Data warehouse-as-a-service Snowflake (SNOW) reported Q4 FY2021 results beating Wall St's expectations, with revenue up 117% year on year to $190.5 million. Snowflake made a GAAP loss of $198.9 million, down on its loss of $83.25 million, in the same quarter last year.

Snowflake (SNOW) Q4 FY2021 Highlights:

- Revenue: $190.5 million vs analyst estimates of $178.6 million (6.6% beat)

- EPS (GAAP): -$0.70

- Product revenue guidance for Q1 2022 is $197.5 million at the midpoint

- Management's product revenue guidance for FY2022 of $1.010 billion at the midpoint (82.5% growth vs 120% growth in FY2021)

- Free cash flow of $7.316 million, up from negative free cash flow of -$37.87 million in previous quarter

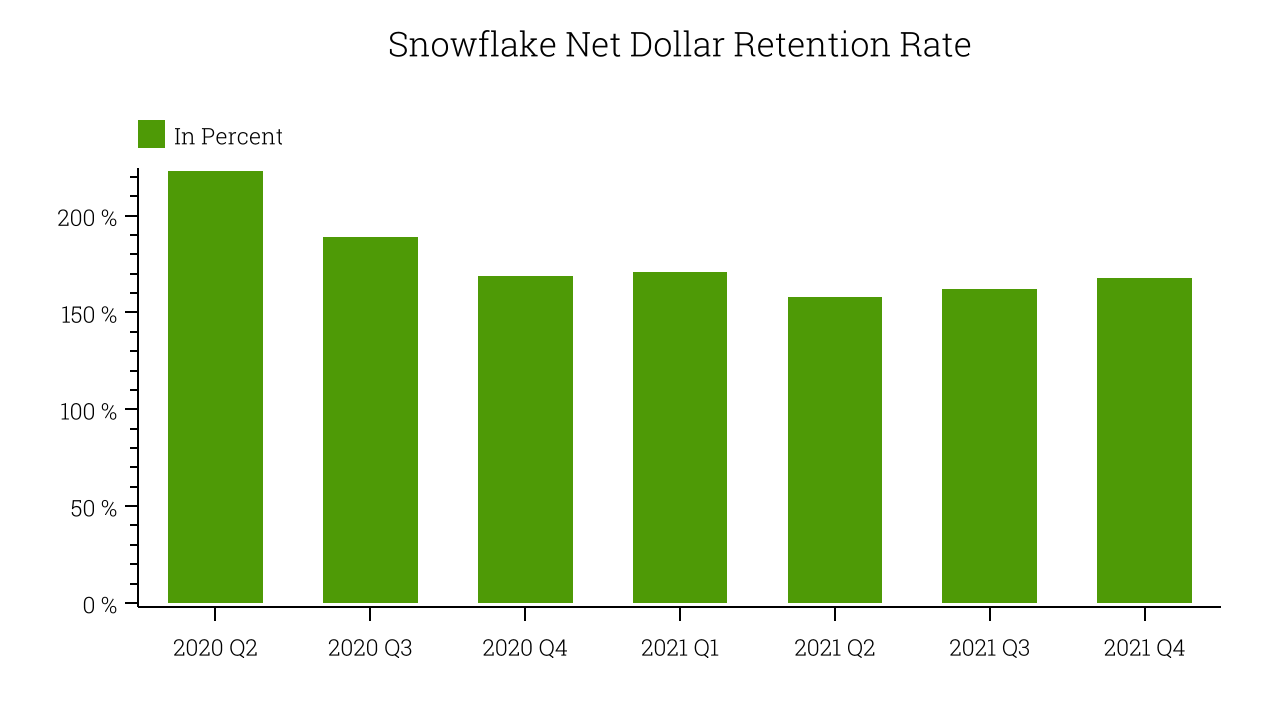

- Net Dollar Retention Rate: 168%, up from 162% previous quarter

- 4,139 customers, up from 3,554 in previous quarter

- 77 customers paying annually more than $1m

- Gross Margin (GAAP): 56.47%, down from 58.23% previous quarter

“We finished our fiscal year with strong performance and reported triple-digit product revenue growth,” said Snowflake CEO, Frank Slootman.

A Cheaper Answer To Complex Questions

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake provides a data warehouse-as-a-service in the cloud that allows companies store large amounts of data and analyze it in real time.

The amount of data generated and collected by companies has exploded and so has the need to analyze it, but it is still often stored in incompatible formats, spread across many different types of storages, and with increasing complexity slow to analyze. Snowflake’s platform separates the storage and analysis and makes it significantly faster, cheaper and easier for their customers to answer their data questions, often replacing number of different systems at once.

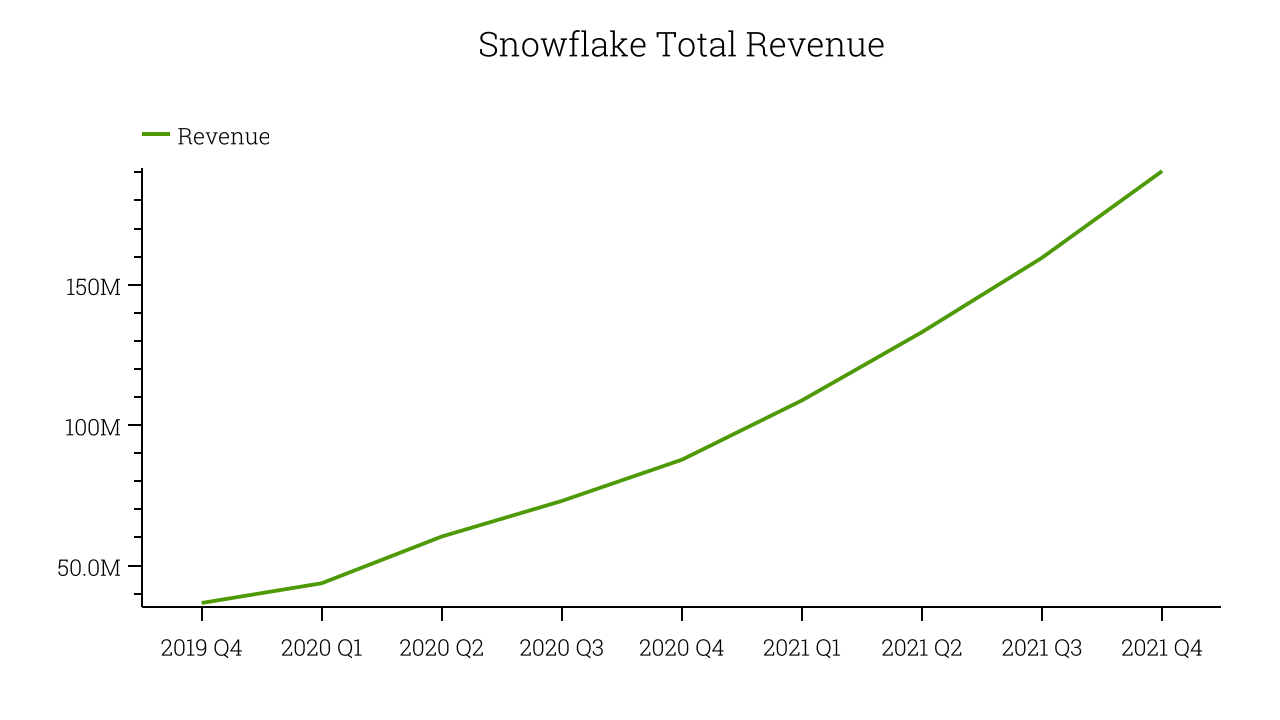

As you can see below, Snowflake's revenue growth has been incredible over the last twelve months, growing from $87.69 million to $190.5 million.

This was another standout quarter with the revenue up a splendid 117% year on year. On top of that, revenue increased $30.84 million quarter on quarter, a solid improvement on the $26.48 million increase in Q3 2021, and happily, a slight re-acceleration of growth.

Shared success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Snowflake offers usage based pricing where customers pay separately for storage and for the minutes of computing time it takes to perform the analysis they require.

Snowflake's net dollar retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 168% in Q4. That means even if they didn't win any new customers, Snowflake would have grown its revenue 68.00% year on year. Significantly up from the last quarter, this is an absolutely exceptional retention rate, meaning Snowflake's software is extremely successful with their customers who are rapidly expanding the use of it across their organizations.

Key Takeaways from Snowflake's Q4 Results

With market capitalisation of $77.05 billion, more than $3.908 billion in cash and operating close to free cash flow break-even, we're confident that Snowflake has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth Snowflake delivered this quarter. And we were also excited to see it that the strong growth is to continue next year. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. Therefore, we think Snowflake will continue to stand out as a compelling growth stock, arguably even more so than before.

The author has no position in any of the stocks mentioned.