Young adult apparel retailer Tilly’s (NYSE:TLYS) missed analysts’ expectations in Q2 CY2024, with revenue up 1.8% year on year to $162.9 million. Next quarter’s revenue guidance of $143 million also underwhelmed, coming in 2.5% below analysts’ estimates. It made a GAAP loss of $0 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Tilly's? Find out by accessing our full research report, it’s free.

Tilly's (TLYS) Q2 CY2024 Highlights:

- Revenue: $162.9 million vs analyst estimates of $163.8 million (small miss)

- EPS: $0 vs analyst estimates of -$0.09 ($0.09 beat)

- Revenue Guidance for Q3 CY2024 is $143 million at the midpoint, below analyst estimates of $146.7 million

- EPS (GAAP) guidance for Q3 CY2024 is -$0.34 at the midpoint, missing analyst estimates by 112%

- Gross Margin (GAAP): 30.7%, down from 41.4% in the same quarter last year

- EBITDA Margin: 1.1%, in line with the same quarter last year

- Free Cash Flow Margin: 4.9%, down from 6.4% in the same quarter last year

- Locations: 247 at quarter end, up from 246 in the same quarter last year

- Same-Store Sales fell 7.9% year on year, in line with the same quarter last year

- Market Capitalization: $148.6 million

"While the macro environment remains challenging for our customer demographic, we believe that our new pricing strategies are gaining traction as evidenced by our second consecutive quarter of improved product margins, and that we are beginning to drive improved customer engagement through our refocused marketing efforts," commented Hezy Shaked, Co-Founder and Interim President and Chief Executive Officer.

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

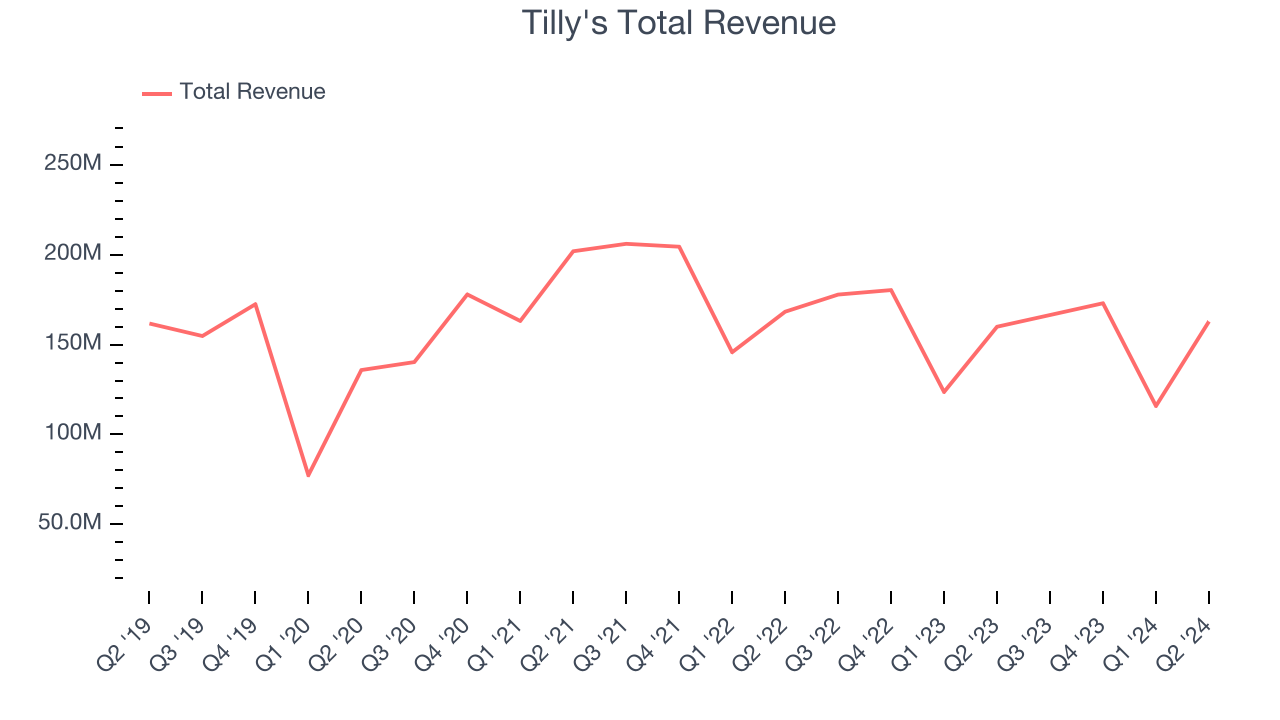

As you can see below, the company’s revenue was flat over the last five years as its store footprint remained relatively unchanged.

This quarter, Tilly’s revenue grew 1.8% year on year to $162.9 million, falling short of Wall Street’s estimates. The company is guiding for a 14.1% year-on-year revenue decline next quarter to $143 million, a further deceleration from the 6.4% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 2.4% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

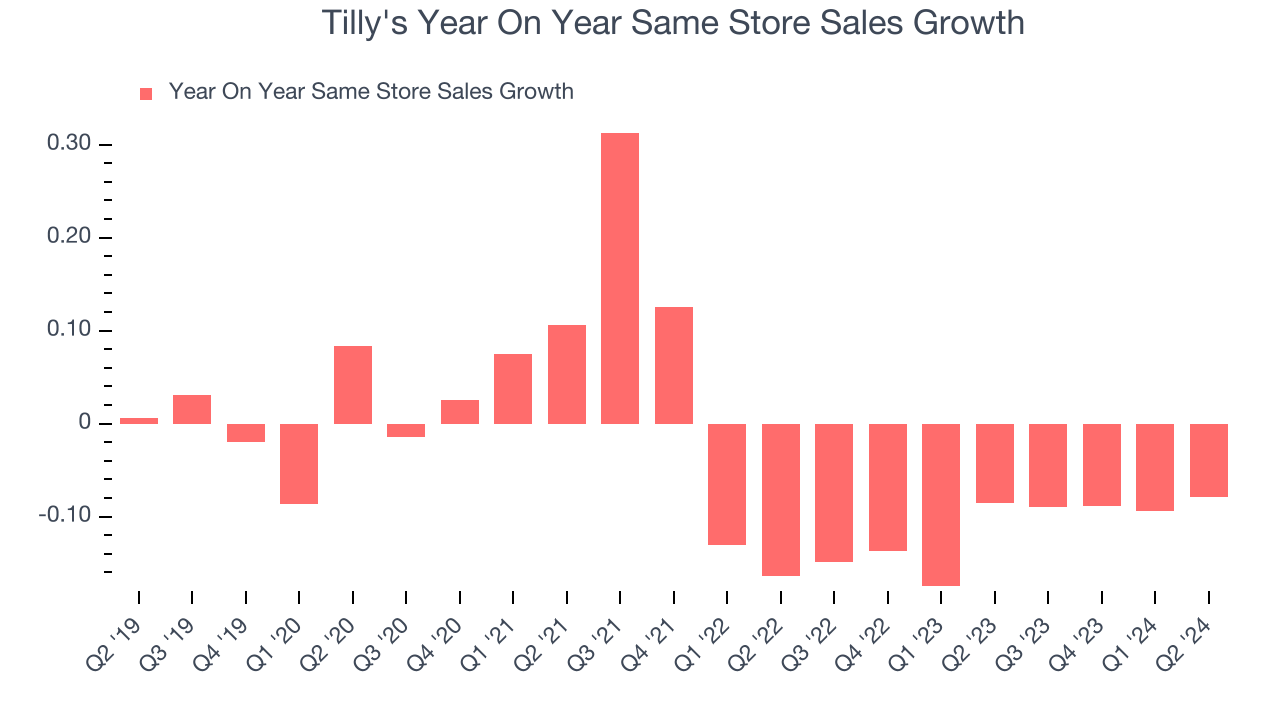

A company’s same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Tilly’s demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 11.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Tilly’s same-store sales fell 7.9% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Tilly’s Q2 Results

We were impressed by how significantly Tilly's blew past analysts’ EPS expectations this quarter. However, that's where the good news ends. Its revenue missed estimates while its revenue and earnings guidance for next quarter fell short. Zooming out, we think this was a mixed quarter with some blemishes. The market seemed to focus on the negatives, and the stock traded down 1.3% to $4.69 immediately after reporting.

So should you invest in Tilly's right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.