As sales and marketing software stocks’ Q2 earnings season wraps, let's dig into this quarters’ best and worst performers, including SEMrush (NYSE:SEMR) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.83%, while on average next quarter revenue guidance was 1.25% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable and sales and marketing software stocks have not been spared, with share prices down 12.6% since the previous earnings results, on average.

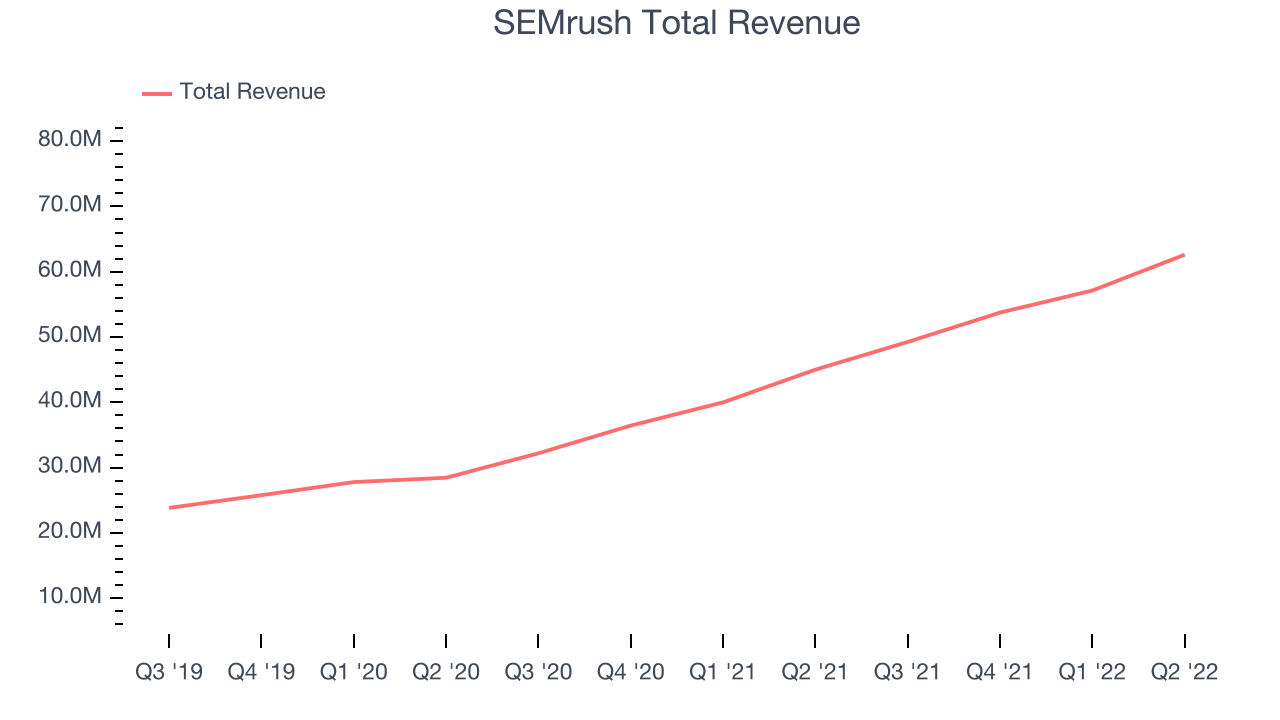

SEMrush (NYSE:SEMR)

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

SEMrush reported revenues of $62.6 million, up 39.1% year on year, beating analyst expectations by 4.32%. It was a decent quarter for the company, with an exceptional revenue growth but decelerating customer growth.

“We saw sequential growth accelerate in the second quarter as we added a record $5.5 million of revenue. Our growth was once again underpinned by higher average revenue per customer, driven by an increased proportion of customers from higher priced plans and growth of add-ons. We also made remarkable progress with relocations and are well on target to wind down our operations in Russia ahead of plan,” said Oleg Shchegolev, CEO and Co-Founder of Semrush.

The stock is down 11.3% since the results and currently trades at $12.23.

Is now the time to buy SEMrush? Access our full analysis of the earnings results here, it's free.

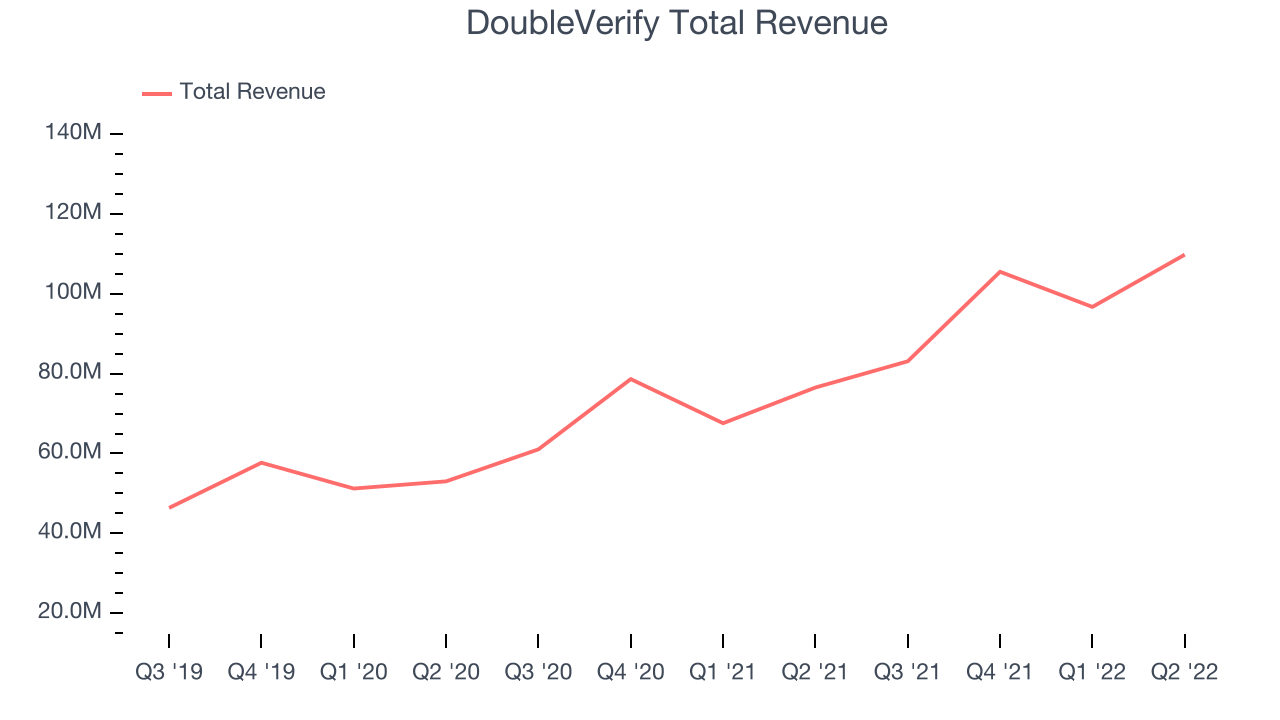

Best Q2: DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $109.8 million, up 43.4% year on year, beating analyst expectations by 7.67%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

DoubleVerify scored the strongest analyst estimates beat among its peers. The stock is up 17.8% since the results and currently trades at $28.16.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Shopify (NYSE:SHOP)

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.29 billion, up 15.6% year on year, missing analyst expectations by 2.67%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a slow revenue growth.

The stock is down 5.72% since the results and currently trades at $26.64.

Read our full analysis of Shopify's results here.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium sized businesses.

Freshworks reported revenues of $121.4 million, up 37.4% year on year, beating analyst expectations by 2.95%. It was a slower quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

The company added 573 enterprise customers paying more than $5,000 annually to a total of 16,212. The stock is down 6.6% since the results and currently trades at $13.

Read our full, actionable report on Freshworks here, it's free.

Zeta (NYSE:ZETA)

Co-Founded by former Apple CEO, John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $137.3 million, up 28.4% year on year, beating analyst expectations by 5.58%. It was a strong quarter for the company, with a solid beat of analyst estimates.

The company added 14 enterprise customers paying more than $100,000 annually to a total of 373. The stock is up 15.4% since the results and currently trades at $7.19.

Read our full, actionable report on Zeta here, it's free.

The author has no position in any of the stocks mentioned