Industrial cleaning equipment manufacturer Tennant Company reported Q2 CY2024 results topping analysts' expectations, with revenue up 2.9% year on year to $331 million. The company's full-year revenue guidance of $1.29 billion at the midpoint also came in 1.2% above analysts' estimates. It made a GAAP profit of $1.45 per share, down from its profit of $1.68 per share in the same quarter last year.

Is now the time to buy Tennant? Find out in our full research report.

Tennant (TNC) Q2 CY2024 Highlights:

- Revenue: $331 million vs analyst estimates of $327 million (1.2% beat)

- EPS: $1.45 vs analyst estimates of $1.43 (1.4% beat)

- The company slightly lifted its revenue guidance for the full year from $1.28 billion to $1.29 billion at the midpoint

- EBITDA guidance for the full year is $210 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 43.1%, in line with the same quarter last year

- EBITDA Margin: 17.7%, up from 16.7% in the same quarter last year

- Free Cash Flow of $14.4 million is up from -$300,000 in the previous quarter

- Market Capitalization: $1.83 billion

“We are pleased to report a record second quarter performance, underpinned by strong order rates and continued progress toward normalized backlog levels. As our investments in our enterprise growth strategy continue to yield positive results, we are confident the second half of the year will see strong performance supported by increased order rates,” said Dave Huml, Tennant President and Chief Executive Officer.

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE:TNC) designs, manufactures, and sells cleaning products to various sectors.

Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

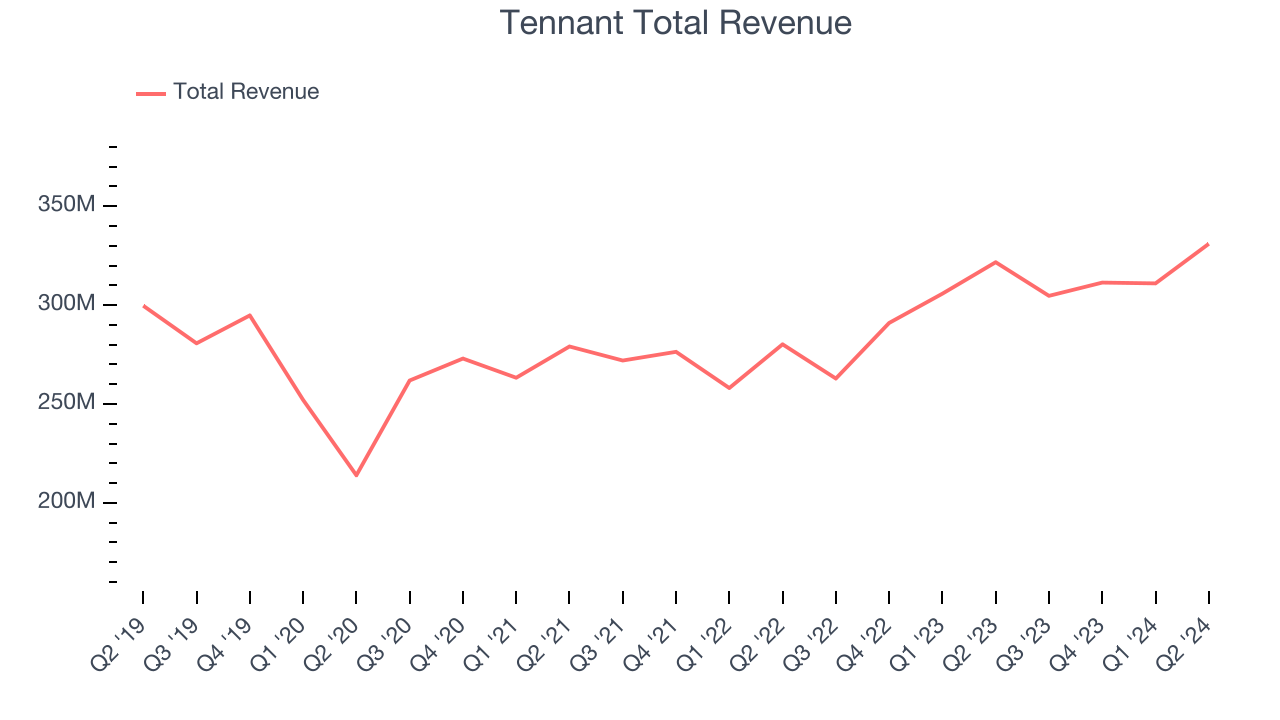

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Unfortunately, Tennant's 2.4% annualized revenue growth over the last five years was weak. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tennant's annualized revenue growth of 7.6% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Tennant reported reasonable year-on-year revenue growth of 2.9%, and its $331 million of revenue topped Wall Street's estimates by 1.2%. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

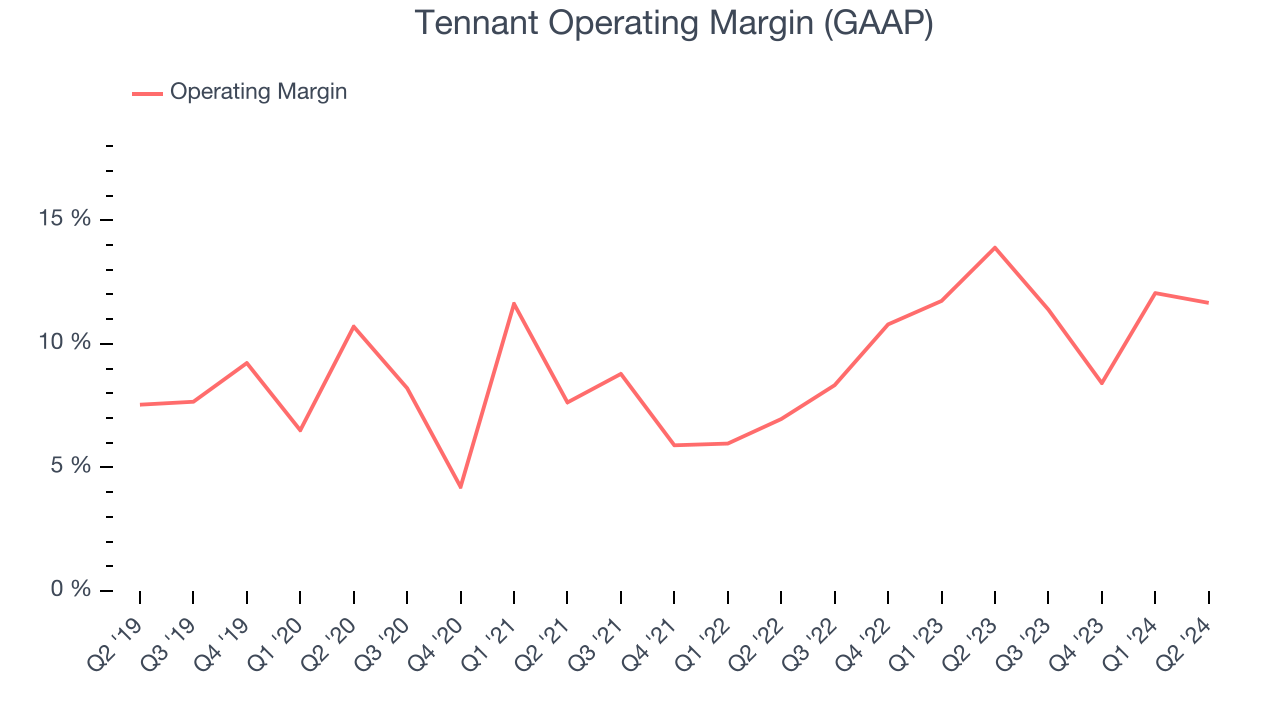

Operating Margin

Tennant has done a decent job managing its expenses over the last five years. The company has produced an average operating margin of 9.2%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Tennant's annual operating margin rose by 2.4 percentage points over the last five years, showing its efficiency has improved.

In Q2, Tennant generated an operating profit margin of 11.7%, down 2.2 percentage points year on year. Since Tennant's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

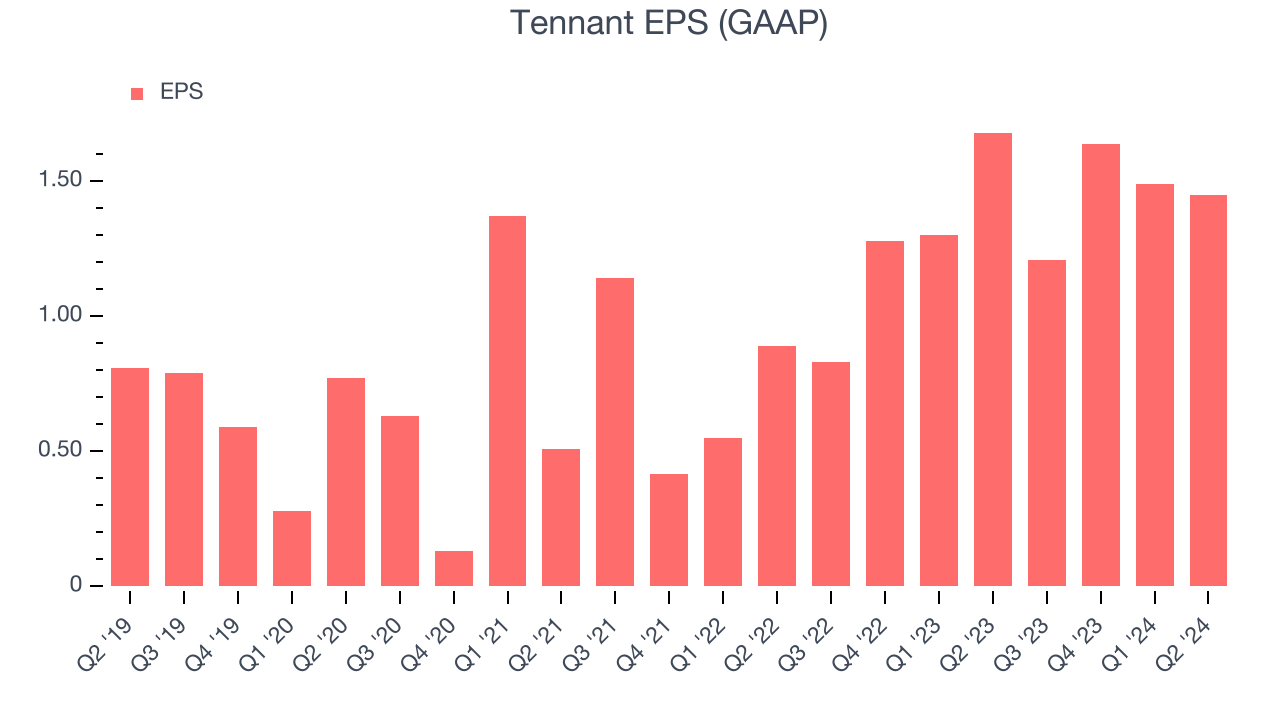

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Tennant's EPS grew at an astounding 24.7% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Tennant's earnings quality to better understand the drivers of its performance. As we mentioned earlier, Tennant's operating margin declined this quarter but expanded by 2.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Tennant, its two-year annual EPS growth of 39% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Tennant reported EPS at $1.45, down from $1.68 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 1.4%. Over the next 12 months, Wall Street expects Tennant to perform poorly. Analysts are projecting its EPS of $5.79 in the last year to shrink by 3.1% to $5.61.

Key Takeaways from Tennant's Q2 Results

It was good to see Tennant's full-year revenue forecast beat analysts' expectations, although full year EBITDA guidance was only in line. We were also glad its revenue outperformed Wall Street's estimates. Overall, this quarter was mixed but with some key positives. The stock remained flat at $96.02 immediately following the results.

Tennant may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.