Snow (snow)

The Snow is a compelling stock. Its blend of fast sales growth, robust.― StockStory Analyst Team

1. Research Report

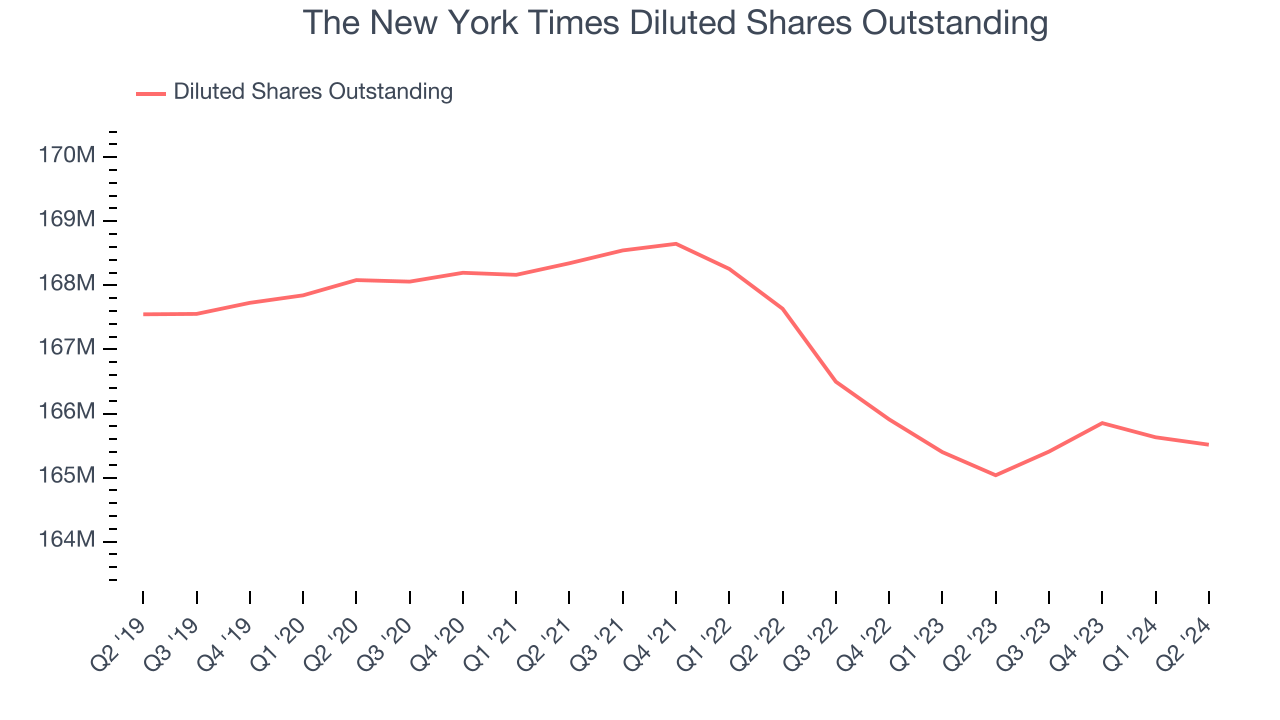

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue

We can take a deeper look into The SNOW's earnings to better understand the drivers of its performance. The SNOW's operating margin has expanded 4 percentage points over the last five years while its share count has shrunk 1.2%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q2, The SNOW reported EPS at $0.45, up from $0.38 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects The SNOW to grow its earnings. Analysts are projecting its EPS of $1.83 in the last year to climb by 2.8% to $1.88.