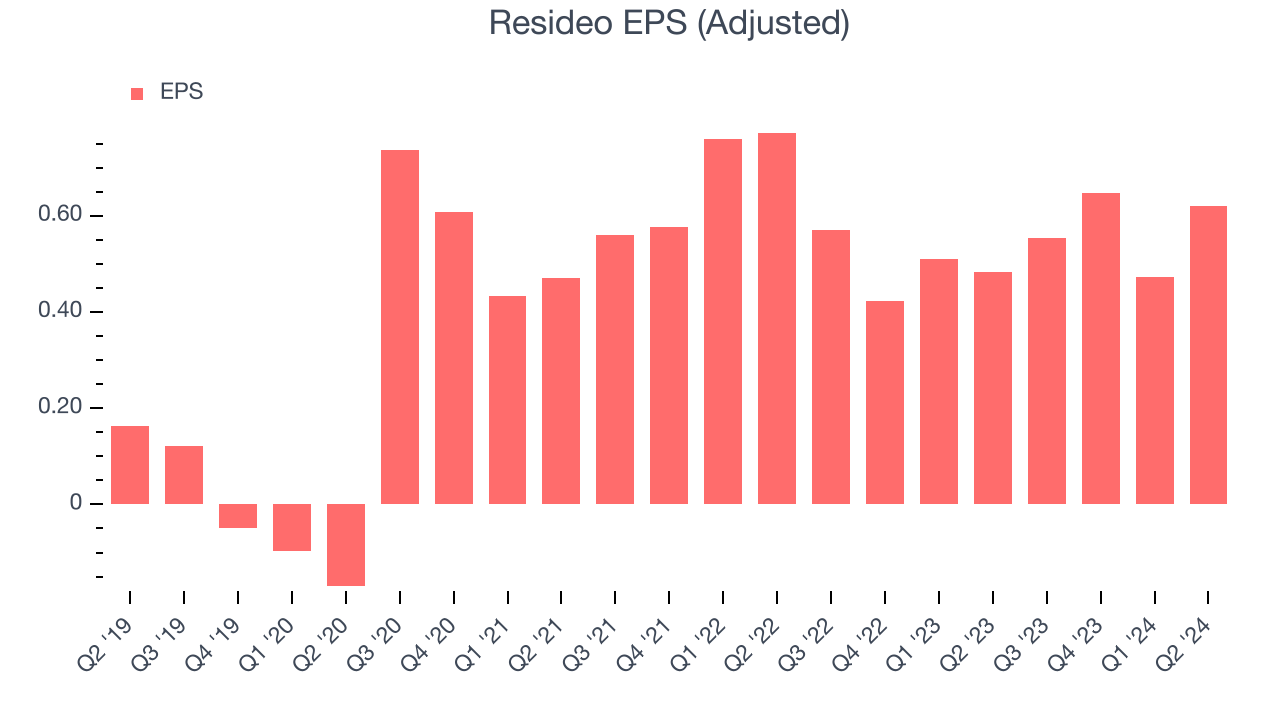

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Resideo's EPS grew at an unimpressive 7.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.6% annualized revenue growth and tells us the company became more profitable as it expanded.

Diving into the nuances of Resideo's earnings can give us a better understanding of its performance. As we mentioned earlier, Resideo's operating margin declined this quarter but expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Resideo, its two-year annual EPS declines of 7.3% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, Resideo reported EPS at $0.62, up from $0.48 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but there is insufficient data.

Key Takeaways from Resideo's Q2 Results

We were impressed by how significantly Resideo blew past analysts' EPS expectations this quarter. We were also excited its full-year revenue, EPS, and EBITDA guidance outperformed Wall Street's estimates. Zooming out, we think was a solid quarter. The stock remained flat at $19.22 immediately after reporting.

So should you invest in Resideo right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.