Cyber security company SentinelOne (NYSE:S) reported results in line with analysts’ expectations in Q2 CY2024, with revenue up 33.1% year on year to $198.9 million. The company expects next quarter’s revenue to be around $209.5 million, in line with analysts’ estimates. It made a non-GAAP profit of $0.01 per share, improving from its loss of $0.08 per share in the same quarter last year.

Is now the time to buy SentinelOne? Find out in our full research report.

SentinelOne (S) Q2 CY2024 Highlights:

- Revenue: $198.9 million vs analyst estimates of $197.4 million (small beat)

- Adjusted Operating Income: -$6.36 million vs analyst estimates of -$11.54 million (beat)

- EPS (non-GAAP): $0.01 vs analyst estimates of $0 ($0.01 beat)

- Q3 revenue guidance for the full year of $209.5 million vs analyst estimates of $209.7 million (small miss)

- The company slightly lifted its revenue guidance for the full year to $815 million at the midpoint from $811.5 million

- Gross Margin (GAAP): 74.5%, up from 70.1% in the same quarter last year

- Free Cash Flow was -$5.44 million, down from $33.76 million in the previous quarter

- Annual Recurring Revenue: $806 million at quarter end, up 31.7% year on year

- Market Capitalization: $7.79 billion

“Based on strong execution and broad based demand, SentinelOne delivered exceptional results with industry-leading growth and our first ever quarter of positive net income and earnings per share,” said Tomer Weingarten, CEO of SentinelOne.

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Sales Growth

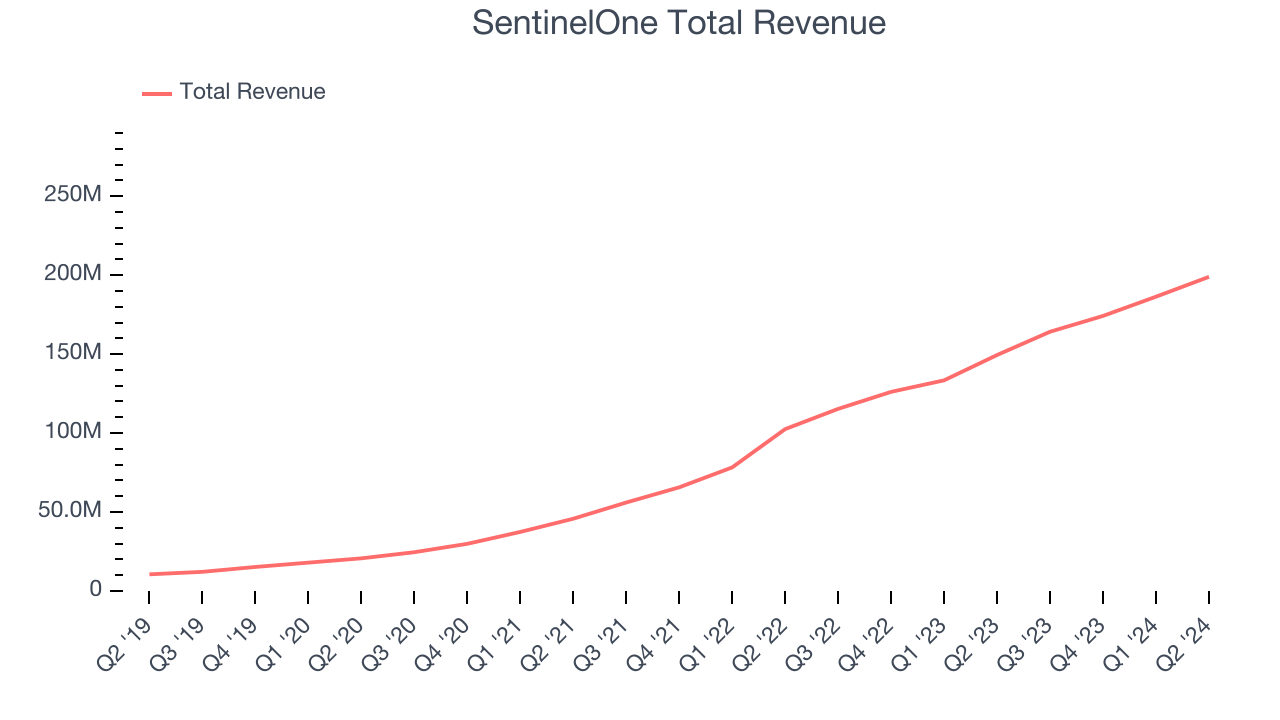

As you can see below, SentinelOne’s 73.9% annualized revenue growth over the last three years has been incredible, and its sales came in at $198.9 million this quarter.

Unsurprisingly, this was another great quarter for SentinelOne with revenue up 33.1% year on year. Quarter on quarter, its revenue increased by $12.58 million in Q2, which was roughly in line with the Q1 CY2024 increase. This steady growth shows that the company can maintain a strong growth trajectory.

Next quarter’s guidance suggests that SentinelOne is expecting revenue to grow 27.6% year on year to $209.5 million, slowing down from the 42.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 26.1% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Large Customers Growth

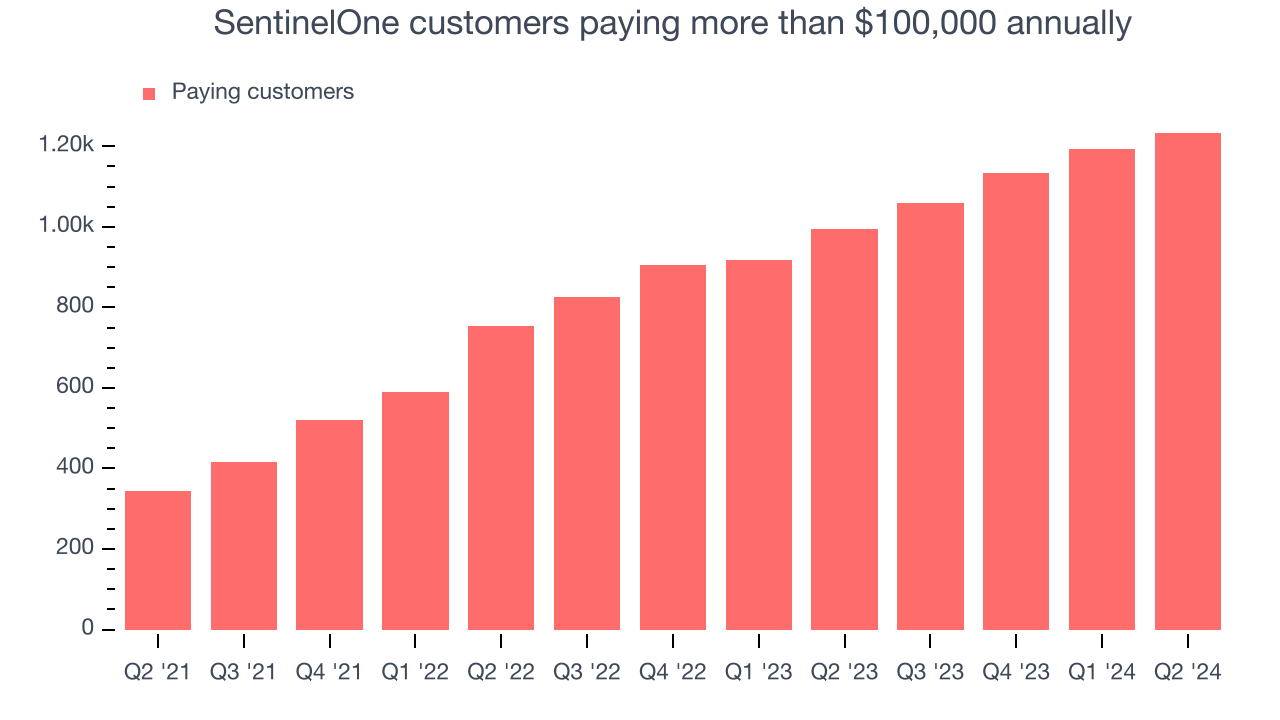

This quarter, SentinelOne reported 1,233 enterprise customers paying more than $100,000 annually, an increase of 40 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from SentinelOne’s Q2 Results

Revenue beat by a small amount and adjusted operating income beat by a more convincing amount. On the other hand, its revenue guidance for next quarter underwhelmed, slightly missing expectations. The company did, however, raise full year revenue guidance to a level slightly above expectations. Zooming out, we think this was a mixed quarter featuring something for bulls and other things for bears. The stock traded down 3% to $24 immediately after reporting likely due to next quarter's slightly weak revenue guidance.

So should you invest in SentinelOne right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.