Integrated packaging solutions provider Sealed Air Corporation (NYSE:SEE) reported results ahead of analysts' expectations in Q2 CY2024, with revenue down 2.6% year on year to $1.35 billion. On the other hand, next quarter's revenue guidance of $1.33 billion was less impressive, coming in 2.3% below analysts' estimates. It made a GAAP profit of $0.67 per share, down from its profit of $0.68 per share in the same quarter last year.

Is now the time to buy Sealed Air? Find out in our full research report.

Sealed Air (SEE) Q2 CY2024 Highlights:

- Revenue: $1.35 billion vs analyst estimates of $1.31 billion (2.9% beat)

- EPS: $0.67 vs analyst estimates of $0.59 (13.9% beat)

- Revenue Guidance for Q3 CY2024 is $1.33 billion at the midpoint, below analyst estimates of $1.36 billion

- The company reconfirmed its revenue guidance for the full year of $5.4 billion at the midpoint

- EPS (GAAP) guidance for Q3 CY2024 is $0.67 at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $1.1 billion at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 30.9%, in line with the same quarter last year

- EBITDA Margin: 21.2%, in line with the same quarter last year

- Free Cash Flow of $129.5 million, up 66% from the previous quarter

- Sales Volumes rose 1% year on year (-8.2% in the same quarter last year)

- Market Capitalization: $5.01 billion

"Our second quarter results were ahead of our expectations, reflecting strong sequential demand within our Food business, accelerated benefits from our CTO2Grow program that more than offset the continued pressure within our Protective business," said Patrick Kivits, Sealed Air's CEO.

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

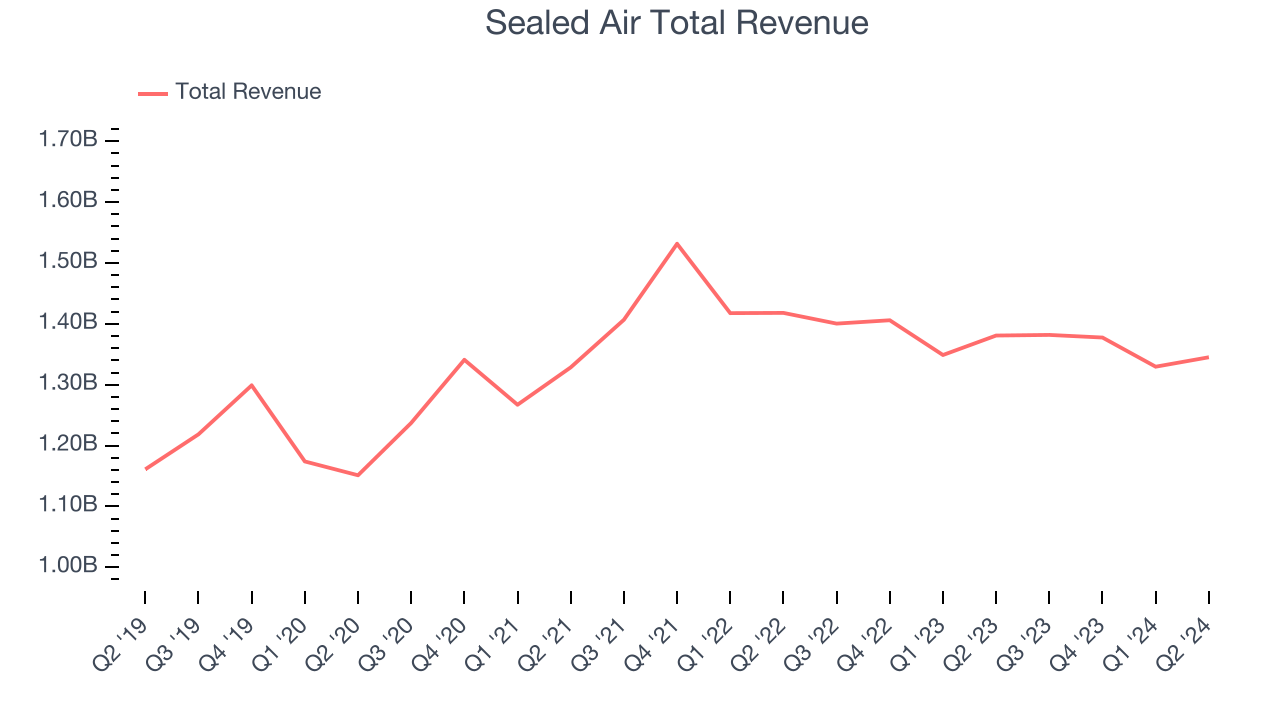

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Sealed Air's sales grew at a weak 2.9% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Sealed Air's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3% annually. Sealed Air isn't alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

We can better understand the company's revenue dynamics by analyzing its sales volumes, which show how much product it was pushing. Over the last two years, Sealed Air's sales volumes averaged 5.4% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Sealed Air's revenue fell 2.6% year on year to $1.35 billion but beat Wall Street's estimates by 2.9%. The company is guiding for a 3.7% year-on-year revenue decline next quarter to $1.33 billion, a deceleration from the 1.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

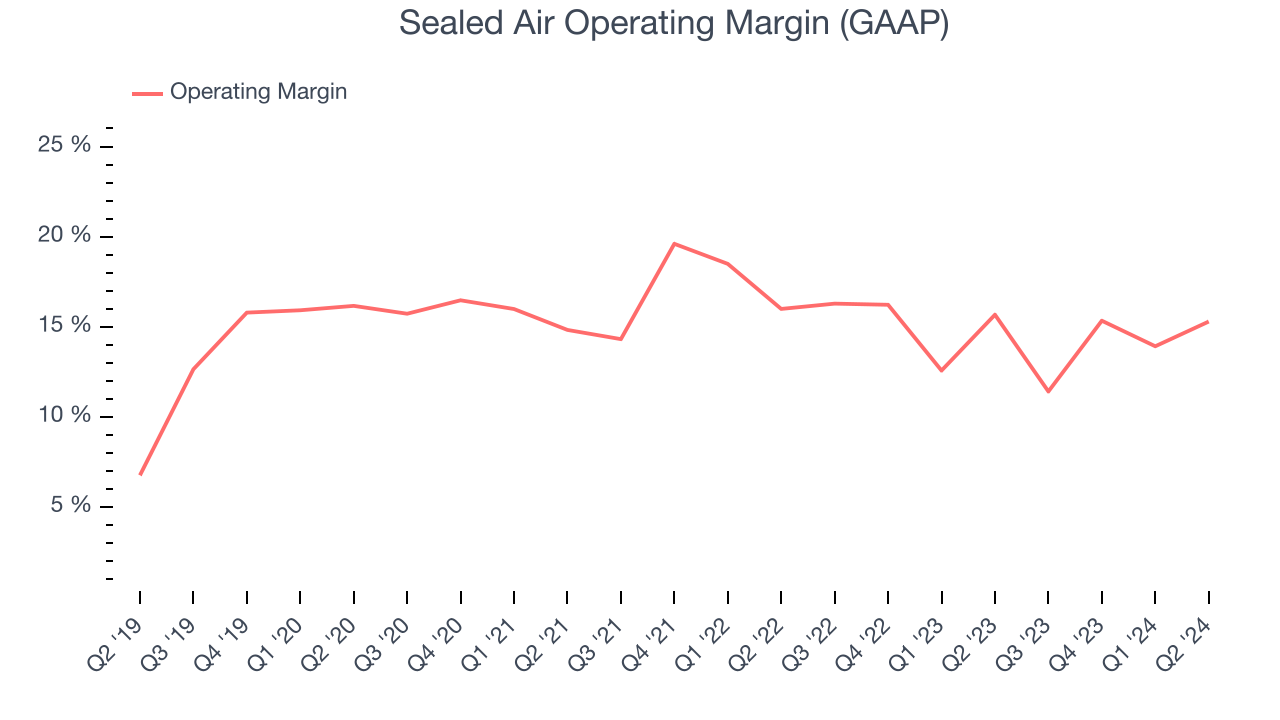

Operating Margin

Sealed Air has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.5%.

Looking at the trend in its profitability, Sealed Air's annual operating margin decreased by 1.1 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Sealed Air become more profitable in the future.

This quarter, Sealed Air generated an operating profit margin of 15.3%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

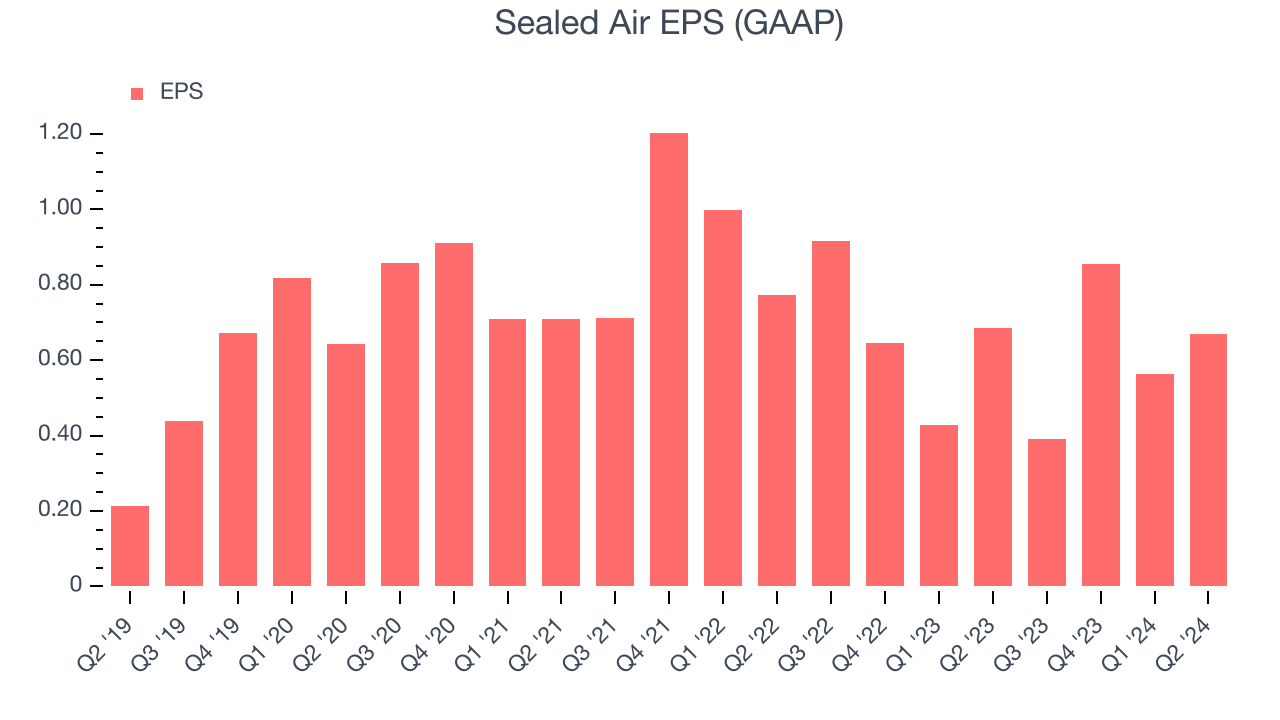

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Sealed Air's flat EPS over the last five years was below its 2.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Sealed Air's earnings can give us a better understanding of its performance. As we mentioned earlier, Sealed Air's operating margin was flat this quarter but declined by 1.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Sealed Air, its two-year annual EPS declines of 18% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, Sealed Air reported EPS at $0.67, down from $0.68 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Sealed Air to grow its earnings. Analysts are projecting its EPS of $2.48 in the last year to climb by 12% to $2.78.

Key Takeaways from Sealed Air's Q2 Results

We were impressed by how significantly Sealed Air blew past analysts' revenue expectations this quarter. We were also glad its sales volumes topped Wall Street's estimates. On the other hand, its revenue guidance for next quarter was underwhelming. Overall, this quarter was mixed but with some key positives. The stock traded up 1.2% to $34.81 immediately following the results.

Sealed Air may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.