Earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how SentinelOne (NYSE:S) and the rest of the cybersecurity stocks fared in Q2.

Cybersecurity continues to be one of the fastest growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location. This explosion of access points to sensitive data has also brought about an increase in bad behavior from nation states to cyber criminals who seek to profit through introducing malware and creating data breaches.

The 9 cybersecurity stocks we track reported a a solid Q2; on average, revenues beat analyst consensus estimates by 4.76%, while on average next quarter revenue guidance was 2.73% above consensus. The market rewarded the results with the average return the day after earnings coming in at 1.73%.

Best Q2: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

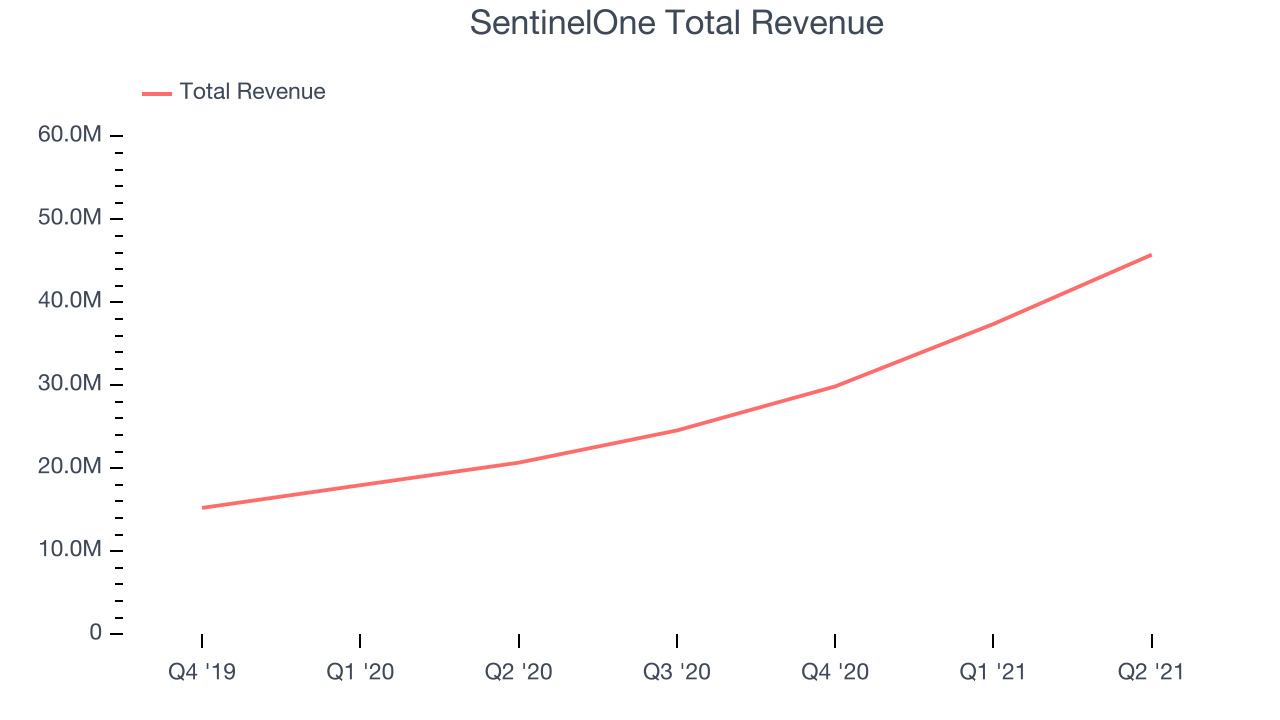

SentinelOne reported revenues of $45.7 million, up 121% year on year, beating analyst expectations by 13.3%. It was a stunning quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

“We’re devoted to protecting our customers and our way of life from cyberattacks in an increasingly digital society. Cybersecurity must be autonomous - that’s what we’ve built. It must perform at a faster speed, greater scale, and higher accuracy than what exists today,” said Tomer Weingarten, Co-Founder and CEO of SentinelOne.

SentinelOne pulled off the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise of the whole group. The stock is down 11.4% since the results and currently trades at $60.30.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it's free.

Palo Alto Networks (NYSE:PANW)

Founded in 2005 by a cybersecurity engineer Nir Zuk, Palo Alto Networks makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches and malware threats.

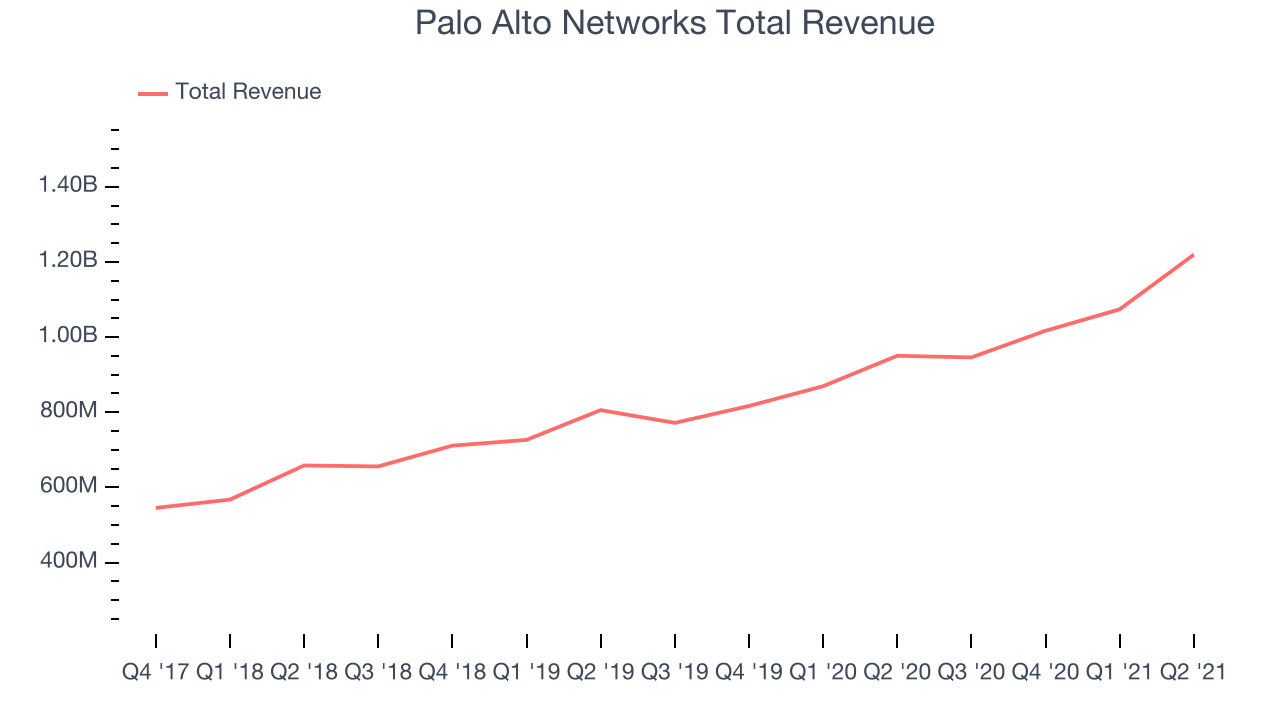

Palo Alto Networks reported revenues of $1.21 billion, up 28.2% year on year, beating analyst expectations by 3.95%. It was an impressive quarter for the company, with a very strong guidance for the next year and a full year guidance beating analysts' expectations.

The stock is up 36.2% since the results and currently trades at $507.60.

Is now the time to buy Palo Alto Networks? Access our full analysis of the earnings results here, it's free.

Weakest Q2: SailPoint (NYSE:SAIL)

Started by Mark McClain after his previous identity management company got acquired by Sun Microsystems, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

SailPoint reported revenues of $102.4 million, up 10.8% year on year, beating analyst expectations by 3.2%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

SailPoint had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 7.47% since the results and currently trades at $45.83.

Read our full analysis of SailPoint's results here.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $337.6 million, up 69.7% year on year, beating analyst expectations by 4.37%. It was a strong quarter for the company, with an exceptional revenue growth.

The stock is down 3.12% since the results and currently trades at $272.16.

Read our full, actionable report on CrowdStrike here, it's free.

Qualys (NASDAQ:QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $99.7 million, up 12.2% year on year, in line with analyst expectations. It was a decent quarter for the company, with an optimistic revenue guidance for the next quarter but a slow revenue growth.

Qualys had the weakest performance against analyst estimates among the peers. The stock is up 7.16% since the results and currently trades at $113.

Read our full, actionable report on Qualys here, it's free.

The author has no position in any of the stocks mentioned