As Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers amongst the consumer internet stocks, including Revolve (NYSE:RVLV) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 18 consumer internet stocks we track reported a slower Q2; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 8.04% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth and consumer internet stocks have not been spared, with share prices down 15% since the previous earnings results, on average.

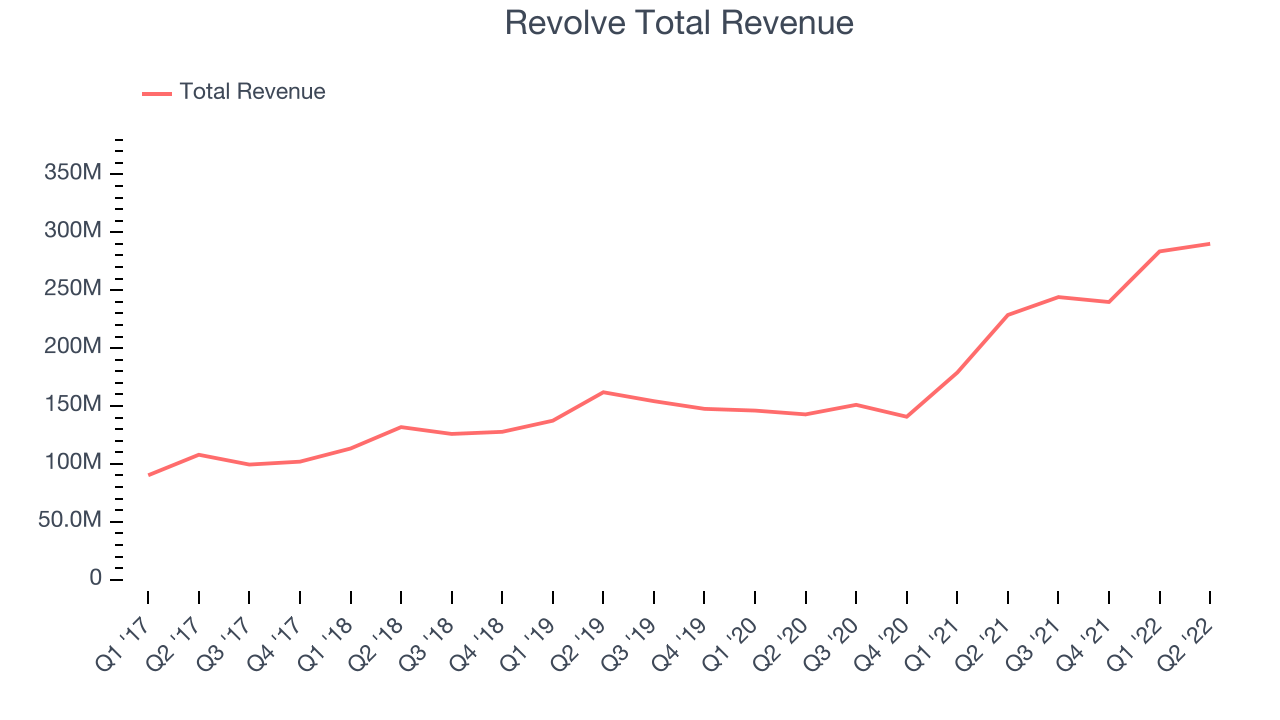

Revolve (NYSE:RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Revolve reported revenues of $290 million, up 26.8% year on year, missing analyst expectations by 0.96%. It was a mixed quarter for the company, with growing number of users but a miss of the top line analyst estimates.

"We delivered strong results in the second quarter, highlighted by record net sales that increased 27% year-over-year, gross margin expansion to record levels for a second quarter, and continued strong growth in active customers," said co-founder and co-CEO Mike Karanikolas.

The company reported 2.16 million active buyers, up 39.3% year on year. The stock is down 20.8% since the results and currently trades at $24.49.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it's free.

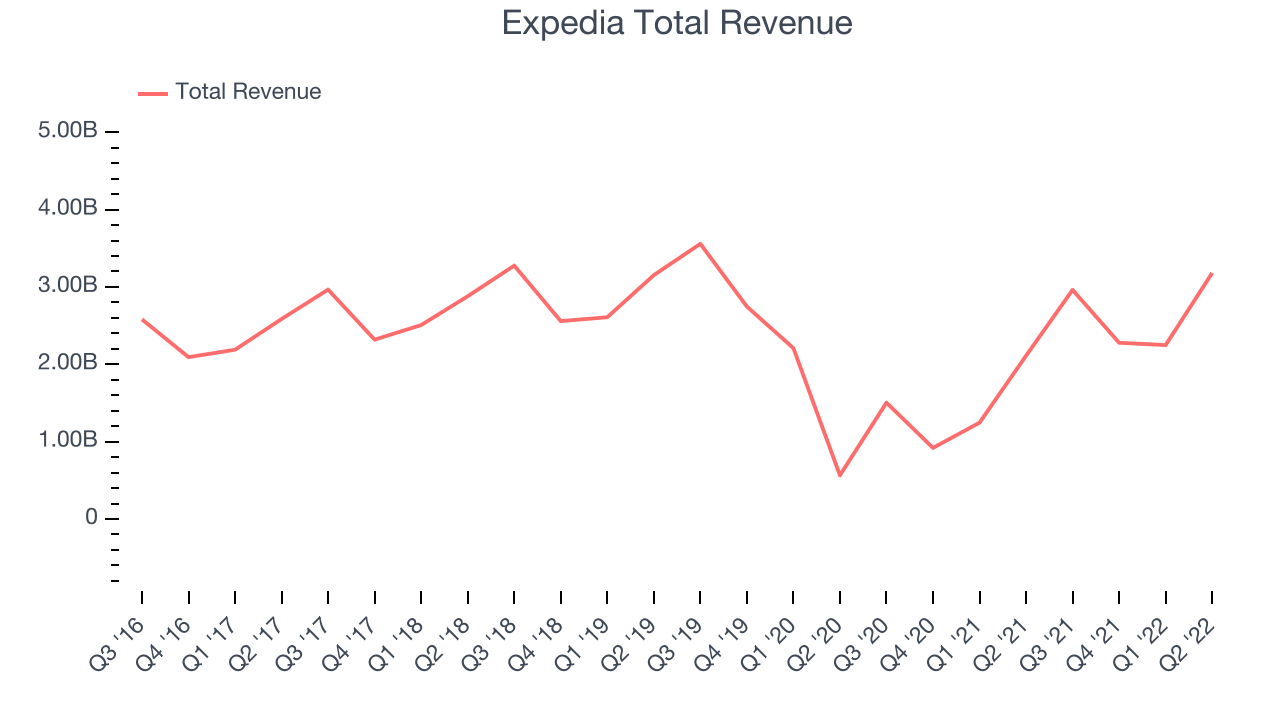

Best Q2: Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $3.18 billion, up 50.6% year on year, beating analyst expectations by 6.42%. It was a stunning quarter for the company, with an exceptional revenue growth and growing number of users.

The company reported 79.1 million nights booked, up 39.7% year on year. The stock is down 6.58% since the results and currently trades at $95.62.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $528.1 million, down 33.6% year on year, missing analyst expectations by 12%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Overstock had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 6.5 million active buyers, down 29.4% year on year. The stock is down 11.6% since the results and currently trades at $25.

Read our full analysis of Overstock's results here.

Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $515.7 million, up 22.5% year on year, beating analyst expectations by 4.11%. It was a slower quarter for the company, with a declining number of users.

The company reported 8.49 million service requests, down 9.78% year on year. The stock is down 47.7% since the results and currently trades at $3.20.

Read our full, actionable report on Angi here, it's free.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

Twitter reported revenues of $1.17 billion, down 1.16% year on year, missing analyst expectations by 11.9%. It was a weak quarter for the company, with a slow revenue growth and a miss of the top line analyst estimates.

The company reported 237.8 million daily active users, up 15.4% year on year. The stock is up 9.34% since the results and currently trades at $43.25.

Twitter has previously entered into a definitive agreement to be acquired by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion.

Read our full, actionable report on Twitter here, it's free.

The author has no position in any of the stocks mentioned