Fast-food chain Shake Shack (NYSE:SHAK) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 21.2% year on year to $276.2 million. Turning to EPS, Shake Shack made a non-GAAP profit of $0.17 per share, improving from its loss of $0.06 per share in the same quarter last year.

Is now the time to buy Shake Shack? Find out by accessing our full research report, it's free.

Shake Shack (SHAK) Q3 FY2023 Highlights:

- Revenue: $276.2 million vs analyst estimates of $275.7 million (small beat)

- EPS (non-GAAP): $0.17 vs analyst estimates of $0.10 ($0.07 beat)

- Free Cash Flow was -$9.88 million, down from $1.94 million in the previous quarter

- Gross Margin (GAAP): 37.1%, up from 34.3% in the same quarter last year

- Same-Store Sales were up 2.3% year on year

- Store Locations: 500 at quarter end, increasing by 100 over the last 12 months

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Shake Shack is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

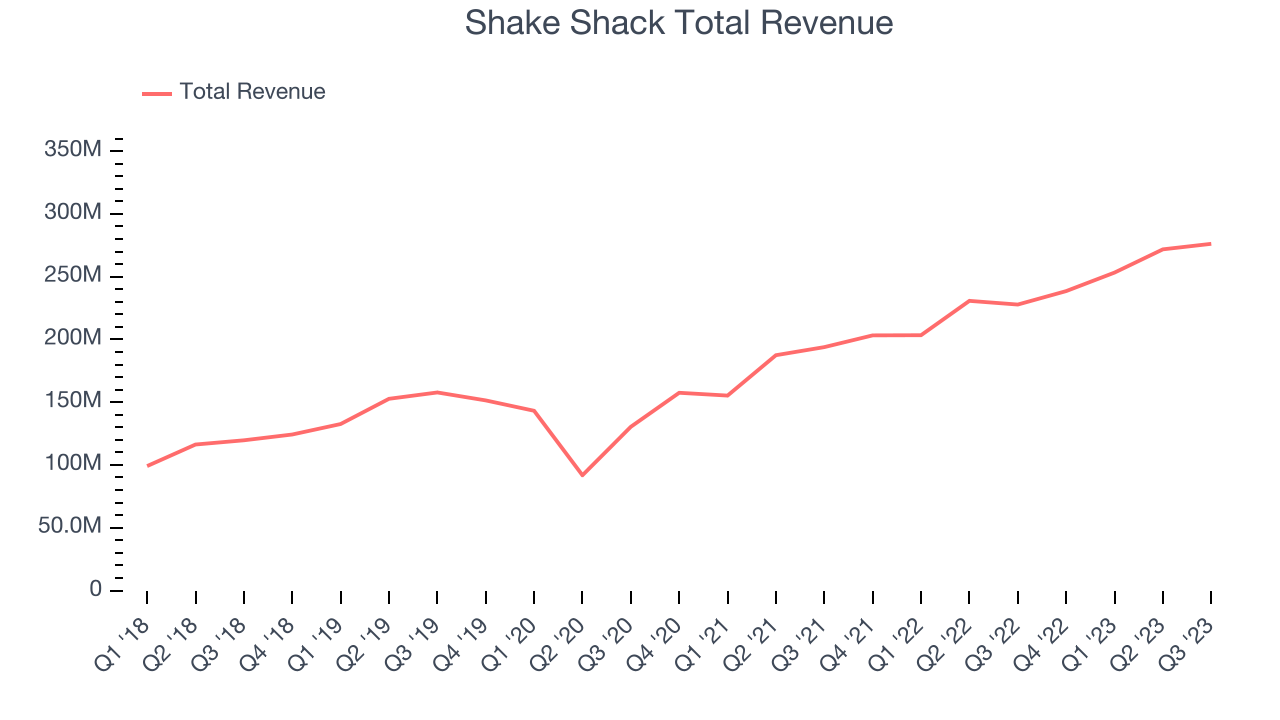

As you can see below, the company's annualized revenue growth rate of 16.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Shake Shack's year-on-year revenue growth of 21.2% was excellent and in line with analysts' estimates. Looking ahead, the analysts covering the company expect sales to grow 15.8% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

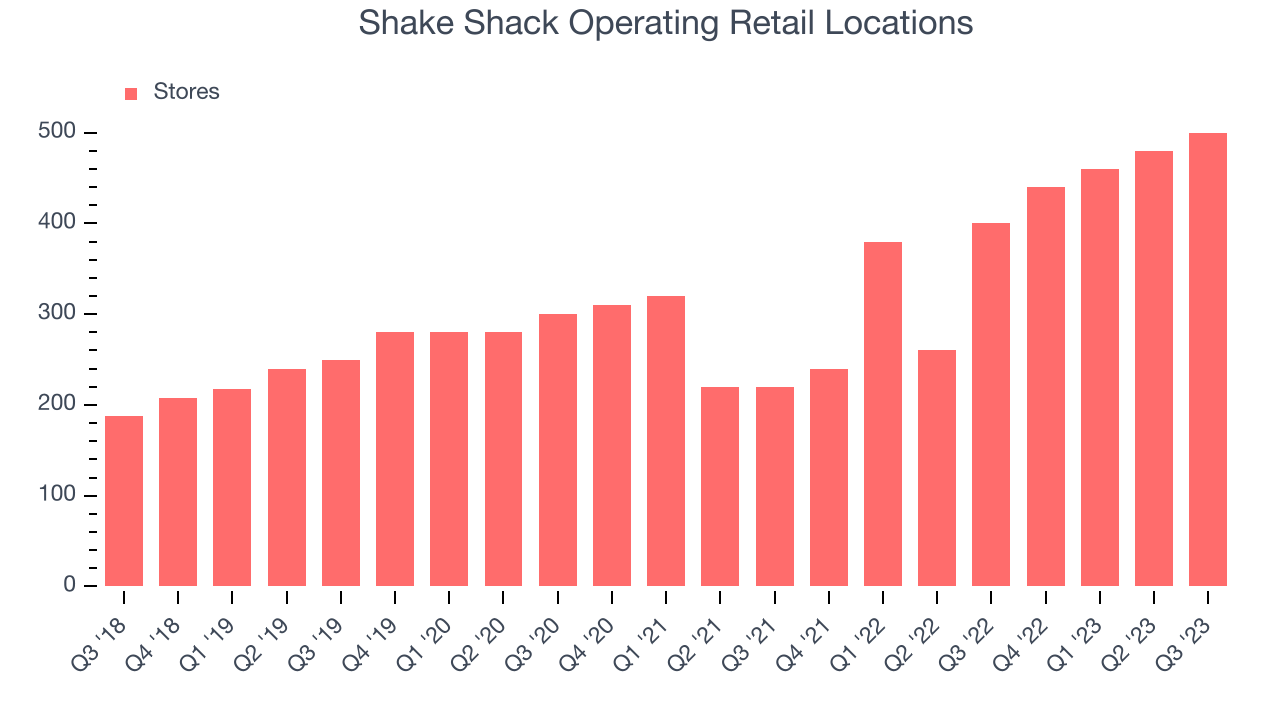

Number of Stores

A restaurant chain's total number of dining locations is a crucial factor influencing how much it can sell and how quickly company-level sales can grow.

When a chain like Shake Shack is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Shake Shack's restaurant count increased by 100, or 25%, over the last 12 months to 500 locations in the most recently reported quarter.

Taking a step back, Shake Shack has rapidly opened new restaurants over the last eight quarters, averaging 38.8% annual increases in new locations. This growth is much higher than other restaurant businesses. Analyzing a restaurant's location growth is important because expansion means Shake Shack has more opportunities to feed customers and generate sales.

Same-Store Sales

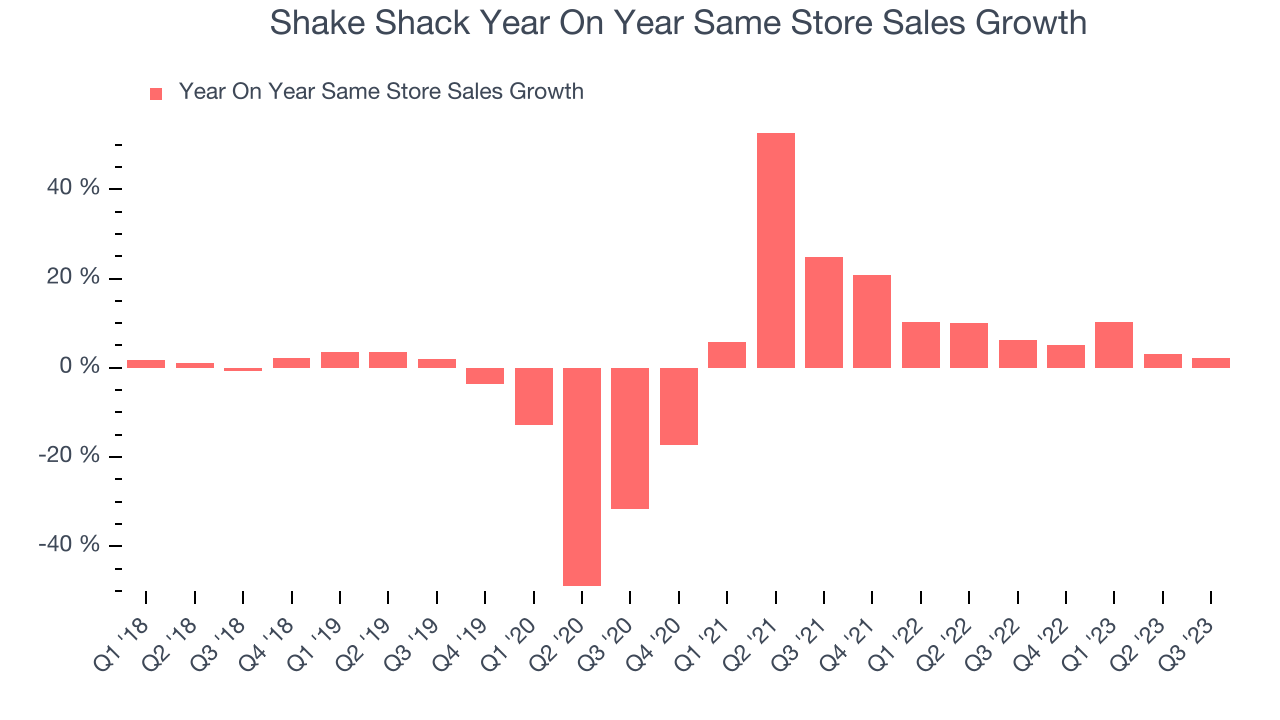

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Shake Shack's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 8.52% year on year. With positive same-store sales growth amid an increasing number of restaurants, Shake Shack is reaching more diners and growing sales.

In the latest quarter, Shake Shack's same-store sales rose 2.3% year on year. By the company's standards, this growth was a meaningful deceleration from the 6.3% year-on-year increase it posted 12 months ago. One quarter fluctuations aren't material for the long-term prospects of a business, but we'll watch Shake Shack closely to see if it can reaccelerate growth.

Key Takeaways from Shake Shack's Q3 Results

With a market capitalization of $2.26 billion, Shake Shack is among smaller companies, but its more than $190 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We were impressed by how significantly Shake Shack blew past analysts' adjusted EBITDA and EPS expectations this quarter. That really stood out as a positive in these results. On the other hand, its gross margin and same-store sales missed Wall Street's estimates. Zooming out, we think this was still a decent quarter, showing that the company is staying on track. Wall Street is rewarding the company for its better-than-expected profitability as Shake Shack is a growth name in the restaurant industry. The stock is up 8.6% after reporting and currently trades at $62.11 per share.

So should you invest in Shake Shack right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.