Broadcasting and digital media company TEGNA (NYSE:TGNA) missed analysts' expectations in Q2 CY2024, with revenue down 2.9% year on year to $710.4 million. It made a non-GAAP profit of $0.50 per share, down from its profit of $0.92 per share in the same quarter last year.

Is now the time to buy TEGNA? Find out by accessing our full research report, it's free.

TEGNA (TGNA) Q2 CY2024 Highlights:

- Revenue: $710.4 million vs analyst estimates of $715.3 million (small miss)

- EPS (non-GAAP): $0.50 vs analyst estimates of $0.48 (3.2% beat)

- Gross Margin (GAAP): 39.2%, down from 41.1% in the same quarter last year

- EBITDA Margin: 24.7%, down from 26.6% in the same quarter last year

- Market Capitalization: $2.46 billion

“Results for the second quarter fell within our guidance range, underscoring TEGNA’s ability to effectively manage what we can control in the current macroeconomic environment,” said Dave Lougee, president and chief executive officer.

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

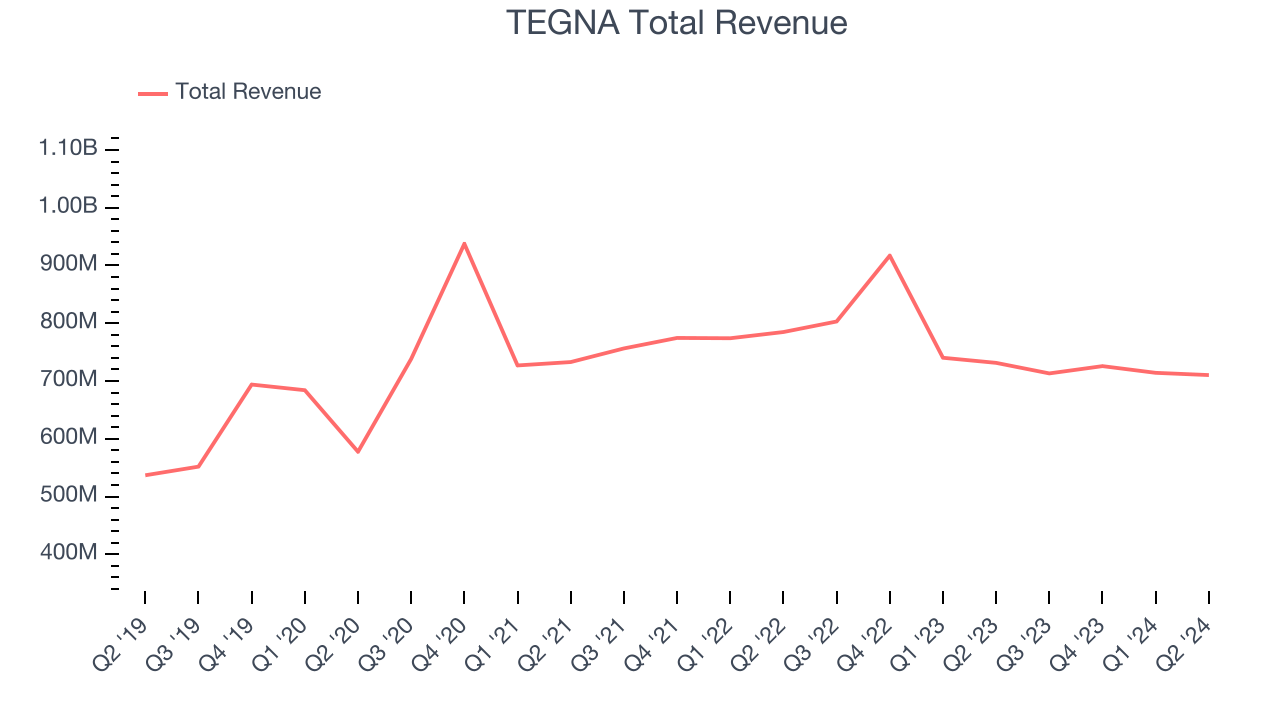

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, TEGNA's sales grew at a weak 5.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. TEGNA's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.7% annually.

We can dig further into the company's revenue dynamics by analyzing its most important segments, Subscription and Advertising, which are 51.7% and 42.4% of revenue. Over the last two years, TEGNA's Subscription revenue (access to content) was flat while its Advertising revenue (marketing services) averaged 6.7% year-on-year declines.

This quarter, TEGNA missed Wall Street's estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $710.4 million of revenue. Looking ahead, Wall Street expects sales to grow 10% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

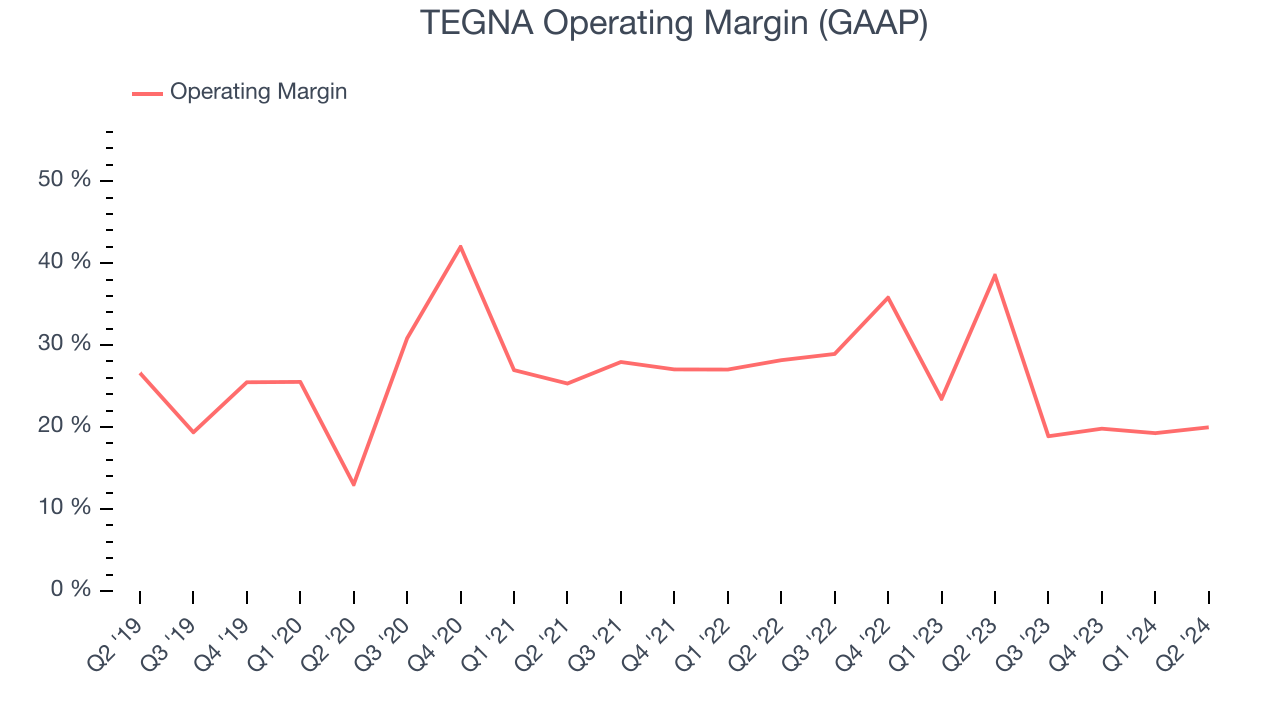

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It's also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

TEGNA's operating margin has shrunk over the last year, but it still averaged 26%, elite for a consumer discretionary business. This shows it's an optimally-run company with an efficient cost structure.

In Q2, TEGNA generated an operating profit margin of 20%, down 18.5 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Key Takeaways from TEGNA's Q2 Results

It was encouraging to see TEGNA slightly top analysts' EPS expectations this quarter. On the other hand, its sales fell short of Wall Street's estimates as its subscription revenue underperformed. Overall, this quarter could have been better. The stock remained flat at $14.52 immediately following the results.

So should you invest in TEGNA right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.